Investors Are Shunning Vanguard’s Best Funds

The company’s actively managed funds are shedding assets.

Basic Math

William Sharpe’s arithmetic of active management is admirably direct: “After costs, the return on the actively managed dollar will be less than the average passively managed dollar,” wrote the good professor in 1991. “These assertions will hold for any time period. Moreover, they depend only on the laws of addition, subtraction, multiplication, and division. Nothing else is required.”

Within the investment industry, those four sentences have become famous, partially because they were written by a Nobel Laureate, and partially because they are so succinctly phrased. They also have held true. Although, strictly speaking, Sharpe’s analysis applies to the entire marketplace as opposed to the subset that consists of publicly traded funds, his dictum has predicted future fund performances. Low-cost indexers have indeed triumphed.

Theory Into Practice

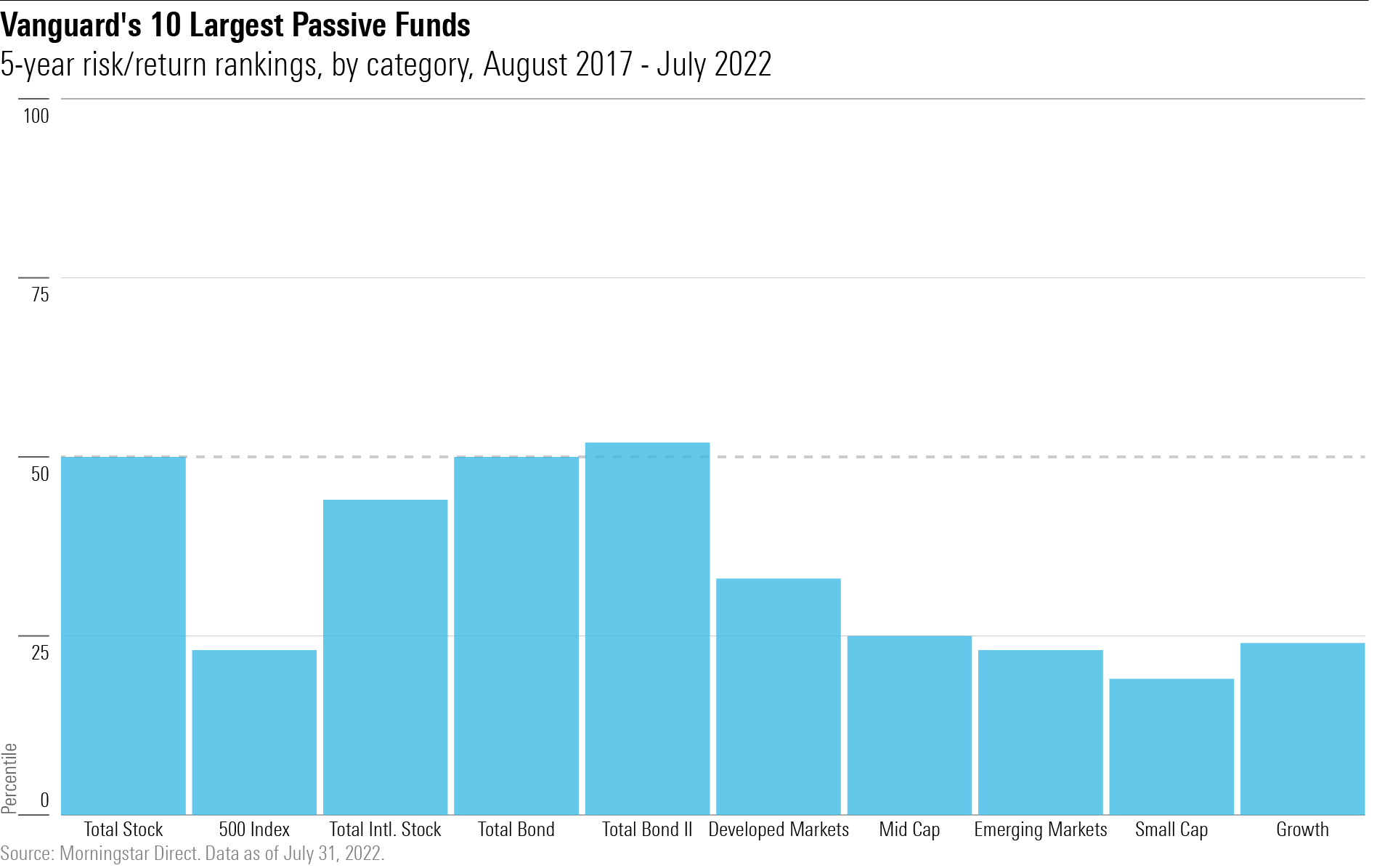

Consider, for example, the results for Vanguard’s 10 largest index funds, as measured by their August 2017 assets. Holding half the company’s retail monies, these investments represented the company’s future. (For this analysis, I have omitted funds that sell solely to institutions.) The funds have not disappointed.

