Don't Panic on Sequence of Returns

Both stocks and bonds are down so far this year, but the long sweep of history provides some solace for recent retirees.

It’s hard to escape the negative drumbeat of market news. Market volatility has spiked in recent months thanks to a long list of worrisome trends: the war in Ukraine, stubbornly high inflation, rising interest rates, and a potential recession, to name a few. Bonds are off to one of their worst years ever, and stocks are rapidly approaching correction territory.

Market commentators often tend toward hyperbole and alarmism, but the market environment is legitimately worrisome, at least at the moment. With both stocks and bonds selling off in tandem, the usually stalwart 60/40 portfolio is having its worst year since 1932. But while a double meltdown in stocks and bonds is concerning, recent retirees can take some comfort in the historical record.

Background on Sequence of Returns

If you're a buy-and-hold investor with a long time horizon, what ultimately determines your results is the long-term average over time. In fact, if you invest a lump sum in a fund and don't make any additions or withdrawals, the total returns you ultimately earn will be the same regardless of the specific order of returns from year to year.

But if you purchase or sell shares, the timing of when those returns happen becomes more important. This issue is particularly relevant during the first few years before and after retirement. When you start making portfolio withdrawals, the value of your portfolio reflects both market performance and cash outflows, which can be a double whammy during extended market downturns.

Sequence of returns is mainly a problem for equity-heavy portfolios during periods when market downturns last at least two consecutive years. It’s usually less of an issue for investors who include bond allocations as ballast, even in periods of weaker fixed-income returns.

Learning From History

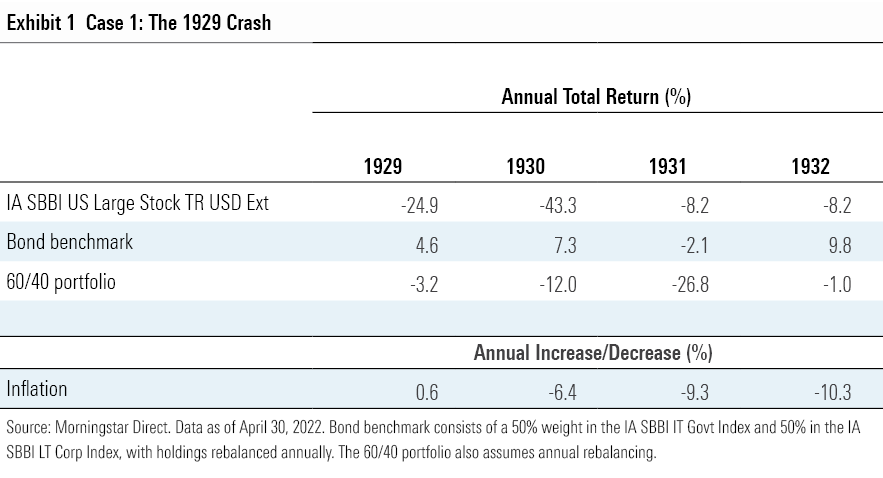

Let’s start with the 1929 crash, the mother of all market corrections. The ebullience of the Roaring '20s ended abruptly on Oct. 24, when the U.S. market suffered its biggest one-day drop ever. The market went on to endure its worst-ever sequence of returns in 1930 and 1931. Bonds helped shore up returns in 1929 and 1930, but lost ground in 1931 when the Fed hiked interest rates to shore up reserves and encourage depositors to keep money in the United States. Deflation was the only saving grace, as falling prices allowed retirees to cut back on spending and portfolio withdrawals.

Investors who retired right before the crash would have seen significant damage to their nest eggs, but portfolio values eventually recovered. As shown in the graph below, an investor who retired with a $100,000 portfolio in 1929 would have seen their portfolio value drop as low as about $50,000 by the end of 1932. Some of those retirees might have lived long enough to see their portfolios fully recover, but that didn’t happen until 1945.

Amounts are based on a $100,000 portfolio value at retirement, a 60/40 portfolio allocation, and a $4,000 initial withdrawal amount adjusted annually for inflation.

