A New Crisis: What’s Happened in Crypto Now?

Turmoil at the FTX exchange, founded by former multibillionaire Samuel Bankman-Fried, has sparked another run on bitcoin.

Cryptocurrency—and specifically bitcoin—is having another meltdown. What’s going on? This Q&A may help to make sense of the chaos.

What’s the Story?

The latest turmoil has been triggered by the near-collapse of the exchange FTX, founded by industry figurehead and billionaire tech investor Samuel Bankman-Fried. FTX suffered billions of withdrawals, sparking rumors of its imminent demise. Binance, the world’s largest exchange, looked set to rescue FTX but has swiftly confirmed it wouldn’t after looking at FTX’s books. This has had ripples across the crypto space, sending bitcoin’s price to new multiyear lows.

Is This Just a Fallout Between Crypto Bros?

Binance chief executive Changpeng Zhao didn’t just rule out buying FTX, he actively criticized how FTX had used customer funds. This is a common theme in this year’s crypto collapses, and it is likely to keep cropping up as more problems emerge.

Will There Be a Regulatory Backlash?

Inevitably, the U.S. Securities and Exchange Commission—which regulates noncrypto markets—will be looking into the case. It has its hands full with existing cases, though.

Is There Any Precedent for FTX’s Implosion?

Sadly for retail investors, yes. Celsius Network is still going through the bankruptcy process, which means customers still don’t know the fate of their money (cash and coins). This case highlighted the problems of keeping customer money separate from company money. We wrote about Celsius initially in June, and also about the wider concept of “custody” in the crypto world.

What Does It Mean for Bitcoin Prices?

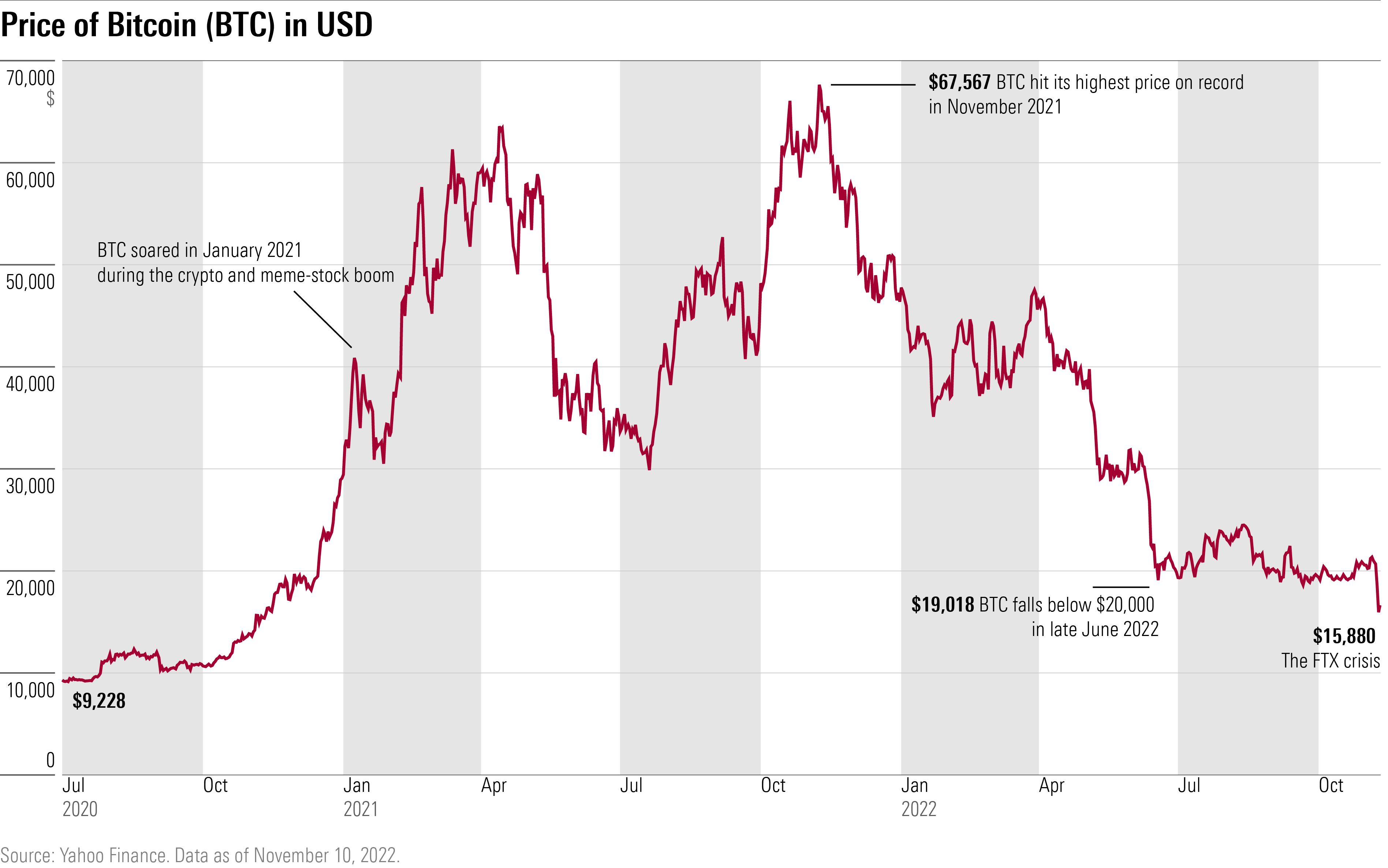

Bitcoin has now fallen 22% in the past five days to around $16,000. Bitcoin broke below $20,000 in June, a key technical level, but had managed to hold above that until this week. Bitcoin is down 65% year to date, meaning all the gains of the past two years are gone.

What Does It Mean for ‘Mainstream’ Crypto?

Shares in Coinbase COIN, the largest listed exchange, have cratered. They have fallen 22% in the past five days and are off 81% this year. A reminder: Coinbase’s IPO price was $250, and it was trading at $50 at the market open on Nov. 10.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)