The chart shows each fund’s risk-adjusted ranking over the subsequent five years versus others in the same Morningstar Category. By definition, a bar that does not reach the dotted line (representing the 50th percentile) signifies an above-average outcome. Seven of the 10 bars surpass that mark, two match it, and just one—Vanguard Total Bond Market II, by the barest of margins—lags the norm.

It was as Professor Sharpe forecasted, and as Vanguard investors hoped. None of the funds were outstanding over the five-year period. Only Vanguard Small Cap Index placed in its category’s top quintile. However, most of the 10 funds were good, and all were at least competent. Their shareholders therefore suffered no regrets. Better yet, because cost benefits accrue gradually, the longer investors hold those funds, the stronger their relative results should be. Time is on indexing’s side.

Not that Vanguard shareholders need me to tell them that. By summer 2017, the company was already the world’s largest mutual fund organization, and it has substantially increased its lead since. As evidenced by Professor Sharpe’s comments, the word on low-cost indexing has long been out.

Quietly Excellent

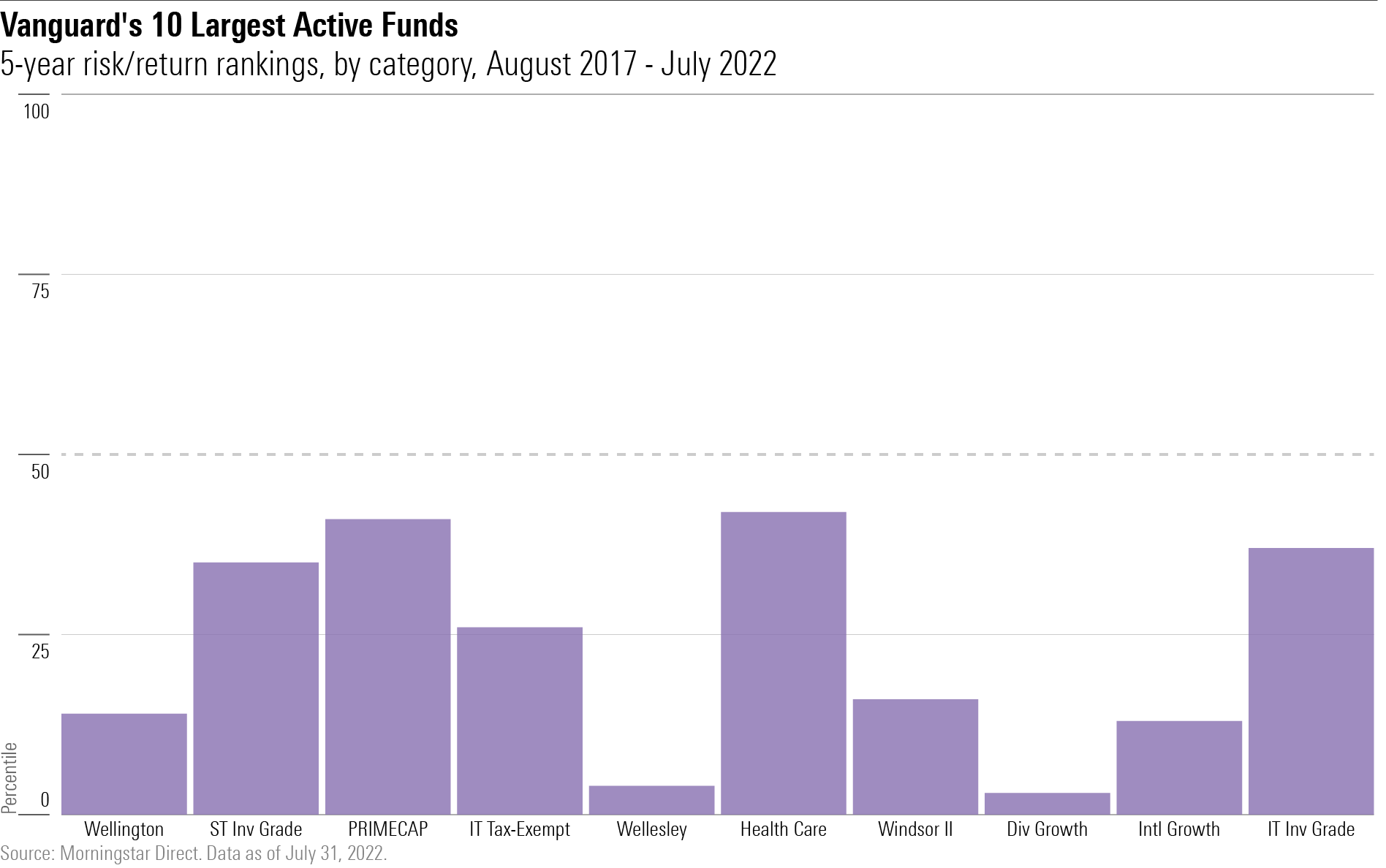

