Tiny Social Security COLA Another Hurdle for the Economy

A minuscule cost-of-living adjustment will likely come despite healthcare inflation that continues to re-accelerate with a vengeance.

Last week, we took a decidedly more cautious view of the U.S. economy, based on various labor market reports. Despite decent employment and wage gains, hours worked have slipped enough to put pressure on total wages.

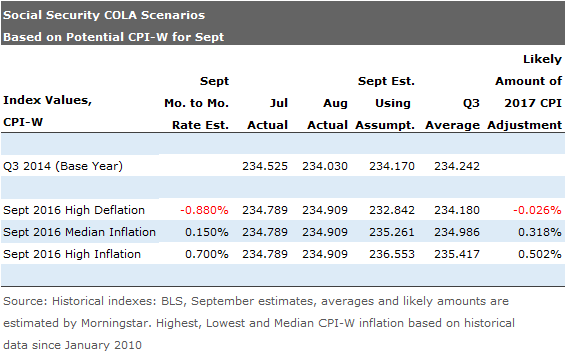

This week our concern is Social Security recipients who are likely to receive a very minimal COLA increase in 2017 (likely less than 0.5% or $5 to $10 per month). This tiny increase comes despite healthcare inflation that has continued to re-accelerate with a vengeance according to the CPI release for August. The report showed year-over-year healthcare services inflation increased 5.1%, and medical commodities, mainly drugs, grew 4.5%.

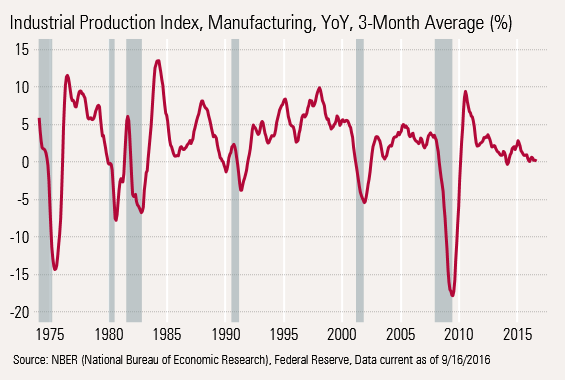

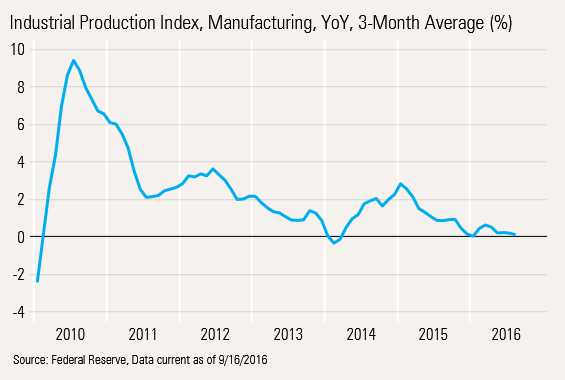

The total wage worries and now Social Security issues are on top of our ongoing concern about airliner and automobile production as well shale oil and gas issues. Weaker-than-expected industrial production figures this week seem to suggest that those worries were well placed. Retail sales also missed the mark, showing a month-to-month decline. However, looking at that data on a year-over-year, average basis, the retail report was OK, though certainly not great.

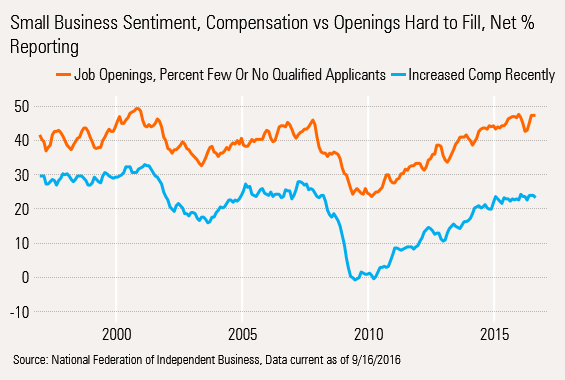

In a piece of good news for the consumer, job openings continued to expand, suggesting that more wage increases may be in the works. But on the flip side, that isn't great news for labor-intensive businesses and their profits.

