How a Top Fidelity Growth Fund Is Navigating This Market

Looking for 'growth quality' has helped cushion the blow in a big down year.

To navigate 2022's brutal down market for growth stocks without blowing up a portfolio has required investors—in the words of an old slogan for one of the all-time best growth stocks—to think different.

Prior to this year, investors had flocked to stocks seen as carrying the biggest potential for earnings growth, almost irrespective of the profitability or probability of hitting those lofty targets. That led to sky-high growth targets for many growth stocks, and in turn, left those names vulnerable to the kind of drubbing taken in 2022.

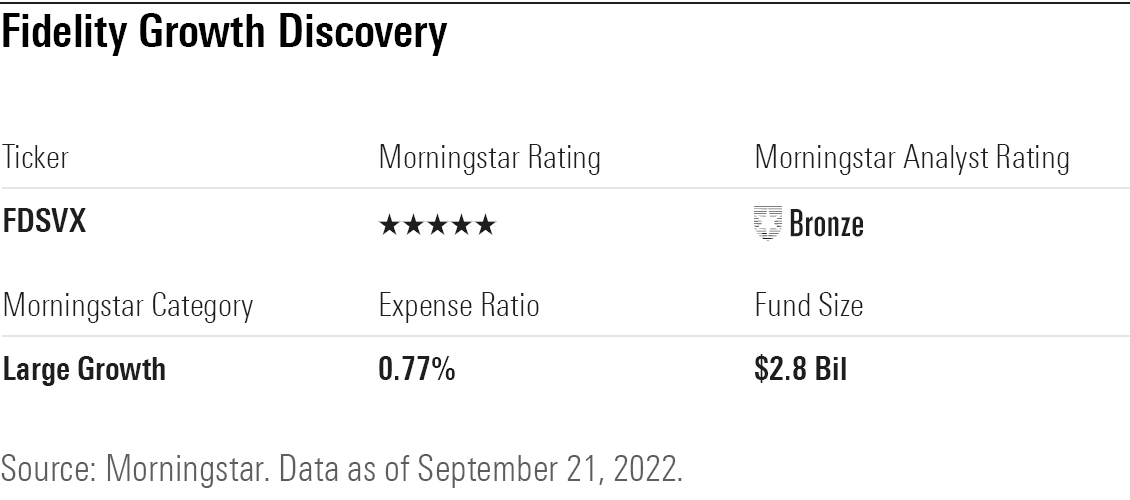

While Fidelity Growth Discovery FDSVX has taken big losses in 2022, the path followed by comanagers Jason Weiner and Asher Anolic offers a different take on how to pick growth stocks. In the process, Growth Discovery’s investors have fared better than those in most other growth funds, building on many years of outperformance for the fund.

