Bond Funds Turn to Quality as Yields Rise and Concerns Grow

A rare opportunity for managers to add income while minimizing risk.

The bond market has shifted dramatically since March 2020, going from rewarding risk-taking to punishing it as the Federal Reserve’s historic intervention to lower interest rates gave way to soaring inflation, tightening monetary policy, rising yields, a bear market, and mounting recessionary fears.

The shift isn’t all bad, though. Rising rates have made less-risky, high-quality bond yields more attractive. Fund managers have taken advantage of those yields. The peer median portfolio in the major U.S. taxable fixed-income Morningstar Categories show an uptick in quality and corresponding drop in credit risk, according to quarterly survey data collected from asset managers. The magnitude or pathway hasn’t been the same in every category, however. Here are the highlights and what it means for investors.

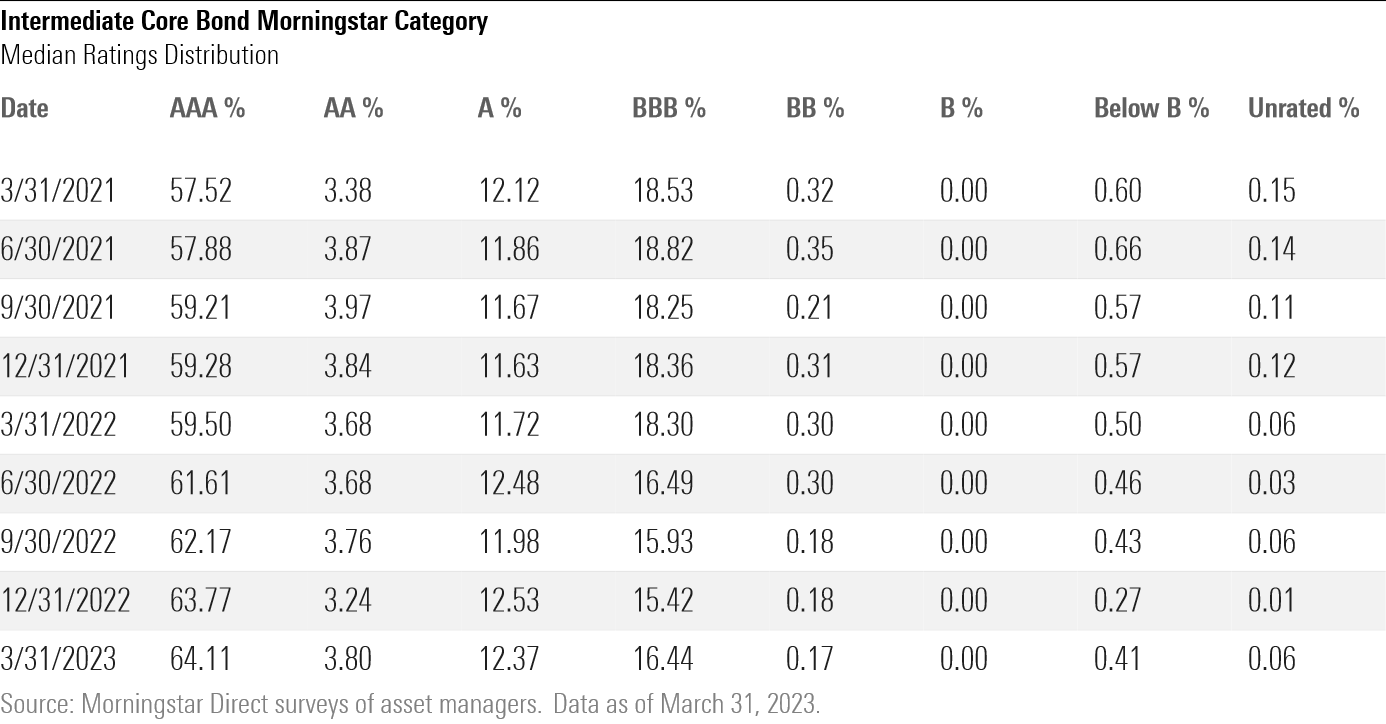

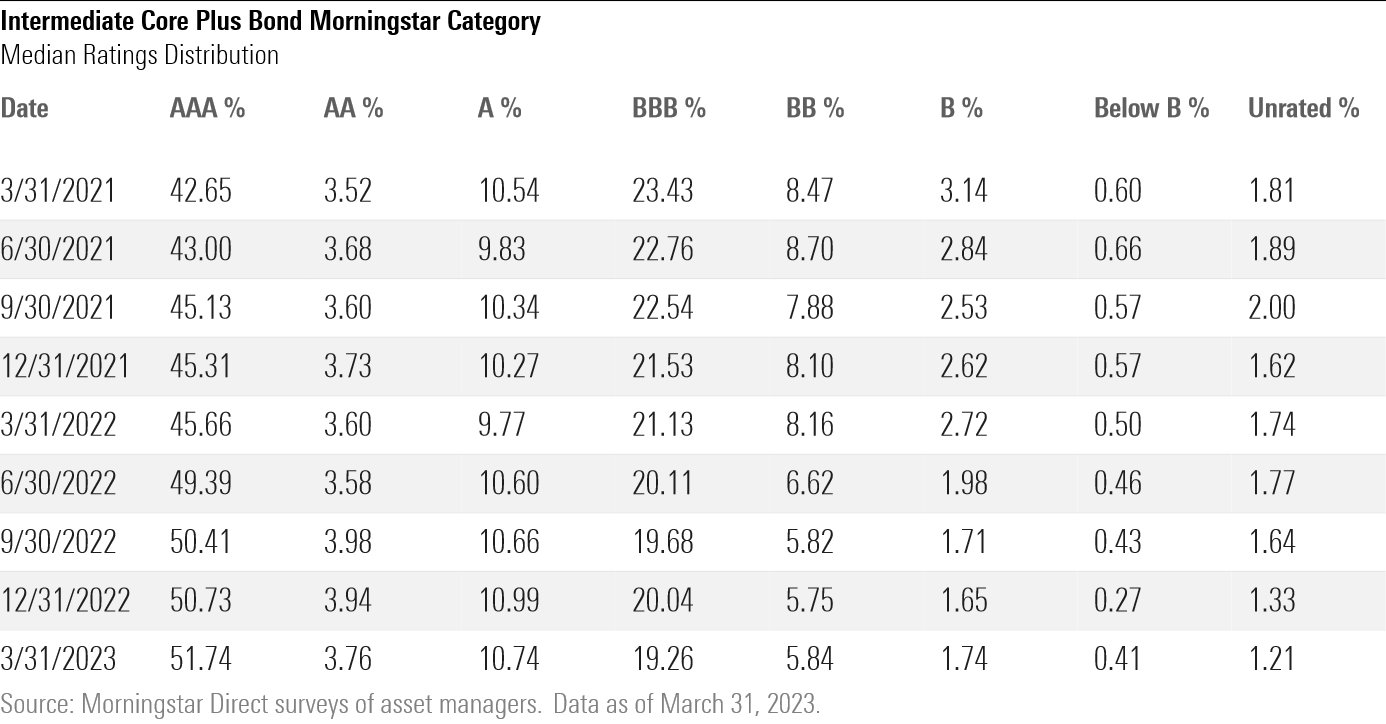

Core and Core-Plus Funds Add AAAs and Ease Up on Corporates

The typical intermediate core bond fund increased its stake in AAA rated debt—the rating agencies’ top rung—by roughly 5 percentage points over the past year through March 2023, much more than the 1-percentage-point increase in the Morningstar US Core Bond Index’s AAA weighting over that period. The market regards AAA bonds as having little to no credit risk, so they tend to be more resilient in stressed environments. Investors pay for that resiliency by bidding up their prices and dropping their yields below those of lower-rated issues. Still, relative to their history, AAA bonds now offer yields not seen since the 2008 global financial crisis.

Core-plus bond fund managers, who have more flexibility to buy junk-rated debt, started buying higher-quality bonds even earlier. This category’s median AAA bond allocation increased 9 percentage points over the trailing 24 months, around double the Morningstar US Core Plus Bond Index’s increase.

Managers of both core and core-plus bond funds also reduced their exposures to the lower-credit-quality tiers. Weightings declined in BBBs, the last rung of investment-grade debt, while the median core-plus bond fund’s stake in below-investment-grade bonds fell, too.

