Financials May Have Near-Term Pressure on Fee Revenue, but We Believe They Are Undervalued

Sector’s stocks are undervalued despite likely softening economy.

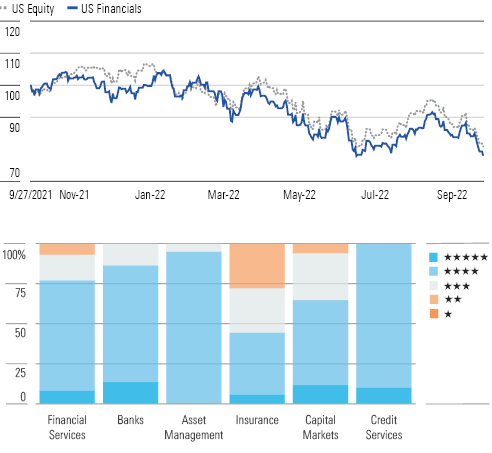

The Morningstar U.S. Financial Services Index trails the Morningstar U.S. Markets Index over the previous year by 280 basis points, but outperformed in the previous quarter, down 2.5% compared with the market that’s down 3.8%. The median North American financial sector stock trades at a 23% discount to its fair value estimate, compared with a 21% discount at the end of the second quarter of 2022 and a 2% premium at the end of the fourth quarter of 2021. We currently rate around 77% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks with about 7% rated overvalued 2- and 1-star stocks.

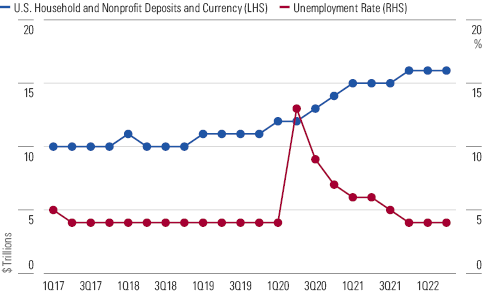

In September, the Federal Open Market Committee raised the federal funds rate by another 75 basis points to a range of 3% to 3.25%. The FOMC members also materially revised their economic projections compared with the June meeting with the median committee member now believing the federal funds rate will end 2022 at 4.25% to 4.5% compared with a range of 3.25% to 3.5% and that the unemployment rate in 2023 will rise to 4.4% compared with 3.9%. Despite the tightening monetary policy over the previous couple quarters, both inflation and the economy have been fairly resilient so far. The August inflation report was higher than expected with the consumer price index increasing 8.3% from a year ago and the index excluding volatile energy and food components increasing 6.3%. Consumer spending also hasn’t significantly decreased, as the unemployment rate has remained low, and households have a buffer of cash that they accumulated over the previous several years.

While higher interest rates are positive for many financial sector companies, the more rapid increase and higher expected level of medium-term interest rates have increased the probability that the United States will enter a recession. We had already expected that earnings for many financial companies would normalize lower over the next couple of years, as 2021 earnings were elevated from strong mortgage refinancing, investment banking, and trading revenue along with negative loan loss provisioning. While we project earnings will face some near-term pressure, we believe much of this is already priced into financial sector stocks and that many are undervalued on a long-term basis.

Top Picks

BlackRock has traded off harder than other asset managers this year, but there’s no fundamental reason for the company to be trailing its peers’ performance wise. The company is at its core a passive investor. Through its iShares exchange-traded fund platform and institutional index fund offerings, the wide-moat firm sources two thirds of its managed assets (and half its annual revenue) from passive products. In an environment where investors are seeking out passive products, as well as asset managers that have greater scale, established brands, solid long-term performance, and reasonable fees, BlackRock is well positioned.

BlackRock BLK 4-Stars

Price (USD) 578.60

Fair Value (USD) 850.00

Uncertainty Medium

Market Cap (USD B) 88.15

Economic Moat Wide

Capital Allocation Exemplary

Citigroup is the most undervalued traditional U.S. bank under our coverage and is trading below tangible book value. The bank is busy shedding non-performing segments, refocusing its operations on core competencies and geographies, and is dealing with consent orders from regulators. Further, Citigroup is not one of the most rate sensitive names, which we think contributes to its current lack of popularity. While the bank faces some headwinds, we think an eventual recovery in card balances will help to drive revenue growth for the bank. We also think the completion of business segment sales and an eventual resolution of consent orders should all serve as future catalysts.

Citigroup C 5-stars

Price (USD) 42.59

Fair Value (USD) 78.00

Uncertainty Medium

Market Cap (USD B) 83.26

Economic Moat None

Capital Allocation Standard

Goldman Sachs and other investment banks will likely face headwinds over the next year or two, as investment banking and trading revenue normalize lower from elevated 2020 and 2021 levels. That said, we believe much of this normalization is already factored into the stock’s price. The company is only modestly interest rate sensitive, so not much of its valuation is dependent on interest rates climbing and remaining high. In the medium term, the market may reward the company for initiatives that should improve the stability of its earnings, such as its push into consumer banking and changes in its investment management business.

The Goldman Sachs Group GS 5-Stars

Price (USD) 291.38

Fair Value (USD) 438.00

Uncertainty Medium

Market Cap (USD B) 100.57

Economic Moat Narrow

Capital Allocation Standard

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)