More Lessons From the Do Nothing Portfolio

Success also comes to those who stand and wait.

An Investment Sloth

This Tuesday, Morningstar’s Jeff Ptak published an article that I wished that I had written. No worries. As James McNeill Whistler allegedly replied to Oscar Wilde after the latter expressed envy for not having uttered a quip of Whistler, “You will, Oscar, you will.” Today’s column will expand upon Ptak’s notion. Call it my Oscar Wilde moment.

Ptak had an idea. What if instead of owning a stock-market index that is periodically reconstituted, an investor simply bought and retained a basket of equities? No new position would be established. The portfolio would change only when its companies were acquired, but even that would not trigger a trade. The purchase price would remain as cash.

He conducted his experiment on the S&P 500 over three different 10-year periods. The first study ran from April 1993 through March 2003, the second over the ensuing decade, and the third for the following 10 years, which concluded on March 31 of this year.

A Remarkable Showing

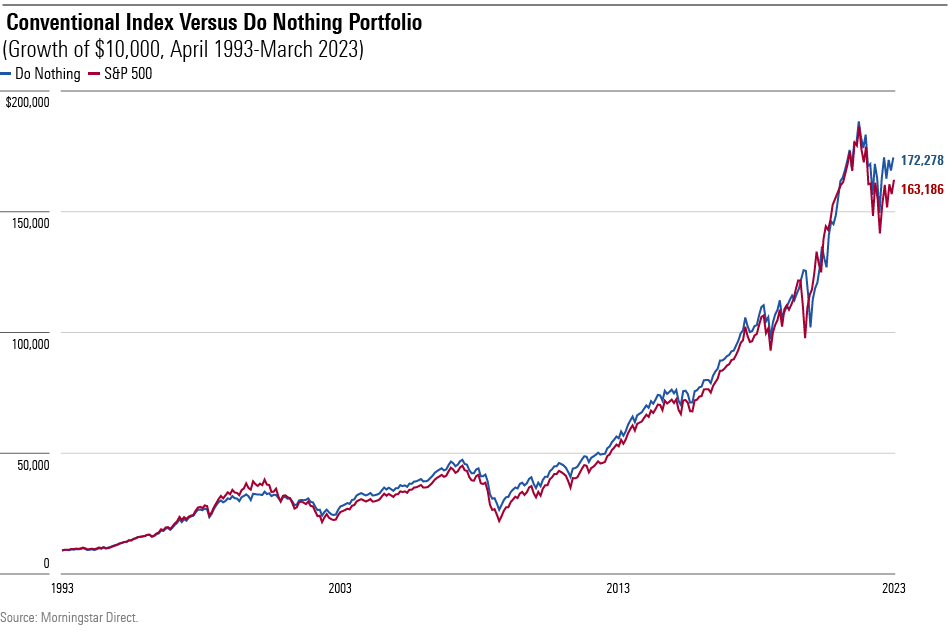

The Do Nothing Portfolio beat the index in the first trial, then matched the benchmark during the next two. Below are the 30-year results from a growth-of-$10,000 exercise, reprinted from Ptak’s article.

The outcome was even better than it appears. (Now my contributions begin.) For one, the S&P 500 was no slouch itself, as it outgained 90% of large-blend funds during the 30-year period. For another, the Do Nothing Portfolio was considerably less risky than the index, posting a 13.02% annualized standard deviation, versus 15.04% for the S&P 500.

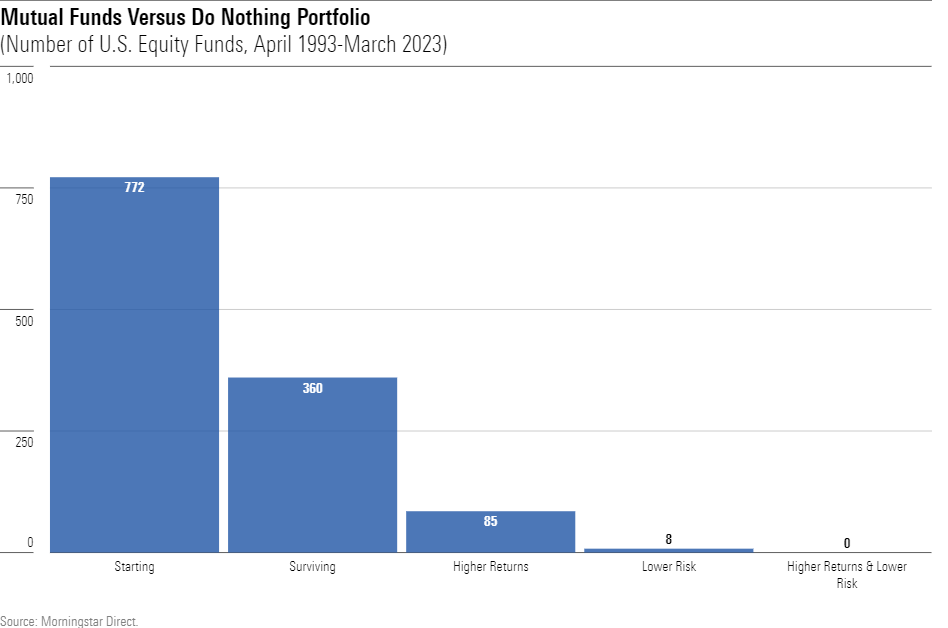

That combination of above-benchmark total returns and below-benchmark volatility was unbeatable. The next chart shows, from left to right, the number of U.S. diversified equity funds that: 1) existed in April 1993; 2) remained in existence for the next 30 years; 3) outgained the Do Nothing Portfolio, 4) were less risky than the Do Nothing Portfolio, and 5) accomplished both the third and fourth tasks.