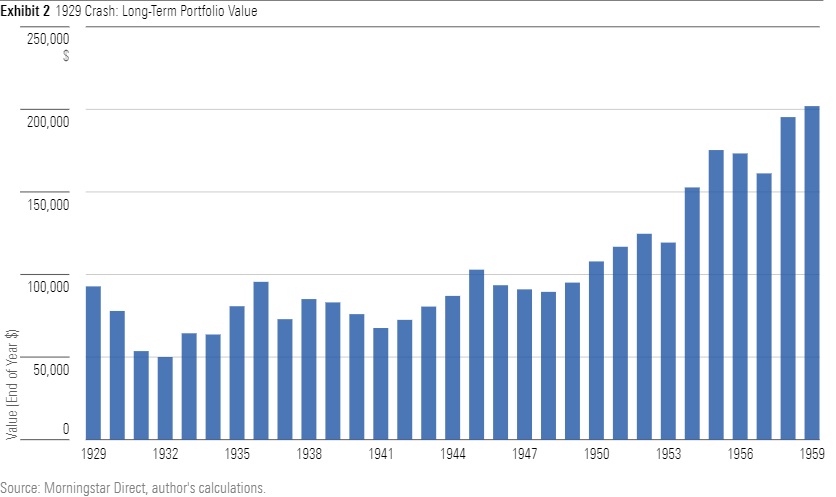

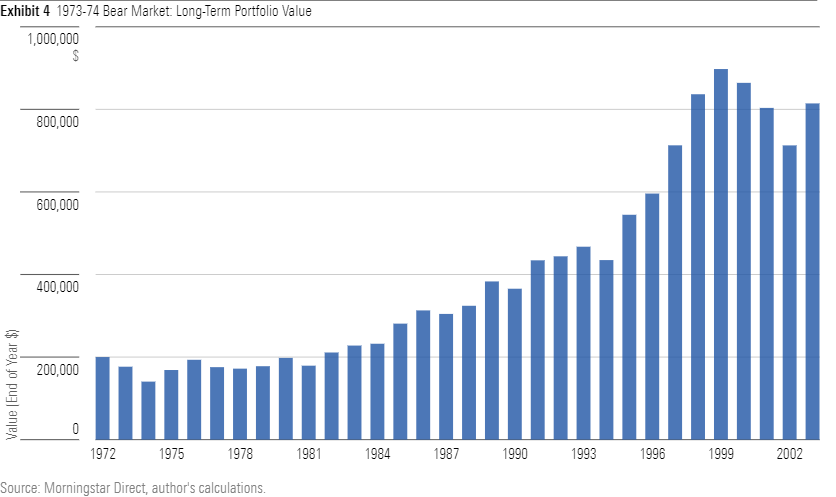

The 1973-74 bear market—the second-longest bear market to date—would have been another tough time to retire. Rising inflation, the OPEC oil embargo, and slower economic growth all weighed down returns. Stocks dropped about 8% in 1973, followed by another 15% loss in 1974. Bonds held up better but generated relatively sluggish returns. Not only were stock and bond returns bad, but inflation was worse, averaging 9.3% over the period from 1973 through 1981.

As a result, a hypothetical investor who retired with $200,000 at the start of 1973 would have lost about 30% in retirement savings by the end of 1974. Despite the corrosive effects of ongoing inflation, though, the portfolio would have recovered by the end of 1982. Retirees who lived long enough would have gone on to enjoy growth in their nest eggs during most of the 1980s and 1990s.

Amounts are based on a $200,000 portfolio value at retirement, a 60/40 portfolio allocation, and an $8,000 initial withdrawal amount adjusted annually for inflation.

