5 High-Quality Stocks to Watch Amid Volatility

When markets sell off indiscriminately, it can be a great time to shop for high-quality bargains.

Many market-watchers have been warning for years that volatility is likely to return. But it's been hard to heed those nagging whispers, especially when the threat just never seemed to materialize.

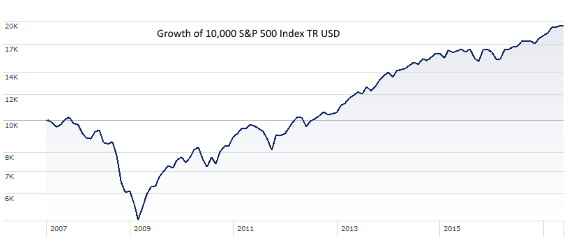

Though there have been some bumps along the way--a few pullbacks in 2010, one in the second half of 2011, and again in 2015 come to mind--the S&P 500 has climbed steadily upward since March 2009.

In fact, the S&P 500 climbed to its all-time high closing price of over 2,400 on May 16. Many other stock market indexes were also reaching fresh highs last week, as optimism reigned that President Donald Trump would cut tax rates for U.S. corporations and small businesses.

- Source: Morningstar Direct

This quiet was broken, however, when the stock market plunged nearly 2% after reaching that all-time high, to "only" 2,357 on May 17. And though stocks have recovered somewhat in the trading sessions since, they haven't risen above that 2,400 high.

Though the reasons for stock market gains and losses is never crystal clear, the slide may have been caused by uncertainty surrounding ongoing congressional investigations, which have called into question the administration's ability to carry through on proposed tax reform or promised infrastructure improvements.

Was last week's pullback foreshadowing volatility? It's hard to say. But if so, the upside of broad market sell-offs is that they can surface great buying opportunities for bargain-hunters. When markets sell off indiscriminately, investors tend to dump even high-quality names--those with sturdy financials and durable competitive advantages--along with everything else. Even a one- or two-day dip can unearth some good bargains.

To find some, we employed our

to find high-quality stocks on our coverage list that were rated 4 or 5 stars, which indicates that we think they are undervalued relative to our estimate of their fair value. Even if they aren't cheap enough for you yet, it could pay to keep them on your watch list; another price dip could place them solidly in buying territory.

We then we looked for companies with a fair value uncertainty rating of low or medium, which means we think we can more tightly bound the fair value because we can estimate the stock's future cash flows with a greater degree of confidence.

Finally, we looked for stocks with an economic moat rating of wide (meaning we think they have advantages that will fend off competitors for at least 20 years).

As of May 22, our

returned 37 stocks. Here's a closer look at five stocks that made it through.

Coca-Cola

KO

As the largest beverage company in the world, Coca-Cola has earned a wide economic moat, thanks to its brand intangible assets and cost advantages created by its strong relationships with retailers and economies of scale, says equity analyst Sonia Vora. In fact, Coca-Cola's unparalleled brand strength and global distribution network have allowed it to generate excess returns on invested capital despite a decade of volume declines in the carbonated soft-drink market, she said. Though consumption of carbonated soft drinks continues to decline in the United States, Vora sees significant opportunity in international markets, where Coca-Cola's carbonated soft drinks tend to enjoy greater share than Pepsi, and in the noncarbonated category. Vora also thinks Coca-Cola's healthy cash flows will allow the firm to continue to invest behind its brands, further entrenching its relationship with retailers.

Emerson Electric

EMR

A steady history of midteen returns on invested capital supports our belief that Emerson benefits from a wide economic moat. Analyst Barbara Noverini thinks the company's competitive advantages stem from three main moat sources: customer switching costs, cost advantage, and intangible assets. And Emerson's newly streamlined portfolio will enable the company to focus on its most competitively advantaged businesses, which will result in higher returns on invested capital over time, she says. In fiscal 2017, Emerson's portfolio will split into two operating segments: Automation Solutions and Commercial & Residential Solutions. Following the successful completion of the $5.2 billion divestitures of Network Power, Leroy Somer, and Control Techniques, and the subsequent $3.2 billion acquisition of Pentair's Valves and Controls business, the new Emerson will remain significantly exposed to the oil and gas industry at nearly 50% of consolidated sales. As such, Noverini believes patient, long-term investors will be rewarded as oil prices recover.

Mondelez

MDLZ

With a strong brand mix (seven brands that each generate more than $1 billion in annual sales, including Oreo, Cadbury, LU, and Trident) and expansive global scale (about 30% of sales comes from emerging markets, just less than 40% from Europe, and the balance from North America), Mondelez is a stalwart in the global packaged foods arena, says sector director Erin Lash. The strength of the firm's edge is evident in its adjusted returns on invested capital, she says: She forecasts ROICs to exceed 16% by fiscal 2021, exceeding its 7% weighted average cost of capital estimate and supporting our stance on its wide moat. Further, Lash thinks Mondelez is demonstrating a commitment to cost management and an improved ability to execute on strategic initiatives, and she thinks it will ultimately be able to take out more than the $1.5 billion in cost savings it targets as efforts to drive efficiencies in its supply chain and eliminate unnecessary spending are rolled out across its vast global network.

Procter & Gamble

PG

Procter & Gamble's wide moat derives from the economies of scale that result from its portfolio of leading brands, 23 of which generate more than $1 billion in revenue per year (including Always, Pantene, Head & Shoulders, Crest, Tide, and Pampers). Over the past three years, P&G has streamlined its brand portfolio. According to Lash, the firm previously entered too many new markets (particularly emerging markets, where competitors already have a leg up) too quickly, and new products failed to resonate with consumers; as a result, its market share position languished. Slimming down has allowed it to become a more nimble and responsive player in the global consumer product arena. Further, P&G is pursuing added efficiency gains as it seeks to extract another $10 billion in costs by reducing overhead, lowering material costs from product design and formulation efficiencies, and increasing manufacturing and marketing productivity. Lash thinks the these efforts will enable P&G to up its core brand spending behind product innovation and marketing, which is key given the ultracompetitive landscape in which it plays, while also resulting in improved profitability.

Starbucks

SBUX

Sector strategist R.J. Hottovy views Starbucks as one of the most compelling growth stories in the global consumer space today, poised for top-line growth and margin expansion through menu innovations, sustainable cost advantages, and evolution into a diversified retail and consumer packaged goods platform. Although nonexistent switching costs, intense industry competition, and low barriers to entry make it difficult for restaurants and specialty retailers to establish long-lasting competitive advantages, Starbucks' wide economic moat is based on a brand intangible asset that commands premium pricing and meaningful scale advantages. Hottovy expects Starbucks to maintain its specialty coffee leadership while successfully accessing new growth avenues. Competitive threats exist in both the retail and wholesale channels, but Hottovy expects Starbucks' strong brand equity, bargaining clout with suppliers of all kinds, and a leverageable model will help to stave off rivals.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)