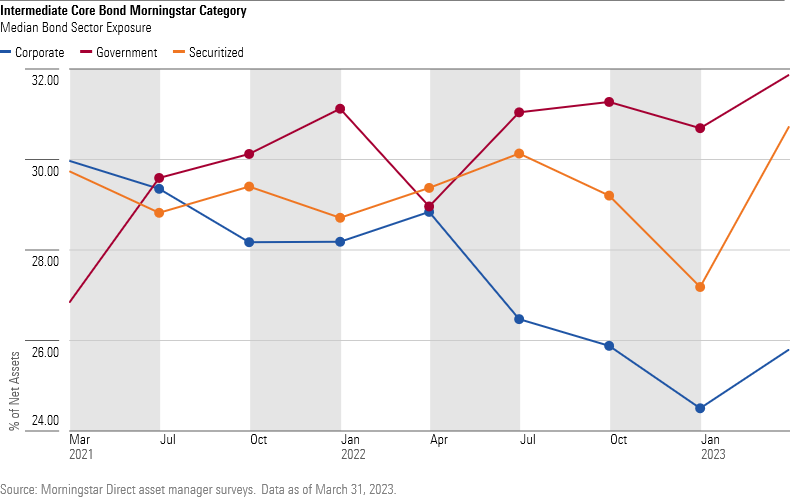

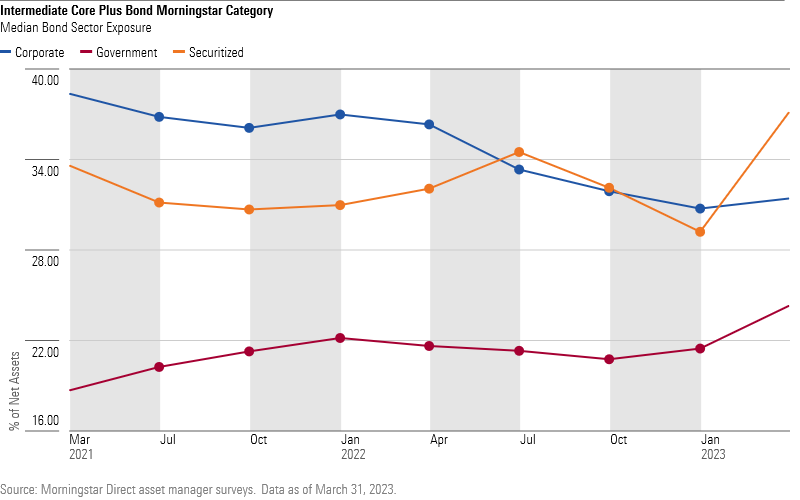

Bond managers have moved among sectors while upgrading quality. Core and core-plus bond-fund managers have moved into safe-haven Treasuries and securitized debt, the most common of which is U.S. agency-guaranteed mortgages. The typical core and core-plus funds also reduced their helpings of corporate credit over the past two years by more than benchmark. Managers choosing to hedge some of the risk of the cash bonds they still held in their portfolios with credit default swap index derivatives could account for some of the drop in corporate exposure.

