10 High-Quality Foreign-Stock Bargains

For investors looking abroad, these moat-worthy stocks are selling at compelling valuations.

The well-known Morningstar Wide Moat Focus Index targets attractively valued, high-quality stocks. But sometimes "cheap" is relative concept. The strategy targets the most undervalued stocks in its universe based on price/fair value, but that universe--the Morningstar US Market Index--has gained more than 15% per year for the trailing five-year period.

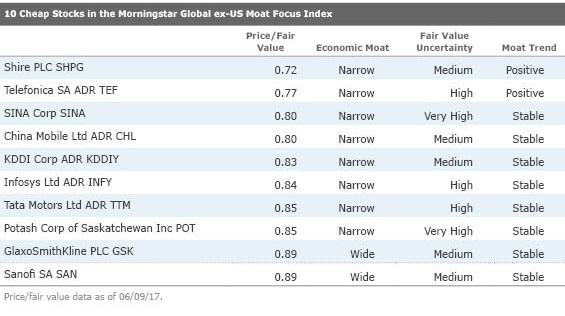

Meanwhile, the Morningstar Global Markets ex-US Index has returned about two thirds of that amount. True, some of the underperformance is due to currency effects. But for bargain-hunters who want to look abroad, the Morningstar Global ex-US Moat Focus Index allows you to harness the moat strategy to find high-quality bargains in developed and emerging markets. Like the Wide Moat Focus, the Global ex-US Moat Focus is pretty straightforward. First, we look at the Morningstar Global Markets ex-US Index, which is a broad index representing 97% of developed (ex-US) and emerging-markets market capitalization. From there, we rank by lowest price/fair value to find the 50 cheapest wide- and narrow-moat stocks (meaning we think they have advantages that will fend off competitors for at least a decade). These 50 stocks represent the most compelling values among the global moat universe, according to Morningstar analysts.

It should be noted that the Global ex-US Moat Focus Index, which is intended as an investment strategy and is licensed for investable products, invests in securities in their local currencies, on their local exchanges. We searched for undervalued stocks in the index that are available to U.S. investors through American Depositary Receipts (which allows a certain number of shares of a non-U.S. company to be traded on a U.S. exchange).

Below, we list 10 stocks that are selling at compelling valuations, and below we take a closer look at three undervalued firms.

Shire PLC

SHPG

Through several acquisitions, Shire has transformed from a neurology-focused specialty pharma to a more diversified firm with increasing exposure to biologics manufacturing and rare diseases, said equity strategist Karen Andersen. She thinks the firm warrants a narrow moat and positive moat trend based on its diversified portfolio and increasing rare-disease focus. The intellectual property underlying Shire's specialty pharma business (in ADHD and gastrointestinal disorders) and its rare disease business are the basis of its competitive advantage. The company is best known for its ADHD franchises, which make up about 16% of its revenue. However, through multiple acquisitions and in-house development, the company has built up a diverse portfolio of both small molecule and biologic products focused generally on niche markets. In Anderson's opinion, this diversity allows the company to better withstand specific product risks, while utilizing a specialist-focused salesforces to penetrate markets, keep operating expenses down, and produce strong operating margins.

Infosys

INFY

One of India's most pre-eminent providers of IT services, Infosys is on a quest to improve its performance. The company has suffered from its slow-moving legacy past (smaller, more discretionary projects) and out-of-date go-to-market strategy, resulting in low revenue growth relative to peers, margin compression, leadership churn, and high employee attrition, says equity analyst Andrew Lange. Lange expects Infosys' performance to improve due to strategic initiatives such as hiring more salespeople and cutting costs. The source of Infosys' narrow moat is high switching costs, says Lange: Roughly 96%-98% of revenue is from repeat business and has been around these levels for many years. Further, on a gross basis, Infosys continually adds over 200 clients per year, which is an encouraging sign and cements further long-dated business given switching costs, Lange says.

Tata Motors

TTM

Tata Motors benefits from substantial profitability and returns generated by its premium Jaguar and Land Rover brands, says senior analyst Richard Hilgert. Since fiscal 2009, when Tata acquired the luxury automaker, JLR's revenue has risen at a compound annual growth rate of 28%, with global volume growing 18%. In fact, Tata Motors' narrow economic moat stems from the strength and global recognition of its Jaguar and Land Rover brands, which enables premium pricing that results in solid margins and healthy economic profits. Hilgert believes that Tata is positioned to gain from the continued growth in Indian automotive sales and the expansion of luxury markets in emerging economies, especially China. Still, Tata faces some challenges; it will need to keep investing in new models across brands and vehicle platforms, and also needs to improve on its ability to execute vehicles at world-class quality levels.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)