15 Cheap Stocks That Could Launch the 'Next Big Thing'

Take a look at Morningstar analysts' nine 'exponential technology' themes and some undervalued stocks poised to benefit from them.

Identifying the "next big thing" before it takes off takes a lot of skill, a little luck, and a leap of faith. After all, if you wait until a new product or technology is flying off the shelves, investors' optimistic expectations of future growth are likely already reflected in the stock's price.

The Morningstar Exponential Technologies Index is a good place to start your search. This 200-stock index helps investors identify companies across sectors that are in the early stages of developing or using technologies that we believe will transform society. We define "exponential technologies" as advances that are likely to gain more widespread use and create outsize economic benefit for the companies that develop and use them. See the index's current holdings here.

With the help of Morningstar's equity research analysts, we currently identify nine exponential technology themes:

- Big Data and Analytics. Capabilities with data sets too large and complex to manipulate or interrogate with standard methods or tools. Related subthemes include the Internet of Things, machine learning, and artificial intelligence.

- Networks and Computer Systems. Technology leaps ranging from hyperconnectivity and integrated systems to service continuity and new software-defined architectures will have a massive impact on the way people think of connecting applications and software with hardware.

- Robotics. The branch of technology that deals with the design, construction, operation, and application of robots. Advances in robotics, specifically when combined with other exponential technologies, have seemingly infinite potential applications, spanning technology, industrial, medical, and consumer-facing channels.

- 3-D Printing. A process for making a physical object from a three-dimensional digital model. This emerging trend is ready for mainstream consumption and has ample potential to disrupt several industries, from industrial manufacturing and medicine to consumer products and retail.

- Financial Services Innovation. Search for and acknowledgement of nontraditional funding sources, platforms, currency, and stored and transferred value. We not only think about opportunities to efficiently expand production, but also the underlying currencies used (including cryptocurrencies), as well as structural shifts in technology and payment delivery methods.

- Nanotechnology. Branch of technology that deals with dimensions and tolerances of less than 100 nanometers, especially the manipulation of individual atoms and molecules. We see a range of potential applications spanning medicine, computing, manufacturing, and travel.

- Energy and Environmental Systems. This involves the exploration of renewable energy sources--including solar, wind, water, and batteries. As organizations set processes to help reduce environmental impacts and increase operating efficiency, new avenues for technological advancement across sectors will open up.

- Medicine and Neuroscience. Sciences, such as neurochemistry and experimental psychology, that deal with the nervous system and brain. Key advancements in unlocking the human genome have created an infrastructure of biomarkers, while paradigm shifts in biotechnology that can alter the immune system are radically changing the way we treat diseases.

- Bioinformatics. The science of collecting and analyzing complex biological data. The "quantified self" trend of acquiring data to quantify aspects of an individual's daily life has exponential potential to positively impact both the duration and quality of life.

If your preferences lean toward high-quality companies trading at reasonable valuations (I'll gladly put myself in this camp), you might want to start your search with the Morningstar Exponential Technologies Moat Focus Index. This index uses the 200-stock Exponential Technologies Index as a starting point, but includes only the 50 cheapest wide- and narrow-moat stocks (as measured by price/fair value). You can see the holdings here.

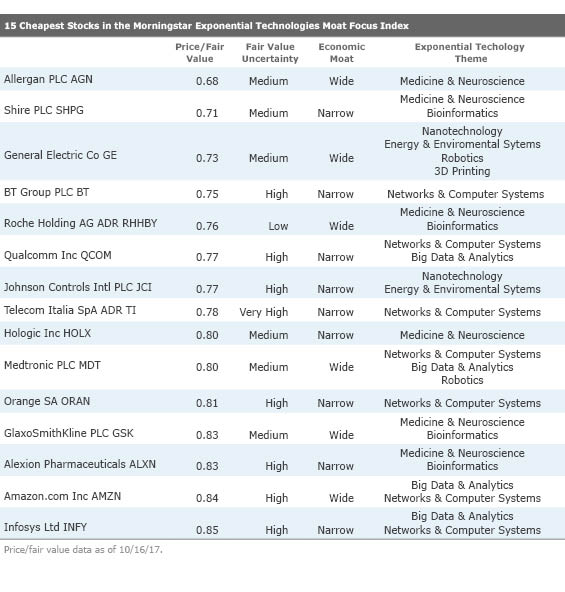

The following table lists the 15 cheapest stocks in the Exponential Technologies Moat Focus Index currently, along with the theme or themes they are expected to benefit from.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)