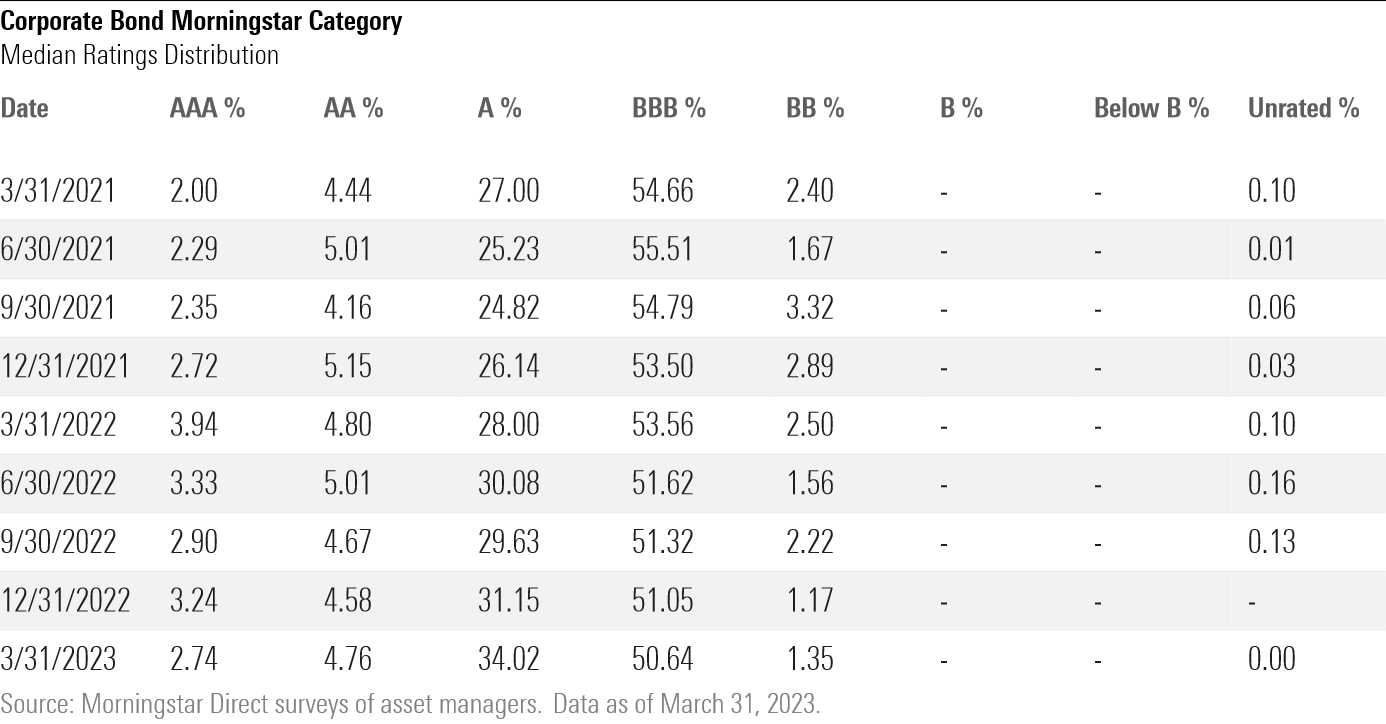

Corporate Funds Also Shift Up in Quality

AAA rated bonds make up only 2% of the Morningstar US Corporate Bond Index’s universe and AA only 10%, but that hasn’t stopped managers of corporate-bond funds from moving up in quality. Over the trailing year through March 2023, the typical corporate-bond category offering added about 6 percentage points of A rated debt, more than the index’s 1-percentage-point increase. Meanwhile, those same managers scaled back on BBBs, which can be vulnerable to downgrades to junk-bond status. They also trimmed their modest stake in BBs, the highest rung of below-investment-grade credit. The moves suggest the managers are not stretching for yield but looking to make their funds more resilient in a potential downturn.

