4 Auto Stocks to Buy in 2023

Despite uncertainty in the sector, we think there’s reason for optimism.

Although the most high-profile names in the auto industry—for example, General Motors, Toyota, Volkswagen—don’t have moats, we still think there are good investment opportunities to be found within the industry.

Economic moats are more prevalent among auto-parts suppliers than automakers, but we think that current market conditions do make some automakers’ stock valuations more compelling.

In our annual “Moats, Motors, and Markets” report, we outline our forecast for auto sales in 2023 and beyond and include our best ideas for stocks to buy in the industry.

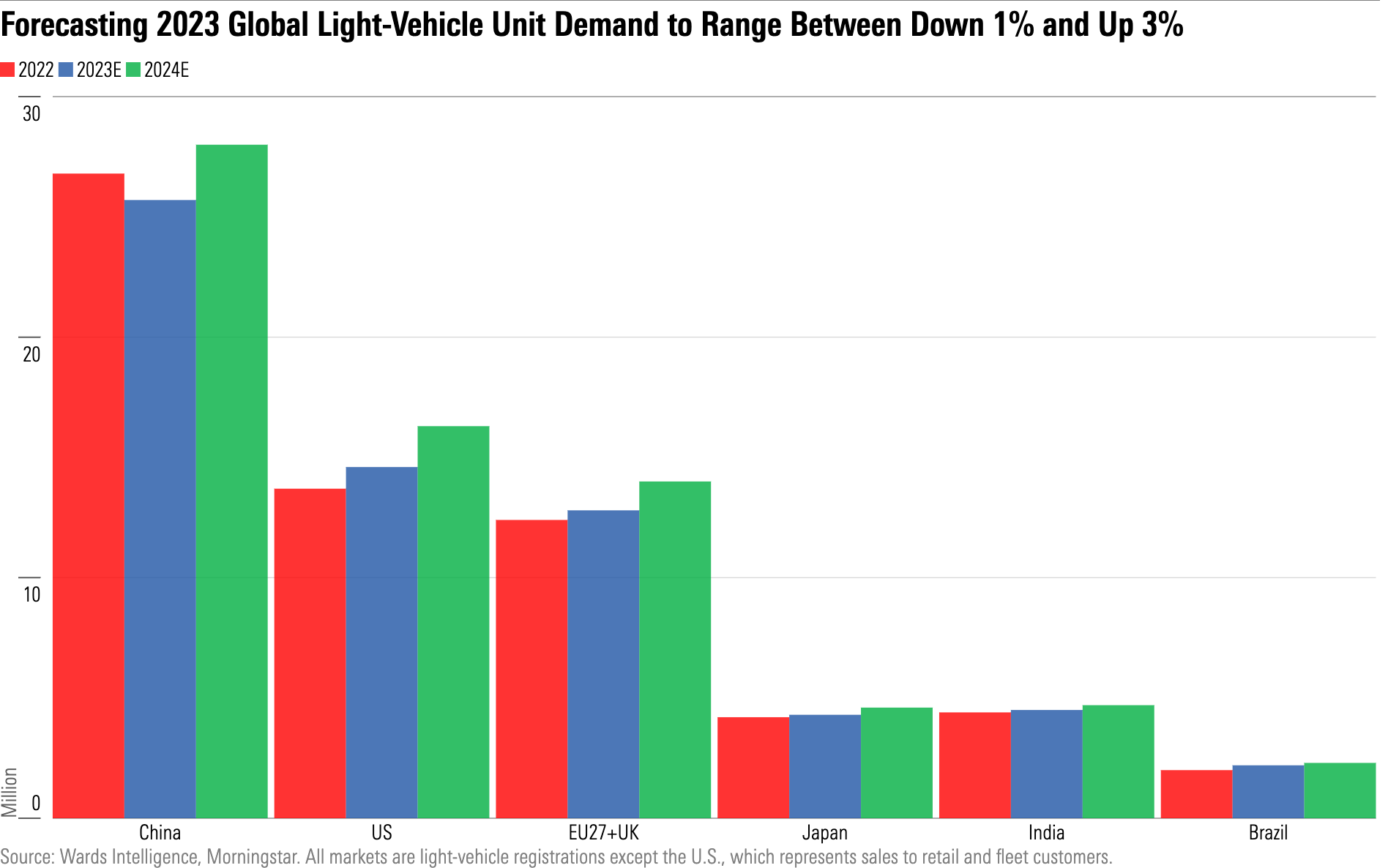

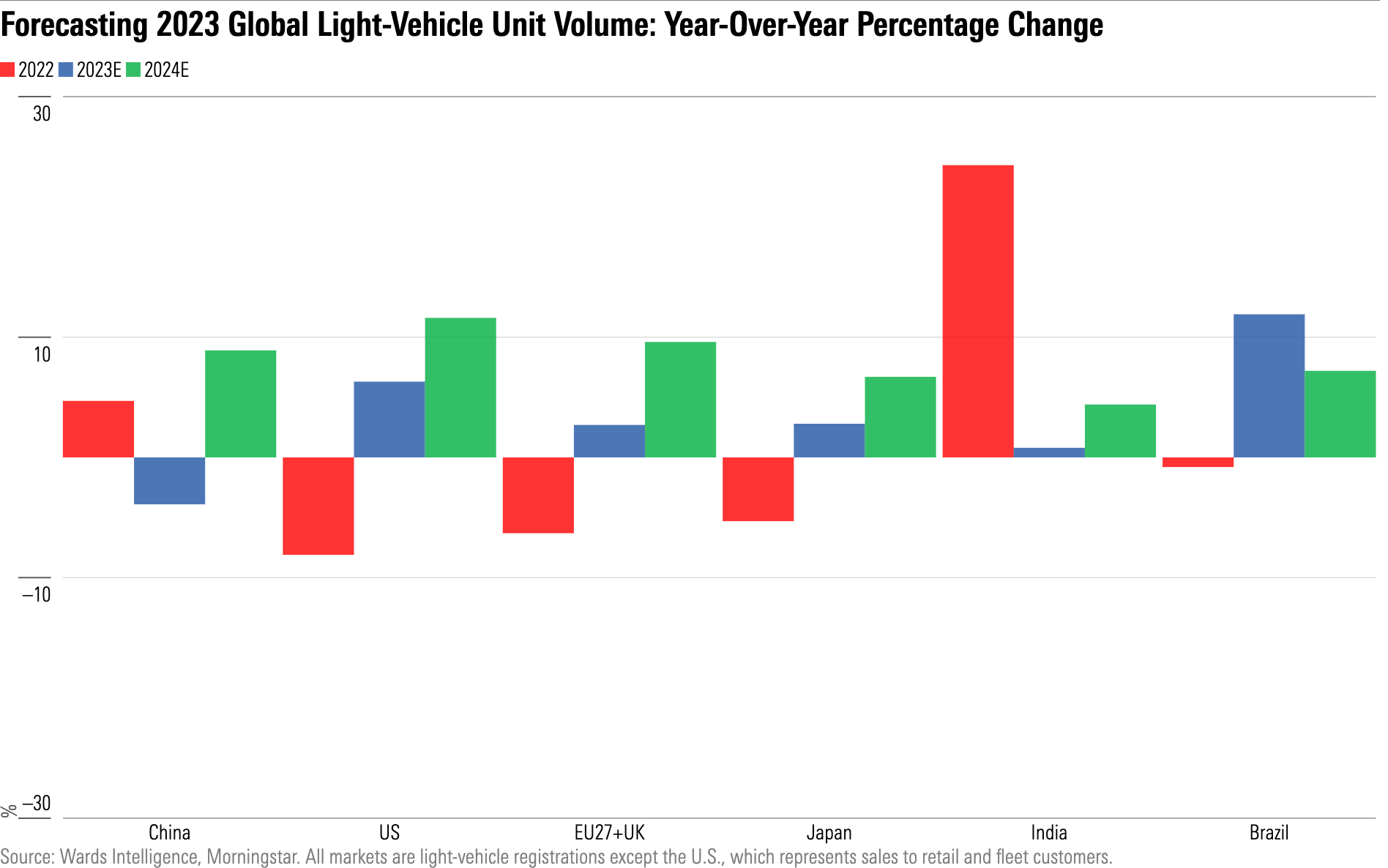

Global Auto Sales to Be Roughly Flat in 2023, Though Uncertainty Remains High

Overall, we forecast global light-vehicle demand in 2023 to be within a range of down 1% to up 3% on softening economic conditions, alleviating microchip shortage, improving consumer availability, and easier comparisons as the chip crisis and the Ukraine war pummeled 2022′s first half.

While we expect sales of electrified vehicles to substantially increase in 2023, we do not view this as something that influences the overall level of global light-vehicle demand.

Most industry forecasts are at the upper end of ours, primarily because of our slightly more pessimistic views on China, Europe, the United States, and India, partially offset by a slightly more optimistic Brazil forecast.

