U.S. Economy Still on Track Even as World Growth Falters

Better consumer incomes and employment prospects, along with low inflation, should keep the consumer and housing sectors moving upward, even in the face of a soft world economy.

After a good October, equity markets took a big break this week as most world stock and commodity indexes fell a relatively large 3.0% to 5.0%. Reduced OECD forecasts for world growth in general and trade in particular started the week off on a bad note. Although other groups had already reduced their forecasts, worries about world trade, especially in developing markets, was not happy news. GDP growth in Europe for the third quarter was also a mild disappointment.

Poor reported earnings and/or forecasts in the retail sector (

Some of the week's data cast doubt on October's strong employment report, which helped boost the market last week. However, this week's small-business sentiment report and the Bureau of Labor Statistics Job Openings report suggest that last week's labor market report was no fluke.

We continue to believe the underlying growth of the U.S. economy remains 2.0%-2.5%, driven by consumers and housing without a lot of help from any other sector. Better consumer incomes and low inflation combined with better employment prospects should keep these two key sectors moving upward, even in the face of a soft world economy. Of course, that all assumes that the initial reports of terrorist attacks in Europe late on Friday afternoon (Chicago time) don't unfold into something even worse over the weekend.

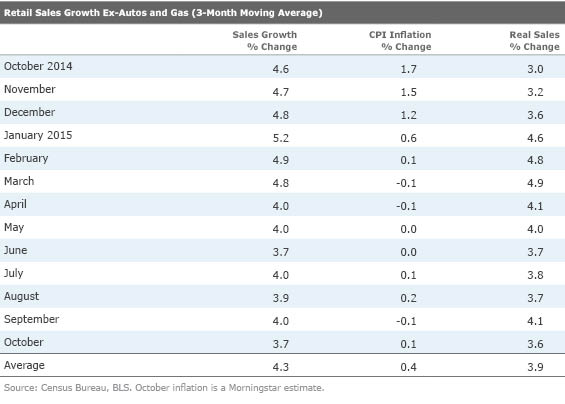

Retail Sales Report Not Terribly Enlightening On the surface, the overall retail sales report looked disappointing, as overall sales growth was just 0.1% between September and October. However, excluding gasoline and auto sales, sales growth was a more respectable 0.3%. Even that number was likely held back by warm weather depressing the sale of fall and winter apparel (the apparel category showed no growth in October) and maybe falling food prices.

The more reliable year-over-year averaged data showed some modest deterioration, but still very consistent with the data over the past year, especially after our adjustment for inflation. Also recall that last fall showed anomalously strong growth in employment and retail sales, which complicates our normally reliable year-over-year methodology.

As the weather grows colder and some of the weekly retail sales data has begun to show signs of life, I suspect that the November report might look a little better. We certainly would not be panicking over the retail sales report as the market appeared to do on Friday. We still believe the consumer and the housing market are doing well enough to make up for lackluster business investment and government spending, and very soft net export activity.

Auto and Restaurant Sales Both Indicate Consumers Remain Confident

The retail sales report has always been tricky to interpret because it isn't adjusted for inflation, shifting weather patterns, and new retail channels. Greater interest in services, autos, and restaurant meals have meant that sales at conventional retailers have indeed been poor, even as other consumption data has been quite strong. Notably, both

But readers need to be careful not to confuse poor results at conventional retailers and a mediocre retail sales report with a slowing consumer. Nothing could be further from the truth. Auto sales were above 18 million units in October on a seasonally adjusted, annualized basis--their best performance of the recovery. Restaurant sales in today's retail report were up 0.5% month to month and 5.5% year over year, hardly a sign of consumer retrenchment. And gauging from growth in non-store retailers (

Other notable category data includes strong results in two housing-related categories--building materials and furniture--which showed growth of 0.9% and 0.4%. Housing data, especially existing-home sales, have been picking up for several months, and now as those homes are furnished, remodeled, and spruced up, the related retail sales categories have continued to accelerate. Even if existing-home sales were to plateau now, the related retail sales are unlikely to fall for several months.

We are a little less sure what to make of the strong drugstore sales. It could be fewer drugs going generic, keeping prices high. Or it could be people trying to accelerate health-care purchases as we approach year-end and individuals examine their use-or-lose health-care flexible spending accounts. Or it might relate to industry merger activity. Still, it seems a bit odd to see drugstores do well in a month when weather was unusually warm.

