Why Are U.S. Equity-Fund Managers Performing Worse?

In theory, their odds should be improving.

The Investment Math

The challenges that confront actively managed mutual funds (and their younger cousins, actively managed exchange-traded funds) are well known. In the near run, active funds hold their own. Although they carry higher expenses than do index funds, that handicap has negligible effect over short periods because the movements of the financial markets overwhelm the cost differences. But over time, the markets cut both ways, while fund prices do not. Gradually, the active funds fall by the wayside.

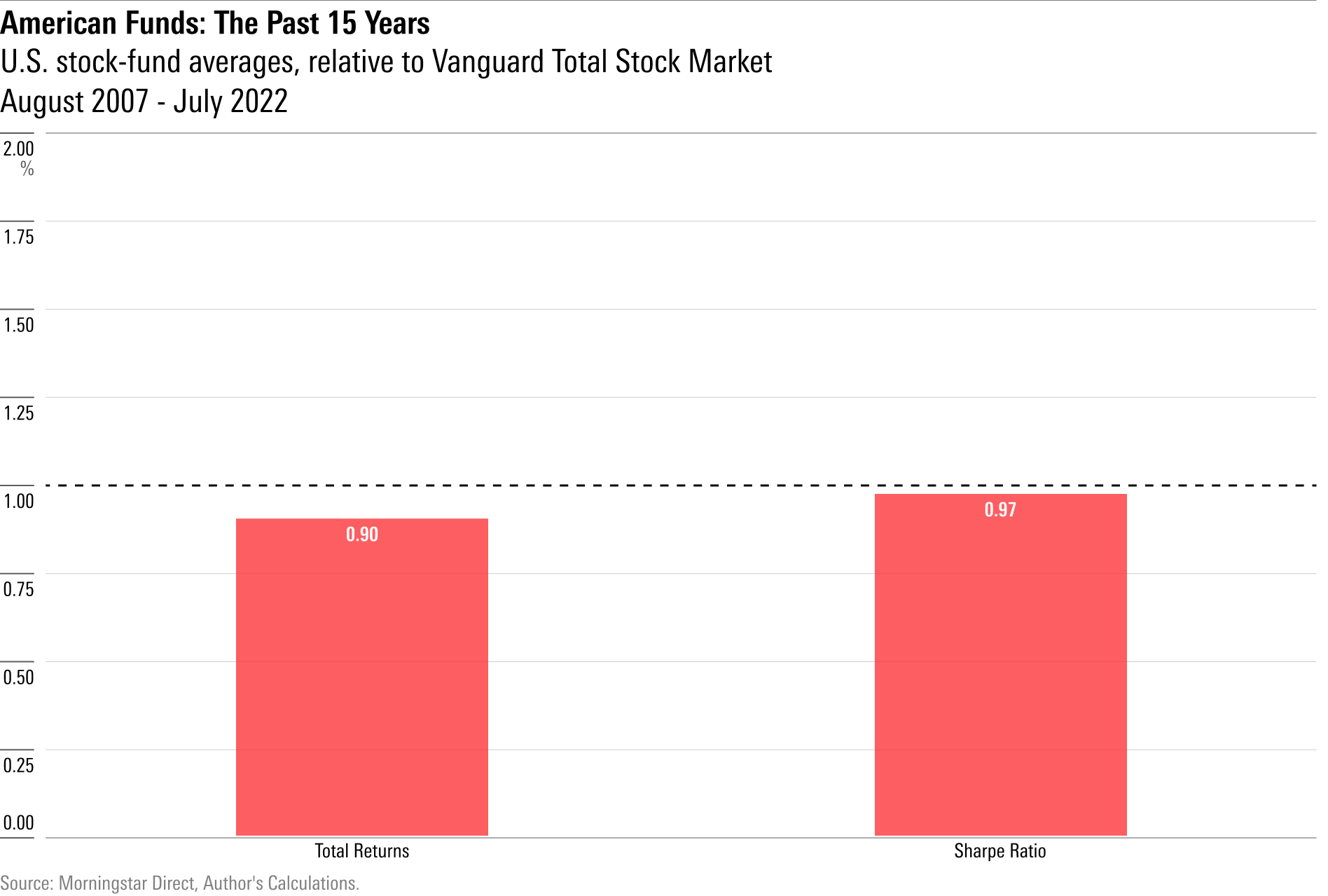

Consider, for example, the trailing 15-year results for the domestic-equity funds managed by the Los Angeles-based organization, American Funds. The following chart compares the average total returns and Sharpe ratios (a version of risk-adjusted return) for the company’s U.S. stock funds from August 2007 through July 2022 against those from Vanguard Total Stock Market Index Fund VTSMX. The active funds recorded meaningfully lower returns, although their Sharpe ratios were closer.