Although the chip shortage has been gradually improving, we are somewhat skeptical that microchip producers have capacity to meet automakers’ demand, continuing a lack of availability for new-vehicle consumers. Uncertainties remain high in 2023, with the threat of recession in major global auto markets, the chip shortage, the Ukraine war, inflation, and rising interest rates.

Despite Headwinds, U.S. Demand Shouldn’t Collapse in 2023

In the U.S., we think the market will be up by about 4%-8% as consumers keep shifting more of the fleet to light trucks while battling high vehicle prices and rising interest rates amid continued recovery from the ongoing chip shortage. This puts us at a forecast of 14.5 million-14.7 million, versus 13.7 million U.S. sales in 2022.

Sales in 2022 were held back significantly by the chip shortage, marking the industry’s lowest sales volume since 2011. We expect a choppy recovery this year, with inventories trending upward throughout 2023 as production capabilities improve.

Despite the uncertainty, we strongly believe there is massive demand still to be met. The fleet remains old, electric vehicles bring an exciting change to consumers as well as superior driving performance versus combustion vehicles, credit access remains mostly healthy, and we don’t see evidence of a subprime auto lending bubble.

We believe that U.S. auto sales have been at severe recessionary levels for many months now anyway because of the pandemic and the chip shortage, so we maintain our forecasted sales growth this year, even if the U.S. does enter a recession.

4 Stock Picks in the Auto Industry

Like a pendulum with too much kinetic energy, an overly enthusiastic market can swing suppliers’ valuation multiples higher as the sell side rationalizes the chase for richer multiples on increasing profits and returns.

