European Stocks Are the Cheapest They’ve Been in Years

Technology stocks, consumer cyclicals offer the most opportunities.

Key Takeaways:

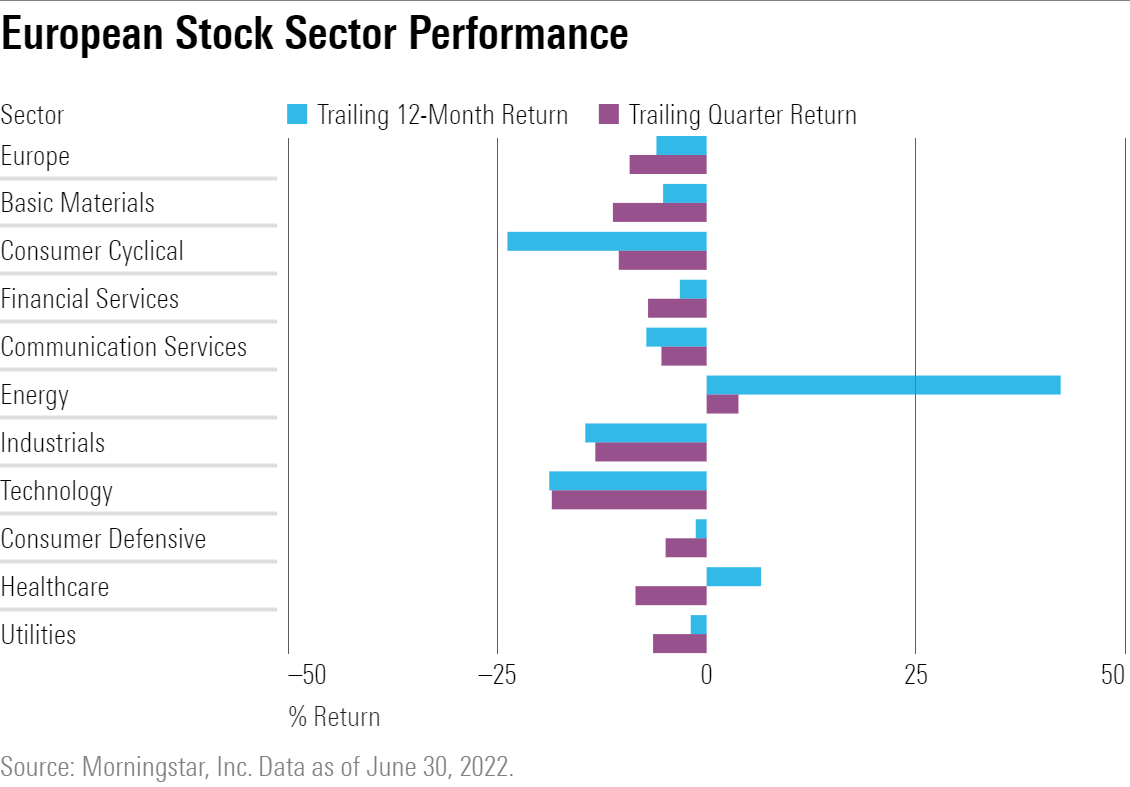

- 2022 has not been kind to investors, with two consecutive quarters of negative price movements.

- European stock valuations have contracted significantly, making it the cheapest region globally.

- Energy was the only sector to experience gains, albeit modest, over the quarter as the impact of Russian embargoes and higher energy prices has raised the value of oil and gas stocks.

- Technology was the worst-hit sector, with losses of almost 20%, as heady valuations were punished by more cautious-minded investors.

- Dividends have held up quite well, despite concerns around the broader economy. For many sectors, expectations for pay outs have actually increased over the quarter.

Investors who believed the declines in the first quarter were a one-off were left disappointed as the second quarter of the year saw even steeper falls in European stocks, and markets braced for the dual impact of high inflation rates and interest-rate increases.

European equity markets declined by more than 9% over the quarter, bringing year-to-date declines north of 15%, and wiping out a good chunk of the gains made in 2021.