Less discussed, if at all, have been the accomplishments of Vanguard’s actively managed funds: They have been nothing short of astonishing. In support of that statement, I offer a second version of the chart above. This study is calculated in the same fashion as the first, except that it depicts risk-adjusted rankings for Vanguard’s 10 largest active funds (again, as of August 2017).

A pretty picture! Not only does every bar land well below the 50th-percentile line, but five of the 10 active funds posted top-quintile rankings. Two, Vanguard Wellesley Income and Vanguard Dividend Growth, were among their category’s leaders. (Note: Although I employed risk-adjusted results for this column, using total returns alone would not have changed the conclusion. Over the past five years, Vanguard’s biggest active funds have bested its largest index funds. Full stop.)

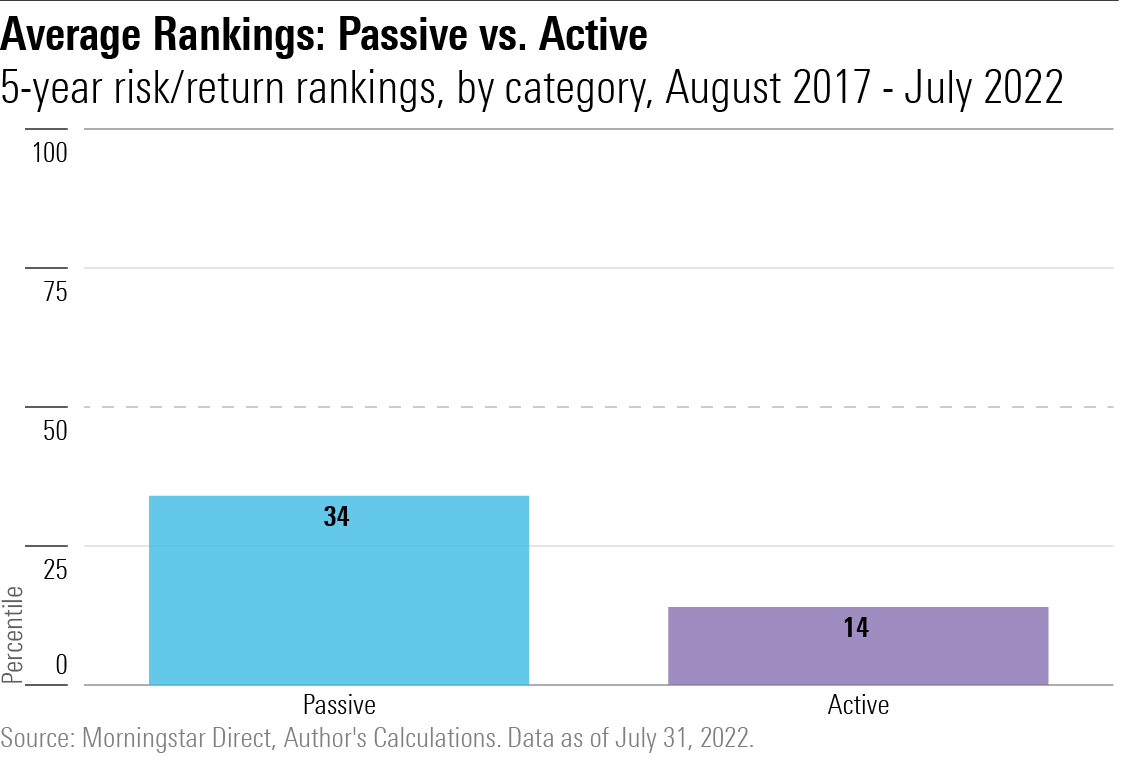

As comparing the two illustrations requires toggling, I have summarized each group’s totals by calculating its average five-year risk-adjusted ranking.

Yet, Vanguard’s index funds have performed well—but not as well as their actively managed siblings. I suspected before starting this article that the company’s actively run funds had shone. (The advantage for veteran researchers lies not in being able to outthink younger heads, but instead in walking down fewer blind alleys.) However, I did not anticipate this degree of success. Use whatever rule you wish to select 10 funds. Rarely, if ever, will the future returns for that group, risk-adjusted or otherwise, land in the 14th percentile.