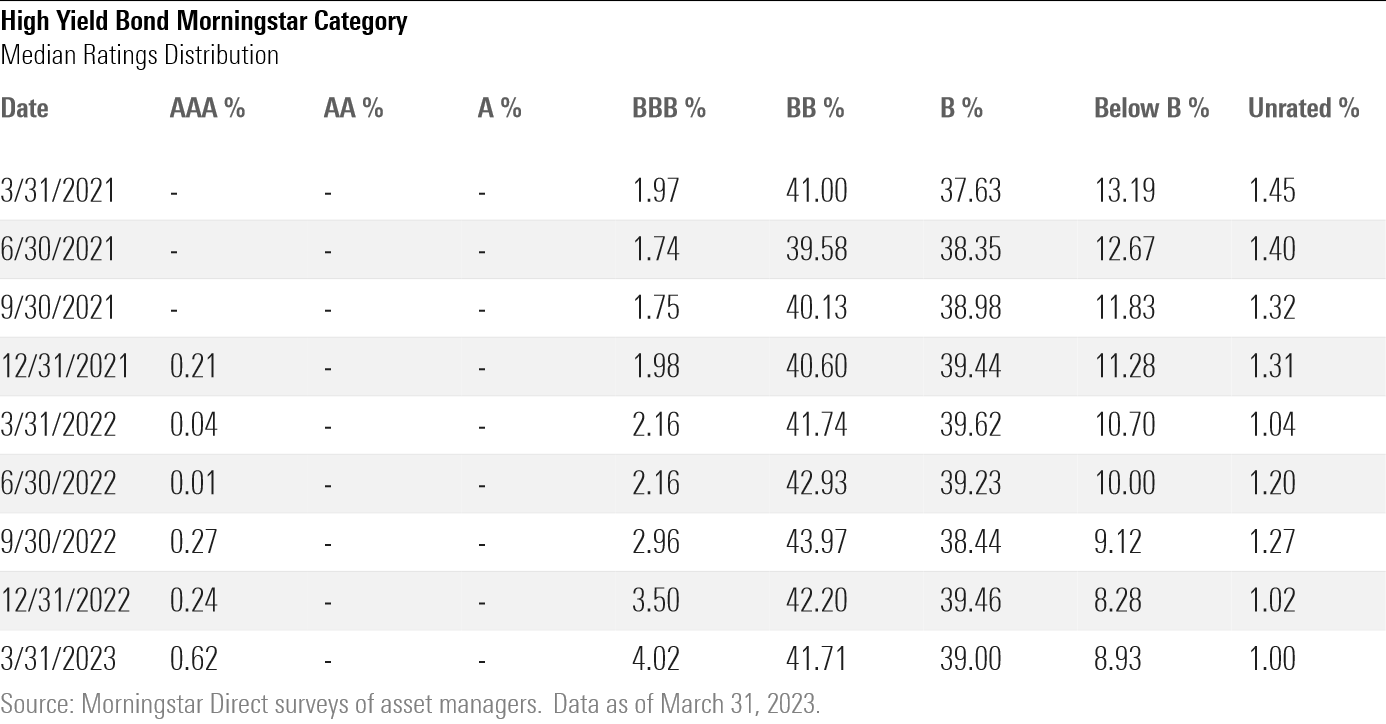

Liquidity concerns, or fears of being unable to quickly sell an investment without hurting its price, explains at least some of the quality increase in high-yield bond and bank-loan funds. Beginning two years ago, the typical high-yield bond fund added modestly to BB and B rated bonds, before buying more securities from outside its benchmark a year ago to help protect against credit stress. It then added roughly 2 percentage points of BBB exposure, and 1 percentage point to AAA bonds. That 5% investment-grade bond stake reduced the credit risk of the median high-yield bond fund and improved its liquidity because higher-quality bonds are easier to trade.

