Ultrashort Bond Funds Are Once Again Attractive

Rising yields have increased their return, but investors should pay heed to their potential pitfalls, too.

At their best, funds within the ultrashort bond Morningstar Category let investors in search of stability, or those with shorter-term goals, earn a better return than savings accounts or money markets for minimal additional risk. The return part of that equation had been lacking in recent years due to ultralow interest rates, but with 2022’s rise in rates these funds look attractive once again, provided investors know how to avoid the peer group’s riskiest options.

Here, we recount the resurgence of ultrashort bond funds, highlight their attributes and potential pitfalls, and end with two funds worth a closer look.

Ultrashort Bond Funds Are Back

The context for ultrashort bond funds’ comeback is the Federal Reserve’s determination to combat inflation through hiking the overnight lending rate charged to member banks multiple times this year. Those rate hikes have in turn led to significantly higher yields for investment horizons of one month to two years—the very range upon which ultrashort bond managers focus.

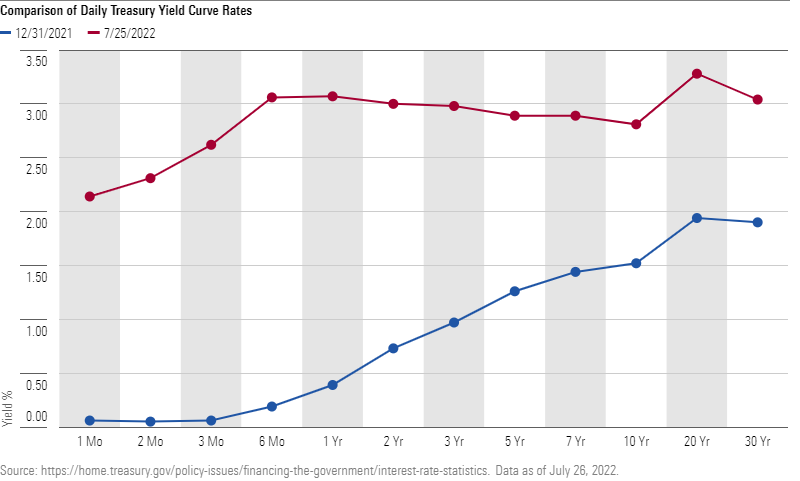

Indeed, between year-end 2021 and July 25, 2022, yields for U.S. government securities in the one-month to two-year range have risen on average 2.45% (or 245 basis points), about twice the average increase in the 10- to 30-year range. Moreover, with six-month and one-year Treasury bills now yielding more than maturities of two to 10 years, the yield curve (a linear plot of each security’s yield relative to its maturity at a given point in time) has become inverted.

The leap in near-term rates has begun to filter through to ultrashort bond funds. As of June 30, 2022, this category’s average 30-day SEC yield of 2.0% was up 131 basis points since the start of the year. And those yields will likely continue to rise as older bonds with lower coupons mature and are replaced with newer issues.

A Conservative Category

Better yields haven’t kept most ultrashort bond funds from modest losses year to date, but they’ve fared much better than their stock as well as intermediate and long-term bond counterparts. That’s by design. Ultrashort strategies invest predominantly in investment-grade issues (though some will invest modestly in high-yield debt), can allocate to a variety of sectors, and have less-than-one-year durations, a measure of interest-rate sensitivity. [1]

Given that profile, these funds are typically strong performers relative to other bond funds in periods of rising rates and rocky credit markets. That was also true when yields spiked in 2021’s first quarter, for example. The average ultrashort bond fund then posted a 0.2% gain, while most other bond offerings posted a loss.

Beware of Credit Risk

Still, some funds in this space can be more adventurous with respect to credit risk and therefore can be subject to unwanted surprises when markets turn. In March 2020’s coronavirus-related market turmoil, a small number of funds that had taken on additional credit risk, with higher allocations to junk-rated debt and/or securitized credit, posted much higher losses than the category norm. Going further back, some ultrashort funds posted tremendous losses during the global financial crisis in 2008 when the securitized markets seized up.

Investors looking to use an ultrashort fund as a low-risk investment should avoid the category’s highest yielding funds because the extra yield often comes at the price of lowering their credit quality profile. While the typical ultrashort bond fund had roughly 1% of its assets in below investment-grade issues in June 2022, roughly a dozen offerings had a stake north of 5%. Significant nonrated exposure can be another warning sign. While the lack of a credit rating on a bond isn’t necessarily a sign of elevated risk, these issues are generally seen as less liquid which can spell trouble during periods of market turmoil.

Beware of Interest-Rate Risk

Nor do all ultrashort offerings take on the same interest-rate risk. As of June 2022, the typical ultrashort bond fund had a duration of half a year, but the spectrum ranged from funds with a duration of close to zero to those with a duration north of one year. Taking on more interest-rate risk can be another way to boost a fund’s yield. Funds with higher interest-rate sensitivity fare worse during periods of rising rates, so it is important to be cognizant of this if you are seeking out an ultrashort fund for refuge.

Two Funds Worth a Close Look

Here are two ultrashort offerings that steer clear of the asset class’ major pitfalls, but nonetheless have slightly different risk profiles.

Fidelity Conservative Income Bond FCNVX, which has a Morningstar Analyst Rating of Silver, is the more conservative of the two. It positions itself as an enhanced cash offering with more flexibility than a money market fund, but not so much as to get into trouble. The strategy’s veteran management team has proven adept at striking this balance through a cautious approach. The team focuses exclusively on investment-grade bonds, limits BBB rated issues to 5% of assets, and avoids securitized credit. The portfolio’s conservative posture routinely shows, as in its June 2022 SEC yield and duration measures of 1.53% and 0.1 years, respectively, well below the corresponding category norms. While the strategy’s defensive tact leaves it trailing most of its ultrashort bond category peers for long periods when the market rewards risk taking, it has posted strong relative results in stress periods, such as 2020’s first quarter and 2022’s first half.

Gold-rated Pimco Short Asset Investment PAIDX adopts a risk profile closer to that of its typical ultrashort bond rival. As of June 2022, its SEC yield of 2.0% and duration of 0.4 years roughly matched the respective category norms. Lead manager Jerome Schneider and his well-resourced team focus on capital preservation by maintaining a high degree of liquidity, minimizing volatility, and avoiding below investment-grade debt. Corporate credit, securitized debt, and U.S. Treasuries typically comprise the bulk of the fund’s assets. While the strategy fared slightly worse than its typical peer in early 2020, its returns in rocky patches have for the most part been on par with the norm and its Sharpe ratio, a measure of risk-adjusted return, ranked in the category’s top third since its June 2012 inception through June 2022.

The right ultrashort offering ultimately depends on an individual’s needs and broader portfolio. However, the category’s most reliable options, like the two we discussed, combine a higher-quality credit profile, often signaled by moderate or lower yields relative to peers, with modest fees. Investors will rarely go wrong when they choose ultrashort options with these attributes.

[1] Each year of duration translates into an additional 1% loss (gain) for each 1% increase (decrease) in interest rates. If interest rates rise 1%, for example, a bond fund with a one-year duration would be expected to lose about 1% whereas a bond fund with a five-year duration would be expected to lose about 5%.

/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)