A New Risk for Telecom Providers

Internet access is increasingly considered a human right. Here’s what it means for Comcast and others.

Internet access is increasingly seen as an essential service. The United Nations now considers it a human right, and many countries’ top regulators, high courts, and even constitutions similarly recognize it as a fundamental right.

That is creating increased social and regulatory risk for carriers. We expect regulators to take an evenhanded approach to telecom providers, striking a balance between discouraging harmful behavior and providing incentives for companies to invest in essential telecom services. For investors, that’s highlighting the charms of stocks like Comcast CMCSA, Proximus PROX, and TPG Telecom TPG.

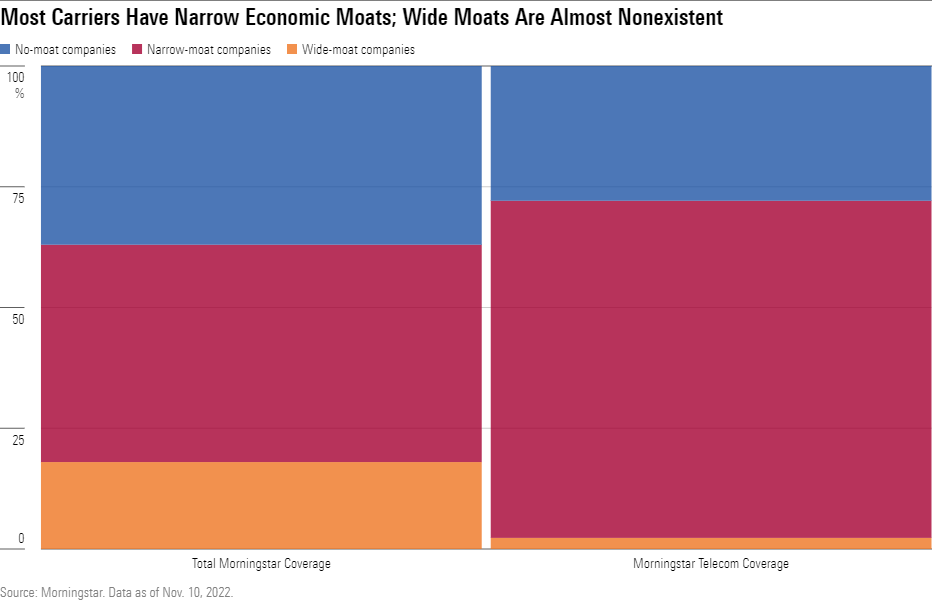

Most providers have narrow Morningstar Economic Moat Ratings, meaning that they have sufficiently strong competitive advantages to fend off their rivals for at least 10 years, but wide moat ratings in the sector are rare. A key reason for this is the persistent threat of additional regulatory or government intervention, which make it difficult to confidently project durable economic profits.

Unlike electricity or water, internet access is not formally treated as a utility. Nevertheless, governments are interested in ensuring affordable, universal access to high-speed broadband. This can lead to heavier-handed regulation that threatens the ability of providers to maximize profits. In Western countries, regulatory risk related to network quality, pricing, or market power contributes to the bulk of environmental, social, and governance risk for telecom providers.

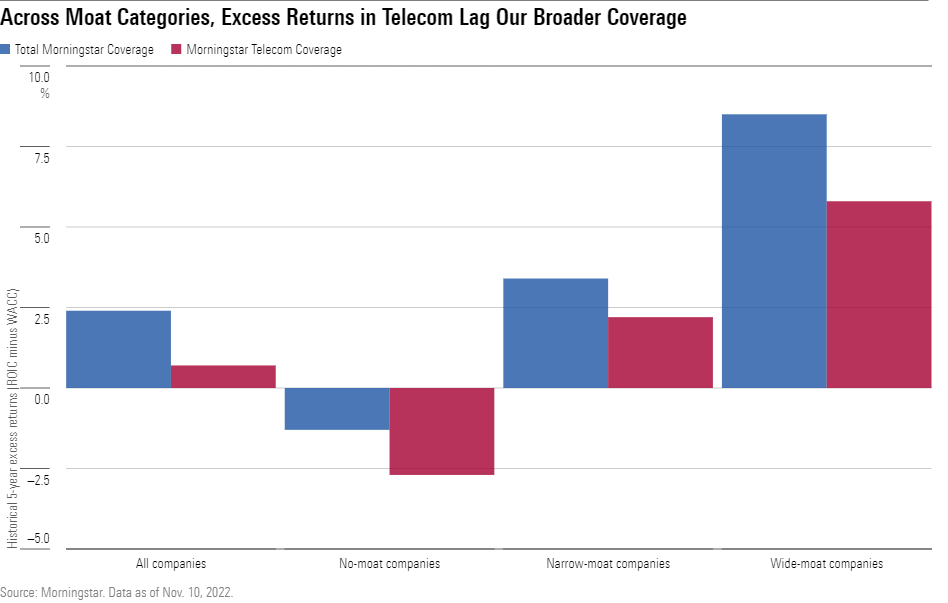

In some countries, regulators have required providers to open their networks to competitors without their own networks or set price caps for offerings. Other measures include requiring providers to expand or maintain networks in areas that may not be economically profitable and prohibiting providers from cutting off services to delinquent customers. These types of regulatory maneuvers benefit consumers but can limit a firm’s pricing power and contribute to continually high capital investment spending, restricting sizable returns on invested capital.

