Financial Sector Stock Outlook: Berkshire the Usual Stalwart

Blackstone, Citigroup also stand out within a more cautious banking landscape.

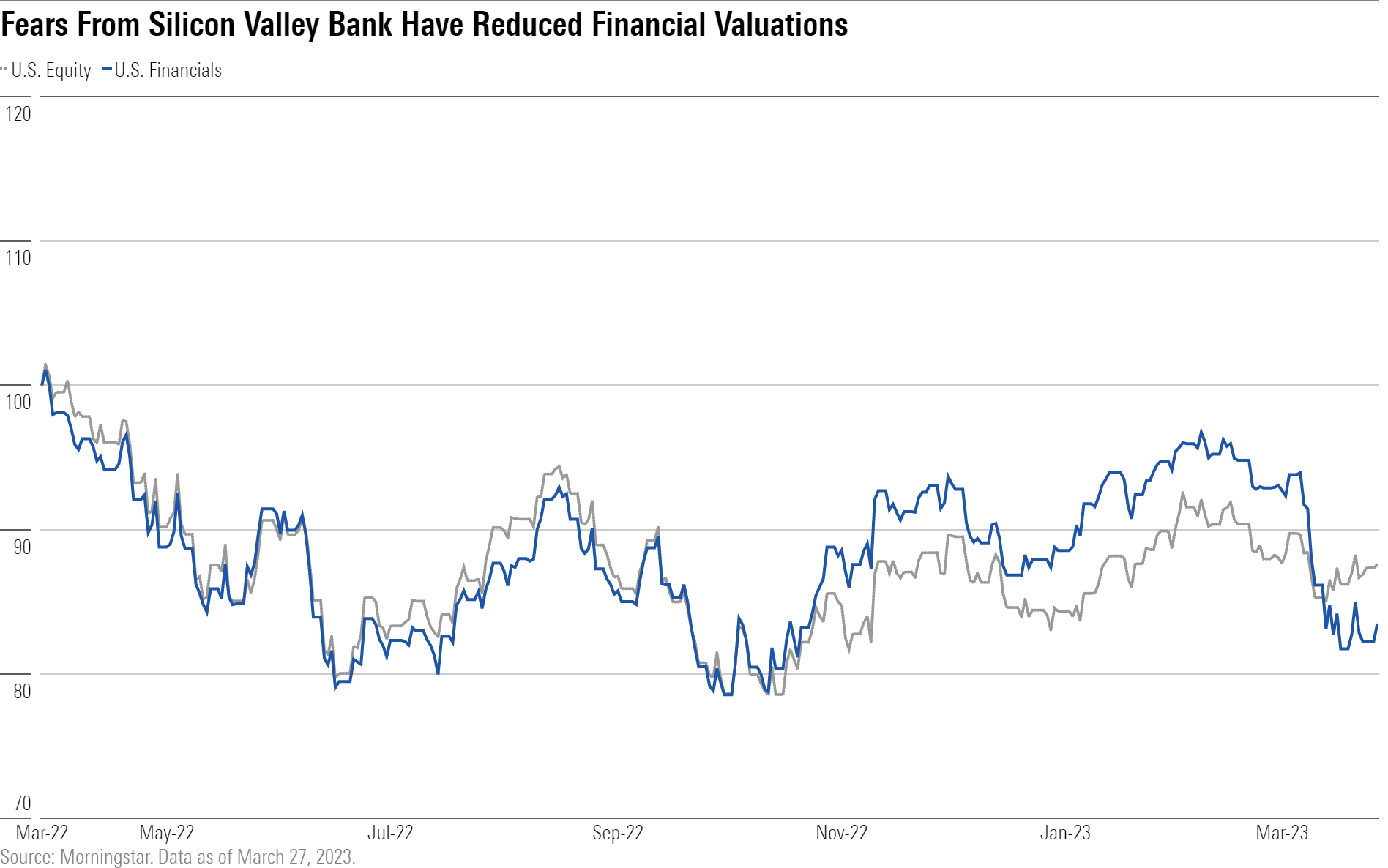

The Morningstar US Financial Services Index significantly underperformed the Morningstar US Market Index over the previous year, down 14.3% compared with 9.6% for the benchmark. Quarter to date, the sector is down 5.71% compared with the market’s gain of 3.83%.

The median North American financial sector stock trades at a 15% discount to its fair value estimate compared to a 10% discount at the end of the fourth quarter of 2022 and a 1% discount at the end of the first quarter of 2022. We currently rate over 50% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks with less than 10% rated overvalued 2- and 1-star stocks.

