How Worried Should New Retirees Be About Market Losses and High Inflation?

Sequence-of-returns risk can leave even the best-laid retirement plans in tatters. Here’s what to do about it.

Recent retirees are grappling with the triple threat of a losing stock market, declining bond prices, and high inflation. This has shrunk their retirement nest eggs and reduced their spending power just as they are embarking on retirement, creating sequence-of-returns risk in the process.

In this piece, which excerpts our recently published “The State of Retirement Income“ study, we explain sequence-of-returns risk and illustrate the danger it can pose to recent retirees. We also examine how recent market conditions have eroded the odds of retirement success and suggest steps that recent retirees can take to mitigate the risk of outliving their retirement assets.

Sequence-of-Returns Risk, Explained

What is sequence-of-returns risk? It’s the risk of running out of money in retirement because of losses in the early retirement years. Early losses increase the probability of portfolio exhaustion for two reasons. First, they forestall the stock and bond gains needed to maintain and enlarge retirement funds over time. Second, they can force retirees to sell assets to support their spending at inopportune times—when stocks and bonds boast more-attractive expected returns.

High inflation has accentuated that risk in 2022, as many retirees naturally increase their spending as consumer prices escalate. While this inflation adjustment helps retirees maintain their standards of living, it further ratchets up the pressure on retirement funds and permanently elevates the base spending amount to which future inflation adjustments will be made. After all, today’s currently torrid inflation rate may moderate, but consumer prices are unlikely to go back to previous levels.

How Sequence Risk Can Change the Odds of Success

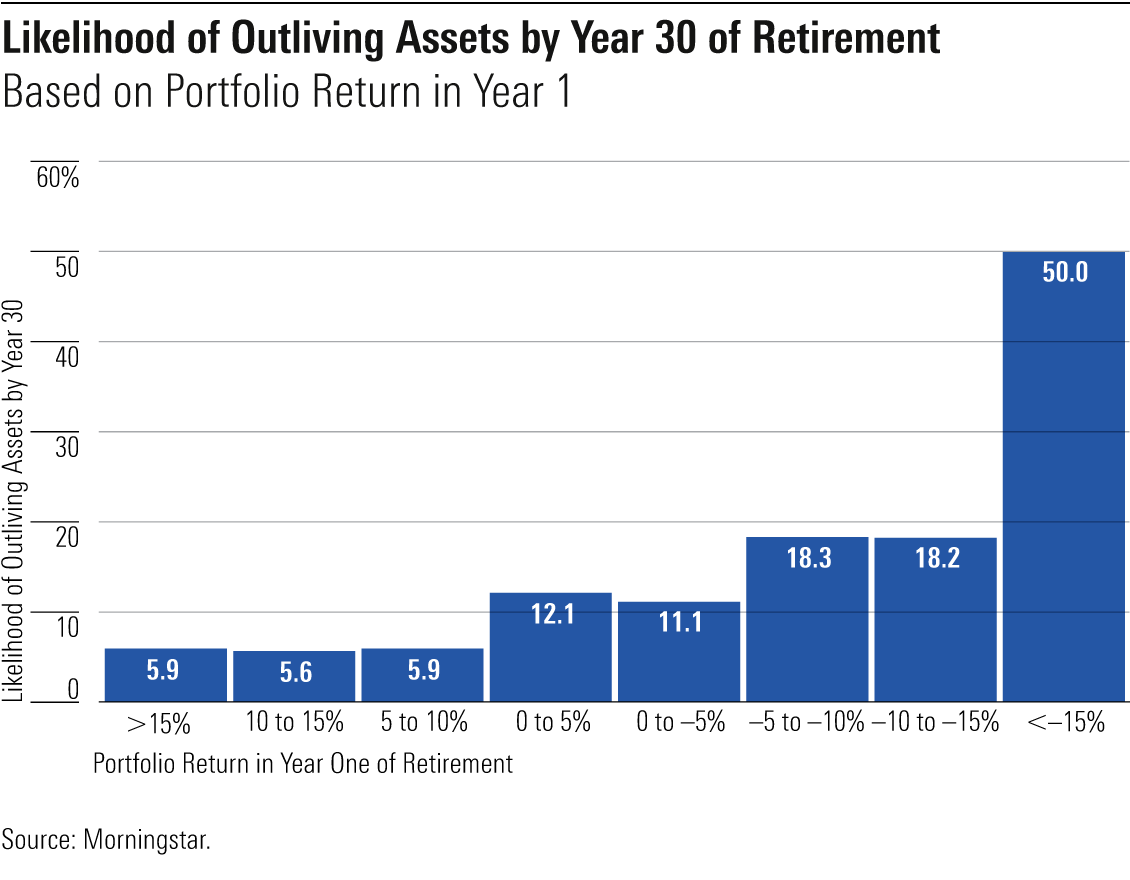

To better illustrate the danger that sequence-of-returns risk can pose to recent retirees, we conducted an exercise that estimated how often a retiree would have run out of funds by year 30 of retirement depending on how the retiree’s portfolio performed in the first year of retirement.