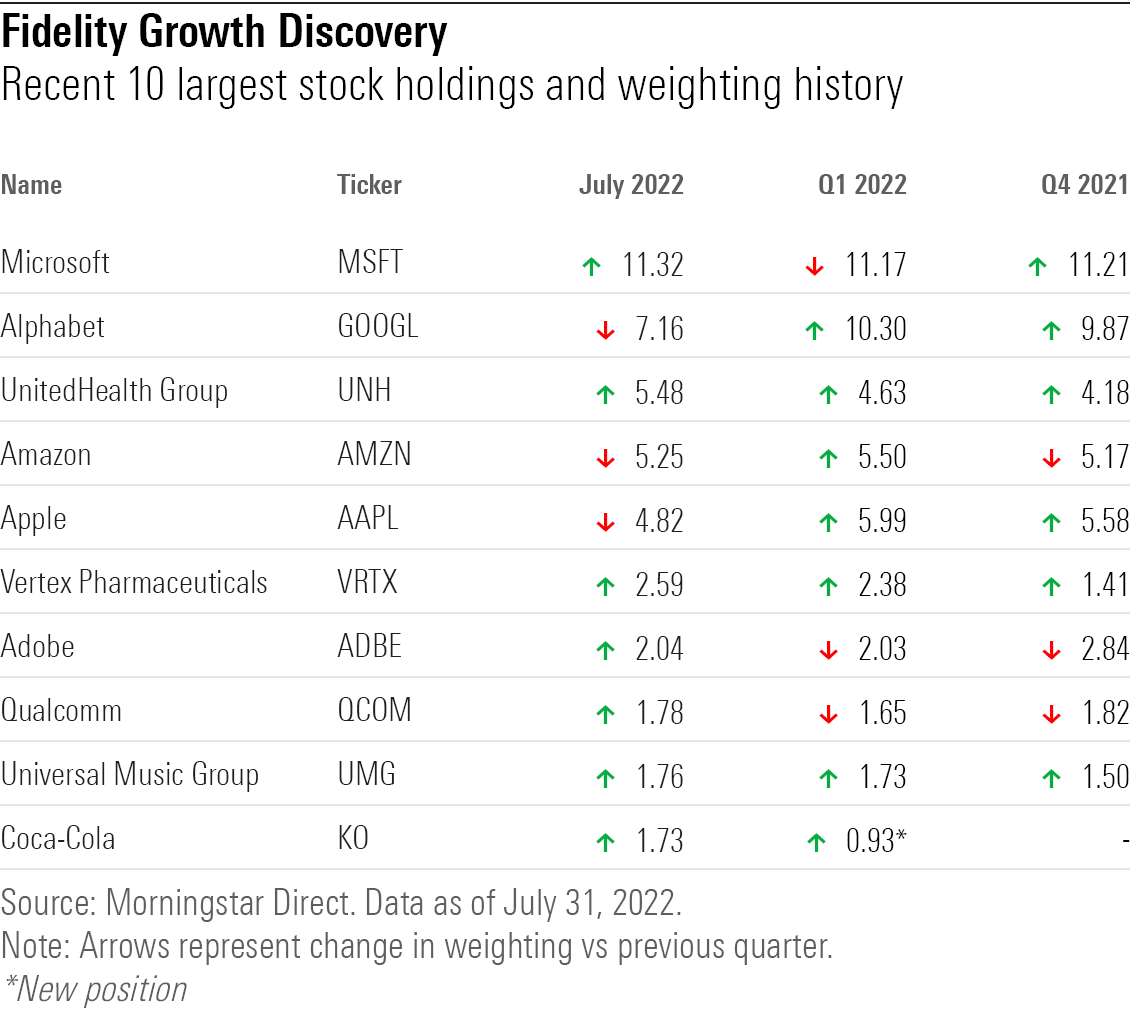

The top-10 holdings of the portfolio includes growth stock stalwarts, but also a number of names not usually found in growth portfolio. Among the top holdings:

- Microsoft MSFT

- Coca-Cola KO

- Vertex VRTX

- UnitedHealth Group UNH

- Universal Music Group UMG

“Understanding the fundamental drivers beyond just simple growth rates is super important,” says Weiner, who has been on the $2.8 billion fund since 2007.

“Say you own a stock and you think it’s going to grow 25% for the next five years, but it’s actually going to grow 15%. The CEO might pat him- or herself on the back saying ‘Hey, we grew 15%.’ But the stock would be down 80% because it was priced for 25% growth,” Weiner says.

“As we’re seeing now with some of these super-growers, as we like to call them, the wheels are falling off because the economy is slowing and their business models were reaching for goals that couldn’t be met,” he says. “That’s the key risk we’re trying to manage for.”

With the wheels falling off so many growth stocks in 2022, Fidelity Growth Discovery is deep in negative territory for the year, down 22% as of Sept. 20. However, that’s five percentage points better than the average large growth fund, and those returns land the Bronze-rated fund in the top quartile of the category.

In the last three years, Growth Discovery is up an average of 14.6% per year, six percentage points ahead of the average fund in its Morningstar category. For the last five years the fund has provided investors with an annual average return of 14%, roughly 3.4 percentage points ahead of the average large growth fund. For both time frames, the fund ranks in the top 10% of all large growth funds.

Looking for Growth Quality

Weiner and Anolic approach their mandate by looking for what they call “growth quality.”

“You have out there ‘quality growth,’ but when push comes to shove, we think growth is going to be more important to what we’re looking for,” says Anolic, who has been a comanager on the fund since 2017.

“I try not to get too caught up between the difference between growth and value,” Weiner says. “It's so hard not to think in terms of growth and value. But the real melding of growth and value gives you some of the best stocks in the world. If an analyst came into my office and said ‘I don't have any names for you because I cover value,’ I'd say do not think that, just give me the names of companies that grow their earnings a lot.’’

At a high level, the duo defines “growth quality” stocks as having two main growth characteristics: companies that can grow revenues meaningfully and can grow earnings faster than Wall Street analysts expect.

But along with those two growth requirements is the quality aspect of "growth quality."

“For us quality starts and pretty much finishes with the gross margin line, which we think is the best indication of a company’s competitive position,” says Anolic.

Why Gross Margins Matter

“Gross margin tells you the value that you are extracting from whatever good or service you sell. And then you have improving gross margins, which is a similar concept but, are you getting better at it?” says Anolic. “That right there is the definition of a competitive advantage.”

