Dominion Continues Its Wide-Moat Transformation

Growth projects and the Questar acquisition will add to its scale.

Dominion’s proposed $4.4 billion Questar acquisition will add a high-quality regulated utility and a 2,700-mile wide-moat interstate gas pipeline network in Utah, Wyoming, and Colorado. This will be a small earnings contributor initially, but we think it offers Dominion another leg of wide-moat investment potential during the next decade as a western hub for supplying natural gas to utilities that are converting coal-fired power plants to gas to meet state and federal environmental regulations.

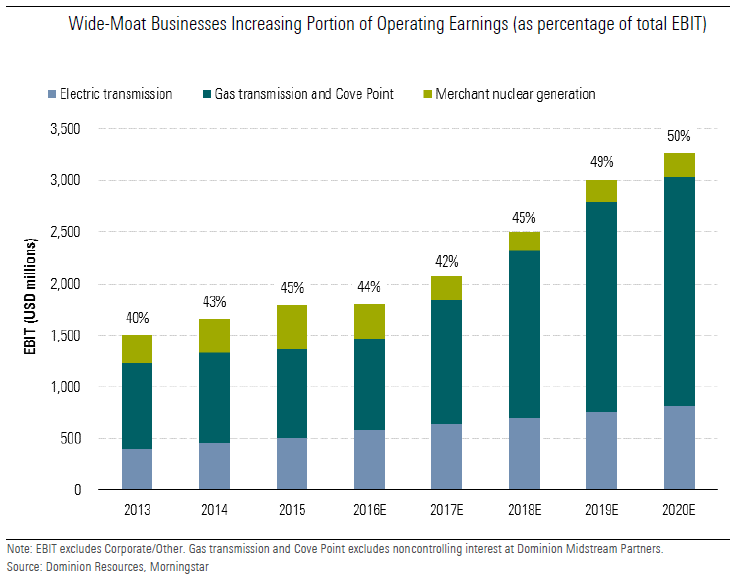

Wide-Moat Earnings Continue Growing Morningstar believes a regulated utility can establish a wide economic moat if it operates in a constructive regulatory environment and it has a material share of earnings from nonutility businesses with sustainable competitive advantages. We believe Dominion meets these criteria. We estimate that wide-moat nonutility and regulated transmission businesses will contribute 50% of earnings by 2020, with the balance coming from regulated gas and electric utilities with some of the most constructive regulation and attractive growth potential in the country.

Dominion’s wide-moat businesses include natural gas transmission and storage in the Marcellus and Utica shale regions, the unique Cove Point LNG export facility in Maryland, and interstate electric transmission regulated by the U.S. Federal Energy Regulatory Commission. In addition, we expect Questar’s pipeline network will offer wide-moat investment opportunities into the next decade.

Dominion’s regulated utilities demonstrate attractive fundamentals and constructive regulation. We estimate that Virginia Electric Power Company will contribute about 38% of consolidated earnings in 2020, excluding transmission. VEPCO’s unique regulatory arrangement will keep retail base electric rates frozen through 2022. Typically, rate freezes are terrible for regulated utilities, but VEPCO actually stands to benefit from the rate freeze, given its attractive rate riders, above-average electric demand growth outlook, and above-industry-average allowed returns. We think Virginia will continue to support a highly constructive regulatory environment to encourage investment in new service and reliability. This should allow VEPCO to earn above its cost of capital for a very long time. Dominion’s gas utilities--including Questar’s utilities--also enjoy topnotch regulation and attractive returns on capital. Together, Dominion’s wide-moat nonutility businesses and constructive regulated utilities should allow the company to earn returns above its cost of capital for many years to come.

Uncertainty Has Lessened We recently lowered our fair value uncertainty rating to low from medium, given our increased confidence that Dominion will complete its two major growth projects--Cove Point and ACP--on schedule and on budget. These wide-moat natural gas infrastructure projects have long-term contracts with investment-grade utilities and international gas suppliers. Dominion has no commodity or volume risk for either project.

The Morningstar uncertainty rating captures the range of likely potential fair values and uses it to assign the margin of safety required before investing, which in turn explicitly drives our stock star rating system. The uncertainty rating is based on the characteristics of the business, including operating and financial leverage, sales sensitivity to the overall economy, pricing power, and other company-specific factors. For Dominion, our prior uncertainty rating of medium was due in part to the development and construction risk associated with Cove Point and ACP.

