The Best Target-Date Funds for 2023 and Beyond

Five series earn the coveted Morningstar Analyst Rating of Gold.

Target-date strategies weren’t immune to market losses during the rough and tumble markets of 2022. Despite taking in net inflows, market depreciation saw target-date strategies’ assets fall to $2.82 trillion at the end of 2022 from $3.27 trillion in 2021—roughly a 14% drop.

However, investors continued contributing to target-date strategies as stocks and bonds both suffered double-digit losses in 2022, showing that retirement savers are using these vehicles as they are intended: as long-term investments.

These popular all-in-one retirement saving vehicles brought in $153.3 billion in net new money across both mutual fund and collective investment trust series. CITs led the way, absorbing $121 billion, or 79% of the year’s net inflows.

Plan sponsors continue to display a strong preference for lower-cost target-date strategies, exhibited by both inflows to lower-cost mutual fund series and the growing popularity of CITs.

Morningstar’s 2023 Target-Date Strategy Landscape covers 2022′s flows and the continued growth of CITs as well as other trends shaping target-date strategies. Morningstar Direct and Office clients can download the full report here.

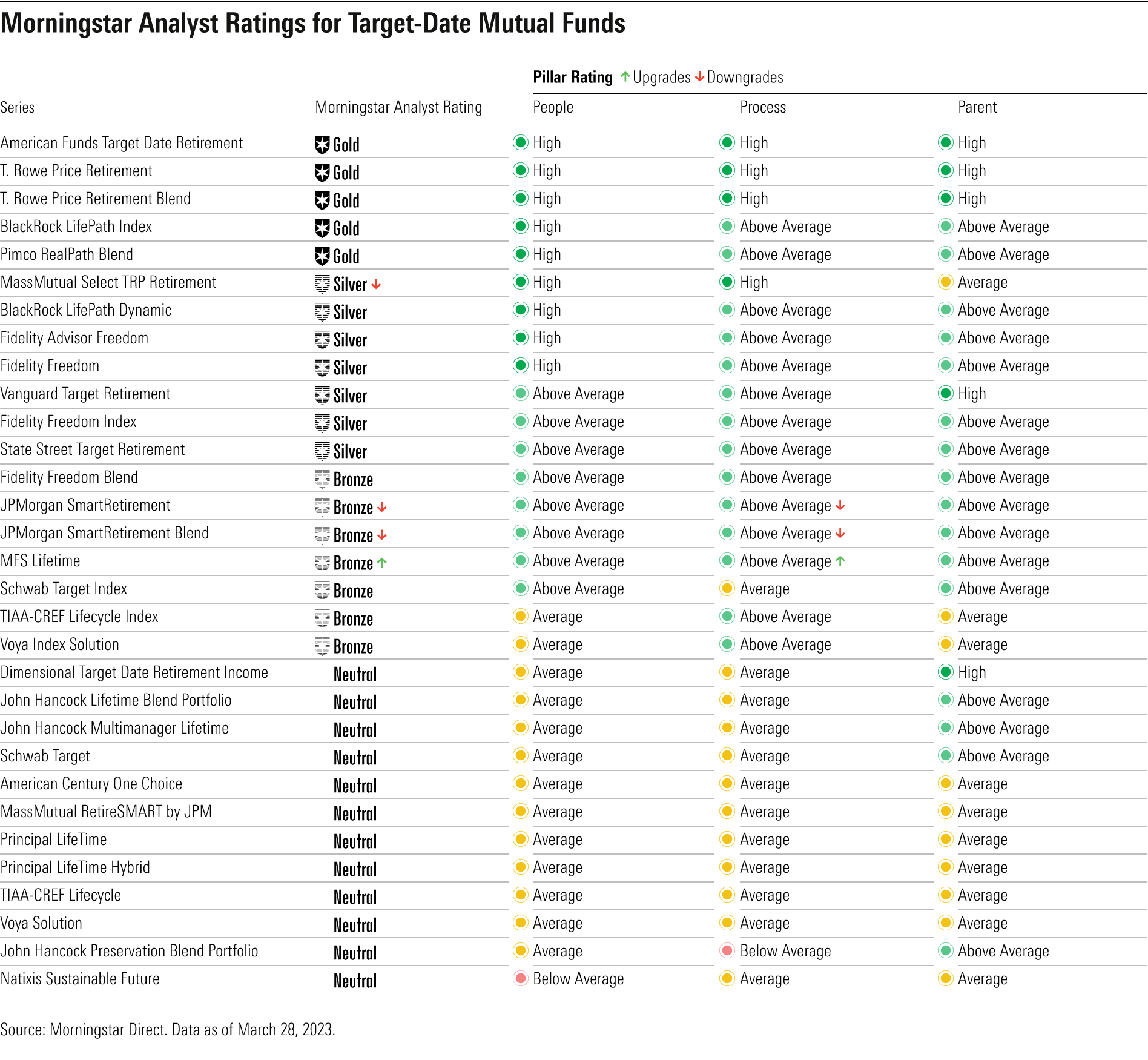

Our Morningstar Analyst Ratings for target-date mutual funds help investors navigate the target-dates available, and our coverage has expanded over the past year. Below, we illustrate our ratings and showcase our top-rated series.

