Ultimate Stock-Pickers’ Top 10 High-Conviction and New-Money Purchases

Big moves were scarcer in the second quarter among these top money managers.

By Greggory Warren, CFA | Senior Stock Analyst

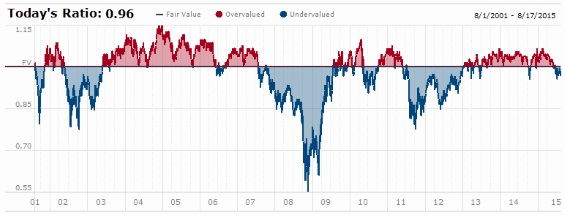

Despite reaching an all-time high midway through the second quarter of 2015, the U.S. equity markets (as represented by the S&P 500 TR index) have risen less than 3% since the start of the year. The prospect of lower oil and gas revenue, as well as reduced capital expenditures by energy companies, weighed heavily on energy stocks and the industrial companies that serve them during the first quarter of 2015. However, solid earnings results across most other sectors combined with expectations of continued accommodation on the part of the Federal Reserve, as well as more positive views on Europe, to lift the markets 0.95% during the period. Performance for U.S. stocks was far less robust during the second quarter of 2015, as concerns about the Greek debt crisis and slowing growth in China increased volatility in both the credit and equity markets, with the S&P 500 TR index increasing just 0.28% during the period (having declined 1.94% in June). The markets did, however, bounce back in July, rising 2.10% despite ongoing concerns about the Chinese economy and the prospect of rising interest rates in the near term (with the Federal Reserve signaling an increase in rates as early as September), as investors seemingly put the Greek debt crisis behind them.

While we don't see a near-term catalyst for a meaningful market correction, we are not alone in believing that we are due for one. It has now been more than three years since we have had a genuine price correction of at least 10% in the markets. We came close last year, when the markets declined about 7% between September and October, but they rallied to close out the year up 11.4% (and up 13.7% on a total return basis). The last genuine correction we had was during April-June 2012, when the markets pulled back 10% in response to concerns about corporate earnings, the Fed's removal of its quantitative easing program, and the expanding European debt crisis. While not as dire as the corrections we saw during May-August 2011 (when the markets dropped close to 20%) and April-June 2010 (when the markets fell more than 15%), it was a reminder that the markets can go down for a short period of time and still continue to march upward. Since the markets bottomed in early March 2009 they have risen more than 200%, with just three corrections along the way. While there have been a few periods like the current one, where the markets have charged higher for a number of years without seeing too many pullbacks in excess of 10%, it has generally been during periods of stronger economic expansion than we are currently seeing. That said, corrections tend to follow no clear pattern and are generally unpredictable.

Market Fair Value Based on Morningstar's Fair Value Estimates for Individual Stocks

Source: Morningstar. The graph shows the ratio price to fair value for the median stock in the selected coverage universe over time.

We continue to see signs that our Ultimate Stock-Pickers are being much more selective about the companies they pick up, with firms with wide and narrow economic moats having attracted the majority of new and incremental investments of capital during the first half of 2015.

Morningstar’s methodology is based on finding companies with solid and sustainable competitive advantages trading at a discount to our own fair value estimates, believing that these firms are likely to outperform in the long run. These businesses tend to experience lower levels of volatility, even during recessionary periods, making them more attractive to the risk-averse among our top managers. That said, the trend of lower high-conviction and new-money purchases continued during the most recent quarter, with no more than two managers making individual stock purchases at the levels required to hit our lists. This now makes eight straight calendar quarters where our top managers have generated incredibly low levels of both buying and selling activity.

Unlike past periods, though, cash balances crept lower during the second quarter, with the 22 fund managers that are included in our investment manager roster holding an average cash balance of 5% of their total assets (and a median cash balance of 4%) at the end of June, compared with 6% (5%) at the end of the first quarter of 2015. Those that are less constrained with regard to their cash balances had an average balance of 8% (and a median cash balance of 7%), which is down from 9% (8%) at the end of the March quarter. It was not too surprising, though, given that actively managed U.S. equity funds saw their worst quarter of outflows during the second quarter since the fourth quarter of 2012. That trend of outflows continued during July, with investors pulling more than $20 billion out of actively managed U.S. equity funds, their worst monthly showing since July 2011. All of this occurred without a genuine correction in the markets, a sign that investors are less than enthusiastic about the longevity of what has so far been a six-year-plus bull market.

