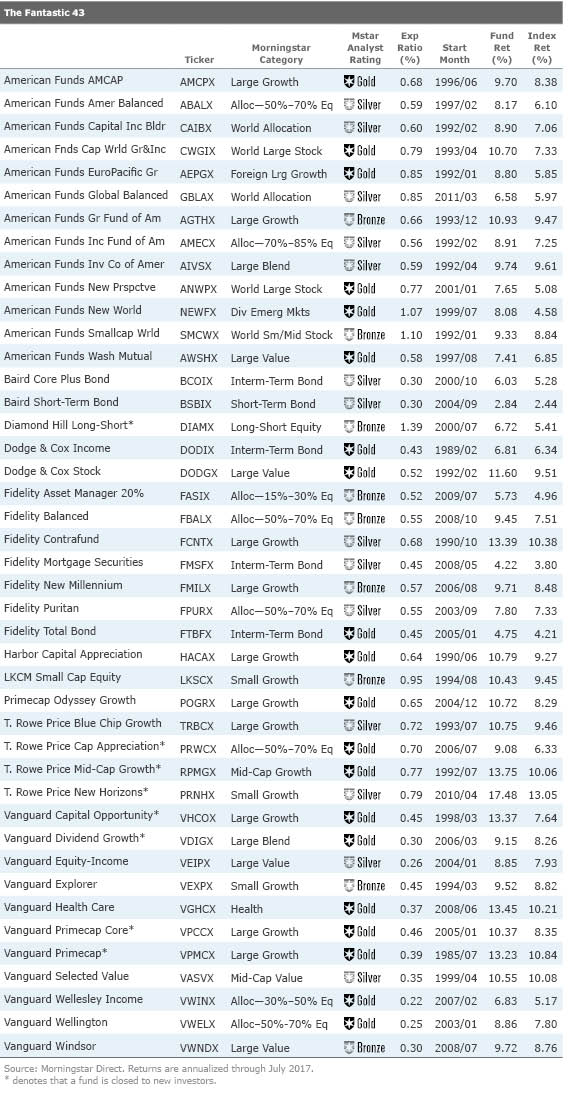

Kinnel: 43 Fantastic Funds

A few good screens can whittle the whole fund universe to fewer than 50 funds.

This article was originally published in the June 2017 issue of Morningstar FundInvestor. The screen has since been updated using data through July 31, 2017, so the lists are close but not perfect matches. Download a complimentary copy of FundInvestor here.

It's time once more for my annual screen for fantastic funds. With just a few key screens, I pare the universe of more than 8,000 mutual funds to just 43. (We had 48 last year.)

The final number changes a bit each year depending on how many funds pass all the tests. With so many funds, you can be very choosy. It's a purely quantitative screen--I don't make exceptions just because I like a fund.

Here are the screens:

Cheapest quintile of category. Morningstar studies show that funds in the cheapest quintile of their Morningstar Category are a much better bet than higher-cost funds, so this is the first test.

Manager investment of more than $1 million in the fund. We found that funds where at least one manager has invested more than $1 million of his or her own money are more likely to outperform than those without such alignment of interest.

Morningstar Risk rating below the High level. Our Morningstar Investor Return studies have found that highly volatile funds are harder for investors to hold, and investor returns tend to trail total returns by a greater margin in those funds.

Morningstar Analyst Rating of Bronze or higher. This fundamental, forward-looking rating factors in qualitative and quantitative measures.

Parent rating of Positive. You want a good steward with a strong investment culture when you invest for the long haul.

Returns above the fund's benchmark over the manager's tenure. Rather than looking at a standardized time period, look at the period of the manager's tenure. I start with the earliest start date of the managers on a team and insist that the fund beat the benchmark over that time period. I used returns through July 2017. There is a minimum five-year manager tenure, too, to weed out those with less meaningful track records. (This is why no index funds make the list. But we have plenty of Gold-rated index funds. You can screen for Gold-rated index funds on this page.)

I use a category benchmark for allocation categories. Many balanced funds have one equity benchmark and one bond benchmark rather than a blend of the two. That means they have either a very high or very low bar depending on which was the primary benchmark. Our category benchmarks are blended mixes of stocks and bonds, which make them a better fit. In a few cases, I had to use category averages if the index returns didn't go back far enough.

No institutional share classes. I exclude these to help you get a list you can use. (There are three funds with "institutional" in their names but minimum investments of $25,000 or less, which I don't consider to be institutional.)

Closed funds are not screened out. Many people still own them and want to know if they still make the grade.

Let's review the 20 Gold-rated funds among the Fantastic 43.

VDIGX shows how compelling a dividend-growth strategy can be. This closed fund is run by Donald Kilbride who builds a relatively focused portfolio of cash-rich companies likely to raise dividends. That's kind of an indirect strategy for buying high-quality companies, and the results have been strong.

New to the List All told, eight funds that didn't make the cut last year are on this year's list. Let's take a look at them in reverse alpha order.

FMSFX is back on our coverage list, and its Silver rating qualifies it for the Fantastic 43. The fund is mostly government-backed mortgages but has a portion in nongovernment mortgages. That provides a modest boost to yield and returns. With very low costs and a strong management team, this fund has plenty of appeal.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)