6 Bond Funds for Navigating Inflation

These inflation-fighting options can help fend off the negative impact of rising prices.

The fixed-income market’s negative return in 2022 and thus far in 2023 has shown how concerns about inflation can lead to rising yields and lower bond prices, but investors shouldn’t panic if inflationary pressures persist. Rather, they should understand the economic landscape and real return options that may fit within their diversified asset allocation.

Granted, the rate of higher inflation has ebbed in recent months, but rising prices could pick up the pace again, spurring the Federal Reserve to continue trying to tame them by hiking short-term interest rates. As the cost of money increases, businesses and consumers may think twice about borrowing and spending; eventually, there is no longer too much money chasing too few goods and services, and the rate of inflation falls. The Fed’s determination to combat inflation shows in 525 basis points of federal-funds rate hikes since March 2022, with most of the market now believing the Fed is done raising rates for the time being.

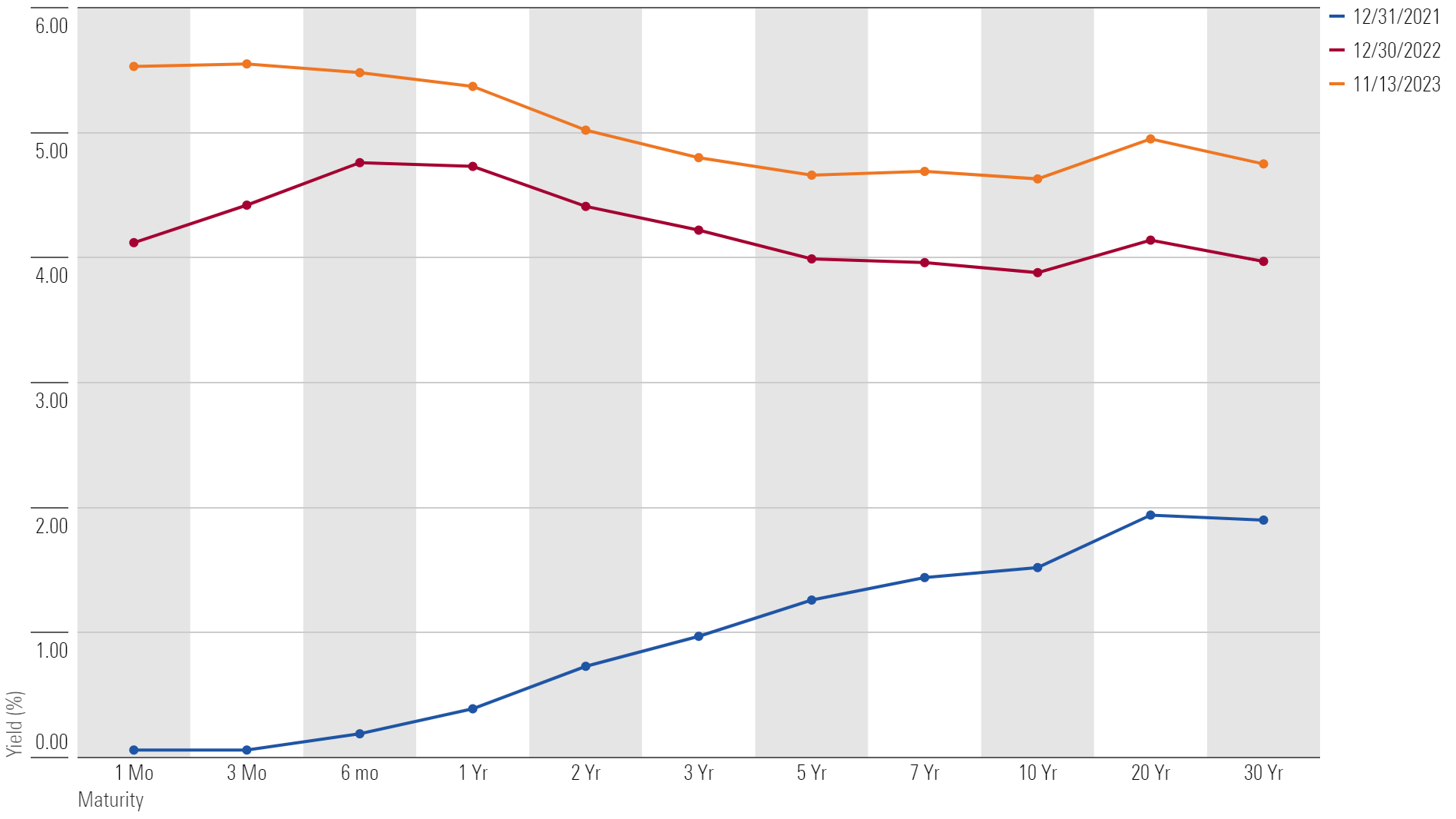

Signs now suggest the Fed’s efforts are working. Since the beginning of 2022, interest rates in the one-month to three-year range of the Treasury yield curve (a plot of each security’s yield versus its maturity) have increased around 550-380 basis points each, and the 10-year Treasury note is now yielding less than a one-year T-bill.

U.S. Treasury Yield Curves

This inversion of the typically upward-sloping yield curve in the accompanying chart could indicate an impending recession, but that isn’t inevitable. Indeed, the yield curve has become less inverted since year-end 2022 without a recession. The market now expects inflation to fall and average about 2.3% over the next decade, which is around its historical norm. This market-implied measure of future inflation is the breakeven inflation rate: the difference in yield between like-maturity nominal Treasuries and Treasury Inflation-Protected Securities. Although year-over-year inflation as measured by the Consumer Price Index has yet to return to that level, it has reversed its upward trend, and October 2023′s report came in at 3.2% (core inflation, which excludes more-volatile food and gas prices, was 4.0%) versus a year prior but still higher than the Fed’s 2.0% target.

Even if outpacing inflation in the near term proves challenging, bond investors have solid options for lessening its impact. Those who believe the market may be too optimistic about inflation falling should consider a strategy focused on U.S. TIPS, whose prices adjust based on actual CPI inflation levels. However, the negative price impact of higher yields can offset the positive impact of inflation adjustments. Vanguard Inflation-Protected Securities VAIPX, which has a Morningstar Medalist Rating of Silver as of November 2023, is a low-cost pure-play active offering that invests across the entire TIPS yield curve. Pimco Real Return PRRIX (rated Silver as of December 2022) is a more flexible option that ventures outside of TIPS to deliver on its mandate.