Even so, several of our top managers moderated their previously bearish views, commenting more on what they saw as a fully but fairly valued market. With interest rates remaining near or below 0% around the globe, fixed-income investments appearing to be one of the more overvalued asset classes (with a near-term catalyst for weaker market performance as U.S. interest rates rise), and alternative investments in things like gold and other commodities increasingly out of favor with investors, equities still look to be one of the more attractive asset classes for investors. This belief was reiterated by Bill Nygren, manager of the Oakmark (OAKMX) fund, in a published interview with GuruFocus.com in June:

An investor today can sit on the sidelines, with capital in cash earning nothing, or can lend that money to the U.S. government for 10 years and earn 2% annually. Lending to risky credits increases the yield by less than it has historically, as does lending for longer time periods. I think stocks compare quite favorably to those options. The S&P 500 yields more than a 10-year bond, and is likely to grow both earnings and dividends. Current P/Es, though higher than the recent past, are only slightly higher than their mid-teens long-term average. Compared to bonds, stocks have a higher current yield, and unlike bonds are likely to be worth more in a decade than they are today. Additionally, unlike bonds, stocks give some protection against inflation.

Some of our other top managers have been less sanguine, noting that while it is hard to point to an imminent downturn in the markets, they see limited reasons to be optimistic about a continued expansion in the markets from current price points. With operating margins at all-time highs, and interest rate hikes all but certain in the near term, they believe that the downside could outsize the upside, given where the average stock is trading today. Steve Romick of FPA Crescent (FPACX) added some color to this view with the following comments in a recent presentation to the CFA Society of Chicago:

It's not just what you do that can make money over time, it's what you don't do. You might be able to make money by buying a 30-year Treasury bond. We don't know that rates won't drop another 1%, causing your bond value to jump more than 20%, assuming it happened immediately. With rates at all-time lows, we'd prefer not to make that bet because just a 1% increase will cause a price decline of around 18%. The risk/reward's not there. The same thought applies to stocks. Buying a company at 20x earnings, hoping for growth in earnings and a future P/E of 22x is not a recipe for good risk-adjusted returns.

Romick went on to emphasize the constant possibility of surprise in markets to bring home the importance of investing with a margin of safety:

Cycles, as true in investing as in life, have been with us since the beginning of time. So don't be surprised at the ups and downs. Don't be surprised if the economy isn't as strong as you hoped. If there are currency wars. If there is more volatility. If QE returns. Because when you're already down the rabbit hole you might as well look for Alice. Don't be surprised if there's inflation...or deflation. But also don't be surprised that the United States prospers over time (but not without the aforementioned volatility). That good, growing businesses, which trade at reasonable prices run by capable people who think like owners, will make you money. Not every day, or even every year, but over time.

We note that when we look at the buying activity of our Ultimate Stock-Pickers, we tend to focus on both high-conviction purchases and new-money buys. We think of high conviction purchases as instances where managers make meaningful additions to their existing holdings (or make significant new-money purchases), with a focus on the impact these transactions have on the portfolio overall. It also pays to remember that when looking at this buying activity, the decision to purchase the securities we are highlighting could have been made as early as the start of April, with the prices paid by our top managers different from today's trading levels. As such, investors should assess the current attractiveness of any security mentioned here by looking at some of the measures our stock analysts' research regularly produces, like the Morningstar Rating for Stocks and the price/fair value estimate ratio. It is especially important right now, with the S&P 500 trading at/near record highs and the market as a whole looking modestly overvalued, with Morningstar's stock coverage universe trading just above our analysts' estimates of fair value at the end of last week.