We believe that, at times, some suppliers’ stocks have been priced as though cyclical downturns will no longer exist. Current market valuations have focused on industry headwinds like the semiconductor shortage, the Ukraine war, and potential for recession in major automotive markets. As a result, most auto-parts supplier stocks are attractively valued.

We think the valuation pendulum on some original equipment manufacturer stocks remains too pessimistic, as it focuses on near-term industry headwinds. Waning enthusiasm for the automakers has led to generally higher star ratings among OEMs, and we think buy-and-hold investors have an opportunity to own certain OEMs at attractive valuations.

We name four stock picks within the auto sector in 2023.

General Motors GM

- Morningstar Rating: 5 stars

- Price/Fair Value: 0.51

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: None

We think the market is finally coming around to GM’s battery electric efforts, despite the derailment of the stock’s momentum in 2022, and we think that the stock will rally significantly once broader negative market sentiment around the economy improves.

General Motors has increased its targeted 2025 battery electric vehicle revenue expectation to $50 billion due to optimism about strong demand across the price spectrum for the firm’s BEV offerings.

We also note that GM’s new battery technology, Ultium, is a different battery technology from the batteries recalled for fire risk in the Chevrolet Bolts, which we believe offers GM increased flexibility in the vehicles it can produce. It also allows electronics, motors, and battery management systems to be used on a massive scale that internal combustion engine lineups cannot replicate.

