Eaton Vance Makes Move Into Sustainable Investing

Acquisition of Calvert reflects heightened interest in ESG among conventional asset managers.

It was just a matter of time before a large asset manager gobbled up Calvert Investment Management. A small firm with a lineup of 25 sustainable and responsible mutual funds and $14 billion in assets under management, Calvert was widely thought to be getting readied for sale under CEO John Streur, who came to the firm in 2014. Eaton Vance announced last week it was acquiring Calvert, which had been an indirect subsidiary of Ameritas.

The acquisition reflects the ongoing mainstreaming of sustainable and responsible investing in the United States. Having been the province of a few deeply committed boutique firms, the field is becoming increasingly attractive to conventional asset managers who see it as a way to engage the next generation of investors. Making matters more urgent, firms dependent on active management are under intense pressure created by the tide of money flowing to low-cost index funds and exchange-traded funds. One response for larger firms is to increase scale, in this case, by adding new expertise in an investment area that seems poised for growth. And one response for smaller firms is to be acquired. Thus, Eaton Vance has joined firms like BlackRock, John Hancock, Nuveen, and SSgA by getting involved in this space, with more firms likely to come.

Over the next several decades, more and more Gen Xers and millennials will hit their stride as investors as their earnings increase and as they benefit from a large transfer of wealth from older generations. As the financial industry has tried to better understand younger investors, it has found, among other things, that they have a high level of interest in sustainability and in applying that concept to their investments.

So the move makes sense for Eaton Vance, even though Calvert comes with some baggage. It has been beset with outflows in recent years during a period when sustainable funds, in general, have been getting inflows. In addition, Calvert announced last week that it had agreed to pay the SEC $3.9 million to settle charges it had improperly valued bonds in eight of its fixed-income funds from 2008 to 2011. Calvert also said it had notified the SEC earlier this year that the firm had misused fund assets to pay for distribution costs prior to 2015 and offered a plan for repaying shareholders, something the SEC has not yet responded to. An SEC settlement is never a good thing, regardless of the firm, but when the fund company takes a sustainable and responsible approach, investors may be especially turned off.

On the other hand, Calvert offers considerable expertise in the field and the most comprehensive lineup of sustainable/responsible funds in the U.S. In the past few years, Calvert has focused on improving its proprietary environmental, social, and governance research process, which narrows the universe of companies in which its equity and fixed-income funds can invest to those that are the top sustainability performers based on key material ESG issues within their industries. Calvert has built a suite of index funds based on that universe, and its active managers select securities from the list but apply their own financial analysis.

Calvert has also brought more of its active equity management in-house (perhaps so that a sale would come with fewer complicating strings attached). Its biggest remaining subadvisor, Atlanta Capital, which manages Calvert Equity and the equity portion of Calvert Balanced, is also owned by Eaton Vance.

On the fixed-income side, Calvert has always managed its funds in-house but confusingly offered both sustainable and conventional bond funds. That’s also changed recently, as all bond funds are now sustainable offerings. In addition, it recently launched Calvert Green Bond CGAFX, which focuses on environmental projects.

It appears Calvert will continue to operate as its own entity within Eaton Vance. That would be a good thing, especially if Calvert is permitted to continue its important shareholder advocacy and corporate engagement work, which is a way for sustainable investors to wield more impact and to stay personally connected with their investments. Sometimes larger firms look askance at such efforts or water them down.

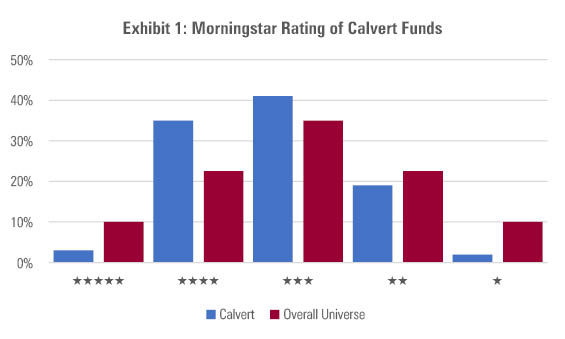

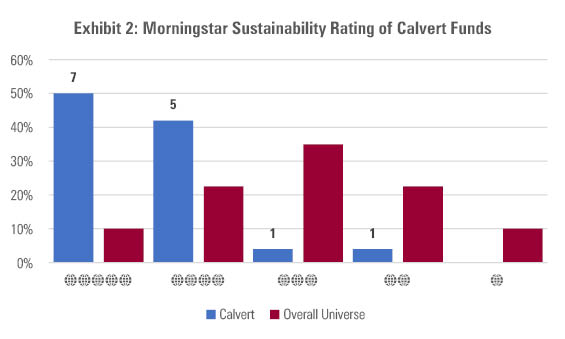

Calvert has a reputation for average fund performance, but the Morningstar Rating distribution of its current funds skews positive and its portfolio-based Morningstar Sustainability Ratings are generally high, which is one way to confirm that Calvert is doing what it claims to be doing. Given the high levels of interest in sustainable investing today and the relative lack of sustainable investment products, the wider distribution of Calvert funds that’s now possible with the acquisition by Eaton Vance is a welcome development.

- source: Morningstar Analysts

- source: Morningstar Analysts

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)