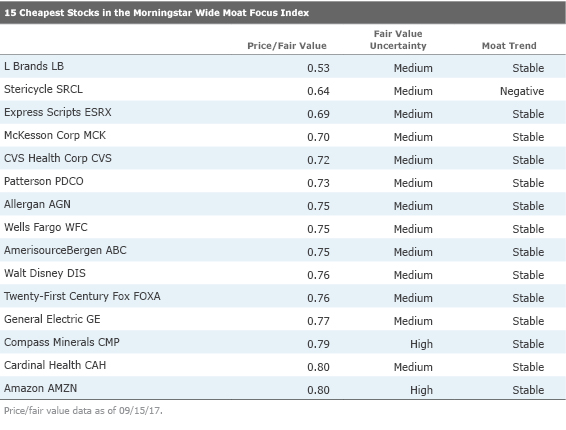

The 15 Cheapest Stocks in the Wide Moat Focus Index

These high-quality names are on sale.

The stock market, in aggregate, isn't a screaming buy: The average stock in Morningstar's coverage is about 2% overvalued as of this writing, according to Morningstar's Market Fair Value Graph.

Yet even in the most richly priced markets, there are almost always bargains to be had. With that in mind, we turned to the Morningstar Wide Moat Focus Index to find great businesses that are currently trading at attractive prices.

To be included in the Wide Moat Focus strategy, a company must have an economic moat rating of wide (which means our analysts think they have advantages that will fend off competitors for at least 20 years), and its shares must be among those trading at the steepest discount to their fair value estimates. (Fair value estimates are determined through independent research by the Morningstar Equity Research team.) Only U.S. stocks are included in the index. The index consists of two subportfolios with 40 stocks each. The subportfolios are reconstituted semiannually in alternating quarters, and stocks are equally weighted within each subportfolio.

The table below lists the 15 cheapest stocks in the index as of its most recent reconstitution, ranked by price/fair value.

Here's a closer look at three stocks from the list that were added during the latest reconstitution.

Patterson

PDCO

A wholesaler to the dental and animal health markets, Patterson faces some significant challenges. For starters, the company is searching for a permanent CEO after the departure of CEO Scott Andersen in June. Additionally, dental customers are shifting their spends to lower-cost suppliers, pressuring the firm's operations.

"Interim CEO James Wiltz is making an effort to reformulate the firm's dental sales operations in order reflect this new market dynamic, but this change may take several quarters to take hold, from our perspective," says senior analyst Vishnu Lekraj in his latest report.

Despite the near-term headwinds, Lekraj sees long-term potential here. An aging population means a growing demand for complex machinery in the dental market, while companion animal spending should remain strong as owners dedicate more dollars to their pets, adds Lekraj.

"We believe the scale and distribution network advantages for Patterson remain largely intact as it will be challenging for a new entrant to totally displace the firm," he says.

General Electric

GE

GE made news this week, selling its electrification products business (Industrial Solutions) to

"New CEO John Flannery appears to have hit the ground running by calling for additional cost cuts throughout the portfolio, efforts that may yet benefit 2017 results even if the close of the Industrial Solutions deal pushes into 2018," writes analyst Barbara Noverini in her latest note.

Indeed, GE has spent the past couple of years undergoing aggressive restructuring--and Noverini thinks the conglomerate's portfolio looks better than ever. She expects that GE's established product categories will track economic growth; selling long-term maintenance agreements will be a key driver of profitability, as will the company's push into predictive analytics that will support new product development and enhance customer utility of the services portfolio.

"In our view, this paves an additional pathway for growth that really wasn't available to the company in any meaningful way until recently," Noverini says. "We believe that monetizing digital services is GE's next frontier, with potential the strongest in the aviation, power, and oil and gas segments."

Cardinal Health

CAH

This drug distributor made waves in early August as it lowered its fiscal 2018 guidance, citing "customer investments" and IT upgrades. Though displeased with the lack of detail, Morningstar's Lekraj reiterated the company's wide-moat rating at the time.

"We believe the firm's position of one of only three major drug distributors in the U.S. provides it with a strong platform for healthy long-term economic profits," he noted. "The delivery of pharmaceuticals to consumers encompasses many firms along the supply chain, and out of the numerous players, Cardinal stands out as an elite participant."

As the population ages, the use of pharmaceuticals will continue to grow, paving the way for continued success for Cardinal. Further, Lekraj thinks the company has made some smart strategic moves that will benefit over the long term, including an agreement with CVS Caremark to combine generic sourcing opportunities, which should lead to greater pricing discounts from generic drugmakers.

"More critically, the colossal distribution operations of Cardinal allow it to build excellent asset efficiency," says Lekraj. "However, the ability to effectively manage its capital base is the true driver of outsize returns for Cardinal. The firm is able to produce top-tier asset turns, cash conversion, and inventory management metrics that have led to outsize ROICs; a trend we believe will last over the next several years."

Click

to see the top 25 positions in the Morningstar Wide Moat Focus Index. (Premium members can see

.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)