Financial sector stocks have recently fallen due to fear stemming from the demise of Silicon Valley Bank, Signature Bank, and Credit Suisse. We broadly put the fear into 2 categories: 1) liquidity and solvency 2) long-term profitability. In terms of liquidity and solvency, banks are holding higher-quality assets and the financial system is better capitalized to absorb any losses than during the global financial crisis. The recently established Bank Term Funding Program by the U.S. Federal Reserve and emergency measures to make all depositors of Silicon Valley Bank and Signature Bank whole provides liquidity to the banking system and reassurance to depositors.

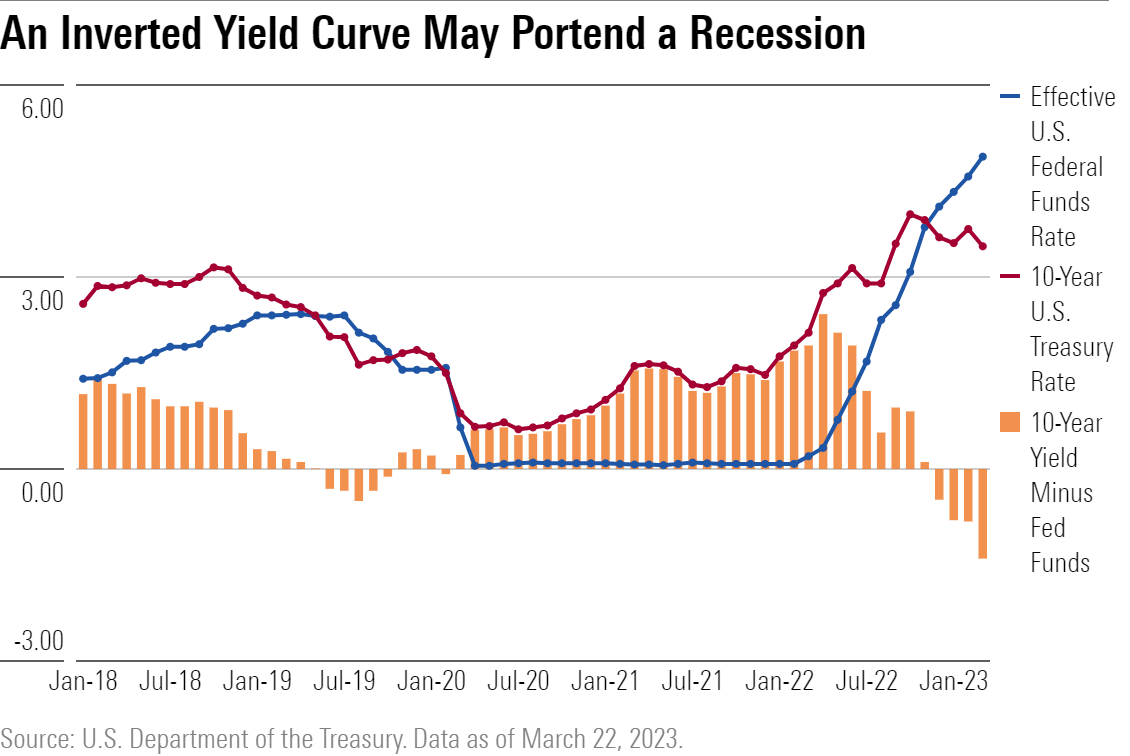

While the U.S. financial system is sturdy, we believe that financial institutions will be cautious in the near to medium term, which could pressure profits. A commonly cited forward indicator of a recession is the inversion of the yield curve. We can see that on a monthly basis, the effective federal-funds rate has been higher than the 10-year U.S. Treasury yield since December 2022.

To prepare for a recession, banks will likely tighten lending standards that reduces loan growth and the availability of credit to the economy.