Weiner adds that gross margins are particularly important in an economy hit with high inflation. “In an inflationary environment, if you have 80% gross margin, and your costs go up 10%, you’re in better shape than if you have 25% gross margins,” he says. “It’s protection.”

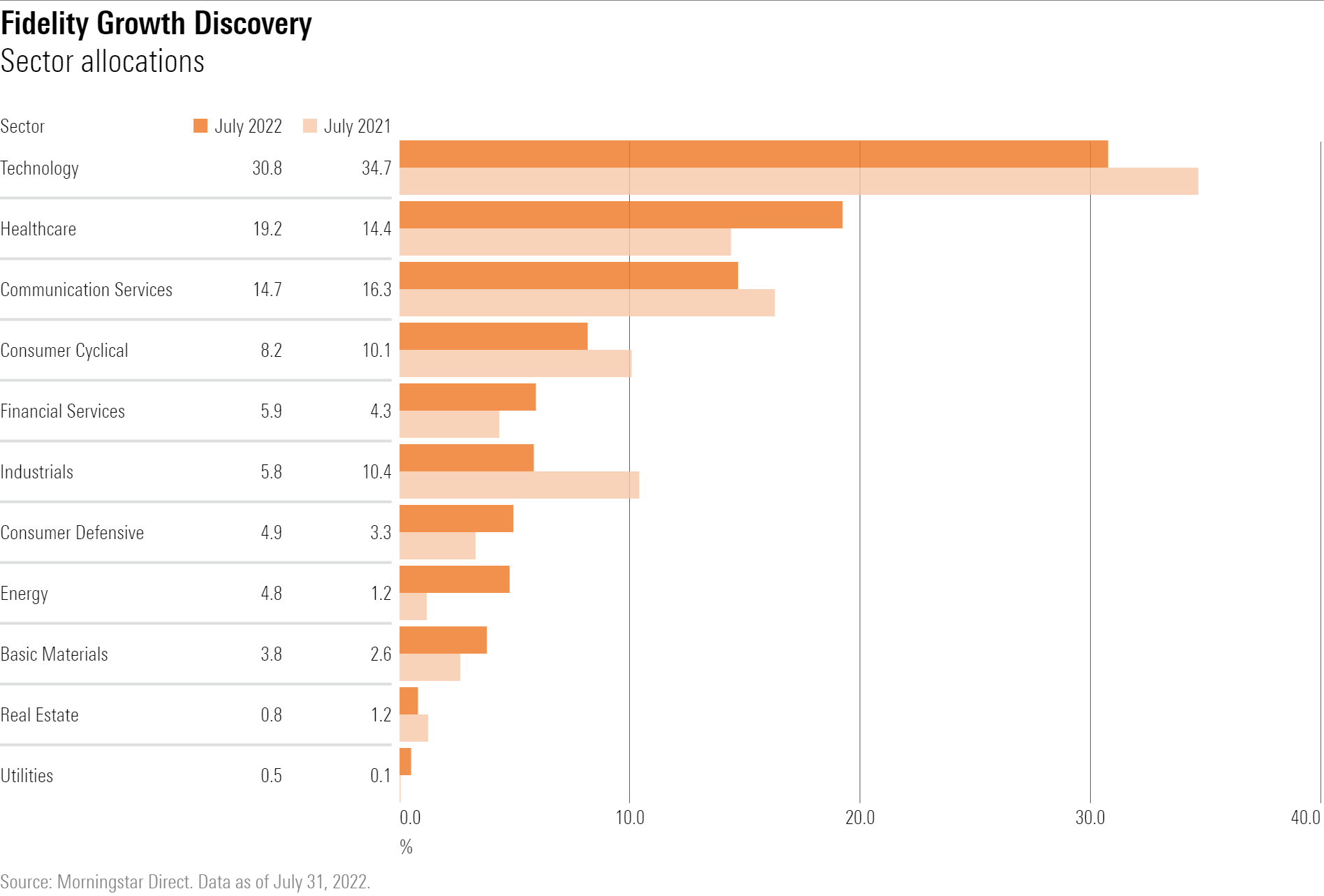

He points to software as a high-margin industry. “In the growth (stock) space that we live in, software is such an important space,” he says. “Everyone wants to get to Microsoft or Oracle ORCL profitability if they’re good.”

But even with gross margins, Weiner and Anolic, working with Fidelity’s teams of analysts, will stress test gross margin results by looking at a company’s ability to convert gross margins into strong operating margins and operating cash flows. All of which is also compared with their assessment of what the market has priced in for a stock, along with information gleaned with conversations with company management. “What’s happening with a company behind the scenes really matters,” says Weiner.

