Where Active Management Succeeds (or Fails)

Dunn's Law suggests the advantage (or weakness) is only temporary.

From the Outside In the mid-1990s, Steve Dunn, a Los Angeles lawyer and amateur investor, coined what came to be known as Dunn's Law: "When an asset class does well, an index fund in that asset class does even better." That insight earned him more than 15 minutes of fame, as it's been regularly cited by fund writers ever since, ranging from my 1999 Journal of Financial Planning article to, most recently, a blog by author and index-fund investor Rick Ferri. However, the word is far from fully spread.

When index funds first came to the fore, in the 1980s and early 1990s, active managers scoffed. It was a bull market, and index funds are fully invested, so naturally index funds were winning. Any idiot could realize that a cashless fund would outperform when stocks were rising. Without knowing it, those managers were citing a specific application of Dunn's Law: When stocks did well, stock index funds did even better.

We saw a demonstration of the "without knowing it" part the next decade, when style, sector, and geographic index funds were launched. The logical follow-up to the argument that general stock index funds thrive when general stocks thrive is that style index funds thrive when that style thrives. But aside from Dunn, nobody was saying that--or thinking through the implications.

There are two reasons index funds in a style, sector, or geography tend to beat funds run by active manager when that category surges. The first reason is mundane: As with general index funds, style index funds hold no cash. The second reason is more subtle, however, and has kept most fund observers from grasping Dunn's Law: Style index funds are purer in their investment approach than actively managed funds that share their category.

Permanently Diversified

For example, no actively managed large-growth fund invests only in large-growth stocks, as Morningstar defines the term.

That is no fault of J.P. Morgan; it is free to define "large growth" as it sees fit, because there is no single standard definition of the term. Also, neither Morningstar's categorization system nor anybody else's requires that actively run funds place their entire assets into a single style basket. A large-growth fund is a fund that fits better into the large-growth Morningstar Category than into any of the remaining eight style-box grids. No more, no less. As a result, a large-growth index fund will have a higher weighting in large-growth stocks than will any actively run fund--which is a fine thing indeed when large-growth companies lead the way.

It's not so fine when large-growth stocks lag. Which leads us to the unwritten second sentence of Dunn's Law: When an asset class does poorly, an index fund in that asset class does even more poorly. The advantages become disadvantages, and the index fund suffers for its purity.

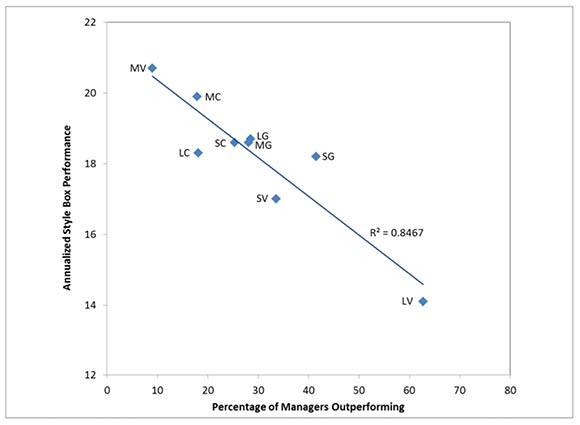

One Thousand Words Ferri's article has a useful chart. Using Morningstar data. Ferri created a scatter plot with trailing three-year style returns on one axis, and the percentage of active managers that beat the relevant style index on the other axis. The picture tells Dunn's story. Mid-value stocks led the charge for that time period, and sure enough, less than 10% of all actively run mid-value funds beat the style index. At the other end of the line, more than 60% of active large-value managers beat the large-value index, which was the weakest of the nine style-grid indexes.

Ferri writes that people overestimate active managers' prowess because they are fooled by the "illusion of skill." The active large-value managers who benefited by being permanently diversified out of the temporarily sluggish large-value style group seem like savvy stock-pickers to those who don't know Dunn's Law. Most of them weren't. They enjoyed a lucky draw. The next three years likely will not be as kind.

That's the moral that an index-fund advocate would take from this, isn't it? While Ferri is certainly correct, the reverse also holds true: Sometimes, fund managers aren't as dumb as they seem. Those who run funds that Morningstar places into the mid-cap value category--because those funds must go somewhere and mid-cap value proves to be the best of nine imperfect fits--currently are handicapped by being compared against the best-performing style-box index. They will become smarter, even as large-value managers become dumber.

Dunn's Law implies that studying the winning percentage of active fund managers by category, to determine the areas are most suitable for indexing, is a mug's game. The numbers are unstable, and the conclusions will constantly change. Also in trouble is the popular idea that active management is best suited for "inefficient markets." Perhaps. Or perhaps, when active management does perform well in allegedly inefficient markets the true underlying cause was Dunn's Law.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)