We conducted this analysis by assuming the retiree invested her $1 million retirement savings in a portfolio split 50/50 between stocks and bonds. That retiree then took an initial 3.3% withdrawal and adjusted her spending for inflation each year thereafter. To estimate how the value of the retiree’s retirement savings could vary over the 30-year horizon, we ran 1,000 random trial simulations, assuming an average annual portfolio return of 5.2% and inflation of 2.2% per year. (1)

Using these assumptions, we found that the retiree had a 50% chance of running out of money by the end of year 30 if the 50% stock/50% bond portfolio lost at least 15% in year one.

Of course, that finding assumes that the retiree who encounters big losses in year one sticks with a system of fixed real withdrawals, making no subsequent adjustments to spending. Moreover, it doesn’t reflect the improved market outlook—bonds’ higher yields and stocks’ reduced valuations are expected to confer higher future returns than the 5.2% per year return used in this analysis. (This is the silver lining of a very bad stretch for the 50% stock/50% bond portfolio, as it now boasts better future prospects.)

Another Risk: High Inflation

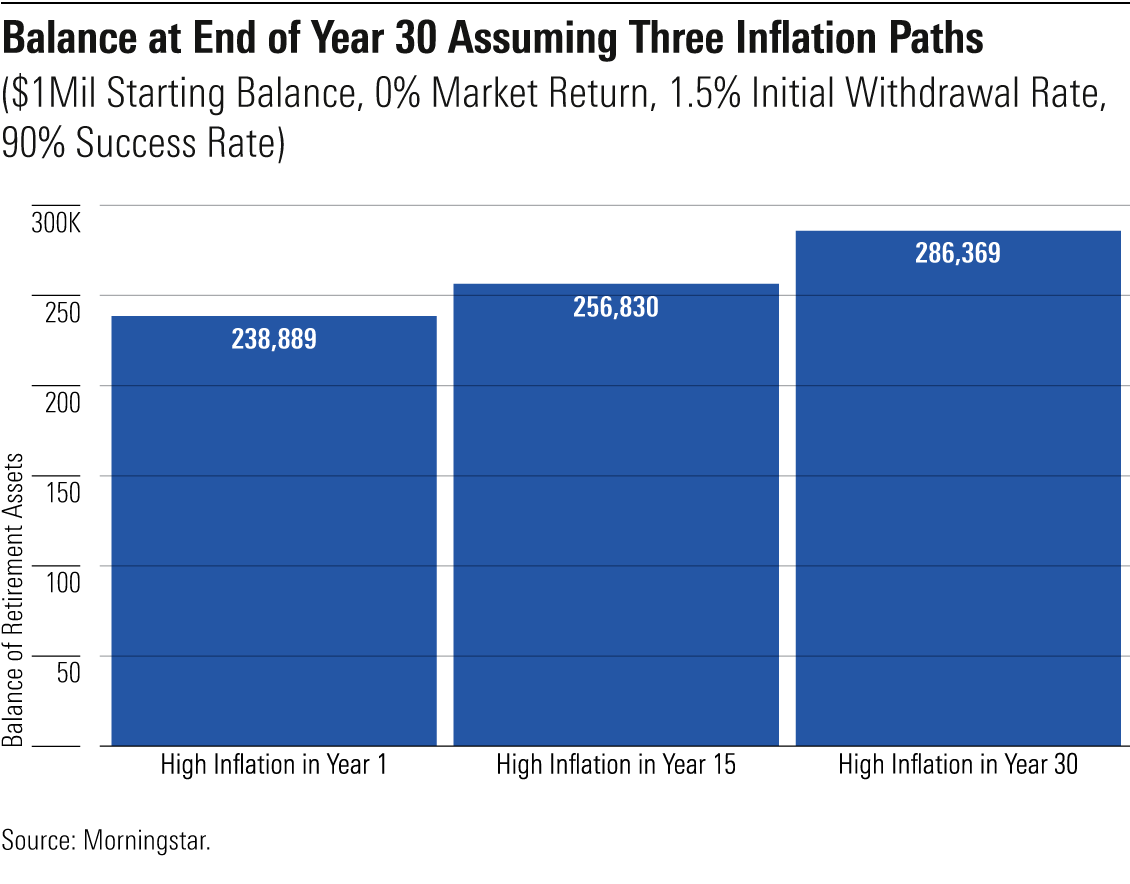

Nevertheless, retirees are facing an additional risk—high inflation. One underappreciated danger of high inflation is that it can also pose sequence risk in much the same way that market losses can. This stems from how inflation that arrives early in retirement elevates future spending, whereas inflation further along in retirement has a more muted impact.

