U.S. Government’s Investment Options Are Good but Could Be Great

The U.S. Federal Thrift Savings Plan’s Lifecycle Funds’ unique status as part of a huge government entity is a blessing and a curse.

As the workplace retirement savings vehicle for U.S. federal civilian workers and uniformed services members, the Federal Retirement Thrift Savings Plan stands as the largest defined-contribution plan in not only the United States but also the world. Its more than 6.7 million participants include most employees of the U.S. government, such as postal workers, military personnel, agency employees, and members of Congress.

Like most U.S. retirement savings plans, target-date strategies are important and growing components of TSP. They are known as the Lifecycle or L Funds, and more than half of TSP’s 6.7 million participants have directed at least a portion of their assets to these target-date funds; of those, 2.3 million workers invest solely in the L Funds. To offer a measure of independent analysis to L Fund investors and the advisors who serve them, Morningstar reviewed the L Funds through a lens similar to the one used to examine target-date investment strategies available to the general public, examining the funds’ Process, People, Price, Parent, and Performance.

Here, we explore the main advantages and disadvantages of TSP L Funds. Let us know if there are any other TSP-related questions that you’d like us to pursue in the future.

Thrift Savings Plan L Fund Advantages:

- Rigorous annual testing of asset-allocation glide path.

- Access to G Fund that provides U.S. government-guaranteed yields with no bond-market risk

- Underlying funds rely on well-regarded managers via BlackRock and State Street Global Advisors.

- Access to G Fund that provides U.S.-government-guaranteed yields with no bond market risk.

- Among the lowest expense ratios available to investors.

- Unmatched level of transparency via board meetings and various reports available to public.

- Returns have soundly matched expectations by protecting in down markets.

- Long-term results consistently ahead of peers.

Thrift Savings Plan L Fund Disadvantages:

- Excruciatingly slow implementation of investment decisions.

- Missing commonly used non-U.S. subasset classes.

- Concentration risk has been somewhat mitigated but still relies heavily on BlackRock.

- Transparency around glide path management and TSP investment personnel could be better.

- Fees could likely be cheaper.

- Evidence of perfunctory oversight doesn’t instill confidence.

- Politics has influenced oversight and decisions.

- Bond-heavy allocation has hampered participation in up markets.

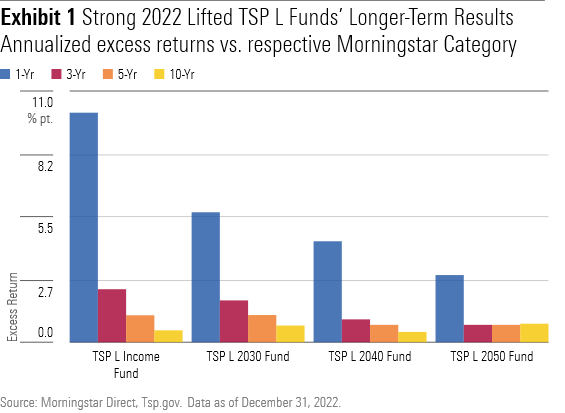

Low Fees Have Supercharged the Thrift Savings Plan’s L Funds’ Returns

L Fund investors have felt the benefits and burdens that come with investing via the U.S. government in the world’s largest retirement savings plan. They enjoy significant advantages: TSP’s size gives it much negotiating power with BlackRock and State Street Global Advisors, two well-regarded firms that manage the plan’s index-based funds. And although we’d like to see administrative fees come down as account balances grow, L Fund fees are still among the lowest in the nation.

TSP savers and L Fund users also benefit from a Government Securities Investment Fund, or G Fund, that boasts a combination of the U.S. government’s guarantee, access to market interest rates, and price stability. The G Fund “delivers high yields while eliminating bond market risk” via a special Treasury note created exclusively for TSP; collectively, these are features that can’t be accessed or replicated outside of this plan. Low fees plus the G Fund have supercharged the L Funds’ recent returns, as shown in Exhibit 1.

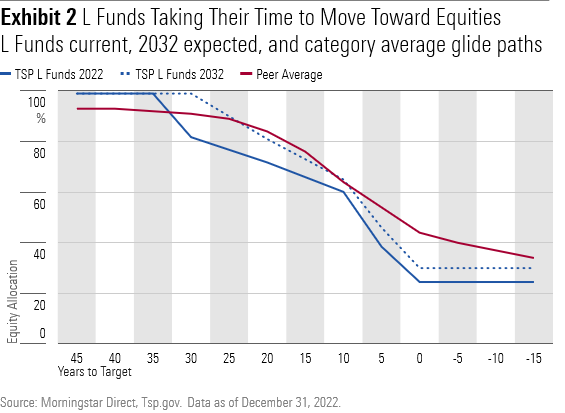

Thrift Savings Plan L Fund Held Back by Exceedingly Slow Implementation

Yet size and government are also sources of the funds’ weaknesses; in particular, marked slowness to make recommended improvements plus political considerations hamper federal workers’ retirement readiness in ways that rarely affect private sector workers to the same extent.

Changes to the funds’ equity asset-allocation glide path are being phased in over what will be an almost 15-year period—a process that off-the-shelf target-date strategies routinely complete in months. The glide path is one of a target-date strategy’s key features and should reflect management’s best thinking. Exhibit 2 shows the L Funds’ current equity asset-allocation glide path, the expected glide path to be reached in 2032, and the industry average glide path.

Meanwhile, long-standing plans to diversify the funds into emerging markets have faced multiple roadblocks. Even as TSP’s investment experts continue recommending the change, U.S. senators have introduced legislation and board members from TSP’s governing body, the Federal Retirement Thrift Investment Board, have passed motions that have put those efforts on hold; they cite national security and other justifications that few private sector plans consider in their fiduciary oversight. Unique to TSP, FRTIB must regularly expend efforts and budget lobbying Congress and monitoring legislation directly targeted at TSP.

Ultimately, there’s much to recommend in the TSP L Funds, but there’s also potential to do better by the 6.7 million workers served by TSP. To get from good to great, follow the investment experts, act with more urgency, and make full use of the scale and negotiating power that comes from running the world’s largest retirement plan.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)