GM’s 5-star-rated stock trades at over a 40% discount to our $78 fair value estimate. We believe that as a long-term investment, GM’s stock could offer considerable upside from present levels, a key reason it remains on our Best Ideas list.

Bayerische Motoren Werke BMWYY

- Morningstar Rating: 4 stars

- Price/Fair Value: 0.71

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Narrow

Narrow-moat BMW’s 4-star-rated stock trades at a compelling 35% discount to our EUR 152 fair value estimate. At the current market value of EUR 99, our normalized midcycle industrial EBIT margin assumption would have to be 3.2% for our model to generate an equivalent fair value, 430 basis points below our midcycle assumption. We think the market has valued BMW shares as though the firm has no economic moat and its cost structure has become permanently impaired.

We think narrow-moat-rated BMW’s electrification strategy is competitive and will provide investors with returns commensurate with historical levels. We estimate that by 2030, the firm’s global sales volume will be 50% battery electric vehicles and 25% plug-in hybrid electric vehicles for a total of 75% electrified powertrain vehicles, or xEVs.

The firm has averaged 7.8 percentage points of economic profits since 2002, supporting our narrow moat rating derived from brand strength and intellectual property in an intangible assets moat source.

The company continues to outperform the worldwide light-vehicle market despite global economic uncertainties. Since 2002, worldwide light-vehicle registrations have grown at an average annual rate of 2.1% versus BMW global volume growth of 4.7%.

Gentex GNTX

- Morningstar Rating: 4 stars

- Price/Fair Value: 0.81

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Narrow

Auto-dimming supplier Gentex is one of our favorite quality names because of its 89% market share and debt-free fortress balance sheet gushing with cash. Gentex’s EBIT margins and free cash flow generation are dominant among auto suppliers.

For these reasons, it is rarely trading below our fair value estimate, but the chip shortage ravaging suppliers’ volumes has put the stock in what we see as an attractive position, trading at about a 20% discount to our $35 per share fair value estimate.

Autos currently makes up about 98% of Gentex’s revenue, with fire protection and auto-dimming passenger windows for airplanes accounting for most of the remainder. We find aviation an interesting growth runway, and Gentex has contracts for its auto-dimming windows in yet to be specified Airbus planes.

Gentex’s capital allocation has become more shareholder-friendly under CEO Steve Downing, with cash and share buybacks as a percentage of revenue noticeably up since his tenure started in 2018. Management now buys back stock far more regularly than prior leadership, and we expect that to continue indefinitely.

BorgWarner BWA

- Morningstar Rating: 4 stars

- Price/Fair Value: 0.63

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Narrow

We think the market has discounted BorgWarner stock because of a possible recession in major auto markets, heavy exposure to internal combustion engine-related revenue, and current industry headwinds including the chip shortage, the Ukraine war, coronavirus resurgence in China, higher raw material costs, logistics disruptions, and other inflationary cost pressures. In our opinion, the bear case on internal combustion engine exposure underappreciates BorgWarner’s economic moat.

Currently trading at a 36% discount to our $79 fair value estimate, we think 4-star-rated BorgWarner stock offers investors compelling value in the electrified vehicle theme. We forecast BorgWarner’s EV revenue will be 45% of 2030 revenue.

We estimate BorgWarner’s consolidated revenue grows at an annualized 4% rate to 2030, using 2019 as the base year, exceeding global light-vehicle demand growth by 1-3 percentage points during the same time frame.

Since 2002, BorgWarner has averaged nearly 6% points of economic profit, supporting our narrow moat rating. The company is one of a few suppliers that tie a portion of management compensation to return on invested capital and has a strict policy that all projects meet a 15% ROIC hurdle rate. Its narrow moat is derived from intangible asset and switching cost sources.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f34aaf21-a6ec-4ce4-964e-1bfba836175c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f34aaf21-a6ec-4ce4-964e-1bfba836175c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)