A decline in merchant generation earnings as a share of Dominion’s consolidated earnings also contributes to our low uncertainty rating. Merchant generation earnings depend heavily on volatile commodity prices. Merchant generation represented 11% of operating earnings in 2015 (excluding corporate and other), of which we estimate the wide-moat Millstone nuclear plant in Connecticut represents roughly 75%. We expect merchant generation earnings to fall to about 3% of consolidated earnings by 2018, in part owing to lower generation margins at Millstone but also as a result of earnings growth in Dominion’s other businesses and the Questar acquisition.

Cove Point Likely to Be Only East Coast LNG Export Facility Cove Point is currently a liquefied natural gas import/regasification and storage facility on the Chesapeake Bay near Lusby, Maryland. Dominion is building an LNG export facility on the existing site after receiving final approval from the FERC in September 2014.

Given the favorable economics of sourcing natural gas in the United States and liquefying and transporting it to Europe and Asia, we suspect the returns for Cove Point are well above Dominion’s cost of capital for at least the 20 years, based on already-signed export agreements. We believe the difficulty of siting a new LNG export facility on the U.S. East Coast gives Cove Point an intangible asset that is the primary source of the facility’s wide-moat fundamentals. Thus, we believe the wide moat could last beyond the initial 20-year export agreements.

Liquefaction is the process by which natural gas is converted to LNG, which can be loaded into oceangoing LNG vessels for worldwide transportation. U.S. exports of LNG are expected to dramatically increase over the next decade, driven by the supply of shale gas and projected growth in worldwide demand.

The liquefaction facility cost is estimated at $3.8 billion. It is expected to be placed in service in late 2017 and export approximately 4.6 million metric tons per year (0.66 billion cubic feet equivalent per day). Half of Cove Point’s capacity has been contracted with a joint venture of Sumitomo and Tokyo Gas, the largest natural gas utility in Japan. The remaining 50% is contracted with a wholly owned indirect U.S. subsidiary of GAIL, one of the largest government-linked natural gas companies in India. The 20-year agreement with each of these creditworthy counterparties begins on the in-service date and has a fixed fee that covers all operating and capital costs, including profit. Natural gas is supplied by the counterparties. Thus, Dominion takes no commodity or volume risk.

Cove Point also owns 136 miles of natural gas pipeline that connects the facility to interstate natural gas pipelines. The import facility generates revenue and earnings from annual reservation payments for regasification, storage, and transportation contracts with a portfolio of creditworthy counterparties that include BP, Royal Dutch Shell, and Statoil. These contracts begin rolling off in 2017.

ACP Connects Marcellus With Southeast U.S. Demand The Atlantic Coast Pipeline is a natural gas transmission line with a capacity of 1.5 billion cubic feet per day that will run from West Virginia to North Carolina, passing through Virginia. Partners in the ACP are Dominion (45%), Duke Energy (40%), Piedmont Natural Gas (10%), and AGL Resources (5%). Dominion will construct, operate, and manage the pipeline.

The pipeline’s owners and Scana have signed 20-year customer contracts for the pipeline capacity. Pipeline owners often have anchor contracts with gas producers, which can come with high credit payment risk. The fact that the ACP’s contracts to move gas out of the Marcellus and Utica shale regions are with more creditworthy utilities further supports its wide moat. The ACP is expandable to 2 bcf/day, offering Dominion a source of wide-moat growth potential beyond its late 2018 in-service date if the region needs more gas to accommodate increased usage by new power plants and retail customers.

The ACP will eventually serve VEPCO’s 1,358-megawatt Brunswick County power station, which began commercial operation in April. VEPCO’s proposed 1,588-MW Greensville County plant will be a short distance away and will also be served by the ACP when completed. Both plants are on the southern border of Virginia, and the ACP will proceed south to provide natural gas to customers of Piedmont, AGL, and Scana Public Service North Carolina. In addition, we expect Duke Energy will construct gas-fired plants to replace coal-fired ones, using natural gas supplied by the ACP.

In April, Dominion and its partners announced that the start of construction of the Atlantic Coast Pipeline would not begin until the summer of 2017, a delay of almost one year. The delay was due in large part to regulators asking Dominion and its partners to relocate the line south of the proposed route to avoid environmentally sensitive areas in two national forests. Although the route is not finalized, we believe the proposed alternate route conforms to the regulators’ request and will be approved by the FERC. The $5.1 billion project is still expected to be completed in late 2018.