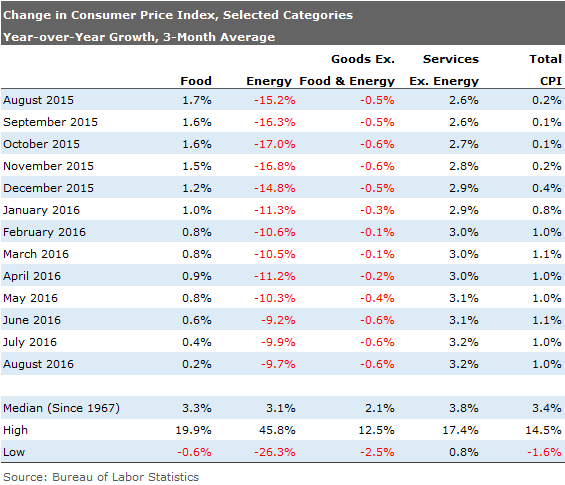

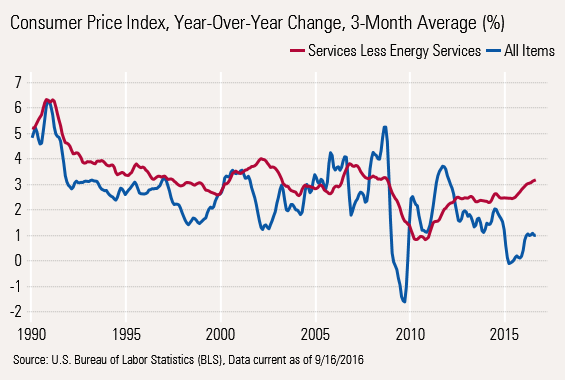

Headline Inflation Stays Low and Stable, but Note the Underlying Shifts Headline or total inflation has been stuck at either 1.0% or 1.1% on a year-over-year, three-month moving average basis since February. However, that disguises the fact that there has been less energy deflation, more grocery deflation, and an ever-accelerating rate of inflation for services, as shown below.

Given these shifts, the move to higher headline inflation is taking a lot longer than I expected, which is good news for the Fed. However, we think headline inflation will be over 2% within the next six to 12 months. We had previously thought that inflation might reach that rate by October. Lower food prices and lower auto prices are the reason for the push-out of accelerating inflation.

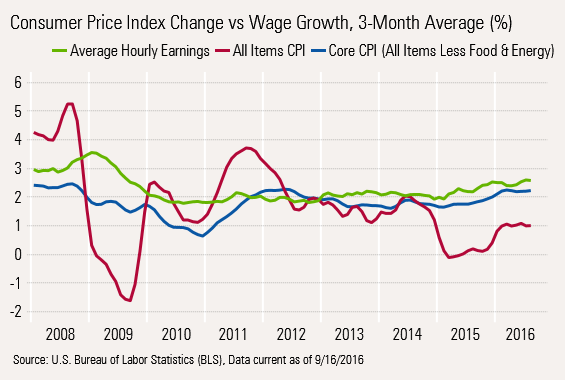

Workers Still Ahead of the Game Hourly wages still are doing better than both core and headline inflation, which is one reason our relatively dire assessment of the economy could be wrong. However, for those wages to help, hours worked and total employment both need to improve, not just wage rates.

Services Inflation Still a Problem, With Healthcare and Housing Leading the Way Despite generally tame inflation overall, services inflation continues to worsen, now at 3.2% year over year averaged. Healthcare inflation and rent inflation continue to drive most of the services inflation. Rents are up 3.8% year over year, and healthcare services are up 5.1%, putting pressure on a lot of consumers, but certainly not everyone.

Tight Labor Markets and High Job Openings Point to Higher Wages and More Services Inflation Small business reported a new high in job openings with few or no qualified applicants. The correlation between that statistic and wage increases is very high, suggesting that wages will likely march higher, which is both good news and bad news for the economy and businesses.

Inflation Data Suggests Minimal Social Security Cola Increase for 2017 As much as we are delighted for the current wage workers (over 140 million wage recipients), Social Security recipients, numbering 65 million, got no raise in 2016 and an insignificant one in 2017. Of course, that assumes the pre-election pressures don't force Congress to act to give retirees a raise.

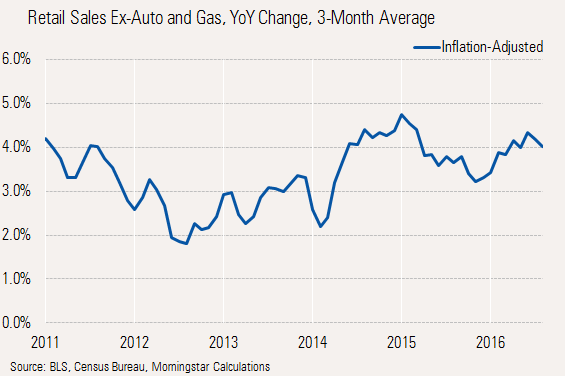

Retail Sales Data Confused by Weather, Shifting Tax Holidays and Deflation Retail sales didn't look good month to month, but the year-over-year data was just fine, especially after adjusting the data for price changes.

Inflation adjustment calculated by Morningstar based on goods and services in retail sales report

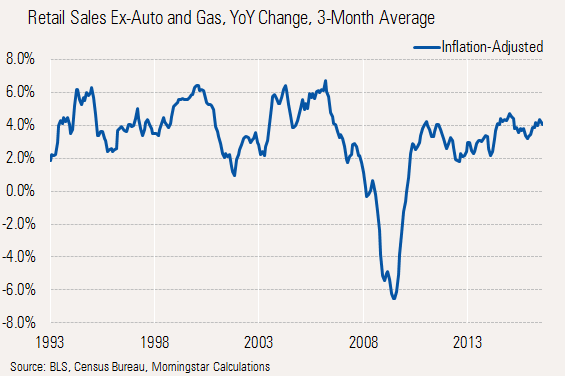

And the current growth is not far off of long-term trends.

Inflation adjustment calculated by Morningstar based on goods and services in retail sales report

Manufacturing Going Nowhere Fast We had been hoping that higher oil prices and commodity prices might help the manufacturing data, but August production data was soft yet again. While manufacturing isn't really hurting the economy, it is not helping, either. Manufacturing represents about 12% of the U.S. economy and is providing no help to growth rates currently.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)