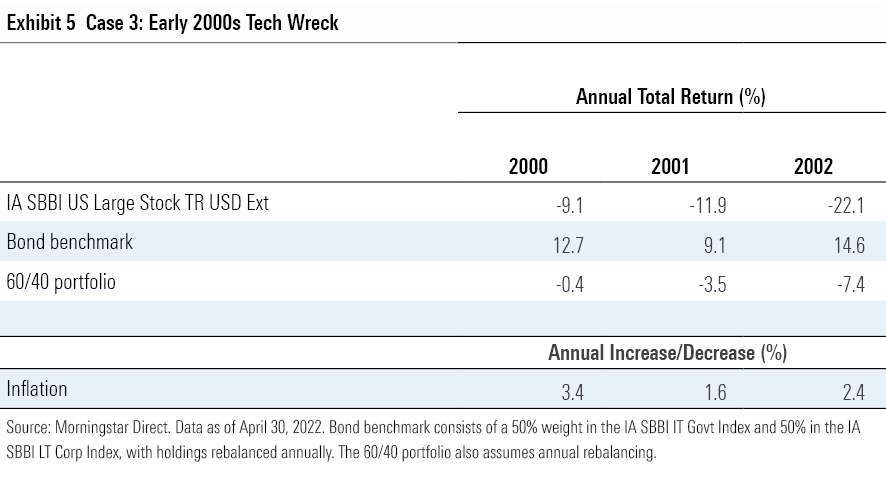

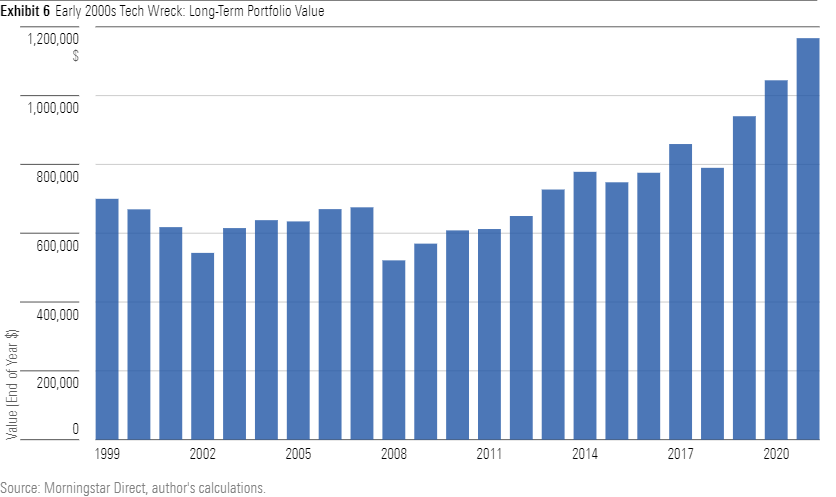

The drawdown in the early 2000s was less severe, but still difficult. After the tech-media-telecom bubble burst, balanced portfolios lost close to 10% in cumulative returns between 2000 and 2002. Those who retired at the beginning of 2000 benefited from below-average inflation over the following 20 years, but also had to deal with heavy equity losses during the global financial crisis in 2008. Bonds buffered some of those losses, but a balanced portfolio would have still dropped about 18% for the year.

Because of the one-two punch of poor results in the early part of the 2000s followed by heavy losses in 2008, an investor who retired with $700,000 at the beginning of 2000 wouldn’t have fully recovered until the end of 2013. From 2013 through 2021, though, the combination of strong market returns plus generally benign inflation would have kept boosting portfolio values.

Amounts are based on a $700,000 portfolio value at retirement, a 60/40 portfolio allocation, and a $28,000 initial withdrawal amount adjusted annually for inflation.

Could Things Get Worse?

The key takeaway is that even during horrible market environments—and unfavorable patterns for sequence of returns—retirees have historically still been able to recover their lost wealth. Of course, it’s not a given that the worst periods for sequence of returns are behind us. If stocks and bonds both suffer over a multiyear period, retirees would have a tough time, especially if inflation remains high.

Fortunately, there are many other ways to help ensure retirement assets aren’t prematurely depleted. For example, investors can guard against the risk of being forced to withdraw assets during a market downturn by putting at least one or two years’ worth of planned withdrawals in a separate cash “bucket.” This also leaves the remaining portfolio better positioned to rebound when the market eventually improves.

Taking a more flexible approach to withdrawal rates can also mitigate the negative effects. There are several ways to implement this, including withdrawing a fixed percentage of your portfolio's value each year, not adjusting withdrawal rates for inflation, or using a "guardrail" approach in which you trim the withdrawal rate if it increases beyond a certain threshold. (Christine Benz, John Rekenthaler, and Jeff Ptak covered these options in more detail in their in-depth report on the state of retirement income and safe withdrawal strategies).

Conclusion

It’s important to be aware of sequence of returns as a potential risk because of the havoc it can wreak for retirees, especially if the adverse sequence happens early in retirement. But sequence of returns is much less of an issue for well-diversified portfolios, even during weaker periods for bonds. Despite the often alarming headlines in today’s market, there’s no need for retirees to panic.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)