Coverage Catch-Up: Target-Date Funds Edition

The table below shows ratings assigned to the cheapest share class of the target-date fund series covered by Morningstar analysts, as of March 2023. It also highlights how the Analyst Rating, People Pillar, Process Pillar, and Parent Pillar changed between April 2022 and March 2023. Morningstar analysts currently cover 25 CIT target-date series, which are mostly clones of their mutual fund counterparts.

The past year marked a number of changes in our Morningstar Analyst Ratings, including two series brought under coverage.

One of these series, T. Rowe Price Retirement Blend, debuted at Gold. This series aptly allocates across active and passive funds, keeping costs low while still maintaining exposure to the firm’s topnotch active funds. It benefits from an experienced and well-resourced management team that consistently strives to implement its best thinking. The CIT version, which has a longer track record, has earned the same rating since it was brought under coverage in 2021.

Morningstar also picked up coverage of Fidelity Freedom Blend series with an inaugural Analyst Rating of Bronze. Run by Fidelity’s strong asset-allocation group, this series fills the middle ground between the firm’s existing active-based and index-based Freedom series. The managers use active funds where they feel Fidelity has an edge, like growth stocks, and where they think markets are less efficient, such as emerging markets.

Fee Pressure and Industry Standards’ Impact on Ratings

Ratings for strategies that we were already covering have also shifted over the year.

MFS Lifetime’s well-regarded fund lineup, management team, and solid long-term strategy give the series a competitive edge. The team’s consistent execution of its well-reasoned investment approach supported a Process rating upgrade to Above Average from Average, driving its Analyst Rating to Bronze from Neutral.

MassMutual Select TRP Retirement did not earn a pillar change, but its Morningstar Analyst Rating was downgraded to Silver from Gold. Increasing fee pressures within a competitive peer group, combined with an Average rating for Parent, drove the downgrade.

Some changes reflect higher standards across the competitive landscape. The process employed for the JPMorgan SmartRetirement Blend and JPMorgan SmartRetirement series isn’t as singularly standout as it was in the past, which resulted in Process ratings downgrades to Above Average from High. The team has seen turnover in recent years, and its tactical moves, which previously set it apart, lack consistency. As a result, the series’ Analyst Ratings fell to Silver and Bronze, respectively.

Target-Date Series That Continue to Earn Gold Ratings

Four series held on to their coveted Gold ratings over the past year and remain top options for investors searching for a target-date fund.

- American Funds Target Date Retirement continues to deliver. The series strikes the right balance between the firm’s renowned bottom-up security selection and its increasingly impressive asset-allocation research. They play to their strengths by allowing a large, experienced, globe-spanning roster of managers and analysts to drive the allocations, leading to a nuanced glide path. On average, its long-term returns top its peers.

- T. Rowe Price Retirement’s experienced and skillful team, ample resources, and drive for enhancements instill confidence here. The forward-thinking management team consistently conducts research and isn’t afraid to be first-time movers. This series comes with an above-average equity allocation and allocates to riskier bond funds, which can lead to a bumpier ride for investors during drawdowns, such as in 2022. Although security selection stumbled over the past year, it has served as a long-term strength here and should treat investors well over the long run.

- BlackRock LifePath Index benefits from an exceptional team, robust resources, and a well-calibrated approach. The trailblazing team continues to challenge the status quo and expand its toolkit. Its most recent initiative broke down the Bloomberg U.S. Aggregate Bond Index to its key underlying components to pinpoint the optimal duration and credit risks across the glide path. In 2014, the team also was the first to up its equity exposure at the onset of the glide path, bringing it to 99%.

- Pimco RealPath Blend draws on an experienced lead manager and a supporting team of world-class practitioners to construct a sensible glide path that uses strong underlying funds. The team struck the right balance when constructing these well-diversified portfolios. It allocates the equity portion of the glide path to low-cost broad market Vanguard index funds and uses its stellar in-house active bond funds for fixed-income exposure. The fixed-income portfolio courts more credit risk than peers that own broad bond market index funds as their core fixed-income holdings. Yet, the underlying active managers’ ability to constructively pair big-picture research and bottom-up analysis gives us confidence in the approach.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)