6 Bond Funds for Navigating Inflation

Investors shouldn’t take inflation lying down.

Fixed-income investors who are feeling the brunt of falling bond prices and negative returns amid heightened inflation shouldn’t panic. Rather, they should understand the economic landscape and their options.

The Federal Reserve’s efforts to bring inflation down through raising short-term interest rates are central to that landscape. As the cost of money increases, businesses and consumers think twice about borrowing and spending; eventually, there is no longer too much money chasing too few goods and services, and inflation falls. The Fed’s determination to combat inflation shows in three 75-basis-point hikes in the federal-funds rate since June 2022, with most of the market now expecting a fourth 75-basis-point increase in November.

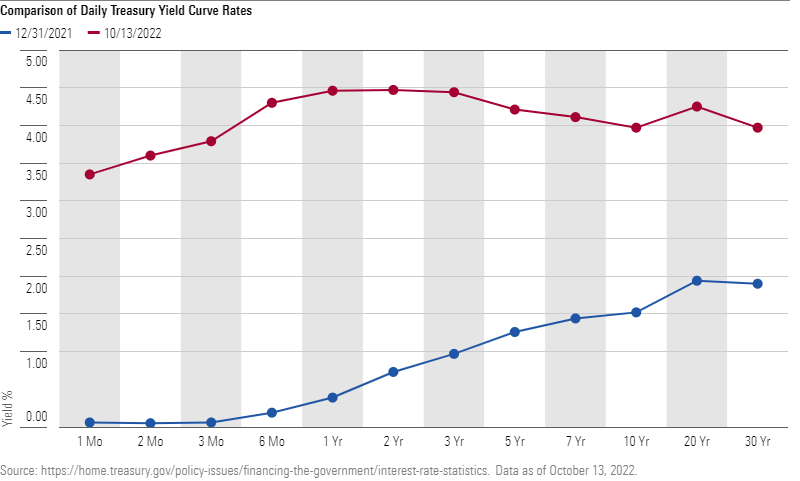

Although inflation could surge again, signs suggest the Fed’s efforts are working. Since the beginning of the year, interest rates in the one-month to three-year range of the Treasury yield curve (a plot of each security’s yield versus its maturity) have increased around 330 to 410 basis points each, and the 10-year Treasury is now yielding less than a one-year T-bill.

This inversion of the typically upward sloping yield curve could indicate a recession is coming, but that isn’t inevitable. It’s clear that the market expects inflation to fall and average about 2.3% over the next decade, which is around its historical norm. Although year-over-year inflation as measured by the Consumer Price Index has yet to return to that level, it has reversed its upward trend and came in at 8.2% in September, versus 9.1% in June.

Outpacing inflation in the near term may be difficult, but bond investors have good options for lessening its impact. Those who think the market may be too optimistic about inflation falling should consider a strategy focused on Treasury Inflation-Protected Securities, whose prices adjust based on actual CPI inflation levels. However, the negative price impact of higher yields can offset the positive impact of inflation adjustment. Vanguard Short-Term Inflation-Protected Securities Index VTAPX, which has a Morningstar Analyst Rating of Gold, is a low-cost pure play that limits interest-rate risk. Pimco Real Return PRTNX is a more flexible option.

Shorter-duration strategies, or those that invest in bonds with less sensitivity to interest-rate changes, can also limit the negative price impact of higher long-term yields resulting from higher-than-expected inflation. Duration measures the price sensitivity of bonds to changes in yields. Shorter-duration funds can offer better protection from rising long-term rates, but they also have lower yields than longer-dated strategies. Gold-rated Baird Short-Term Bond BSBIX keeps its duration between one and three years, while Bronze-rated Pimco Short-Term PSHAX manages the very front end of the yield curve, within one year.

Investments that offer a yield premium to U.S. Treasuries can also combat the negative effect of higher prices, and one could do well to invest in corporate-bond funds because of their relatively higher yields and income. Investment-grade corporate bonds offer slightly higher yields with less default risk, while non-investment-grade yields can be materially higher but come with a greater risk of default and higher volatility. Silver-rated Pimco Investment Grade Credit Bond PIGIX offers a higher-quality approach, while Bronze-rated T. Rowe Price High Yield PRHYX should generate higher yields but with added credit risk.

In the end, riding out this inflation storm can be as easy as doing nothing. Fixed-income funds are considered “self-healing” as mutual fund managers reinvest cash flows from regular interest payments and maturities from existing portfolio investments at higher prevailing yields. This natural dollar-cost averaging takes time but avoids drastic bond allocation moves, changes to an investor’s overall asset-allocation risk profile, and challenging timing decisions based on the market’s ebbs and flows.

A version of this article was published in the September 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/7cdc9192-d5bb-4fb8-8b0d-94fc40a4013b.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7cdc9192-d5bb-4fb8-8b0d-94fc40a4013b.jpg)