Sustainable International-Stock Fund Options Are Growing

Investors have a variety of choices, but many of them are young.

For those interested in building a portfolio around sustainable investing, this may be a good time to select a core international-stock fund. International stocks have outperformed U.S. stocks so far this year, prompting investors to pump money into international-stock funds. That's not a bad idea for those who may have let their non-U.S. equity allocation dwindle since the market bottomed in early 2009 as international stocks lagged well behind their U.S. counterparts over that period. Many investors probably remain underexposed to international stocks even after this year's first-half performance.

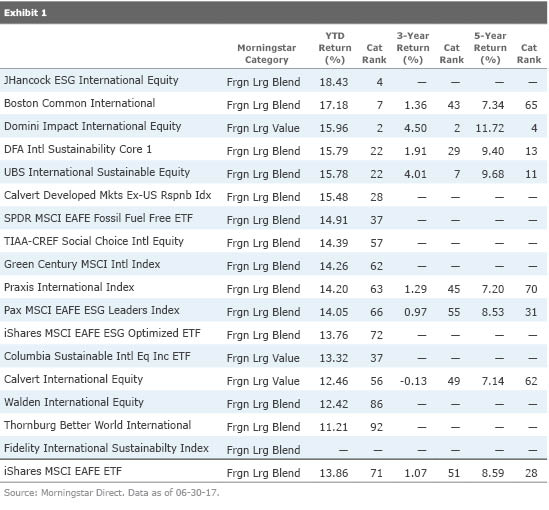

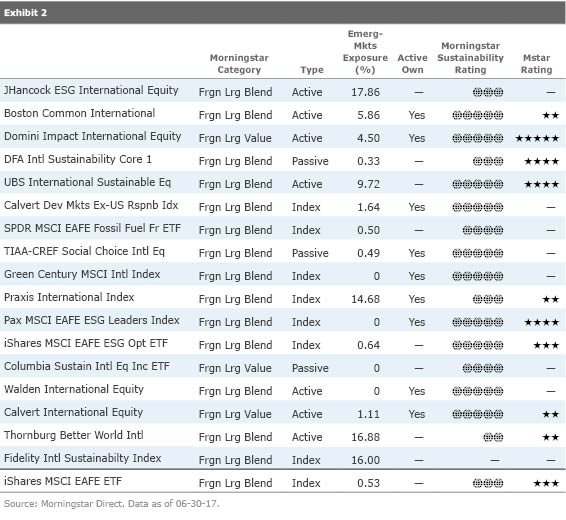

With 14 open-end funds and three ETFs that focus on non-U.S. equities in developed markets, sustainable investors have an array of choices to choose from for their core international exposure. These are funds that clearly state, by prospectus, that sustainable investing is an integral part of their investment process. Seven are active funds, seven are index funds, and three others are passive or quasi-passive portfolios based on indexes.

Performance has been good so far in 2017, with 11 of 16 beating the MSCI EAFE Index through June. (The Fidelity fund launched this year, so it doesn't have a year-to-date return.) That's about typical for all foreign large-cap funds, with about 70% beating the index in the first half. The two top performers, John Hancock ESG International Equity JTQIX and Boston Common International BCAIX, are both run by Boston Common Asset Management. The first-half returns of those two funds, along with those of Domini Impact International Equity DOMOX, placed in the top decile of their Morningstar Categories.

Only seven of the sustainable international developed-markets funds have longer-term records, though, complicating the selection process considerably. The good news is that five of the seven have beaten the MSCI EAFE Index for the trailing three years, and three have won out over the index for the trailing five years. The five-year returns of the Domini fund, which is subadvised by Wellington Management, outpaced all others by a healthy margin and ranks near the top of the foreign large-value category.

Twelve of the funds have Morningstar Sustainability Ratings of 4 or 5 globes, and only one has a Sustainability Score ranking in the bottom half of its category. That means, on average, the companies held in these funds tend to score better on a range of environmental, social, and corporate governance, or ESG, criteria than do those in most conventional foreign-stock funds. That's not surprising because all but one of the 17 funds employ a range of ESG criteria in their stock-selection process. (The SPDR MSCI EAFE Fossil Fuel Free ETF EFAX employs a simple exclusion of companies that own fossil fuel reserves.)

As a result, the typical sustainable international-stock fund has a somewhat different risk profile than the MSCI EAFE Index. Running the funds through the Morningstar Risk Model revealed differences on six risk factors. Compared with the index, the sustainable funds have slightly higher valuations, stronger economic moats, and exhibit less return volatility and momentum. Sustainable funds hold somewhat smaller stocks than the index does, and the active sustainable funds are more growth-oriented. This is generally consistent with what we know about companies that do well on sustainability criteria. They tend to be quality growth companies with lower risk.

The sustainable portfolios differ hardly at all from the index in terms of their sector exposures. Active sustainable managers had slightly more exposure to technology and less exposure to financials, and passive sustainable managers had slightly less exposure to energy. Because several funds have broader mandates that allow them to invest in emerging markets and/or Canada, the sustainable group has somewhat less exposure to Europe. Overall, a sustainable investor need not be too concerned about getting skewed sector or regional exposures. If emerging-markets exposure is desired, several funds have significant stakes, including the new Fidelity International Sustainability Index FNIYX, which tracks the MSCI All Country World ex USA ESG Leaders Index. Sustainable funds otherwise look a lot like conventional funds, except they tilt toward companies that do better on ESG criteria.

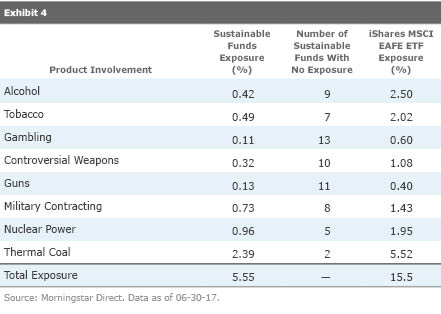

Most of the sustainable funds also employ some product or activity exclusions. Some of the more frequently used exclusions have to do with guns and controversial weapons, gambling, tobacco, alcohol, military contracting, coal, and nuclear power. The sustainable funds have an average exposure of 5.6% to these areas, which is much lower than the index's 15.5% exposure. Finally, some sustainable funds practice what I call "active ownership," which means they engage with company management on material ESG issues and typically support ESG-related shareholder resolutions.

Investors can widen their scope by incorporating the Morningstar Sustainability Rating into their conventional selection process. A quick search of large-cap foreign-stock funds with 5-globe ratings, for example, yielded

Investors wanting a core international-equity fund that's more committed to sustainability issues can choose among funds that have strong ESG profiles and minimal exposure to various exclusions and are active owners. They'll generally find themselves invested in lower-volatility stocks of quality growth companies, which is generally a good recipe for a successful long-term investment.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)