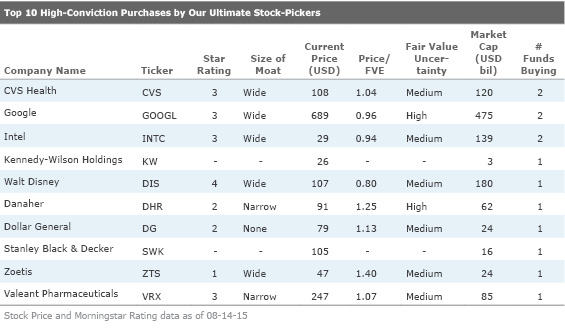

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

Our early read on the buying and selling activity during the second quarter has revealed a far smaller number of situations where our top managers were buying stocks with conviction, or putting money to work in new names, than we've seen in past periods. Of the conviction buying that did take place, most of it focused on high-quality names with defendable economic moats--exemplified by the number of wide- and narrow-moat names in the top 10 list of high-conviction purchases (as well as when the list is expanded out to the top 25 purchases). The conviction buying also focused far more on firms with medium uncertainty ratings, a signal that our top manager are sticking with established holdings where they think they have more visibility into results over the near-to-medium term when putting more money to work.

One of the more noteworthy transactions that we've seen more recently, which did not make our list of second-quarter transactions, but was prevalent during the

, was

Precision Castparts Corp. is a manufacturer of complex metal components and products, including castings, forgings, fasteners and aerostructures for aerospace, power generation and general industrial applications. Precision Castparts enjoys what we believe is an outstanding corporate culture and is led by a long-tenured CEO who is known for aggressively pursuing operating efficiencies. For many years, the company's stock traded at a significant premium to other aerospace and industrial peers, but recent weakness has brought the share price to attractive levels relative to these industry groups and the S&P 500. We believe the current valuation of less than 15x earnings is overly punitive, considering PCP's organic growth prospects and the company's ability to add value through acquisitions. PCP is providing more components on key new airplanes, which should allow the company to outgrow its end markets. In addition, management projects $4 billion-$6 billion of acquisition opportunities over the next couple of years with return characteristics similar to its existing business. Finally, the company's unique technical and process capabilities, coupled with its efficiently run operations, should allow it to continue to generate above-average margins. We are pleased to have the opportunity to add shares of what we consider a best-in-class company at a price that implies it is only average.

Their bet paid off handsomely, as Berkshire ended up paying $235 per share for Precision Castparts, a stock that traded at around $212 per share on average during the first quarter. Unfortunately, they didn't add to their stakes during the second quarter, when the stock traded down to an average daily price of $209 per share. It remains to be seen, though, whether or not they repeated this during the first four weeks of third-quarter 2015, when the stock traded below $190 per share.

With regard to the list of top 10 high-conviction purchases, a continuation of lower levels of portfolio turnover among our top managers continues to result in fewer overlapping conviction purchases. During

, for example, we saw one name purchased with conviction by four of our top managers, another bought with high conviction by three of our Ultimate Stock-Pickers, and eight more that were purchased with conviction by at least two of our top managers. By

, just four stocks were purchased with conviction by two of our Ultimate Stock-Pickers, with the remainder of the high-conviction purchases generated by a single manager. The number of stocks being purchased with conviction by two of our Ultimate Stock-Pickers dropped to three during the most recent period, with the remainder of the purchases being generated by a single manager. Even so, six of the top 10 high-conviction purchases--

Top 10 New-Money Purchases made by Our Ultimate Stock-Pickers

Health Care was a slightly bigger focus during the second quarter, generating three of the top 10 high-conviction purchases--CVS Health, Zoetis, and

Two new positions were added to the portfolio during the quarter, global biopharmaceutical company Celgene and integrated pharmacy health care provider CVS Health. The merger of CVS and Caremark into CVS Health added meaningful purchasing scale and allowed for the development of a suite of innovative products for the combined business. The firm stands to benefit from an aging population, the remaining wave of generic drugs, and a dramatically increasing skew toward specialty drugs in the pharmaceutical pipeline. Celgene has been benefiting from recent approvals for new indications of its flagship product Revlimid, while the 2010 acquisition of Abraxis Biosciences has provided diversification away from immunomodulatory drugs. Pipeline products include treatments for lupus and Crohn's disease.

