4 Reasons Sustainable Investing Is Entering the Mainstream

This year’s Morningstar Investment Conference highlighted four trends that are moving the industry to consider sustainability when building portfolios.

When the likes of Josh Brown, Jack Bogle, and Larry Fink all discuss the growing importance of environmental, social, and governance investing, as they did at the recent Morningstar Investment Conference, it's an indication that sustainable investing has entered the investment mainstream.

On a panel about industry disruption, prominent advisor/blogger Brown commented that ESG is here to stay, not a passing fad. Bogle noted that passive managers, like Vanguard, have a key role to play as large corporate shareholders by demanding better ESG information from companies, and Fink, who has BlackRock's corporate engagement efforts already directed toward ESG issues, noted that growing interest among investors is spurring his firm to grow its sustainable investing platform.

Finally, in a packed breakout session, Paul Ellis and Jeffrey Gitterman, two financial advisors who have successfully transitioned their practices to a focus on sustainable investing, gave practical advice to advisor attendees on how to do so themselves.

At that session, when asked via a conference polling app how many attendees had clients asking them about sustainable investing, 100% answered Yes. OK, that was because the conference polling app had inadvertently left off the No option, but a subsequent show of hands indicated that nearly everyone was a Yes. Emerging out of the panel discussion, which I moderated, were several benefits for advisors regarding incorporating sustainable investing into their practices.

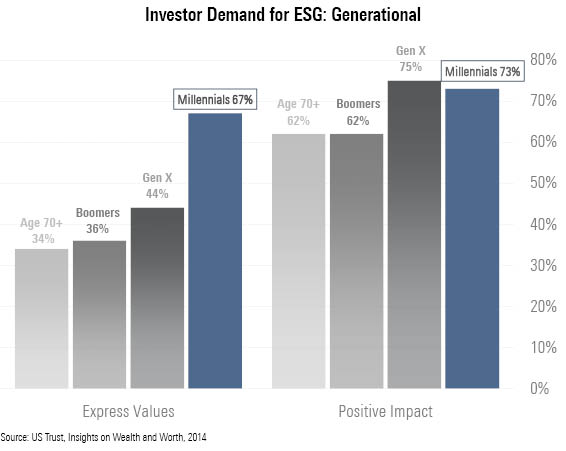

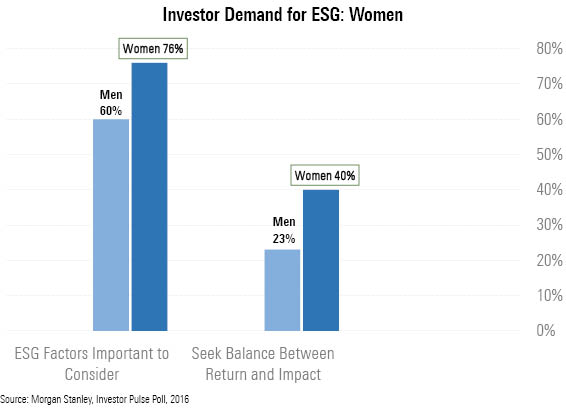

First, by adding ESG to your practice, you are swimming with the tide of investor interest rather than against it. We've been wearing out this tune, but millennials and women consistently indicate high levels of interest in sustainable investing, and these two broad categories of investors are commanding more and more assets. As the massive intergenerational transfer of wealth starts to happen, money will flow into the hands of younger investors, who will be about as likely to be women as men. It's possible that millennials' interest in ESG is merely a lifecycle effect that will moderate over time as they grow older, perhaps less idealistic, and more focused on making money without regard to the societal and environmental impact of their investments. But I doubt it. Their interest in ESG seems more in line with what public opinion experts call a cohort effect, which is likely to persist over time. Cohort effects result from unique circumstances that a generation experiences when it is coming of age that have a lasting impact and continue to differentiate them from older (and possibly younger) cohorts through time. The financial crisis and climate change are two such circumstances. The first not only caused real financial hardship, but it also undermined confidence in the financial system, while the effects of climate change are likely to be personally experienced by millennials throughout their lifetimes.

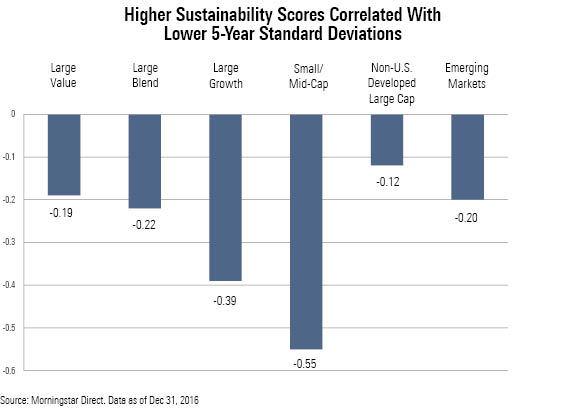

Second, selecting investments for your clients' portfolios that consider how well companies are managing environmental, social, and corporate governance issues is a way to reduce risk. The risks of poor corporate governance have long been recognized by analysts, while those relating to environmental or social factors are less well understood. Nonetheless, firms that manage environmental issues poorly have to deal with costs from fines, litigation, and cleanups, while also facing reputational risks for poor environmental stewardship. Firms that effectively manage social factors such as human capital, supply-chain oversight, product usefulness and safety, and community impact can lower costs, add to their economic moats, and reduce reputational risk. I've found that funds with Morningstar Sustainability Ratings of High tend to be lower volatility funds.

A third reason to add ESG to your practice is the opportunity to connect with clients on a deeper level. The job of an advisor is no longer limited to simply picking investments based on a risk-tolerance questionnaire. A robo-advisor can do that. Real-life advisors are becoming more like "money counselors" for their clients, helping them forge healthy relationships with money and the ways it can enhance their happiness. An advisor able to help those highly interested in sustainability make a difference with their money will develop a deeper bond than many advisors have with clients.

A friend of mine--my doctor, actually--recently told me his advisor "just doesn't get me" after the advisor had rebuffed his request to transition his portfolio to sustainable investments. He changed advisors. Being able to address your clients' interest in sustainability will also make them better investors. By helping them invest in ways that are meaningful to them, you are giving them an identity as investors, a way to relate to their investments. This, in turn, makes them better investors, more likely to stick to the big picture and stay the course over the long run.

Finally, incorporating sustainable investing into your practice can be a great way to differentiate yourself and your practice. There is still a first-mover opportunity in many markets. With sustainable investing already entrenched among institutional investors and with an estimated $9 trillion in assets in the United States and $23 trillion globally, it isn't going away. If you have an established practice, adding an ESG capability may help you retain assets as your older clients pass money to younger generations--or when married women, who tend to outlive their husbands, take control of their investments. If you are still building a practice, having an ESG capability may help you attract new clients--those who are moving away from their parents' or husbands' advisors that just don't "get" them, as well as those who are choosing advisors for the first time.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)