To illustrate, we simulated three inflationary scenarios:

1) 10% inflation in year one followed by 3% annual inflation until the end of retirement

2) 3% annual inflation in years one through 14, 10% inflation in year 15, followed by a return to 3% annual inflation through year 30

3) 3% annual inflation in years one through 29 followed by 10% inflation in year 30

For simplicity, we assumed the retiree earned no market return and withdrew 1.5% of an initial $1 million retirement balance, adjusting withdrawals for inflation thereafter over a 30-year horizon.

The retiree who experienced higher inflation early in retirement finished with a 7% lower balance than the retiree who encountered it midway through retirement and almost 17% less than the retiree who didn’t encounter high inflation until the final year of retirement. Note that these differences occurred even though the average annual rate of inflation was the same across the three scenarios, at 3.2%.

How Recent Market Conditions Have Changed the Odds of Success

Such issues beg the question: How have the odds of retirement success changed for recent retirees confronted by stock and bond losses and high inflation? Specifically, what is the likelihood that someone who retired late in 2021 or early in 2022 would exhaust her savings by the end of a 30-year horizon?

To answer that question, we ran a modified version of this year’s “The State of Retirement Income” study in which we assumed the retiree was entering year two of retirement and thus had a 29-year time horizon. That retiree initially withdrew $33,300 (that is, 3.3% of a $1 million fund) and invested in a 50% stock/50% bond portfolio that lost 18.7% in the year ended Sept. 30, 2022. Taken together, the initial withdrawal and market depreciation reduced her retirement savings balance to $785,927.

Looking ahead, we assume the retiree will increase her spending by 7.7% to $35,864 in year two, with the increase approximating actual inflation. We also assume she’ll earn about 7.1% per year on her investments over the remaining 29 years and that inflation will moderate to an average annual rate of 2.8% over that span. (2)

Under these assumptions, the retiree shows a 78% chance of having money left by the end of retirement. This is lower than the 90% odds of success this retiree enjoyed when she embarked on retirement, reflecting the toll that market losses and inflation took in year one. But it’s considerably better than the 50% success rate we measured earlier (see Exhibit 1), the improvement owing to the higher forecast for future stock and bond returns.

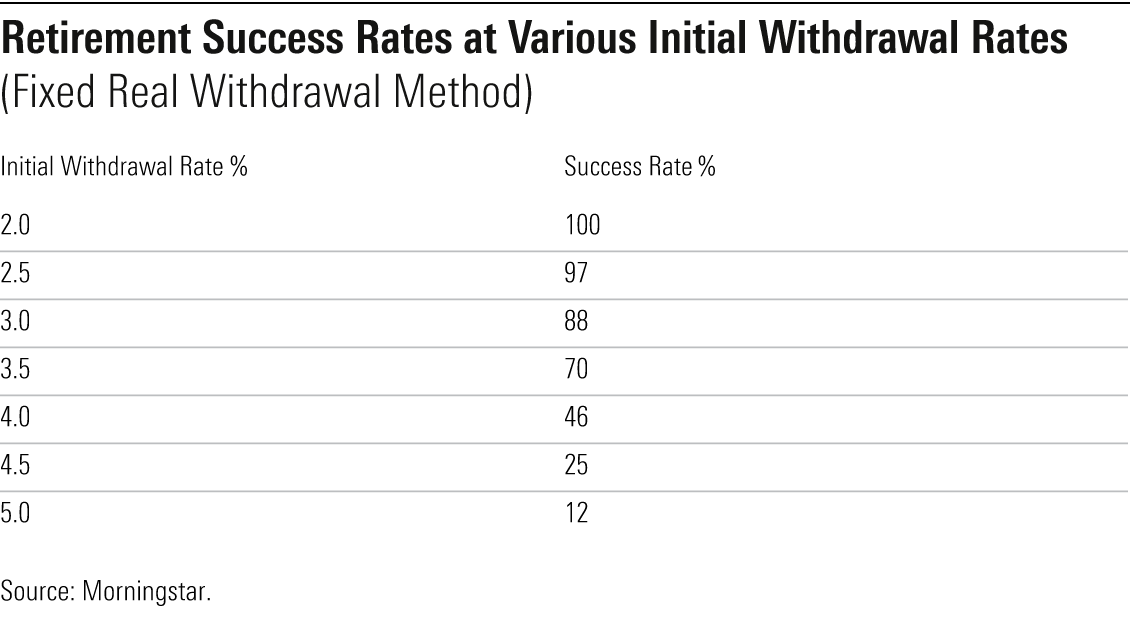

How would the retiree’s odds have differed if she took more of less than the 3.3% initial withdrawal assumed? The following exhibit lists the success rates at various assumed starting withdrawal rates between 2% and 5% after incorporating the assumptions listed above.