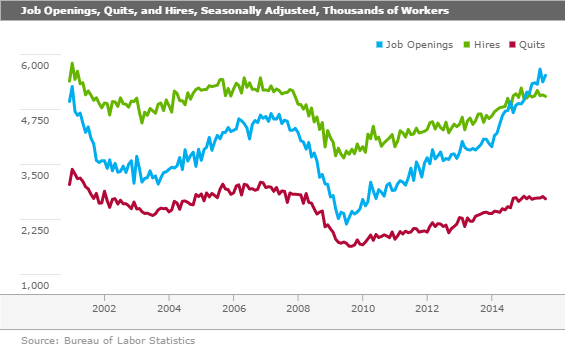

Job Openings Report Consistent With Last Week's Strong Labor Market Report When the monthly jobs report looks unusually strong or unusually weak, we often turn to other labor market indicators to validate the strength. Last week's October labor report did look unusually strong, with total job gains of 271,000. This week's Job Opening Report for September seemed to validate that strength. (Note, the October job count is from mid-October and the September openings report is as of the last day of September). Total openings jumped from 5.38 million to 5.53 million between September and October. The October reading is the second-highest in the series history, which began in 2001, as shown by the graph below:

The overall quality of the openings has improved over the past year and the past few months. Early in the recovery, many of the gains in openings were in the low-paying accommodation and food-services industries, as well as retail. Now the lion's share of the new openings are in the high-paying business and professional services category and the moderately paying health-care sector. However, the retail sector continues to do well and had a particularly good September, although recent poor results at Macy's and Nordstrom suggest that the strength was more related to consumers getting an early jump on the holiday season and not to strong retail fundamentals. I suspect most retail-employment-related data might not look as good next month.

Total job openings tend to be at least modestly forward-looking because an opening needs to exist before someone can be hired. However, despite some nice increases in openings, hirings have remained relatively stagnant since mid-2014. Despite lethargic hiring, the total number of jobs, as reported in the monthly employment data, has gone up, as businesses lay off fewer workers and desperately cling to those they already have. And employees haven't accelerated their job switching lately, also depressing the need to hire more workers. We believe that scars from the Great Recession are still weighing on employees' minds.

The reason for the surge in openings this recovery remains allusive. It certainly appears that a skills mismatch is some of the issue. Employers continue to decry the lack of skilled workers in many industries. Still, it seems that employers need to step up their training efforts and broaden their searching to include qualified people in other industries. The days of computers matching resumes exactly to job qualifications and spitting out the job winners are over. Creativity, networking, and retraining are now needed to get job openings filled.

In addition, we are not so sure that employers understand that better wages might be the answer to all the unfilled job openings. Although we don't want to overstretch just one month's worth of data, it seems interesting that job growth came out of its recent hiatus in the very same month that wages saw their biggest growth since 2009.

Overall, the JOLTS report seems to suggest that labor shortages are continuing to build and the balance of power continues to shift to the employee. Employment growth is more likely to be limited by a shortage of available employees and not employers' desire to hire. In the past we have spoken of shortages of truck drivers, drywallers, pilots, architects, and even chefs. The most recent example of a tightening labor market is the apparent capitulation by the auto manufacturers to union demands for the eventual elimination of the two-tier wage system that had been in place for some time. Despite these well-known situations, we have to see a sustained surge in across-the-board wage increases. We continue to believe that is just a matter of when, not if, these improvements will occur.

Small-Business Confidence Stable, Employment Markets Still Tight We are not fans of the overall National Federation of Independent Business small- business index because it has been more of a concurrent or lagging indicator than an important predictor of the future. That said, the index was flat between September and October at 96.1. The NFIB takes that as a negative because it is still below the long-term average of 98. We think the NFIB index is still in pretty safe territory, far above this recession's low in the mid-80s and not far off the recovery high of 98.3 reached in May of this year. In any case, the overall index doesn't seem to be flashing any new warnings.

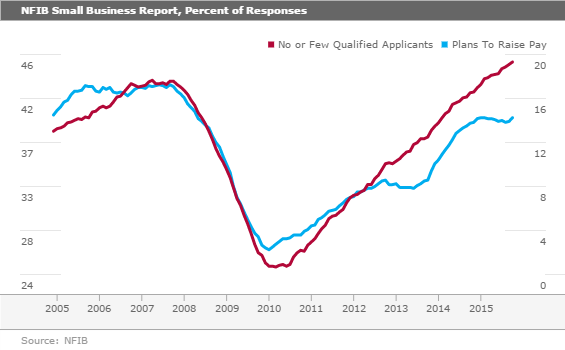

We do like looking at the labor market portions of the NFIB report. In particular this report confirms data in the Bureau of Labor Statistics job openings report. About 48% of small businesses report few or no qualified applicants of current job openings. That is stunningly higher than the 24% level reported as recently as 2010. That data is very consistent with the BLS data. The red line in the table below shows the remarkable change using a three-month moving average.

