Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

The sector looks fairly valued overall, but there are still opportunities for selective investors.

- Secular growth drivers abound across the tech media and telecom industries, but even despite growing tech spending, some legacy firms are stuck in neutral. The sector looks fairly valued, and we'd be selective.

- Even with the evolution of the television bundle, there's still plenty of profit in couch potatoes for wide-moat media firms.

- The programmatic advertising wave is still surging.

- Telecom merger rumors continue to swirl in Europe, but don't get excited.

As of mid-December, the S&P 500 is down a few percentage points for the year to date, though it is still up from the late-summer sell-off. The performance of the technology sector in aggregate has been slightly stronger, but there are notable areas of strength and weakness.

Despite some choppiness across the global macroeconomic landscape, many management teams have remained upbeat and relatively optimistic about their operations and opportunities heading into 2016, but we still embrace a view of bifurcation between legacy and emerging tech companies. Many large tech firms are struggling to reinvent themselves and drive organic growth from new avenues (funded through existing cash flow), while other fast-growing niche players are hoping to disrupt the hierarchy by taking advantage of adoption in analytics, cloud, and engagement (social-media advertising). We continue to believe that persistent foreign exchange headwinds may result in another year of challenging growth and profitability at some firms; however, the underlying tech spend is still projected to grow. In aggregate, we view the tech sector as fairly valued and remain selective in our picks.

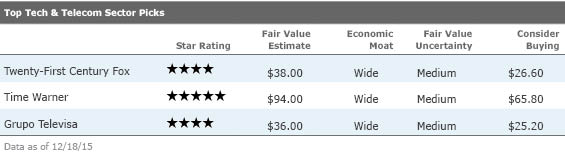

In the table below, we highlight a few companies in technology, media, and telecom that appear to be fundamentally undervalued. All three have significant international exposure in some form or another; because we don't explicitly offer currency forecasts (although we do bake them into our fair value uncertainty ratings), this is a factor that investors will want to keep a close eye on.

Taking a step back, although the media and telecom subsectors trade just below our respective fair value estimates, we would still seek a wider margin of safety in many cases. We are quick to gravitate toward firms with established economic moats, those with strategic assets, and those that are well positioned in key growth areas. We believe firms with this combination should be in a better relative position to withstand near-term revenue and operating-margin volatility, while offering long-term free cash flow growth potential.

The Evolution of the Television Bundle: There's Still Plenty of Profit in Couch Potatoes for Wide-Moat Media Firms The television ecosystem is constantly evolving and the traditional bundle model has come under pressure recently, but we believe investors have overreacted to fears that a sudden shift in consumer behavior is about to occur. In our view, the changes taking place today are a continuation of the fragmentation that has been occurring over the past several decades. Penetration of traditional television service has steadily eroded, following a peak somewhere around the end of the last decade. Perhaps counterintuitively, the industry's growth accelerated sharply during the worst of the financial crisis and has steadily deteriorated since. We ascribe this blip to the limited video alternatives available at the time, aggressive price promotion among several providers aiming to protect their customer bases (especially the phone and satellite companies), and the fact that television service is inexpensive relative to other forms of entertainment.

But the market is different today than it was just a few years ago. We find that younger age cohorts are driving the majority of the decline in traditional television penetration. Younger consumers are increasingly viewing traditional content in nontraditional ways, but we still believe younger consumers simply don't value the traditional television bundle as much as prior generations have.

So looking ahead, the key question is how the media industry can evolve to combat the challenges currently facing the traditional television business. We expect consumer purchase decisions will fragment into network choices, where cable companies such as

As new firms continue to come into the television market, we expect that video on demand and subscription video on demand will steadily grow in importance as these entrants innovate around television distribution. We have introduced a new four-pillar framework through which we evaluate each company's positioning amid the changing media landscape. The four criteria include; (1) known brands and studios; (2) access to a strong library of content; (3) lower dependence on traditional advertising; and (4) higher international exposure.