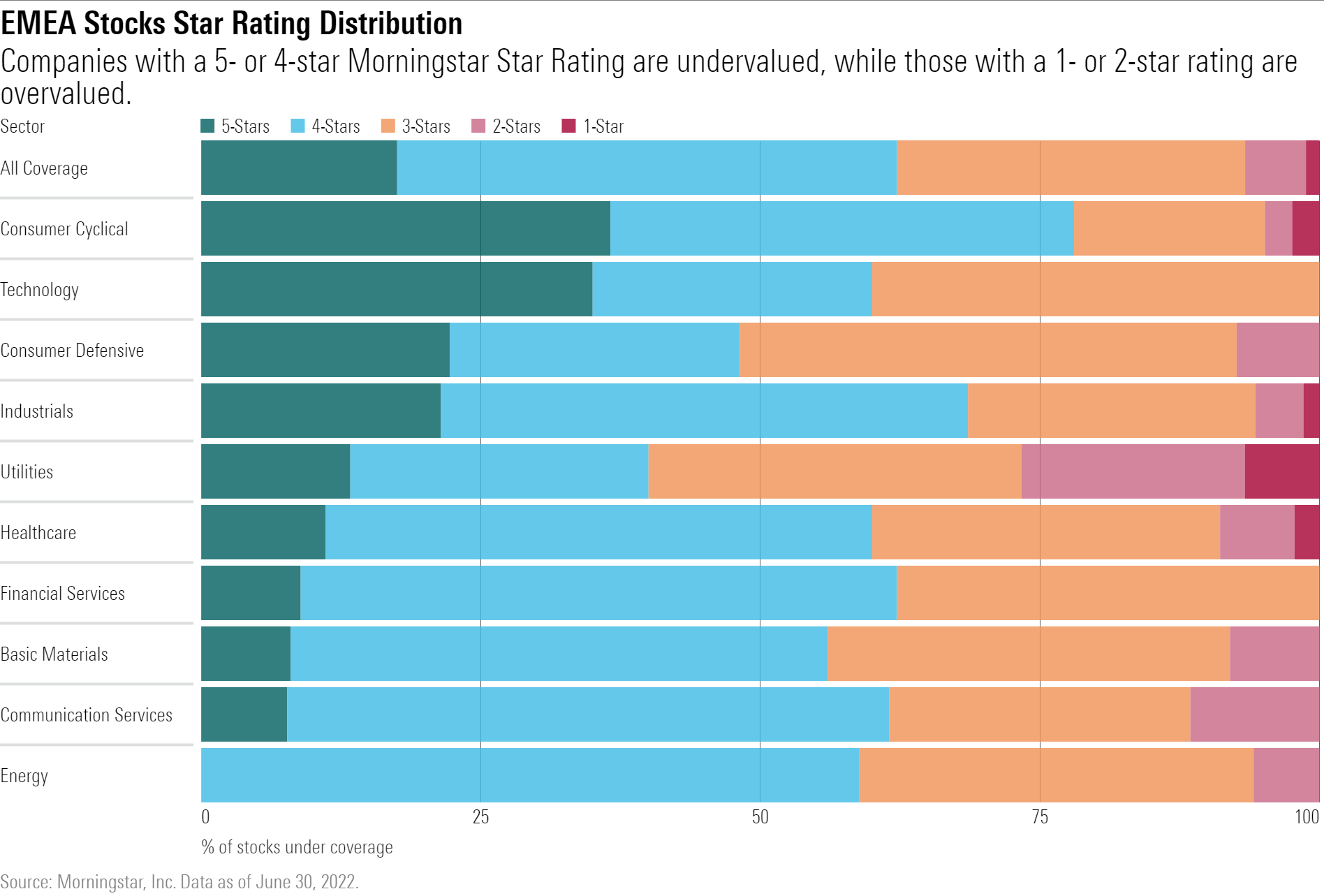

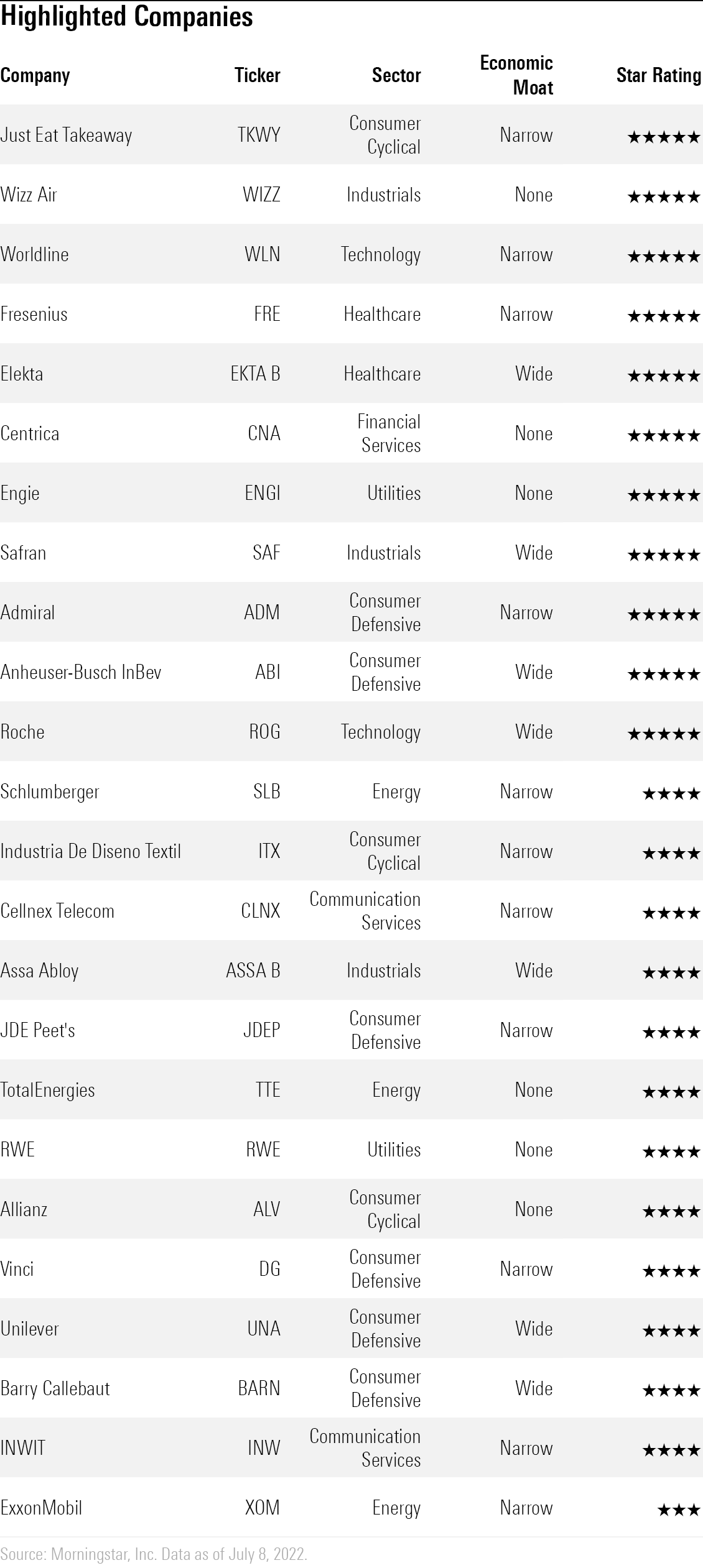

Discounts to our fair value estimates have widened materially over the second quarter, with Europe now trading more than 20% below its intrinsic value. On an absolute basis, this is the cheapest the region has been in years, while in relative terms it is now the most attractively priced region in our global coverage. Although the number of opportunities differs across sectors, almost two-thirds of the stocks in our European coverage are now in 4- or 5-star territory, indicating attractive upside potential. (Scroll down to the end of the article for a list of undervalued stocks)

More Storms to Come or Plain Sailing From Here?

Last time around we wrote about lurching from one crisis to another. One quarter on and the only thing that has changed is the underlying crisis, as rampant inflation and interest-rate increases take center stage, and ongoing concerns over the Ukraine war and coronavirus outbreaks fade into the background, but have not disappeared.

With equity markets falling heavily in the second quarter of this year, opportunities abound across the European equity market, bringing to mind that famous adage by Warren Buffett to “be greedy when others are fearful.” However, things are never that simple, and there are serious concerns among investors that we are heading toward an economic recession, with equity valuations likely to contract further if we do. Economists are hesitant to call a global recession too early, but it seems global economic indicators are worsening and while investors are not necessarily assuming the worst, they are preparing for it.

The flip side of such steep equity market declines in the second quarter is it has left the market attractively priced, with more than 60% of our European coverage in 4- or 5-star territory currently. Every single sector, barring energy, which has seen strong positive price movements on the back of higher energy prices related to the Ukraine war, holds a number of 5-star stocks, indicating strong upside potential.