Happier Days

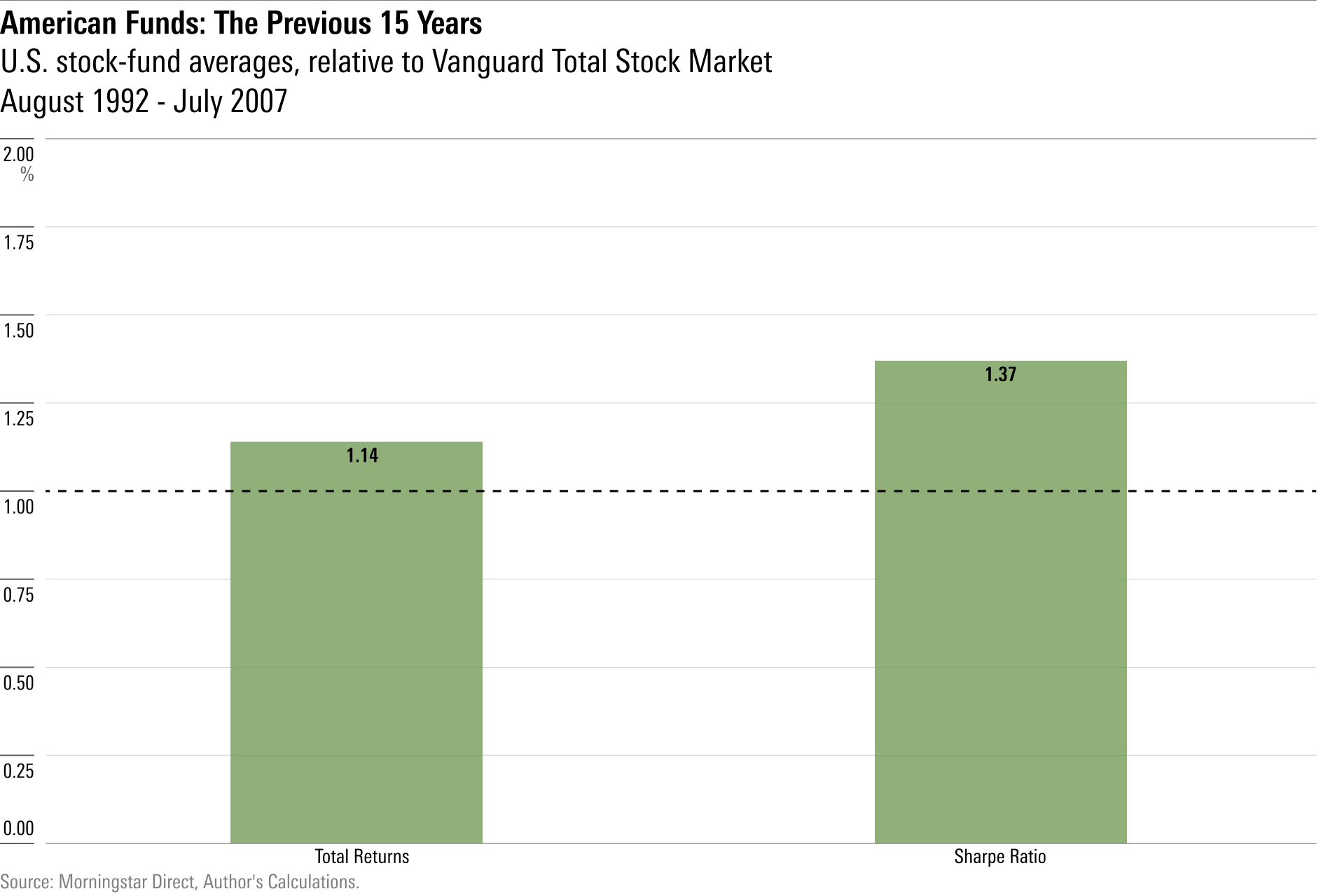

Things were not always this way. Reversing the customary pattern, by which investors flock to that which previously has succeeded, shareholders embraced index funds before they dominated the competition. That is, while few actively managed fund families have outdone the U.S. stock indexes over the past 15 years (aside from Vanguard’s happy exception), many did so during the prior time period. Among that group was American Funds. This is how its U.S. equity funds fared from August 1992 through July 2007, once more versus Total Stock Market.

Making that performance even more impressive was that American Funds has not tinkered with its lineup. In summer 1992, the company managed six diversified U.S. stock funds, and today it still runs those same six funds. None have been merged, liquidated, or added. Thus, the above results are uncluttered by either creation or survivorship bias. They are what the company’s shareholders received.

Many actively run funds thrived during that era. An unpublished paper—it will eventually reach the public but currently is in draft form—by Morningstar’s James Xiong and Thomas Idzorek and Yale’s Roger Ibbotson—relates a similar story. For the 15 years ended in 2005, the trio found U.S. equity funds with small asset bases averaged positive alphas, even after expenses. This was not because those funds held small-company stocks (although many did), as the authors adjusted for the funds’ style exposures. It was instead because the equity markets offered professional managers genuine investment chances, which they seized.

What Changed?

Then, as with American Funds, those triumphs disappeared. From January 2006 through September 2021, report Xiong, Idzorek, and Ibbotson, small U.S. stock funds no longer thrived. Not only were such funds no longer able to outpace the indexes after expenses, but they were also unable to do so even before paying their costs.

