July Ratings Activity Features Downgrades and New Ratings

One fund loses its Gold rating.

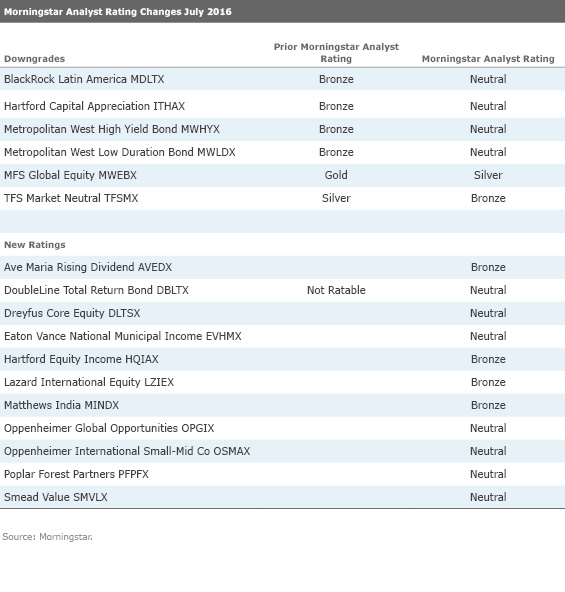

In July, Morningstar manager research analysts downgraded the Morningstar Analyst Ratings of six funds, assigned new ratings to 11 funds, and upgraded no funds. Below are some of July’s highlights, followed by the full list of ratings activity.

Downgrades MFS Global Equity’s

MWEFX rating dropped to Silver from Gold due to a comanager’s pending retirement. David Mannheim, who has run the fund with various comanagers or on his own since it opened in 1992, will retire in 12-24 months. Roger Morley, who became a comanager in 2009, remains, and Ryan McAllister will become a comanager in September 2016.

Mannheim’s departure is a loss, but the team is still much better than average. Morley is experienced and talented, and McAllister, who has no prior portfolio-management experience, will work with Morley and Mannheim for at least nine months before Mannheim departs. The same roster of 28 U.S. and 35 non-U.S. MFS stock analysts will continue to support the modified team. The fund remains a terrific source for global blue-chip exposure.

TFS Market Neutral’s

TFSMX rating slipped to Bronze from Silver due to recent manager turnover and concerns about its ability to consistently outperform. After a decade of stability, the fund’s management team saw some turnover in 2015. TFS’ co-founder, Larry Eiben, stepped down from his portfolio management duties in March 2015 and then left the firm in July 2016. Chao Chen and Yan Liu, the only portfolio managers with Ph.D.s, also left the team in 2015.

The quantitative long/short equity fund significantly outperformed without extra risk from 2006 to 2009, but its risk-adjusted returns have diminished since then, and in 2015, its alpha, a risk-adjusted performance measure, was negative 3.25%. TFS has acknowledged that the future alpha potential of this fund is likely to be lower, and trimmed its fees—which are still above average—as a result.

Hartford Capital Appreciation

ITHAX was downgraded to Neutral from Bronze due to uncertainty regarding the fund’s long-term composition and risk profile. The fund turned into a multimanager offering in 2013 to prepare for longtime lead manager Saul Pannell’s retirement, though no time frame has been given. Pannell still ran 51% of assets as of May 2016, alongside eight other Wellington managers with a variety of investment styles ranging from dividend growth to opportunistic value to international.

It's hard to predict the future composition of the fund and how it might fit into an investor’s portfolio. While Pannell was the fund’s sole manager from 1996 to 2013, it was a relatively bold all-cap fund which posted superb—albeit volatile—returns, but that could change as other managers receive more of the pie. The fund also risks becoming more marketlike when Pannell’s take eventually declines; active share has already dropped to 70% from the mid-80% range when Pannell ran it solo, and could go even lower when he’s gone. For now the fund is in a state of limbo, making it hard for investors to know what to expect long-term.

New Ratings DoubleLine Total Return

DBLTX was assigned a Neutral rating in July. The fund previously received a Not Ratable designation, reflecting our view that we lacked sufficient information to fully and fairly assess the fund’s process or stewardship practices. With this most recent review, we revisited the fund’s rating and assigned a rating based on what we know rather than withholding a rating absent complete information. We respect the skill and experience of manager Jeff Gundlach, as well as his excellent long-term record. The fund’s reasonable expenses also count in its favor. However, we still have questions about the repeatability of the fund’s process and its stewardship. As a result, the fund earns a Neutral rating.

Hartford Equity Income

HQIAX starts off with a Bronze rating because of its strong management, sound approach, and reasonable fees. Lead manager Michael Reckmeyer’s approach is not flashy but it’s effective. He seeks well-capitalized firms that offer above-average dividend yields and attempts to initiate positions when those stocks are out of favor. While that can get him into trouble if a holding cuts its dividend, he's demonstrated good judgment over a long time period. Current large positions include blue chips

Reckmeyer has been part of Wellington Management’s subadvisor team responsible for this fund since its 2003 inception and has been the lead manager since early 2008. Since then, through July 2016, the fund’s annualized gain of 7.7% beat the Russell 1000 Value benchmark’s gain of 5.9% and beat 87% of its large-value Morningstar Category peers. The fund’s Sharpe ratio—a measure of risk-adjusted returns—also beat 89% of its peers during the same period.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)