That final bar represents the null set. From April 1993 through March 2023, no U.S. equity fund of any flavor—I included funds that invest in small and midsized companies, as well as those that buy growth or value stocks—managed to make more money than the Do Nothing Portfolio, while also being less volatile.

Voya Corporate Leaders

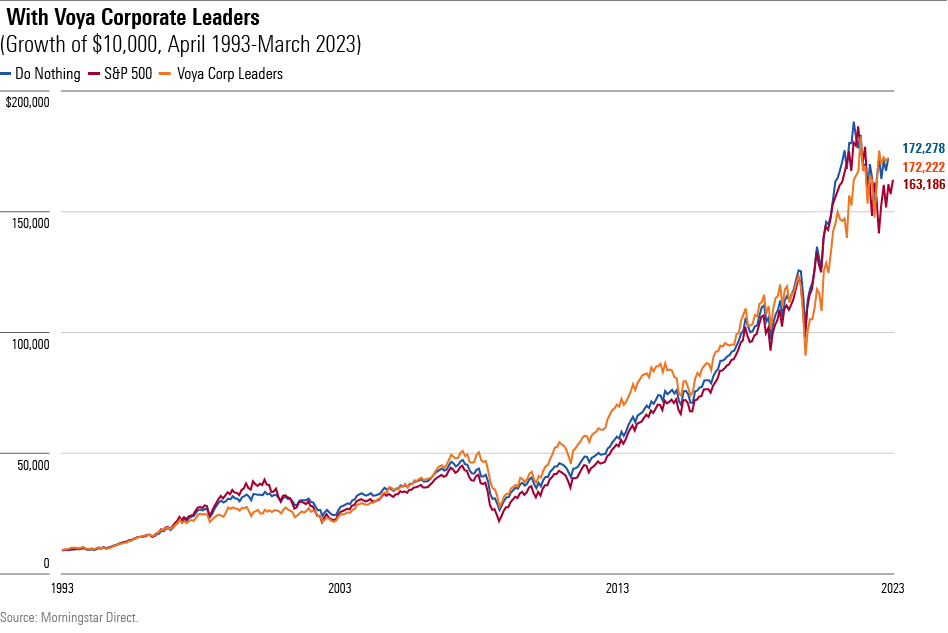

Of course, a single test is a single test, even if achieved over a generation. A second example would be useful. Enter Voya Corporate Leaders Trust LEXCX. As with the Do Nothing Portfolio, this venerable (founded in 1935) and quirky mutual fund also avoids new positions. It diverges from the Do Nothing Portfolio by retaining the stocks of acquiring firms, rather than converting those transactions into cash, but it otherwise operates similarly. Its results have been similar as well.

Indeed, from the final values, one might think that the Do Nothing Portfolio and Voya’s fund operate identically. Over the 30-year period, they finished only $56 apart. Sheer coincidence. Because Voya Corporate Leaders was launched almost 90 years ago, it differs sharply from today’s technology-heavy benchmarks. Currently, the fund’s five largest positions are Union Pacific UNP, Berkshire Hathaway BRK.B, Exxon Mobil XOM, Marathon Petroleum MPC, and Linde LIN. (The latter is a German chemical company, headquartered in the United Kingdom.) FAAMG stocks they are not!

Investment Lessons: Part 1

What does not appear to be coincidental, given the success enjoyed by both the Do Nothing Portfolio and Voya Corporate Leaders, is that sit-tight investment strategies can be abundantly lucrative. In his article, Ptak drew four conclusions from the evidence.

1) Cash is not trash. The Do Nothing Portfolio was not penalized for its patience.

2) Avoid the rush. The fewer decisions investors make, the better.

3) Don’t be afraid to let winners run. Some will continue to prosper, and overall portfolio risk is unlikely to climb significantly.

4) Distrust intuition. It often counsels unnecessary action.

Investment Lessons: Part 2

To Ptak’s counsel I have three additions.

1) Don’t sweat an index’s details. Every index provider claims its methods are superior to those of the competition. Not only cannot they all be right, but it is also quite possible that none of them will be. Both the Do Nothing Portfolio and Voya Corporate Leaders outperformed the major benchmarks (Voya’s fund was also less risky than the S&P 500, although only modestly) while breaking the accepted index-construction rules.

The lesson: While investors certainly should understand what their index funds own, to monitor their risk exposures and avoid surprises, index creators cannot forecast the markets any more accurately than can active managers. When selecting among index funds, low costs are the key consideration. Their relative profits can always be pocketed.

2) Worry not about being fashionable. One would think that investment strategies that either delay admission to rising companies, as with the Do Nothing Portfolio, which did not buy Alphabet GOOGL stock until seven years after the company had joined the S&P 500, or bars them entirely, as with Voya Corporate Leaders, would struggle to keep pace with more-responsive indexes. But our test cases did not demonstrate that.

The lesson: While the newest companies tend to shine most brightly, being likeliest to post the highest gains and receive the greatest media attention, there’s plenty of money to be made with the rest of the U.S. stock market. Voya Corporate Leaders has grown its value 17-fold over the past three decades, despite owning businesses that elicit yawns.

3) A little diversification goes a long way. At times, the largest position in the Do Nothing Portfolio reached 11% of assets. The top March 2023 holding for Voya Corporate Leaders is far larger, at 35%! Once again, those figures confound expectations, as one would anticipate such concentrated portfolios to be riskier than the S&P 500, rather than being less volatile.

The lesson: Most investors have more stocks than they need. For adequate diversification, a single portfolio that holds a few dozen positions will suffice. There’s no harm in being more widely diversified, but neither is there meaningful benefit.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)