All this comes together in a portfolio that holds a relatively large number of stocks with 175 names, but 44% of the assets are in the top 10. “The top holdings are always going to drive most of the performance,” says Anolic. But the remainder of the portfolio offers “a stable of the next generation of growers for us to continue to do research on, and when the market comes our way, to be able to act aggressively on.”

Avoiding `Hope and Prayer' Stocks

This time last year, as Weiner and Anolic were watching growth stocks rallying to record highs, the duo was becoming increasingly worried about the froth in the market. That was especially the case for the “super growers.”

“We didn’t own a lot of them, and we certainly weren’t going to chase them,” says Anolic.

Throughout that period Microsoft was (and continues to be as of July 31) the fund’s top holding. “We were walking away from stocks where the company was telling a big story but it’s a hope and prayer,” says Weiner. “We could have put in that number one position a stock that was more of a hope and a dream, but we stuck with (a company) making money now.”

In the first quarter of this year, the team built a new position in a stock not usually found in growth stock funds: Coca-Cola.

Weiner says it’s just as much as surprise to him to own Coke in a growth fund as it would be to many observers. From his vantage point, Coke “was a snooze-fest my entire career.”

Generally Coke’s earnings growth trend is in the mid-to-high single digits per year. “It’s a very mature company,'' Weiner notes.

What has changed, they say, is the inflation backdrop and how that relates back to Coke’s business model. While many investors may not realize it, Coke generally doesn’t produce the bottles of soda found at the store, it makes and sells the concentrate to bottlers. That means Coke isn’t affected by rising costs for aluminum cans, plastics, or delivering the soda to stores.

However, the company has nevertheless been raising prices. Weiner expects earnings growth to shift to a higher growth rate. By normal growth-stock standards Coke may not be a barnburner, but it still will be positive at a time when many growth companies may face declining earnings, he says. (Fidelity doesn’t disclose its forecasts).

“Coke will look like a champ,” Weiner says. “They are having a once-in-a-lifetime inflationary boost to their pricing that will flow through to the” bottom line.

Another kind of stock not often found in growth funds: managed care and insurance. In this case, UnitedHealth Group, a position they began buying in late 2020 and into early 2021. While the company is primarily known as a managed care provider, Anolic notes UnitedHealth Group has also been expanding its position as a vertically integrated healthcare provider. This, for example, includes its aggressive acquisition of doctor groups.

“UnitedHealth Group is vertically integrated in the spaces that allow them to capture more of that value chain and grow above GDP,” Anolic says, in reference to Gross Domestic Product.

He points to the company’s strong position in so-called valued-based care, where providers across the entire healthcare process are paid based on patient outcomes and the quality of service. “There were a whole spate of valued-based care initial public offerings in the last few years…that were claiming to cut the cost of therapy, or take Medicare patients and make them more compliant” with government guidelines. “We spent so much time looking at these companies and they all sounded so great,” he says. ”But you don’t realize the best value-based care company in the country that is public is UnitedHealth Group. It’s not always disruptive technology companies.”

One area that is a bit more common among growth stock funds is pharmaceutical biotechnology names.

Among the fund’s top-ten holdings is Vertex Pharmaceuticals, whose biggest business line is cystic fibrosis treatment. When the duo began building a position this year, the stock was trading at a valuation that was below where Fidelity analysts had pegged the value for Vertex’s existing business franchise. “Anytime you can buy an innovative biotech company trading below what the (current) assets are means you are getting their pipeline (of future products) for free,” says Anolic. “To us that was just a really great opportunity.”

Rounding out the fund’s top-10 holdings as of the end of July was Universal Music Group. (The fund also has a large position in Warner Music Group WMG.)

“What's interesting about these businesses today is if you go back 20 years ago, they were selling CDs and records and then Spotify and Apple music just killed that business,” says Weiner. But now, he says, “that’s well behind us” and digital music is the profit driver.

“These companies are now fully digital, making money off of Spotify, Apple Music, etc.,” Weiner says.

“Anytime a video with a song appears on Facebook and YouTube music labels are getting paid. TikTok is paying them. In the future, in the Metaverse, companies are going to be paying them,” he says.

Video games are another significant future path for revenue growth, Weiner says, pointing to the Epic Games purchase of the Guitar Hero franchise. “Epic Games is the publisher of Fortnight and those guys know how to make big games. It’s just an example of what could happen.”

Plus, says Weiner, “it’s a business that has an amazing moat because once you own the rights to a song, you have it” for decades. “And these are all businesses that have something like 20% margins. Part of our thesis…is that the ceiling for margins is significantly higher for these great businesses and could get well above 30% over time. We feel music has interesting characteristics.”

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)