Mind the Gap -- Alternatives Edition

Investors in alternative funds aren't faring any better than the rest of the fund world.

When Russ Kinnel provided the latest update of his "Mind the Gap" study, he did not include alternative funds in the results. Russ focused on the 10-year history--certainly the most valuable time frame to observe a full market cycle--but there are too few alternative funds with a long enough history to constitute a meaningful sample size.

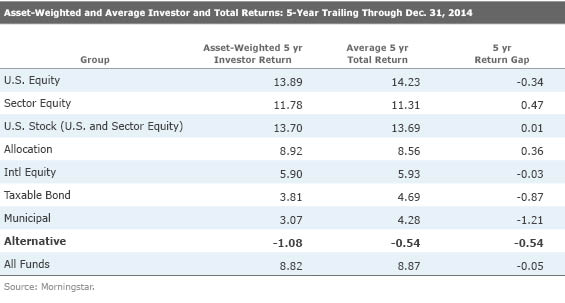

We do have data from the three- and five-year periods, however, which roughly covers the period in which liquid alternative mutual funds have exploded on to the scene. The data rely on the same methodology Russ has outlined in the past. Below, we compare the average investor's returns versus the average fund returns. We look at monthly fund flows and monthly returns, then we weight those by asset size to come up with an estimate of returns for the average investor. We then compare those figures with the average fund return on a category and asset-class basis. The gap between those returns tells us how well investors timed their investments. Returns were calculated through the end of 2014.

A Gap, but Reasonable The general implication of the return-gap concept is that the average investor has a tough time overcoming behavioral biases when it comes to timing fund investments; investors tend to invest in funds or asset classes after returns have risen (that is, performance-chasing) and sell after losses, often missing out some of the juiciest periods for returns.

For the purposes of this discussion, I'll focus on the five-year period, as three years is too short to fully capture the impact of investor timing. Looking at Morningstar's broad category groups, alternative funds exhibit a gap of 54 basis points over the period. That’s very much in line with the rest of the fund universe. The alternatives return gap is better than the results for taxable-bond and municipal-bond funds, slightly worse than U.S. equities (34 basis points), and meaningfully worse than the allocation group, where investor returns actually exceeded total returns by 36 basis points, aided by the positive behavior encouraged by target-date funds.

There are several points worth noting about the data. First, although the return gap is reasonable, the actual returns are fairly unpalatable. The alternatives category group was the only one to produce negative average total returns and investor returns over the five-year period. That indicates there may well be growing dissatisfaction with alternatives. However, it is also true that the 2010-14 period has not been favorable to alternative strategies; the stock market moved steadily upward, causing hedged and volatility-dependent strategies (like managed futures) to trail badly.

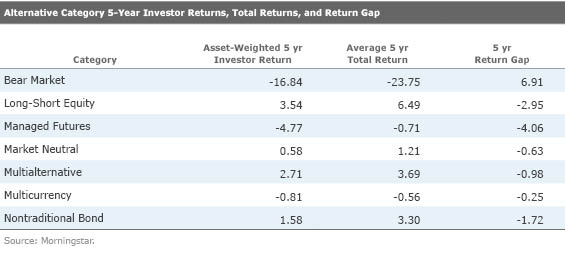

Category-Level Distinctions Drilling down to the various alternatives categories reveals some instructive differences in return gaps. The two smallest return gaps were associated with the multicurrency (25 basis points) and market-neutral (63 basis points) categories. Both categories are intended to have diversifying and volatility-lowering roles in investor portfolios, and it seems that relative to other alternative categories investors have responded with fairly responsible behavior.

The long-short equity category experienced one of the larger return gaps over the period at 295 basis points. The average annualized five-year total return for the category was 6.49%, while the asset-weighted investor return was only 3.54%. A good portion of the gap can be attributed to

The multialternative category falls in between, with an annualized return gap of 98 basis points. This category has grown rapidly in recently years, and while it consists largely of strategies with moderate return and volatility targets, there is a subset of higher-flying global macro funds that may encourage returns-chasing. Similarly, non-traditional bond funds (not officially part of the broad alternatives category but often spoken of in the same breath) have seen significant inflows the past few years as investors have sought fixed-income return streams not tied to interest rates. However, returns for many unconstrained bond funds have been underwhelming: The five-year return gap for the category is 1.72%.

Only five managed-futures funds count in the five-year history, so the category's large 406-basis-point return gap, during a very tough period for the strategy, isn’t meaningful; in fact, it flips around for the three-year period to a positive 480-basis-point gap. Notable within the managed-futures category are the excellent investor returns of Silver-rated

Finally, a bit of an oddity: The most favorable positive return gap, with a five-year gap of 691 basis points, belongs to bear-market funds, which aim to produce results inverse to the stock market. Unfortunately, that merely indicates slightly less severe losses for the average investor than the funds themselves: negative 16.84% investor return versus negative 24.72%. In this case, selling based on performance was a good idea as the market continued to rally throughout the five years. We’ve seen this with funds that lose money over an extended period of time. Bear-market funds thus also account for a good portion of alternatives' negative average returns. Morningstar does not recommend that investors use bear-market funds as long-term investments, as the general movement of the stock market is upward, but at least the data show that investors have somewhat effectively timed their use of these vehicles.

Takeaways Alternative-strategy mutual funds have been marketed in part on the premise that they will help produce better investor outcomes by producing smoother results when they are added to portfolios. The evidence thus far is mixed as to whether investors can exhibit better investor behavior in alternative funds in their own right. Clearly, alternatives firms need to do a better job of setting realistic expectations rather than imply investors will get the best of both worlds. To be fair, the five-year period our data cover is still a relatively short period, one in which there's been an influx of new products amid a market environment largely unfavorable to alternative strategies. So it is at least encouraging that investor returns in alternative categories haven't been worse. But for alternatives to truly serve their intended role in portfolios, investors must go in with a clear understanding of how a strategy is expected to perform and not get seduced by overly optimistic promises or unsustainable track records. Seek out funds with steady risk/return profiles that won't put you on a roller-coaster ride, and firms willing to close funds before they lose their return-generating potential.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)