Nominees for 2015 Allocation Fund Manager of the Year

Two candidates navigated last year's turbulent markets especially well.

Last week, we revealed the nominees for Morningstar's Domestic-Stock, International-Stock, and Fixed-Income Fund Manager of the Year awards. Below are the nominees for Allocation Fund Manager of the Year. A column discussing the nominees for Alternatives Fund Manager of the Year will follow later this week.

We will announce the winners on Jan. 26.

Last year proved to be challenging for allocation managers. Although U.S. large-cap equities and Treasuries finished 2015 slightly positive, international developed stocks and investment-grade corporate bonds posted small losses, while high-yield bonds, small-cap stocks, emerging-markets equities, and commodities finished in decidedly negative territory. Slowing growth in China and uncertainty about when the Fed would begin to hike short-term interest rates dragged equity markets lower in the third quarter, and high-yield bonds took a hit in the fourth quarter as the Third Avenue Focused Credit debacle raised concerns about liquidity across the junk-bond market.

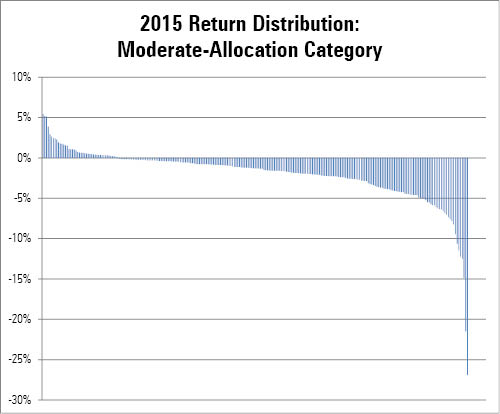

That market environment made it tough for allocation funds to generate positive returns. In fact, the average fund in each of Morningstar's allocation categories lost money in 2015. However, there was a wide dispersion of results, with returns in most categories ranging from solidly positive to sharply negative. For instance, the chart below shows the distribution of fund returns within the moderate-allocation Morningstar Category. The long tail of funds posting losses suggests that avoiding the harder-hit segments of the market, namely those tied to commodities, was of paramount importance.

Source: Morningstar.

This year's allocation nominees navigated 2015's turbulent markets with aplomb, proving skillful in many facets, such as asset allocation and security selection. Of course, having one good year doesn't merit a nomination. To be considered as a Morningstar Fund Manager of the Year, a manager must also boast a strong long-term record and enjoy a Morningstar Analyst Rating of Gold, Silver, or Bronze, which mark the funds that Morningstar analysts believe will outperform their category peer groups and appropriate benchmarks on a risk-adjusted basis over a full market cycle.

Here are the nominees for Allocation Fund Manager of the Year:

David Giroux

T. Rowe Price Capital Appreciation PRWCX

2015 Return: 5.4%

Morningstar Category Rank: Top 1%

David Giroux was the Morningstar Allocation Fund Manager of the Year in 2012, and he was nominated for the award in 2013 and 2014 as well. He has continued to impress, outpacing 99% of his moderate-allocation peers in 2015.

The fund's equity stake (60% of assets as of December 2015) did most of the heavy lifting last year. Giroux has gradually upped the fund's exposure to growth companies, which took nearly 60% of the stock sleeve in 2015 as compared with about 20% in 2012. That boosted performance in 2015, as the Russell 1000 Growth Index climbed 5.7%. At more than 14% of assets, healthcare represented the fund's largest equity sector weighting. Pharmaceutical firms

Meanwhile, Giroux stashes slightly more than half of the fixed-income sleeve (roughly 25% of assets) in securities rated BB. Although high-yield bonds generally suffered during the year, BB rated securities fared relatively well. Financials, which represented the fund's largest fixed-income sector weighting, had an especially standout year.

This fund has outperformed more than four fifths of its moderate-allocation peers in each of the past seven calendar years, and it came out slightly ahead of the pack in 2008's market sell-off. Strong results have attracted significant inflows, and the fund closed to new investors in June 2014.

Michael Reckmeyer and John Keogh

Vanguard Wellesley Income VWINX

2015 Return: 1.3%

Morningstar Category Rank: Top 1%

Stability has been the key to this fund's success. Unlike many conservative-allocation peers, it doesn't make tactical shifts between stocks and bonds. Michael Reckmeyer invests between 35% and 40% of the fund's assets in equities that pay above-average dividends, which he tries to buy when they're out of favor. Meanwhile, John Keogh tilts the remaining 60%-65% bond portion toward corporates rated in the A range, and he eschews big interest-rate bets. The duo uses the market's fluctuations to rebalance the fund's mix of stocks and bonds and relies primarily on security selection to come out ahead.

In 2015's rough market, the fund's 1.3% gain doubled the return of its customized benchmark (weighted 65% in the Barclays U.S. Credit A or Better Index and 35% in the FTSE High Dividend Yield Index) and placed in the conservative-allocation category's top 1%. The fund's equity portfolio had a strong year, owing to stock selection within the consumer staples and energy sectors. Former top-10 holding

The fund also boasts a superior longer-term record. Since the shared tenure of fixed-income manager Keogh and equity manager Reckmeyer began in July 2008, the fund's 7% annualized gain through December 2015 places second out of about 140 peers, while its Morningstar Risk-Adjusted Return places first.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)