Tempering the Risk of Small Caps

These funds have lost less in downturns than the S&P 500.

With small-cap benchmarks lagging larger-cap counterparts during the past year, is now a good time to invest in small-cap funds? There is no easy answer to that question--for example, conventional wisdom says that rising interest rates are hard on smaller companies, but then again, the economic growth that often accompanies such increases could be a tailwind. But for most stock investors, it is always a good time to have some small-cap diversification.

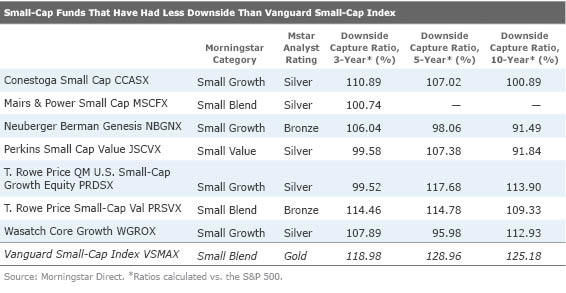

Still wary? We compiled a list of small-cap Morningstar Medalists that have had lower downside capture ratios relative to the S&P 500 than

Perkins Small Cap Value reopened to new investors in 2015, and all of the rest are open as well. (

Conestoga Small Cap CCASX

This fund's managers take a relatively conservative approach to the small-growth universe. They are patient, seeking investments with the potential to appreciate by at least 100% over three to five years, and tend to hang on to their picks for about that long. They prefer companies with strong franchises and at least a 15% return on equity, as well as a debt/total capitalization ratio of less than 40%. They invest with conviction, holding between 40 and 50 names, have much leeway to deviate from the Russell 2000 Growth Index's sector weightings, and also try to stay fully invested at all times. The result is one of the strongest 10-year risk-adjusted records in the small-growth Morningstar Category. Below-average expenses and a small asset base add to the fund's attraction.

Mairs & Power Small Cap MSCFX

This young fund doesn't have a five-year record yet, but it follows Mairs & Power's long-established strategy of buying and holding financially sound businesses with sustainable competitive advantages that can deliver consistently above-average return on equity. The resulting high-quality portfolio has shown moderate volatility so far--and is the same strategy that enabled the firm's all-cap flagship

Neuberger Berman Genesis NBGNX

Veterans Judy Vale and Bob D'Alelio implement a long-term, fundamentally driven strategy. They look for small-cap stocks, preferably not too cyclical, that dominate a competitive niche and feature solid balance sheets, strong cash flows, and reasonable valuations, and often hold on to favorites for many years. (The fund has long straddled the border between small-cap and mid-cap territory.) While the fund sometimes lags when lower-quality stocks lead, its 15-year returns rank in the top 2% of the small-growth category as of February 2016, and it has been one of the least volatile offerings. A caveat: With nearly $10 billion in assets, this is among the largest funds in the category, even after suffering $5 billion in net outflows in recent years. The managers argue that the fund's quality bias and low turnover allows them to handle size and outflows relatively easily.

Perkins Small Cap Value JSCVX

Perkins Small Cap Value has reliably provided downside protection despite some team turnover. The approach focuses first on how much a stock could potentially lose, and the portfolio routinely sports a lower debt/capital ratio and higher returns on invested capital than the Russell 2000 Value Index. That's helped the fund hold up relatively well in rough patches, including the third quarters of 2014 and 2015, when strong stock-picking, rather than a large cash stake, drove results. The fund's strong long-term risk-adjusted record within the small-value category dates back to its 1987 founding under Bob Perkins, who has stepped back but remains involved. The 2013 departure of comanager Todd Perkins was unexpected, but comanager Justin Tugman remained on board and was joined by financials analyst Tom Reynolds.

T. Rowe Price QM U.S. Small-Cap Growth Equity PRDSX

This fund has racked up an excellent record since Sudhir Nanda took the helm in October 2006, beating most of its small-growth peers on both a total-return and risk-adjusted basis. The fund has been a consistent performer, too, landing in the category's top half in each calendar year during Nanda's tenure. Nanda relies heavily on quantitative stock-picking models but has kept a lid on volatility by relying less on momentum than many quants, instead focusing on valuation and earnings quality. The portfolio holds about 300 stocks, with positions capped at 1% of assets. The fund's quant models don't take companies' debt into account, so the portfolio's debt/capital ratio is sometimes above the category norm, and the fund could be hurt if interest rates rise. (That said, it typically has held up well when leveraged fare has suffered.) However, Nanda's disciplined strategy and record of strong stock selection, coupled with the fund's well below-average fees, bode well.

T. Rowe Price Small-Cap Value PRSVX

This fund has generated good long-term risk-adjusted performance with a portfolio diversified across more than 300 names--which not only minimizes stock-specific risk, but has also kept a large asset base manageable. David Wagner, who had served as associate portfolio manager since 2005, took over for longtime manager Preston Athey in July 2014 after working alongside him for nine months to ensure a smooth transition. He follows the same risk-conscious strategy, buying stocks trading at low absolute or relative valuations and hanging on as their gains compound. This buy-and-hold approach pushes up the fund's valuation metrics, nudging it into the small-blend category. However, management avoids holding too many stocks that graduate to mid-caps: The fund's average market cap hovers around $1.5 billion, similar to the Russell 2000 Value Index.

Wasatch Core Growth WGROX

Wasatch is known for building compact portfolios of stocks with defensible economic advantages and consistent economic returns across market cycles, and this fund has delivered competitive results within the small-growth category with generally low Morningstar Risk ratings. Stock-picking drives portfolio construction, so assets can cluster in sectors where managers J.B. Taylor and Paul Lambert find opportunities: The fund has large helpings of industrial and financial stocks relative to its small-growth peers and a significant underweighting in healthcare. Its average valuation measures are generally in line with the category average, but its quality metrics--such as return on assets--are usually stronger than peers', and risk-adjusted performance is its selling point. The fund hasn't always outperformed in down markets--it was out of step in 2008--but it was well in the black in 2011's tough market. While its sector biases worked against it in 2015, strong stock-picking led to a category-topping performance.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)