Despite being best known for its presence as a retail drug-store, Morningstar analyst Vishnu Lekraj believes that CVS Health is well positioned with substantial market share in both the retail pharmacy and pharmacy benefit manager spaces. He notes that that the firm has been actively deemphasizing its retail sales operation in favor of its PBM segment. CVS Health has faced significant prescription reimbursement pressure, as well as heightened competition, in its retail segment. Lekraj believes that all retail pharmacy players will have to contend with tough long-term headwinds as payers are layering on material reimbursement pressure, and sees the expansion of pharmacy operations by many mass and regional retailer/grocer establishments as a meaningful competitive threat to stand-alone retail pharmacies. Lekraj believes that the ongoing mix shift toward specialty prescription claims eventually will lead to higher gross profits in the PBM segment, which will drive higher returns on invested capital than the firm is currently producing. Despite being well positioned for future growth, with pharmaceutical spending expected to grow robustly over the next several years, CVS Health is currently trading above Lekraj's $104 per share fair value estimate. He would like to see a decent margin of safety for investors before he would consider recommending the name.

The same could be said for narrow-moat rated Celgene, which is currently trading above our $120 per share fair value estimate. Morningstar analyst Karen Andersen agrees with Ronald Canakaris that Revlimid, which she views as the core of the company's economic moat, still has the potential to fuel continued growth via new indications and markets. The drug has been generating impressive data in approved and potential new indications, with future growth likely to be bolstered by an expanded duration of use and novel combinations. Andersen believes that the multiple myeloma market in particular is poised to double by 2019, and that Revlimid could still be approved for use in treating leukemia or additional forms of lymphoma, with phase III trials currently in progress. That said, she also notes that Celgene has other opportunities for growth outside of its blockbuster drug Revlimid, including numerous other oncology treatments, as well as the expansion of its drug platform to treat other diseases, such as psoriatic arthritis with Otezla, which could drive another $3 billion in annual sales for the firm. Andersen also believes that Celgene's acquisitions have contributed to its moat, with the Pharmion deal solidifying its strategic focus on blood-related cancer therapies, Abraxis moving the firm into the broader oncology market, and Receptos and Nogra both providing it with more immunology exposure.

Looking beyond Health Care, the Industrials sector saw nearly as much attention on the part of our Ultimate Stock-Pickers, with two of the top 10 high-conviction purchases--Danaher and Stanley Black & Decker--and three of the top 10 new-money buys--Danaher, Stanley Black & Decker, and

, which included purchases made during the first three months of 2015, as well as during April for those managers who provide holdings data on a monthly basis.

We already knew that Danaher was a new-money purchase made with conviction by the managers of Parnassus Core Equity Investor (PRBLX), but saw little discussion of the purchase, which was made after the March quarter had closed. The fund’s managers,Todd Ahlsten and Benjamin Allen, used their quarterly commentary this time to discuss their purchase of Danaher, as well as wide-moat rated Deere DE:

We added two stocks to the Fund in the quarter. The first is Danaher, a holding company with an eclectic mix of subsidiaries ranging from sophisticated medical devices to a label printing business. What links all of these holdings is an outstanding culture anchored by a formalized system of continuous improvement called Danaher Business System (DBS).

Just after we starting buying Danaher’s shares, management announced its intention to split the corporation into two separate holding companies. This transaction should be completed by the end of 2016. We think this restructuring is a good idea, because the resulting companies will have more focused strategies to grow organically and through acquisitions.

The second new investment is John Deere, the leading seller of agricultural equipment in North America. We have long admired Deere’s competitive advantages, as exemplified by the company’s extensive dealer network, robust research and development efforts and powerful brand. Furthermore, we think that the increased capital intensity of farming is a global trend that should benefit the company for decades.

The timing of an investment in a company whose fortunes are as cyclical as Deere’s is difficult. What mitigates this risk, in our view, is the fact that expectations for Deere’s earnings have come down considerably over the last two years. For the year ending in October of 2016, the consensus estimate for Deere’s earnings is approximately $5.25 per share. At the end of 2013, Wall Street expected the company to make more than $8.00 per share for the same twelve-month period. We like the fact that the bar has been lowered for near-term earnings, and we’re very optimistic about Deere’s long-term prospects.

With the addition of Danaher and Deere, our industrials exposure increased to 22%, which is the largest sector allocation in the portfolio.