We prefer media firms with strong production studios in both film and television, along with a deep content library. As the bundle evolves, we expect the most watched networks to survive and even flourish. Their content and sports rights provide a leg up in discovery, as consumers already watch and monitor their channels. In addition, we are looking for companies with lower exposure to one of the traditional sources of revenue: advertising. We expect that new television platforms will prioritize the customer experience over ad loads, putting pressure on traditional ad revenue. Also, advertisers are steadily shifting budgets to digital formats that are more easily measured. Finally, strong companies should have exposure to the faster-growing international markets where high-quality Internet access is less pervasive, providing a longer runway for traditional distribution models.

We believe five companies--Comcast,

Programmatic Advertising Wave Still Surging

Investors should pay attention to a massive shift in the digital advertising industry toward programmatic advertising (the automated buying and selling of advertising inventory), a trend that we believe highlights the distinct competitive advantages of

In our view, the rich customer data that Google and Facebook possess is even more valuable in a programmatic world, particularly as these companies seem to be operating walled gardens. We also believe that wide-moat firms such as

Telecom Merger Rumors Continue to Swirl in Europe, but Don't Get Excited

Telecom merger rumors continue to swirl in Europe, but we don't place much credence in many of them. For example, it seems a regular occurrence that

A more likely longer-term scenario includes the possibility of Orange acquiring an operator in another country. But this isn't without its challenges, as we think

) in the Netherlands and

) in the Belgium area would be too small, and neither has any interest in selling. Similarly, we think

Elsewhere, we think all eyes remain on the EU regulator's rulings for the proposed acquisition of

) 3 Group and its Italian unit's proposed merger with

In general, anticipation surrounding global mergers and acquisitions across the telecom industry is reflected in higher stock prices in many cases. There are still pockets of value across the global telecom space, but most come with baggage in the form of lagging sales growth, higher legacy costs, or poor macroeconomic conditions, so we encourage investors to be highly selective.

Twenty-First Century Fox

FOXA

Twenty-First Century Fox is a media conglomerate with a wide range of assets: a film studio, which creates television programs and movies; broadcast television, including the Fox broadcast network and local TV stations in the U.S.; cable networks, which comprise over 300 channels around the world; and direct-broadcast satellite TV in the form of SKY, a satellite pay-TV provider in Europe. We acknowledge that the streaming service and skinny bundles will disturb the traditional pay-TV bundle in the near future. However, the timing and magnitude of the disruption remains unclear, and too much pessimism appears baked into the share price at current levels.

Time Warner

TWX

Time Warner is a pure-play entertainment company that owns several television networks, including HBO, CNN, TNT, and the CW. The filmed entertainment segment creates and distributes movies and television programming for both internal and external distribution outlets. Warner Bros. and New Line Cinema combine to form the largest filmmaker in the world. The company owns a deep and valuable content library that includes popular movie franchises such as DC Comics and Harry Potter and television programs such as Friends and The Big Bang Theory. We acknowledge that the streaming service and skinny bundles will disturb the traditional pay-TV bundle in the near future. However, the timing and magnitude of the disruption remains unclear, and too much pessimism appears baked into the share price at current levels.

Grupo Televisa

TV

Grupo Televisa is the largest media company in the Spanish-speaking world. Besides operating broadcast channels in Mexico, the company produces pay-television channels whose content reaches subscribers in North America, Asia, Europe, and Latin America. Televisa also owns interests in satellite television, cable TV, terrestrial radio, magazine publishing, Mexican bingo parlors, and three of Mexico's professional soccer teams. We remain focused on the regulatory front, but management appears focused on strengthening its core businesses. The firm continues to seek out balance between growth, investment (margin preservation), and navigating the regulatory environment.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Energy: Pain Persists as OPEC Refuses to Play White Knight

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Healthcare: Even After Uptick, Some Great Values Remain

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)