Without Reward

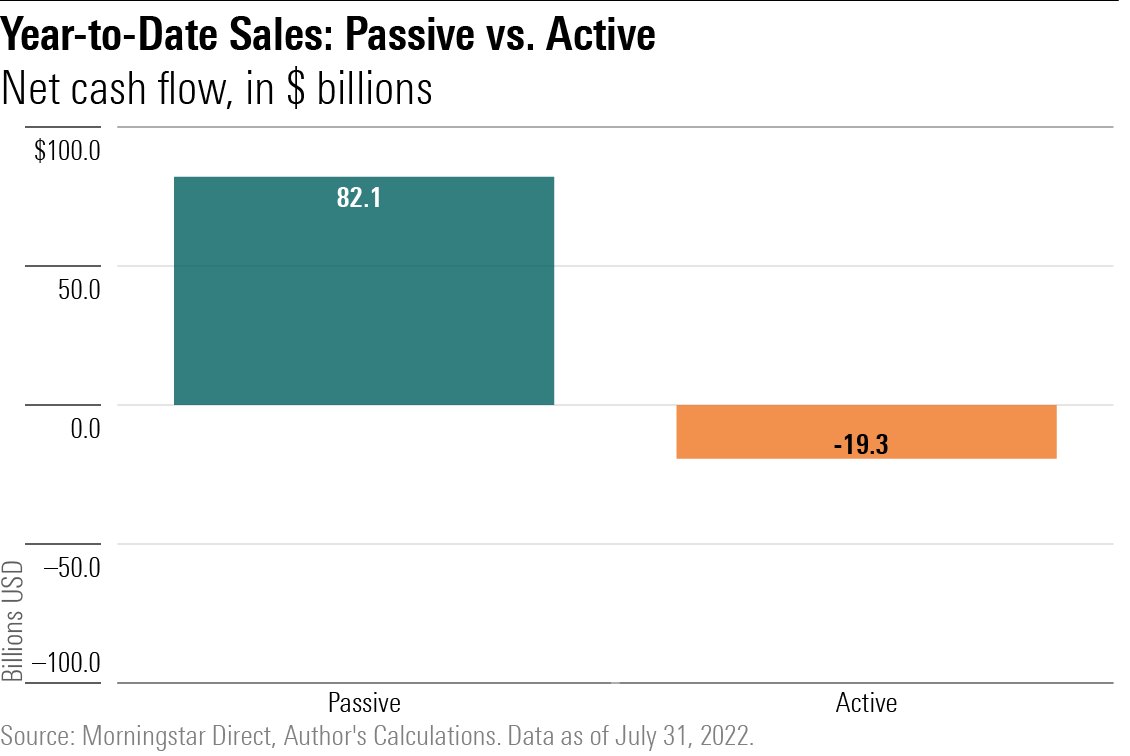

Investors seem not to have noticed. Although Vanguard’s index funds have defied this year’s fund-industry sales slump—for the first time in this millennium, net new cash flows into U.S. mutual funds and/or exchange-traded funds threaten to be negative—the company’s actively managed funds have not. Through July, those 10 actively run funds had suffered $19 billion in net redemptions. In contrast, their index-fund counterparts have enjoyed $82 billion in net new sales.

From one perspective, that outcome makes perfect sense. Decade after decade, index funds deliver on their promises. Meanwhile, active funds come and go. One year’s hero is the next year’s villain. Indexing has appeal not because it excels at identifying past winners, but rather because it avoids that task. Knowing what has succeeded is fine and good, but profiting from that knowledge is another matter.

A Happy Exception

In this instance, though, investors’ skepticism is unwarranted. First, Vanguard manages its leading active funds cautiously and steadfastly. They are well diversified, rather than idiosyncratic; their portfolios turn over slowly; and their salient features remain constant. As a result, their relative performances are unusually steady. Second, Vanguard’s active funds also carry modest expense ratios, albeit somewhat higher than the company’s index funds. Consequently, they also possess an ongoing cost advantage.

This combination of careful management and low expense makes Vanguard’s largest active funds unusually reliable. In August 2017, each of these 10 funds, save for Vanguard Intermediate-Term Investment-Grade, boasted 10-year total returns that ranked in the top half for their categories. Halfway through the next decade, all nine funds that managed the feat are repeating it, and the tenth has now joined them. Even index funds rarely achieve such consistency.

Vanguard’s index funds are justifiably popular. Given how infrequently they distribute capital gains, they are particularly well suited for taxable accounts. For investors holding tax-sheltered assets, though, the company’s major actively run funds deserve more attention. They are too good to be losing business.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)