Compass Minerals' Headwinds Bring Opportunity

Higher prices from elevated snowfall should more than offset near-term operational challenges.

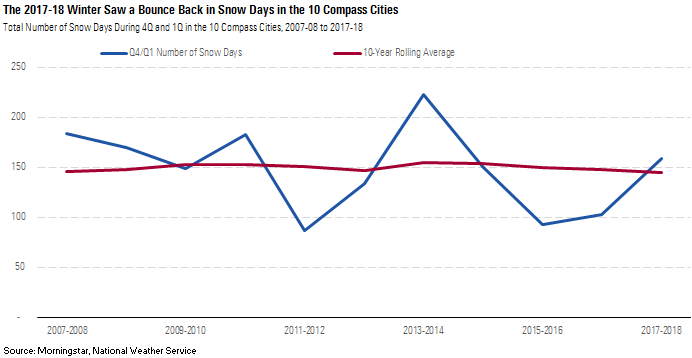

Harsh 2017-18 Winter Reflects Mean-Reverting Nature of Snowfall Levels The 2017-18 winter, which we define as the fourth quarter of 2017 and the first quarter of 2018, saw 159 snow days in the 10 cities that drive the majority of Compass' deicing salt volume. This is roughly 8% above the long-term average of 147 days and 54% above the 103 days in the winter of 2016-17. In our September 2017 Stock Strategist, we outlined our thesis that winter weather has historically exhibited mean-reversion tendencies. Regardless, Compass' shares tend to sell off during mild winters. We'd characterize this market reaction as short-sighted, reflecting a recency bias that can provide patient, long-term investors with an attractive entry point.

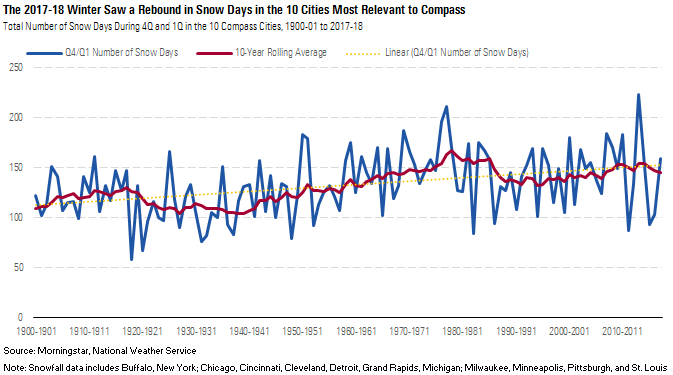

Because winter weather can be volatile from year to year, we prefer to forecast deicing salt demand over a multiyear period based on average snowfall over a longer time horizon. To illustrate our point, we show the same weather data in two charts. The first shows the total number of snow days each winter over nearly the last 120 years, from the winter of 1900-01 to 2017-18.

The second shows the total number of snow days each winter over the past decade. Although this data subset involves a much smaller sample size, the 10-year rolling average still doesn’t indicate a significant upward or downward trend. This increases our conviction that back-to-back winters of below-average snowfall in 2015-16 and 2016-17 aren’t representative of a “new normal” stemming from global warming, but rather typical snowfall volatility.

Higher 2018 Deicing Salt Prices Should Provide Near-Term Catalyst Deicing salt prices have historically moved in line with the most recent winter season's number of snow days. Following winters with above-average snowfall, Compass Minerals has generally increased prices. In years following a mild winter, it has decreased prices. Given this historical trend, we expect Compass Minerals will be able to raise prices during the upcoming 2018 bid season. Even after accounting for a higher near-term cost profile at the Goderich rock salt mine, rising deicing salt prices should serve as a catalyst for profitable growth in 2018 and 2019. We think the market is weighing the company's recent operational challenges too heavily and overlooking this near-term profit catalyst.

The company’s salt prices fluctuate because of the nature of the underlying deicing salt contracts. Local governments issue deicing salt bids based on a midpoint volume. However, these buyers have the right to purchase between 80% and 120% of the midpoint volume during the winter season. This variable volume clause provides governments the flexibility to adjust their salt inventories based on snowfall levels. During harsh winters, purchase volume at the upper end of the range ensures there is enough salt to keep roads clear. Purchases toward the lower end of the range typically reduce the government’s salt inventory and expense during a mild winter.

Upcoming bid prices are also affected by the inventories of salt producers, which are subject to more substantial fluctuations. When inventories are higher following a mild winter, salt producers are likely to accept lower bid prices to move inventory. However, after a harsher winter when inventories have been drawn down, salt producers can demand higher prices that are more closely in line with the marginal cost of production in a given region.

Compass Minerals reported 2018 first-quarter deicing salt sales of 4.3 million tons, roughly 0.9 million tons higher than in the first quarter of 2017. At this level, the company has probably sold enough inventory to be able to raise prices in the upcoming bid season.

Despite Operational Hiccups, Long-Term Cost-Reduction Plan Intact Although favorable winter weather should boost deicing salt demand, Compass Minerals faces near-term operational issues at its flagship Goderich mine that will limit the profitability of incremental salt volume. In September 2017, the Goderich mine experienced a partial ceiling collapse. In addition, Compass unexpectedly hit a patch of lower-quality salt, requiring that it install additional refining equipment to remove impurities.

As a result of these operational issues, Goderich’s production was down during a period of the year when Compass typically builds inventory to prepare for the upcoming winter. To fulfill customer contracts, Compass produced extra salt at its Cote Blanche mine in Louisiana and shipped it to the Midwest and Great Lakes regions, which are typically served by Goderich. Management estimates the financial impact will be roughly $25 million in additional expenses in 2018, with half of the cost overruns related to higher production costs and half from additional shipping costs. Management also estimates a $10 million increase to capital expenditures from the new refining machinery.

While we share investors’ disappointment with Compass’ operational issues, we think the negative impact on the company’s cost profile will prove fleeting. More important, we expect the company’s longer-term cost-reduction plan to bear fruit, albeit a year or two later than we originally projected. Compass has finished installing continuous miners at Goderich, which should materially benefit its cost profile. We forecast that Compass’ unit costs will fall from just over $33 per metric ton in 2017 to around $30 in 2020. Lower unit costs should support operating margin expansion. We forecast that operating margins will increase from 18% in 2017 to 28% in 2020.

Wide Moat Is Based on Cost Advantage Despite near-term operational headwinds, Compass' wide economic moat is unscathed, as its durable cost advantage remains in place. The unique geology of the company's salt and sulfate of potash assets puts the company safely on the low end of the cost curve for both commodities. The Goderich mine has salt deposits that are 3-5 times thicker than many of its competitors, which allows Compass to use more cost-efficient mining techniques and realize more bang for its buck in the form of cost savings when installing new technologies such as continuous miners.

Furthermore, the Goderich mine’s location on Lake Huron provides Compass with a transportation cost advantage. Because of salt’s low value/weight ratio, it can only be shipped economically by land over very short distances, roughly 150 miles or less. Compass estimates that shipping its products by water is about half the cost of using rail and one fifth the cost of using trucks. This helps Compass supply its customers by water in the Midwest and Great Lakes regions in a cost-effective manner. Additionally, thanks to its favorable geographic positioning, the spread between Compass’ shipping costs and those of its competitors tends to widen when transportation costs increase.

Compass’ sulfate of potash production at its Ogden operation benefits from being one of only three naturally occurring sulfate of potash brine sources in the world. This provides Compass with a significantly lower cost of production versus marginal-cost producers that make SOP from standard potash using the Mannheim process.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)