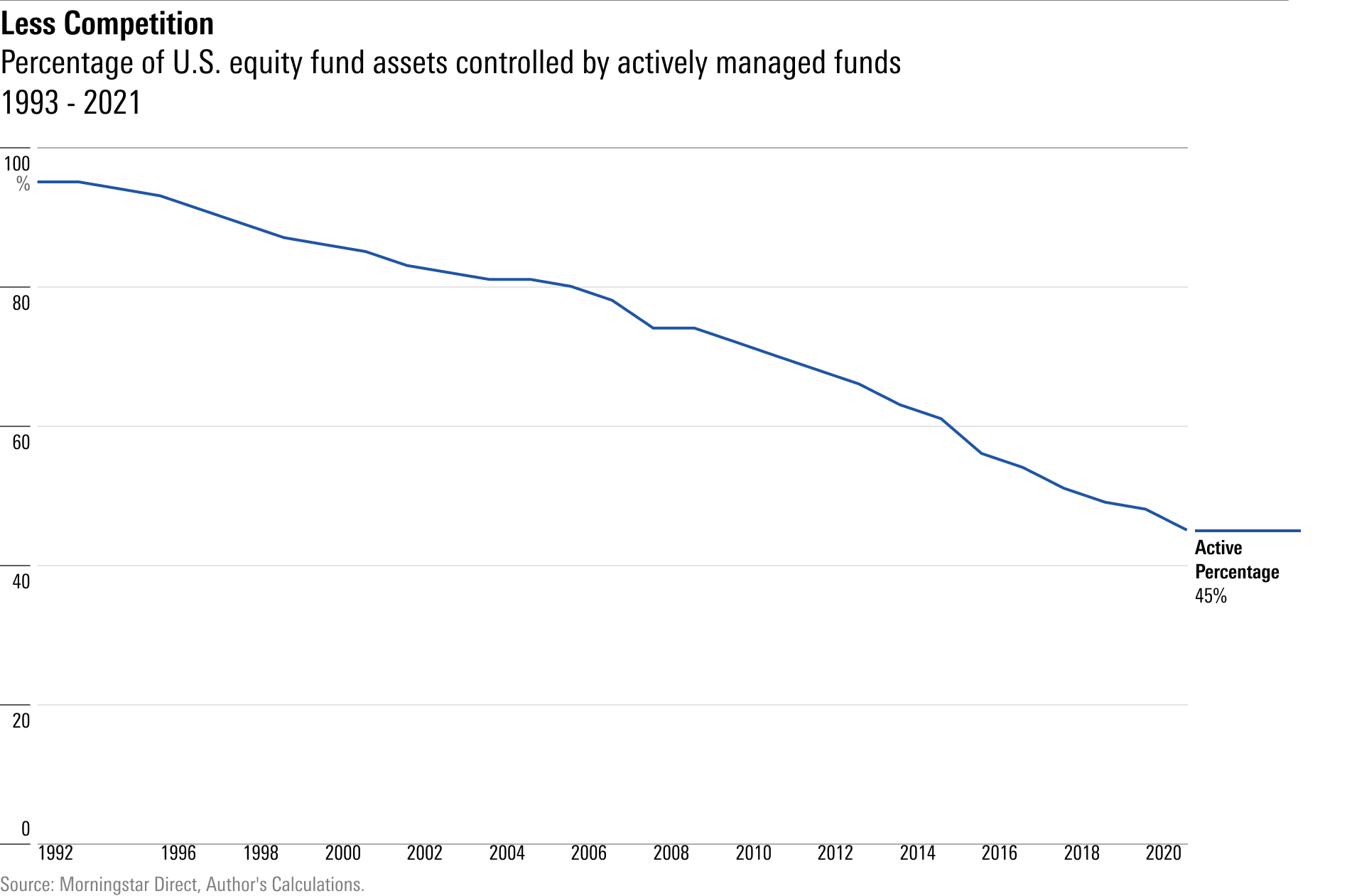

It is difficult to understand why active managers’ fortunes have so declined. Supporters of active management assert that, as indexing gains popularity, the prospects for active managers brighten. That claim seems reasonable. After all, each dollar possessed by an index fund is a dollar that is not used to establish market valuations. Instead, the index-fund manager simply accepts the prices that others have set. Presumably, having fewer investment debates leads to more investment opportunities.

Or so one would think. And yet, as is widely known, the recent struggles of active fund managers have been accompanied by a dramatic gain in indexing’s market share. The following chart provides the specifics. It shows the percentage of U.S. equity-fund assets (mutual funds and exchange-traded funds) held by actively managed funds over the past 30 years. That figure has plummeted to 45% from 98%.

Some argue that these figures should not surprise, because indexing’s sales prowess has caused its investment success. By this account, the monies that have poured into index funds have boosted the prices of the index’s stocks. Perhaps. However, that interpretation neither explains why the factor-adjusted alphas of smaller funds have declined nor why the funds from American Funds have slumped, given that they mostly own stocks that are members of the S&P 500.