Electricity Demand and Security Drive Electric Transmission Investment Similar to natural gas transmission, we believe high-voltage electric transmission regulated by the FERC is a wide-moat business. We expect investments in high-voltage electric transmission to total approximately $750 million per year through 2020, resulting in average annual earnings growth of approximately 10% from this business. The investments are driven by more than 100 growth and reliability projects in Virginia.

Virginia has the highest concentration of technology workers per capita in the nation, resulting in more than 50% of U.S. Internet traffic passing through Loudoun County on a daily basis. This has driven data center growth in VEPCO’s service territory, and Dominion estimates that electric demand growth from these centers will increase 9% annually through 2020. Because of the security concerns of these facilities and the large number of military installations served by VEPCO, the security of the transmission system is of critical importance. Dominion estimates that it will spend roughly $300 million-$500 million on upgrading substation security over the next 5-10 years. Thus, we believe investing in wide-moat FERC-regulated transmission could continue through the next decade, supporting Dominion’s wide moat.

Questar Acquisition Brings Growth Potential On Feb. 1, Dominion announced an agreement to acquire Questar for $4.4 billion in cash and the assumption of about $1.6 billion of debt. We think the most attractive part of the deal is the Questar Pipeline, a wide-moat FERC-regulated natural gas transmission pipeline network in Utah, Wyoming, and Colorado. The 2,700-mile pipeline and storage network is allowed attractive returns on equity between 11.4% and 13.0%.

The pipeline represents only 28% of Questar’s EBITDA right now, but we think it has a long runway of high-return growth potential, owing to the continuing retail customer demand for relatively inexpensive natural gas and the economic health of the Rocky Mountain region. In addition, the region’s electric utilities remain heavily concentrated in coal-fired generation.

The states bounding Utah, home to the majority of the Questar Pipeline’s network, will have to make significant reductions in coal-fired generation in order to comply with the Clean Power Plan. These states also have aggressive renewable energy targets, and gas-fired generation is the generation of choice for utilities to back up and supplement intermittent power from wind and solar energy. Although the future of the CPP is in doubt because of legal challenges and the departure of the Obama administration, we believe public opinion will continue to drive state regulators and legislators to use more gas and renewables and less coal, benefiting the Questar Pipeline.

We believe this creates the same potential investment opportunities for pipeline expansion on which Dominion Energy has capitalized in the Marcellus and Utica shale plays. We have a high degree of confidence that opportunities like the ACP will surface for the Questar Pipeline. In our opinion, this will create a long-term investment runway under attractive FERC regulation well into the next decade, adding to Dominion’s wide moat.

We expect Dominion to close the deal by the end of the year and incorporate Questar in our forecasts beginning Jan. 1. Utah regulators could approve the deal as early as August, and Wyoming approval could come in September. These states have relatively constructive regulation, so we don’t expect the regulatory and political struggles that have delayed other recent transactions in the utilities sector.

Dominion plans to finance the transaction with new Dominion equity, convertible debt, parent-level debt, and funding from asset drop-downs to Dominion Midstream Partners. In early April, Dominion issued 10,200 shares with gross proceeds of approximately $750 million. We assume the drop-down occurs in 2017 and raises $1.7 billion.

Questar’s primary earnings contributors are Questar Gas and Wexpro. Questar Gas is a regulated natural gas distribution utility serving almost 1 million customers in Utah, Wyoming, and Idaho. Strong economic growth in Utah, home to over 95% of Questar Gas’ customer base, should drive customer growth of approximately 2%, a level very few natural gas utilities in the U.S. are seeing. On a negative note, many gas distribution utilities are benefiting from significant rate base growth replacing old cast iron and bare steel pipe. As a relatively young utility, Questar has very little pipe to replace. Questar Gas provides about 30% of EBITDA, and given its solid regulatory framework, we believe it is a narrow-moat business.

Wexpro develops and produces natural gas and contributed about 41% of Questar’s adjusted EBITDA in 2015. It supplies roughly 65% of Questar Gas’ natural gas supply for retail customers under a cost-of-service regulatory agreement that has been in place for 35 years. The agreement allows Wexpro to receive a regulated return on acquisition costs and expenses, similar to a utility. In 2015, the unit achieved a return on equity over 15%. Based on the relatively low-risk nature of the business arrangement and returns well above our estimate of its cost of capital, we believe Wexpro is also a narrow-moat business. We expect Dominion to retain the long-term relationship between Wexpro and Questar Gas. We would be very surprised to see Dominion re-enter the exploration and production business that it exited in 2010.

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)