With Danaher's shares currently trading at 125% of our fair value estimate, it is difficult to see a valuation rationale for buying the stock. Morningstar Analyst Barbara Noverini notes that the shares have moved up steadily since the firm announced it would be buying narrow-moat rated

As for General Electric, the firm was a top 10 new-money and high-conviction purchase in both the fourth quarter of 2014 and the first quarter of 2015, and made both lists once again in the second quarter. This time around, it was Clyde McGregor at Oakmark Equity and Income doing the buying, following in the footsteps of Bill Nygren and Kevin Grant at the Oakmark fund. They had the following to say about the stock when they bought in during the fourth quarter of 2014:

General Electric is a company with businesses we have always admired, but we have questioned management’s focus on returns when making capital allocation decisions. However, the appointment of a new CFO in mid-2013 ushered in significant changes. Since then, GE has, in our view, acquired assets cheaply (Alstom) and sold assets at good prices (Synchrony and its appliances division). In 2015 the company plans to totally revamp its variable compensation plan for thousands of employees, emphasizing factors that drive return on invested capital, which should boost future results. We believe there is substantial opportunity to improve gross margins, and the stock trades for just under a market multiple on 2016 earnings. Some investors may have a stale opinion of GE after the past 15 years of persistent underperformance, but we believe it’s a good investment at the current price.

During the second quarter, McGregor purchased 7.6 million shares of the stock for his fund, noting the following about the wide-moat firm:

General Electric is a company with businesses we have always admired, but we have questioned the stock's valuation and management's focus on returns when making capital allocation decisions. However, the appointment of a new CFO in mid-2013 ushered in significant changes. Since then, GE has, in our view, acquired assets cheaply (Alstom) and sold assets at good prices (Synchrony and its appliances division). GE is also significantly reducing its financial services business to focus on those lending activities that are core to its industrial products. The company has totally revamped its variable compensation plan for thousands of employees, emphasizing factors that drive return on invested capital, which should boost future results. Some investors may have a stale opinion of GE after the past 15 years of persistent underperformance, but we believe the remaining businesses will grow in excess of global GDP with high returns on capital. At less than 14x our estimate of normalized EPS and with over a 3% dividend yield, we believe the current valuation is attractive for this good collection of businesses.

Noverini remains positive about GE’s outlook, particularly as the firm has accelerated its efforts to sell the majority of GE Capital, only keeping the specialty finance businesses that directly support its wide-moat industrial businesses. She notes that the company just disposed of another $8.5 billion in Healthcare sector lending to narrow-moat rated

As for the other names on the two lists, wide-moat rated Intel and no-moat Dollar General stood out in that they were both high-conviction new-money purchases for at least one of the managers that was buying the stocks during the most recent period. Intel in particular received two high-conviction purchases by American Funds American Mutual (AMRMX) and Parnassus Core Equity Investor, with the latter making a new-money purchase of the name during July. While neither of the firms commented on their purchases, Morningstar analyst Abhinav Davuluri believes that Intel continues to be positioned well within the industry despite the shift toward mobile, which has propelled wide-moat rated

Dollar General was a new-money purchase for Ronald Canakaris during the first quarter, who noted the following about the purchase of the stock for his fund:

Dollar General plans to accelerate its square footage growth as merging competitors Dollar Tree and Family Dollar consolidate, and may be able to acquire stores that their rivals must [eliminate]. The firm also initiated a dividend and plans to buy back $1.3 billion of its stock.

Pat English at FMI Large Cap joined Canakaris in backing Dollar General, picking up 3.9 million shares (equivalent to a 3.5% stake) during the quarter. While English said little about the position in his quarterly commentary to fund shareholders, the move seems to line up with his more defensive stance in the face of tepid domestic economic growth. Situated near the bottom of the retail food chain, dollar stores will often pick up additional customers when the economy loses its footing, and tends to hold on to many of those customers once things improve. Morningstar analyst Ken Perkins thinks Dollar General should remain a solid competitor in the dollar store space, and with plans to expand its footprint materially should see sustained growth through the next decade. That being said, he notes that competition in this space will likely pick up with Dollar Tree acquiring Family Dollar, and Wal-Mart rolling out stores with smaller footprints that can compete more directly with the dollar stores. The no-moat retailer has seen its stock price advance rather steadily over the last couple of quarters, leaving it trading above our $70 per share fair value estimate, making it less attractive at today's levels.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)