High-Quality Dividend-Payers Selling at a Discount

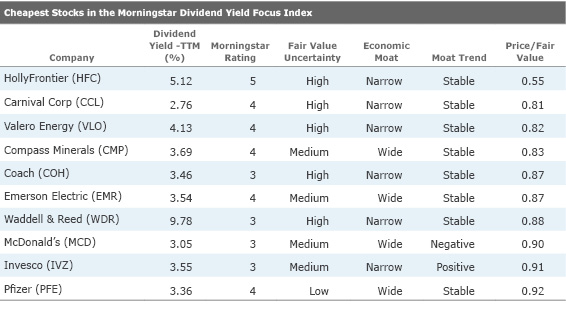

We highlight a few of the cheapest stocks in the Morningstar Dividend Yield Focus Index.

We don't need to convince most of our readers of the virtues of dividend investing. Especially in this low-yield environment, investors have taken renewed notice of the attractions of dividend-paying securities.

For one, by their cash-paying nature, returns of dividend-paying stocks tend to be more predictable: When more of the total return comes from dividend payments, investors don't need to rely as much on price appreciation to get a reasonable return. And such stocks tend to be less volatile: When the bulk of a stock's total return is built with steady dividends, there's less reason for investors to focus on "market noise" such as quarterly earnings, management changes, rumored takeovers or mergers, etc.

The management of a dividend-paying stock is often a disciplined bunch, too: Because they want to continue to make their dividend payments else risk losing their investors, management (in theory) will want to maintain a conservative balance sheet and focus on core, cash-generating businesses.

In theory, but not always. There are certainly companies that pump up their yield in ways that are unsustainable (master limited partnerships serve as a recent, painful reminder). And some stocks sport high yields because their share price is depressed due to fundamental problems (such as financials in 2007 or commodities-related companies in 2013). The Morningstar Dividend Yield Focus Index can help investors find high-yielding stocks of companies that are financially healthy enough to sustain and even grow their dividend. (In contrast to most other dividend indexes that use only backward-looking criteria, the Dividend Yield Focus also considers qualitative forward-looking measures.)

To find the constituents in the Dividend Yield Focus, we first screen the Morningstar US Market Index--a broad market index targeting 97% of the overall market capitalization--for the highest-yielding companies. (The dividend must come from qualified income, so real estate investment trusts are not included.) We also apply quality screens: We search the high-yielders for companies that have Morningstar Economic Moat Ratings of wide or narrow, meaning that we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's Morningstar Distance to Default ratio, which is a proprietary metric that uses market information and accounting data to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). Click here to see the current holdings.

In the table below, we show the cheapest 10 stocks in the index, ranked by lowest price/fair value ratio. And then we take a deeper dive into our analysts' insights on three of the companies. (Please note that the dividend yields listed below are backward-looking and could change going forward. For instance, Morningstar senior analyst Gregg Warren

Emerson Electric

EMR

Over the past 10 years, Emerson averaged over 15% return on invested capital (including goodwill) relative to a weighted average cost of capital of around 8.4%, said Morningstar equity analyst Barbara Noverini in a recent

Compass Minerals International

CMP

Compass Minerals produces rock salt for use in road and highway de-icing. Compass owns the world's largest active rock-salt mine in Ontario, whose thicker seams allow for more efficient mining operations. In addition, the mine is on Lake Huron, giving Compass easy access to snowy markets along the Great Lakes. These assets are difficult, if not impossible, to replicate, giving the firm a sustainable cost advantage over other producers, says Morningstar senior equity analyst Jeffrey Stafford. Stafford notes that highway de-icing salt prices are relatively stable, and Compass' average selling prices in this area have increased year over year in each of the past 10 years. In addition, Compass is also a cost-advantaged producer of its other main product, sulfate of potash, which is a specialty fertilizer used by growers of high-value crops that are sensitive to standard potash (muriate of potash). Furthermore, Compass controls one of only three naturally occurring brine sources that produce sulfate of potash, which is priced at a premium to standard potash.

Invesco

IVZ

The publicly traded asset managers we cover tend to have economic moats due to competitive advantages that stem from switching costs and intangible assets. Invesco, in senior equity analyst Gregg Warren's view, has a narrow economic moat. The company's $779.6 billion in total assets under management at the end of June 2016 is well diversified across asset classes and geographies, as well as both institutional and retail clients. As Warren notes in this video, it wasn't a surprise that Invesco's share price was impacted by the Brexit event, given that the firm sources 13% of its managed assets from the United Kingdom and another 10% from Continental Europe. Now the shock of the Brexit vote has waned Invesco's price has rebounded, but there is still some room left to run, in Warren's view. For one, Invesco is more appealing than some of its competitors in the group because the firm provides clarity into its numbers by reporting AUM flows on a monthly basis. It also has a lot more capital to put to work in share repurchases and it pays a dividend, notes Warren.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)