In a related effect, the trading volume of U.S. equities has subsided. After surging before and after the 2008 financial crisis, according to the World Bank’s data, annual turnover of the United States stock market has subsided to the level of the mid-1990s. In practical terms, that rate is lower yet, because half of today’s volume comes from high-frequency traders. As with index funds, high-frequency traders accept the prices that others set. They tinker on the margins, but they do not question the fundamental valuations that have been assigned to U.S. stocks.

An Investment Puzzle

In the past, I have argued that, although indexing has pushed aside many active investors, the benefit for the remaining practitioners is less than advertised because the investment business has become so thoroughly credentialed. Not only do professional portfolio managers continue to supplant individual investors (or did until three years ago, when individuals made something of a comeback during the Robinhood era), but the percentage of portfolio managers who are Chartered Financial Analysts also continues to balloon. The skill level grows ever higher.

While this is correct as far as it goes, it does not go far enough. In truth, I cannot fully explain why U.S. stock funds with small asset bases have failed to repeat their previous successes. Nor do I understand why the domestic-equity funds offered by American Funds have not been able to match the performance of Total Stock Market, at least on a risk-adjusted basis. The question posed by this article’s headline is therefore partially rhetorical. The reasons why active U.S. equity managers have fallen further behind the indexes have not been fully discovered.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)