Shorter-duration strategies, or those that invest in bonds with less sensitivity to yield changes, can also limit the negative price impact of rising long-term yields resulting from higher-than-expected inflation. Duration measures the price sensitivity of bonds to changes in yields. Shorter-duration funds can offer better protection from rising long-term yields, but they also typically have lower yields than longer-dated strategies; however, with the current yield-curve inversion, shorter-term funds’ yields are competitive with intermediate-term options. Baird Short-Term Bond BSBIX (rated Gold as of February 2023) keeps its duration between 1 and 3 years and invests in a diversified portfolio of U.S. government, investment-grade corporate, and securitized debt. JPMorgan Ultra-Short Income ETF JPST, which is included in the ultrashort bond Morningstar Category and earns a rating of Silver as of September 2023, has delivered strong returns for investors seeking even lower interest-rate risk. This low-cost, diversified strategy generates competitive yields in an exchange-traded fund wrapper.

Investments that offer a yield premium to Treasuries can also combat the negative effect of higher prices, and one could do well to invest in corporate-bond funds because of their relatively higher yields and income. Investment-grade corporate bonds offer slightly higher yields with less default risk, while non-investment-grade yields can be materially higher but come with a greater risk of default and higher volatility. Pimco Investment Grade Credit Bond PIGIX (rated Silver as of October 2023) offers a higher-quality approach, while PGIM High Yield PHYZX (rated Gold as of July 2023) should generate higher yields but with added credit risk.

In the end, riding out inflation storms can be as easy as doing nothing. Fixed-income funds are considered “self-healing,” as mutual fund managers reinvest cash flows from regular interest payments and maturities from existing portfolio investments at higher prevailing yields. This natural dollar-cost averaging takes time but avoids drastic bond allocation moves, changes to an investor’s overall asset-allocation risk profile, and challenging timing decisions based on the market’s ebbs and flows.

Higher Bond Yields and Interest Rates Are Here to Stay

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/7cdc9192-d5bb-4fb8-8b0d-94fc40a4013b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7cdc9192-d5bb-4fb8-8b0d-94fc40a4013b.jpg)