Those who retired late in 2021 or early in 2022 and who limited their starting withdrawal to no more than 3% of retirement assets continue to enjoy excellent odds of success. But those who withdrew 4% or more are facing a sobering outlook. Indeed, new retirees who took a 4% initial withdrawal last year are likelier than not to outlive their savings based on our analysis, assuming they continue to spend 4% of savings per year in inflation-adjusted terms through year 30.

How to Mitigate Sequence-of-Returns Risk

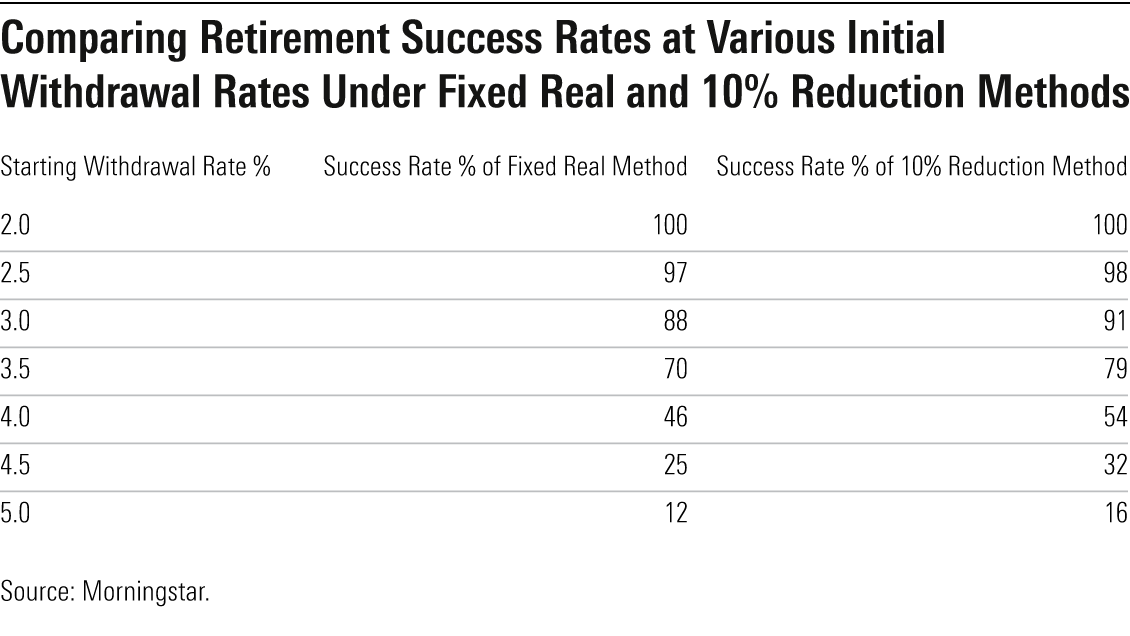

How could a retiree grappling with sequence-of-returns risk improve the odds of not outliving their savings? One option is to temporarily reduce spending in the year following a portfolio loss.

To illustrate, let’s return to the scenario above, where the retiree initially withdrew 3.3% of retirement assets. But this time, let’s assume the retiree reduces spending by 10% to $29,970 from $33,300. Under that scenario, she has an 84% chance of still having money left by the end of retirement. That’s lower than the 90% odds of success at the start of retirement, but it’s better than the 78% success rate if she continued to withdraw 3.3% of inflation-adjusted retirement assets per year.

The following exhibit compares the success rates of this 10% reduction approach with those of the fixed real withdrawal approach at various initial withdrawal rates.

Although temporarily reducing spending in this manner demands sacrifice, it can help mitigate sequence-of-returns risk, with recent retirees retaining good odds of maintaining their inflation-adjusted spending through year 30 of retirement provided their initial withdrawals were less than 4% of assets.

Endnotes

1) To provide withdrawal-rate guidance that considers current yields, valuations, and inflation, we turned to our colleagues in Morningstar Investment Management. Like many firms, the MIM team develops forward-looking asset-class return assumptions as well as assumptions about the expected volatility of each asset class and future inflation levels. The figures cited here are the forecasts that we incorporated into last year’s “The State of Retirement Income” study.

2) These are the MIM forecasts incorporated into this year’s “The State of Retirement Income” study.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WNDFS2S4FNA6LEJDB2Y6E4XHYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)