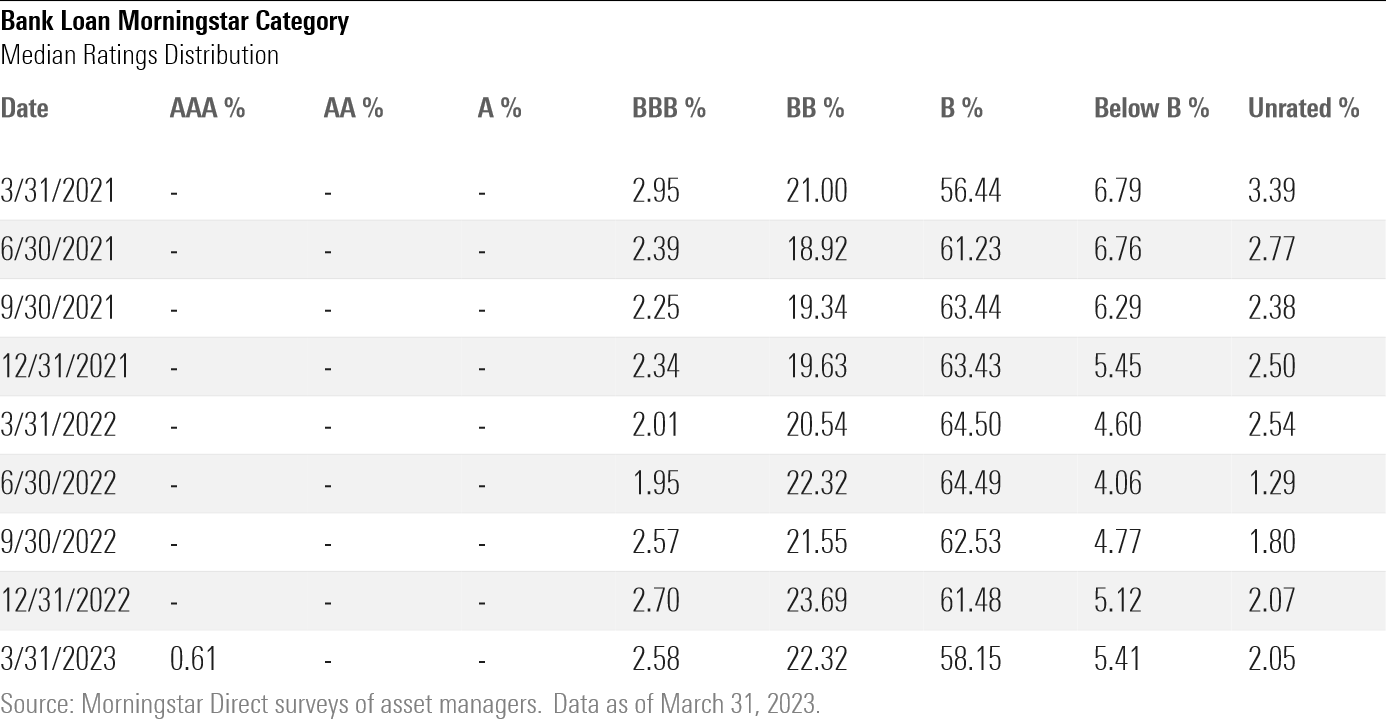

The typical bank-loan fund added modestly to AAA, BBB, and BB rated debt over the past year, while B rated exposure fell 6 percentage points, 3 times the Morningstar LSTA US Leveraged Loan Index’s drop. Given the relative rarity of investment-grade loans, a significant part of the category median’s increase in higher-quality credits is likely bonds rather than loans. Holding bonds supports liquidity because they can be traded more readily than loans, which have lengthier settlement times.

