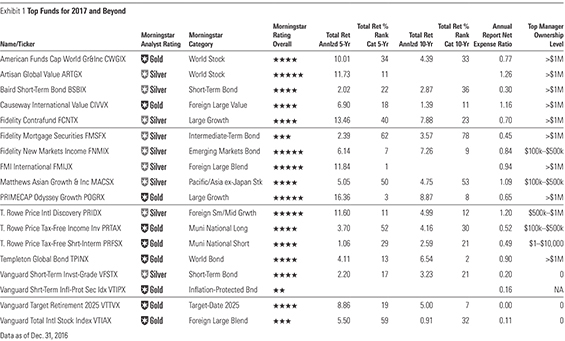

17 Funds for 2017 and Beyond

Some fund ideas for long-term investors.

With transitions in the White House, Fed policy, and the inflation outlook, it feels particularly precarious to make predictions. On the plus side, investors have enjoyed tremendous gains in recent years as equities have had one of their all-time great runs, especially in the United States. In addition, unemployment and inflation are low.

But given the cyclical nature of markets, the chances for a bear market grow the longer a rally lasts. There are signs that inflation is on the rise, and the Federal Reserve has acted accordingly. It raised rates in December and signaled it expects to raise them three more times in 2017. That doesn’t mean that markets or the economy will hit the brakes, but it could signal more sobriety in the markets. The bond market has noticed the potential for even more inflation and rates are rising.

To me, the best response to uncertainty is diversification. If it’s unclear where we are headed, I want my eggs in a lot of baskets. I also want to be sure that I err on the side of caution rather than aggression, but I wouldn’t make the mistake of equating foreign with high risk and domestic with low risk. Diversifying by country and, to a lesser degree, currency will reduce your risk.

In fact, investment management firm GMO forecasts emerging markets will be the highest-returning markets over the next seven years. Its forecasts are after subtracting inflation, so the figures are not quite as bad as they might first sound. However, it doesn’t adjust for risk. It forecasts a 4.4% real return for emerging-markets stocks and a 1.8% real return for emerging-markets debt. Emerging markets have been some of the worst-performing regions in recent years because of slowing growth from China and a decline in commodity prices. Emerging markets might actually be cheap in a world in which not much looks cheap. GMO’s worst return forecasts are for U.S. large-cap stocks (negative 3.0%), U.S. small caps (negative 2.3%), international bonds hedged back to the dollar (negative 3.0%), and U.S. bonds (negative 0.8%). It’s just one forecast, of course, but it’s certainly sobering.

The ideas shared here are ones that are particularly appealing at this time, but they are still meant to be long-term investments rather than one-year bets. Be sure to read the complete analysis for any fund you consider so that you can figure out if it suits your needs. You can find all our Morningstar Medalists here.

So, how should you diversify? Glad you asked.

Short-Term Bond Funds Short-term bond funds are all about playing defense. It's good to have some protection against rising interest rates and falling stock prices.

Silver-rated

Gold-rated

That leads me to Gold-rated

Foreign Equities and Bonds If you have 80% or more of your portfolio in U.S. securities, you probably could do with some foreign exposure. Foreign developed markets are no riskier than the U.S. market, and they should reduce the overall risk of a portfolio that is heavily skewed to the U.S.

Foreign markets have the added appeal of having mostly lagged the U.S. in recent years and so may be a bit cheaper. Here are four good ways to play them.

Smaller-cap stocks have less correlation with U.S. large caps because their fates are more closely tied to their local economies. So, the small-cap-focused

World Stock World-stock funds may raise your foreign exposure only slightly, but they are a sensible way to invest. Why limit a manager's investment universe? Here are two of the best funds, and they happen to have recently become more accessible.

We recently highlighted top funds at American in light of their move to join No Transaction Fee networks, and Gold-rated

Emerging Markets

My emerging-markets shopping list always starts with the Asian specialists at Matthews funds. They go deeper down the market-cap spectrum yet tend to run with less risk than their peers.

Large Growth

Poor large growth. It’s had yet another year of brutal outflows, and in December two former flagbearers for the style were slated for the chopping block: Janus said it would merge away

No, I’m not contractually obligated to include a Primecap fund in every “Where to Invest” article, but I’m going to again anyway.

Newly Rated Medalists Sometimes it's better to think of opportunities in terms of securities rather than asset class. In that spirit, I thought I would share three Morningstar Medalists that we started (or restarted) covering in 2016.

Target-Date Funds Target-date funds have produced excellent investor returns in recent years, meaning investors use them well. The reason is partly because they are so boring that they don't inspire panic or greed. The other part is that they are 401(k) vehicles in which investors generally invest steadily through the markets' ups and downs. So, a simple thing you can do to achieve your goal is to invest as much as you can in your 401(k)'s target-date fund and stick to it. Vanguard's target-date lineup is one of the best.

Table available in larger size here.

- source: Morningstar Analysts

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)