The data also show that unwillingness or inability to pay higher wages may be part of the reason that openings are remaining unfilled. Recently the percentage of businesses reporting a lack of qualified applicants has grown considerably faster than businesses "planning" to increase wages. Interestingly, the percentage of businesses that have reported an actual given wage increase is considerably higher (21% increased comp versus just 17% that said they would in the future). However, there is some indication that businesses are beginning to understand the need for higher compensation to attract or retain workers. The gap between recently given raises (21%) and expected future raises (17%) is now at one of the very narrowest levels of this recovery. As recently as January, a measly 12% of businesses planned to give raises, while in actuality an amazing 25% gave raises.

The relatively high wage numbers, especially relative to planned price increases, may explain why, despite a generally good U.S. economic recovery, small-business owners are not a particularly happy group of campers. Just 14% of businesses plan to raise prices while 17% expect to have to give raises. And the recent reality has been that actual price increases are lower than expected and wage increases, as noted above, are almost always higher than planned. That is certainly not good news for business profits and is probably behind the relatively grim assessment of overall small-business conditions. The fact that owners are probably working harder, to make up for the workers that they have been unable to hire, certainly isn't helping matters, either.

Next Week Brings Manufacturing, Housing, and Inflation Data Inflation has been so muted lately that the Consumer Price Index hasn't been market-moving or even all that relevant. This time around the report takes on a little more significance because of the Federal Reserve's focus on inflation and the upcoming December rate meeting.

The Fed's core inflation target rate is 2%. If the consensus for October core and headline inflation is correct at 0.2%, the year-over-year core growth rate will move up to 2% from recent readings that have been stuck at 1.8%. We caution that the Fed prefers to use a separate measure of inflation that is not increasing as rapidly. Nevertheless, a core CPI inflation rate of 2% is likely to mean that Fed probably won't use a low inflation rate as an excuse not to raise rates.

The consensus forecast for CPI is more up in the air than usual. This week's producer price reading showed prices declined much more than expected. A new auto model year drove that PPI below expectations, as auto prices didn't move much but the number of features improved sharply. In the Bureau of Labor Statistics' eyes, this is a price decline. We are a little unsure if this effect will also turn up in the CPI this month. Also, just guessing from the retail sales report, we suspect that clothing, furniture, and maybe food prices will be down. Drug prices, health-care services, and rents are likely to be substantially higher. Given the relative balance of pluses and minuses, the consensus of a 0.2% CPI increase could prove to be just a little high.

Manufacturing has been floundering for most of the year after an unbelievably strong 2014. Recent industrial production data for manufacturing has been almost unchanged for three months in a row. Purchasing manager and manufacturing employment data suggest that things on the manufacturing side aren't getting any worse. The consensus is for the manufacturing-only sector to increase 0.1% month to month, which seems about right to us. A renewed slump in drilling activity and warm weather (lower electricity usage) are likely to depress the fully combined industrial production figure below the consensus 0.3% growth rate. All of our economic reports, including GDP, incorporate almost no growth in the manufacturing sector for the full year.

Unlike manufacturing, the housing industry has been improving nicely in recent months, helping drive up retail sales and the economy as a whole. Permits data suggests that single-family unit starts are likely to moderate some in October, perhaps dropping from the mid-700,000 level to the low 700s. That would be down, but still slightly above the year- to-date average of 698,000.

The multifamily data has been skewed by some New York City tax incentives for several months. Permits in particular have soared, but all of those permitted homes have not yet been started. Exactly when that will happen makes the multifamily sector more difficult to project than usual. I suspect that as some of the provisions of the New York incentives were thought to have ended and then were extended, the rush to physically start a home may not match permit growth in the short run. That would seem to suggest multifamily starts decline slightly to 450,000 units in October for a combined starts estimate of 1,150,000 units. That is still slightly below the consensus of 1,180,000 annualized units, but nevertheless a healthy number, in our opinion, and still 7% above year-ago levels. Still, brace yourself if our forecast proves correct. Following weak numbers out of Europe this week and the allegedly soft retail sales report, a decline in housing starts could cause all the market bears to pile on.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)