This heightened regulatory oversight weighs on excess ROIC in the sector, which has trailed the broader Morningstar coverage on a five-year historical basis.

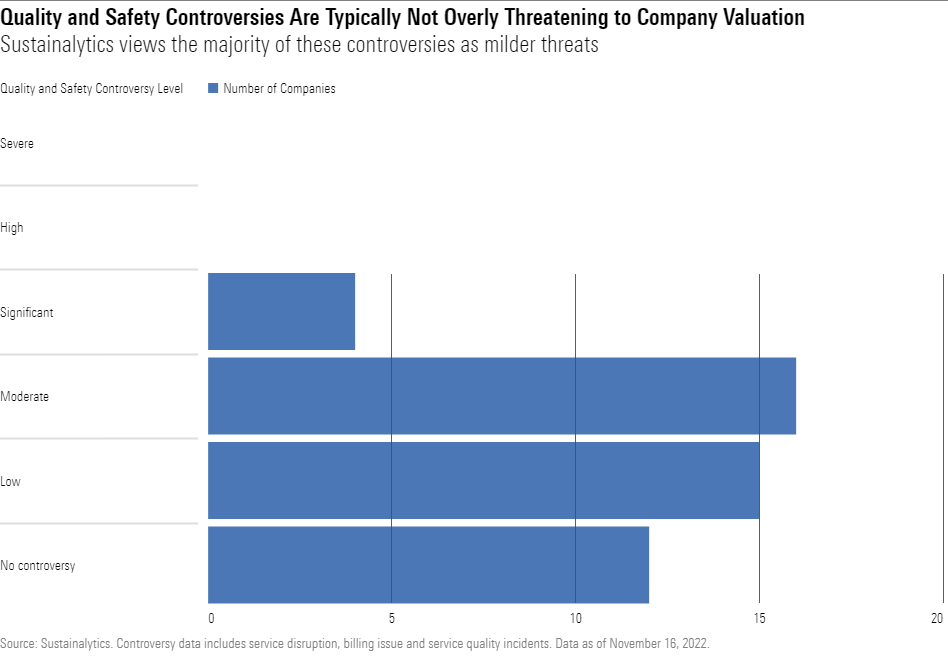

Service Disruptions Can Be Material for Customers but Typically Not for Company Valuation

Another risk is widespread network outages, which can disrupt essential banking, healthcare, and emergency services, as seen during Rogers Communications’ July 2022 outage in Canada. However, network disruptions are an omnipresent, industrywide risk that haven’t historically led to big customer defections, untenable fines, or a prolonged hit to economic profits.

Providers Need Reasonable Returns and Regulatory Certainty to Encourage Investment

Despite an ever-present risk of intervention, we expect that regulators and government bodies will continue to seek a balance between dissuading harmful behavior and providing enough incentive for continued investment in essential telecom services.

The U.K. market is illustrative of this dynamic at play. Regulatory intervention in the region has been onerous over several years. Major provider BT was forced to split into retail and wholesale units, and wholesale pricing was tightly controlled. This led to increased competition and hindered BT’s willingness to invest in its networks. That resulted in a deterioration in network quality in the United Kingdom relative to other European markets. Following lengthy negotiations with the regulator, BT established a wholesale pricing framework in 2021, providing sufficient economic incentive for the provider to rapidly invest in its network and simultaneously deliver essential telecom services to U.K. consumers.

Even after consideration of these risk factors, we see plenty of undervalued opportunities among telecom providers in every region we cover. These include:

Comcast

Comcast is a rare wide-moat company within our telecom coverage, currently trading with a Morningstar Rating of 5 stars. The company faces a double whammy as concerns over slowing broadband customer growth have dogged the core cable business and fears surrounding increased content investments have hounded NBCUniversal. We expect broadband customer growth will further slow, but we still expect Comcast to increase broadband revenue through the combination of modest customer additions and solid pricing power. NBCUniversal will need to invest to increase interest around streaming service Peacock, but we still like the firm’s position overall thanks to its solid stable of content franchises, strong theme parks, and still highly profitable traditional television business.

Proximus

Narrow-moat Proximus is the incumbent telecom operator in Belgium, where it has maintained stable share atop the broadband market over the past decade, ahead of cable peer Telenet. The firm is now stepping up fiber investment and expects to have 95% of the country blanketed with fiber over the course of the next decade. In mobile, Proximus is the number two player in a market with three major providers, and we think the stock has recently been overly punished due to the expected entrance of a fourth competitor. As a result, Proximus shares are currently in 5-star territory and trade well below our analyst’s fair value estimate.

TPG Telecom

Shares in narrow-moat TPG Telecom trade at an attractive discount to our AUD 7.40 fair value estimate and screen as the most attractive under our Australian telecom coverage. We see clear catalysts for earnings recovery on several fronts and forecast an adjusted EBITDA compound annual growth rate of 7% over the next three years. Recovery from the effects of the coronavirus pandemic, benefits from a more rational mobile market, and synergies from the recent Vodafone merger will be the key drivers, augmented by projected growth from fixed wireless, the corporate division, and regional markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/349733fa-2129-460a-bd1a-9587528b9b83.jpg)

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/349733fa-2129-460a-bd1a-9587528b9b83.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)