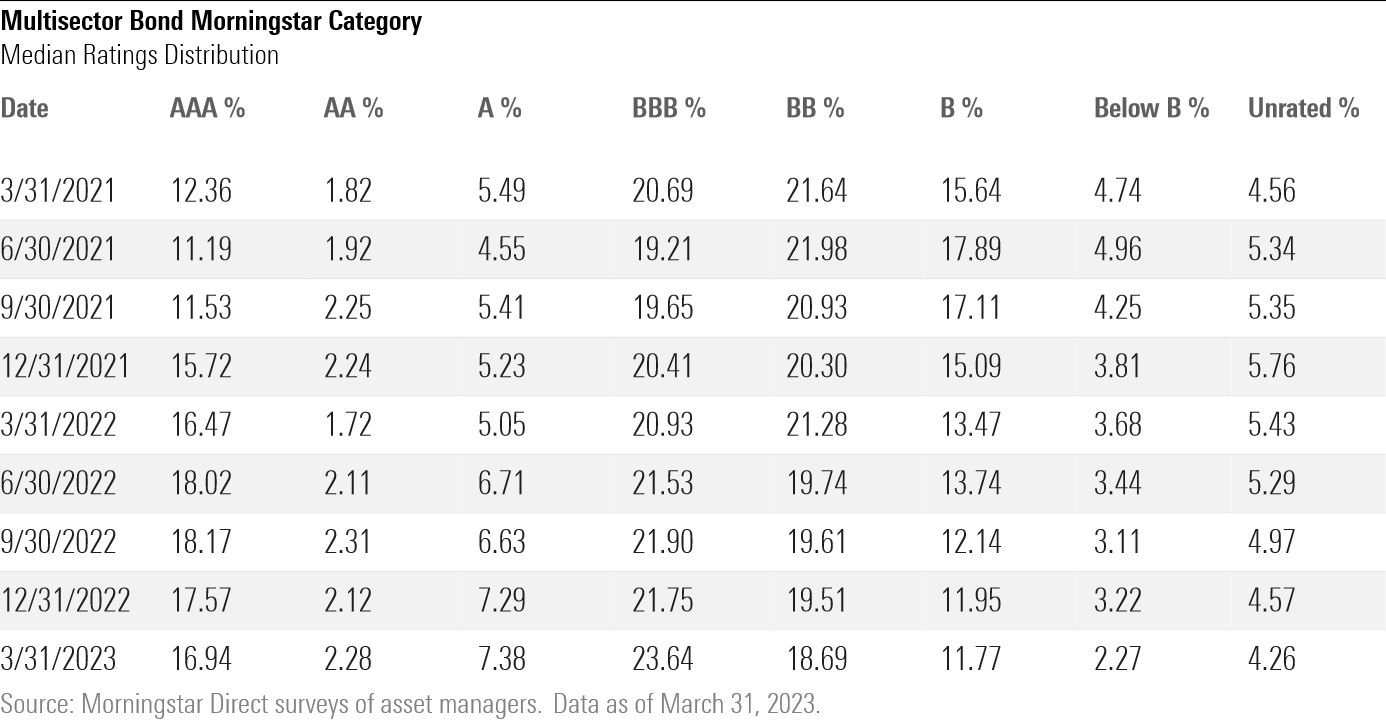

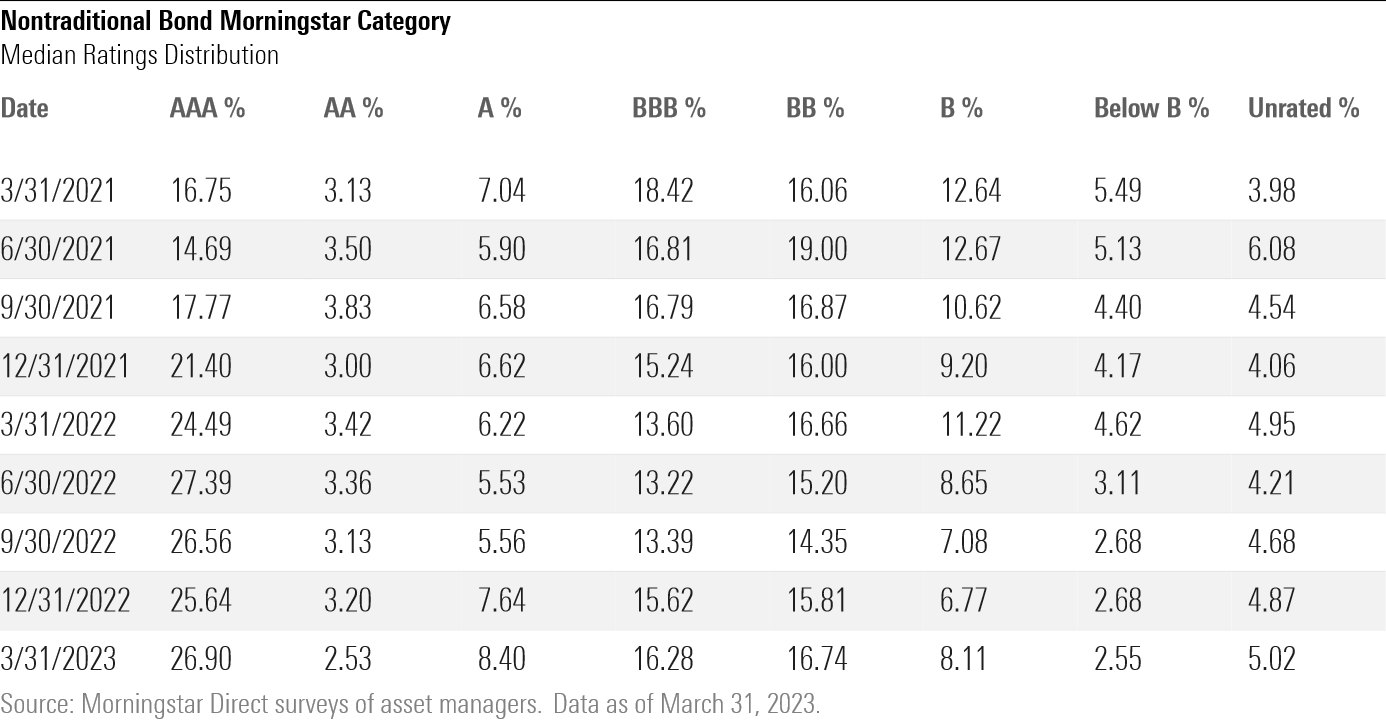

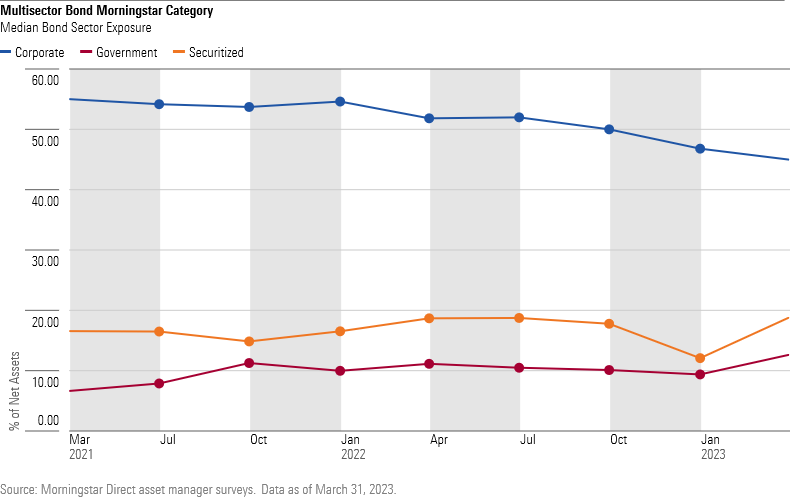

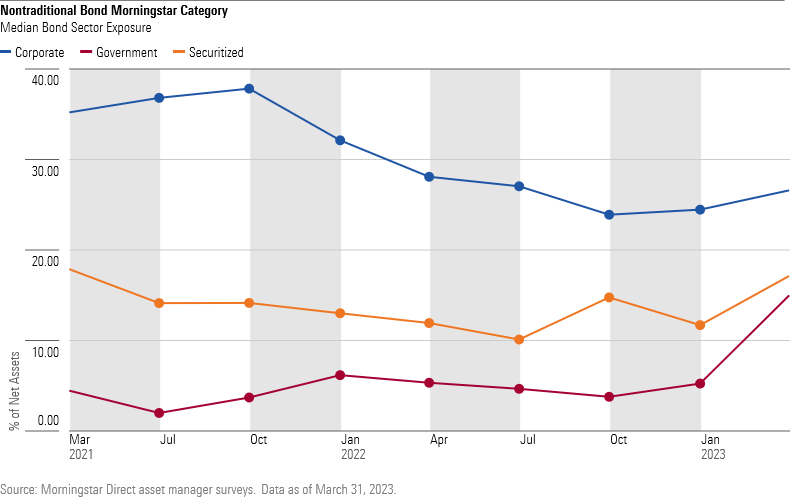

Multisector and Nontraditional Bond Funds Add Both Quality and Duration

Multisector and nontraditional bond funds, which have more flexibility to manage credit and interest-rate risk, made bigger and more varied changes. The typical fund in both categories added investment-grade exposure over the past two years through March 2023, starting with AAA rated bonds and later As and BBBs, perhaps indicating an initial preference for safety before looking to take advantage of attractive yields in investment-grade bonds.

As with the core and core-plus bond categories, sector changes came with multisector and nontraditional bond funds’ shift toward AAAs. The median corporate stake for both declined about 10 percentage points overall, while stakes in government debt increased. The typical multisector and nontraditional bond strategies also lengthened their durations (a measure of interest-rate sensitivity) by roughly half a year over the 12 months ended in March 2023. These funds typically run with shorter durations than intermediate-bond funds, so lengthening duration may help protect them if yields fall.

Less Risk but More Yield

It’s clear that funds across Morningstar’s seven taxable-bond categories are reining in risk. Median investment-grade bond stakes have increased by more than they should have if managers were merely tracking changes to their benchmark indexes. That suggests the median fund has deliberately bought more quality bonds—such as AAA rated Treasuries and U.S. agency-backed securitized debt—while reducing corporate bonds, very few of which are rated AAA. Managers have done this as high-quality bond yields and recession concerns have increased.

Trends do not apply in all cases, however. Investors should still check how their bond funds have reacted to recent market shifts. The timing and extent of the changes will vary, but being aware of them can help distinguish managers from each other.

Overall, the shift toward quality is welcome. While soaring yields helped make 2022 one of the worst years in many decades for bonds, funds have been able to pare credit risk while improving income potential, a luxury that bond managers have not had in a long time.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)