Handy Weapons in an Inflation Fighter's Arsenal

We take a close look at TIPS and I Bonds, investment products that can help preserve your long-term purchasing power.

After laying low for several quarters, inflation is stirring. In fact, the Federal Reserve explicitly mentioned realized and expected inflation in its decision to raise the target range for the federal funds rate on March 15.

Not everyone needs an investment that provides explicit inflation protection in their portfolio. As discussed in this article, many younger investors already have some built-in protection from inflation in the form of steadily increasing wages and a heavy exposure to equities, which have a good chance of outpacing inflation over long periods.

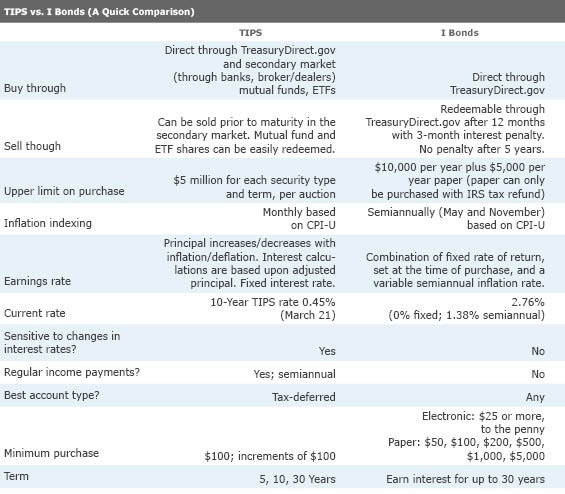

But investors with a shorter time horizon or those who are already drawing income from their retirement portfolios might have a growing need to preserve their long-term purchasing power. Treasury Inflation-Protected Securities and I Bonds are two popular inflation-fighting tools. But, although we compare and contrast the two security types in this article, the decision to use one doesn't necessarily prohibit you from using the other. If both security types suit your needs for inflation protection, there's no reason you can't use them together in a portfolio. For instance, you could hold I Bonds in a taxable account and TIPS and equities in a tax-deferred account as part of a multipronged inflation-protection strategy.

All About I Bonds If you work with a broker or advisor, I Bonds might not be on your radar because they are available for purchase only directly from the Treasury.

I Bonds are not an especially complicated security, and they are extremely low risk and very liquid. During your holding period, they earn interest and protect you from inflation. Unlike TIPS, they can't lose money over your holding period, even if you sell them before maturity. Even if inflation is negative, the combined rate will not go below 0%, protecting your principal value.

One potential drawback of I Bonds (depending on the size of your portfolio) is that purchases have annual limits of $10,000 per Social Security number (electronic), or $5,000 for paper versions (purchased using a tax refund). So, it may take you a while to amass a suitably sized stake to protect your portfolio against inflation. (This is also why you won't see any I Bond mutual funds or ETFs).

Earnings Rate The I Bond earnings rate has two parts: a fixed rate and an inflation rate. The fixed rate, which is determined by the Treasury, is reset each May and November. Purchasers of I Bonds today will get a pretty attractive composite rate of 2.76% that comprises the semiannual inflation rate and the fixed rate. The fixed rate, as its name implies, is fixed for the life of the bond (30 years).

Knowing this, it can pay to be strategic about when to buy an I Bond. David Enna, author of the TIPSWatch blog, points out that though the Treasury doesn't say how it determines the I Bond fixed rate, inflation seems to be on the rise, which should make I Bonds more attractive. Therefore, it could pay to wait until May 1 to see if the Treasury raises the fixed rate above 0.0%.

"A higher fixed rate is coveted because it stays with the I Bond until it is sold or matures," Enna said. Based on his analysis of historical spreads between the I Bond fixed rate and the 10-year Treasury yield, he thinks it's likely, though certainly not guaranteed, that the fixed rate will go up a small amount on May 1 (to 0.1%).

Tax Considerations Another feature of I Bonds, which could be a negative or a positive depending on your circumstance, is that they don't make regular income payments. They are designed as a long-term savings product. You pay taxes on the earned income when you sell. Therefore, they are a good fit for taxable accounts (and in fact, since you can't buy them through a broker, you can't really own them in an IRA).

On the flip side, though, they would not be a good option for investors who want to fund any part of their living expenses with the interest payments from the bonds.

One more interesting thing to note: If you redeem I Bonds during the same year that you pay qualified educational expenses, you would be able to exclude all or part of the interest paid during that tax year (subject to certain income thresholds). Click here for more.

Traits of TIPS TIPS are also inflation-adjusted based on changes in the CPI-U, but the mechanics work differently. Unlike traditional bonds, TIPS' principal value will change to keep pace with inflation as measured by CPI-U (with a lag of a few months). The coupon payments, which are paid twice per year, will also vary, then, because though the coupon rate is fixed, the inflation-adjusted principal amount is changing.

If an investor holds a TIPS bond to maturity, she receives the adjusted principal or the original principal, whichever is greater. This provision protects the bond owner against deflation. (If the TIPS holder sells before maturity, it's possible that she would experience a loss of principal.)

Tax Considerations Unlike I Bonds, TIPS pay out income twice per year (every six months). And holders of individual TIPS bonds should be aware of a phenomenon called "phantom income"--essentially, investors have to pay taxes on the principal adjustments in the tax year they occur, even though they won't receive the full value of those adjustments until the bond matures. For that reason, owners of individual TIPS bonds may want to house them in a tax-deferred account.

Owning mutual funds or ETFs helps circumvent this problem a bit, because the distributions from funds attempt to match up both forms of payment--they periodically pay out both the income and the realized inflation. (Investors are still on the hook for paying the taxes on these distributions.) Because the principal values fluctuate, however, the size of the fund's distributions can rise and fall.

Individual Bonds or Funds? There are several advantages to owning TIPS through a mutual fund or ETF wrapper rather than owning the individual securities, including:

• The distributions can be easily reinvested. • The mutual fund or ETF shares have better liquidity in the event that investors would want to sell all or part of their TIPS allocation. • A mutual fund facilitates a laddered approach to TIPS exposure, investing in TIPS securities of varying maturities. • A TIPS fund portfolio manager can look across the TIPS yield curve to find relatively undervalued TIPS, and can swap out lower yielding TIPS for higher-yielding issues.

There is a drawback, however--market risk. TIPS' principal protection feature only applies if an individual TIP security is held to maturity. In the meantime, TIPS' prices can be extremely volatile: When yields rise, TIPS' prices come under pressure--the longer the bond, the more pressure--even if inflation is pushing up their principal value at the same time.

This is important to note because although TIPS mutual funds and ETFs hold bonds whose principal values adjust along with inflation, the funds themselves don't have a maturity date. Therefore, there is no explicit guarantee of principal protection; it's possible that you could lose money in a TIPS mutual fund over the course of your holding period.

Some of our favorite TIPS funds include:

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)