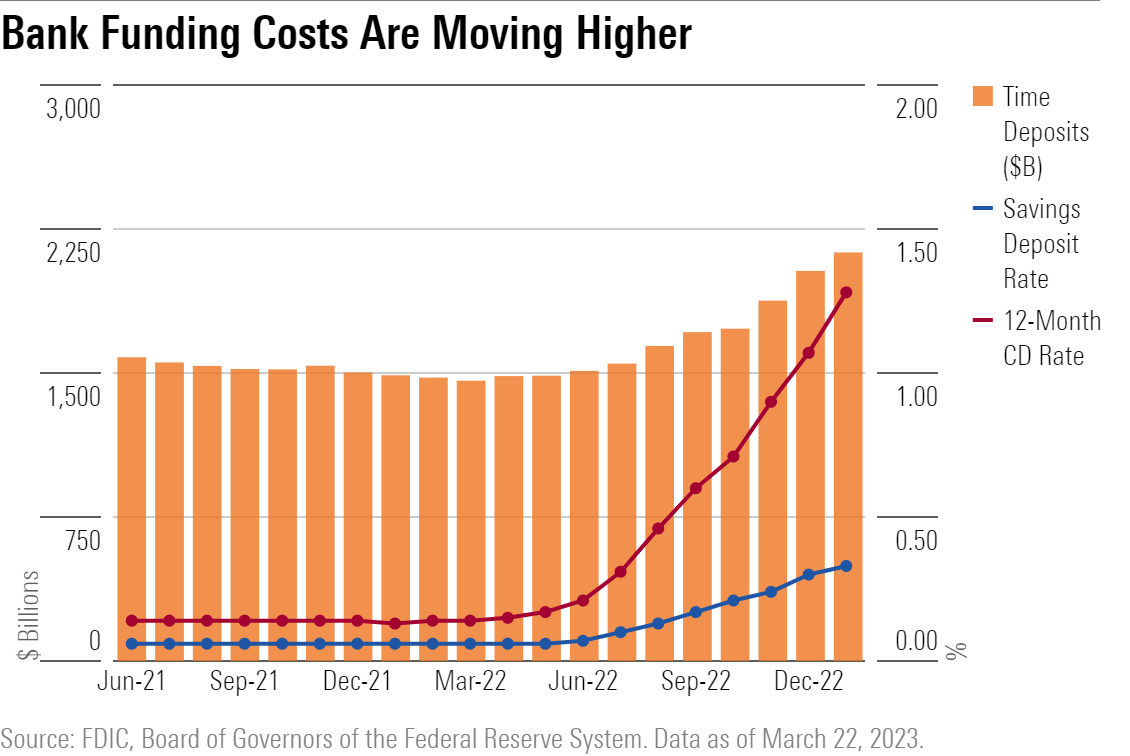

To further shore up liquidity, banks may invest in lower-yielding short-term securities and pay more for funding. Time deposit balances have increased more than 40% from their 2022 low and the rate paid on certificates of deposits have steadily increased. Outside of the banking industry, we see less fallout from Silicon Valley Bank with indirect effects from recently lower asset prices, higher probability of a recession, and potentially lower peak interest rates.

Top Financial Sector Stock Picks

Berkshire Hathaway BRK.A

- Fair Value Estimate: $555,000.00

- Star Rating: 4 Stars

- Uncertainty Rating: Low

- Economic Moat Rating: Wide

We continue to view Berkshire’s decentralized business model, broad business diversification, high cash-generation capabilities, and unmatched balance sheet strength as being true differentiators for the company. Owing to its diversification and its lower overall risk profile, we believe the wide-moat firm offers one of the better risk-adjusted return profiles in the financial-services sector, viewing the market losses recorded on its investment portfolio this year as near-term mark-to-market adjustments representing unrealized losses for a firm that has a rock-solid balance sheet and tends to be a buy-and-hold investor over time.

Blackstone BX

- Fair Value Estimate: 115

- Star Rating: 4 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

We believe Blackstone has built a solid position in the alternative-asset management industry, utilizing its reputation, broad product portfolio, investment performance track record, and cadre of dedicated professionals to not only raise massive amounts of capital but maintain the reputation it has built for itself as a “go-to firm” for institutional and high-net-worth investors looking for exposure to alternative assets. With demand for alternatives increasing, and investors in limiting the number of providers they use, large-scale players like Blackstone are well-positioned to gather and retain assets for its funds.

Citigroup C

- Fair Value Estimate: $75

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Citigroup is one of the most undervalued U.S. banks under our coverage and is trading below tangible book value. The bank is shedding non-performing segments, refocusing its operations, and is dealing with consent orders from regulators. The bank should be in a better position than the average regional bank in the current environment, as Citi’s size and GSIB status encourage deposit inflows. Furthermore, the bank’s unique idiosyncratic drivers can help break the correlation with the overall sector. The bank also has a lower percentage of unrealized losses to regulatory capital, another important metric in today’s uncertain times.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PEXHY2NG2ZPQBNXNNFWY76ZU5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)