The market focus on inflation has become even more pronounced over the last quarter, with much of this report dedicated to steering you through this period of extraordinary cost inflation. While inflation is something that most businesses have to deal with, some are better positioned than others in doing so.

We look at businesses with Morningstar Economic Moats, firms that have sustainable competitive advantages over their peers, such as through high switching costs or intangible assets like patents. We also look at industries with pricing power, which are those that are designed to pass this directly on to the end customer, be they fast-moving consumer goods brands such as Diageo DEO or L’Oreal LRLCY through to healthcare providers. We also dig deep to find less obvious areas of inflation protection in sectors such as telecommunications, where some tower operators have inflation-linked contracts, or in insurance, where certain firms have positioned themselves in more niche/protected segments. Last, we look at firms that are outright beneficiaries of inflation because of elevated energy prices, oil majors such as TotalEnergies TTE and ExxonMobil XOM, or lesser-known European utilities with unappreciated wholesale divisions to their businesses.

Consumer cyclicals is a key area of focus for us this quarter. Share prices declined by more than 10% in the last quarter alone, meaning the sector has fallen by almost a quarter over the last 12 months. The reasons behind this move are logical, higher inflation rates and borrowing costs mean a tighter-strapped consumer, which could lower consumer spending over coming quarters. However, with a fall of this magnitude comes an opportunity, and right now almost one-third of stocks in this sector are in 5-star territory, more than any other sector.

While many companies in the consumer cyclical sector may feel some pain in coming months, some are well positioned for the longer term and have been building their online customer bases materially during the pandemic. Moaty names such as Inditex IDEXY in the apparel sector, and Just Eat Takeaway JTKWY are just two firms that come to mind.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)