Report Card: Grading the Investor Experience in 26 Global Markets

Why the U.S. is one of only three markets to earn a Top grade for practices related to fees and expenses.

Global fund fees continue to trend downward, as the majority of the 26 markets we studied--including the United States--have seen asset-weighted median expense ratios for funds fall since our last analysis.

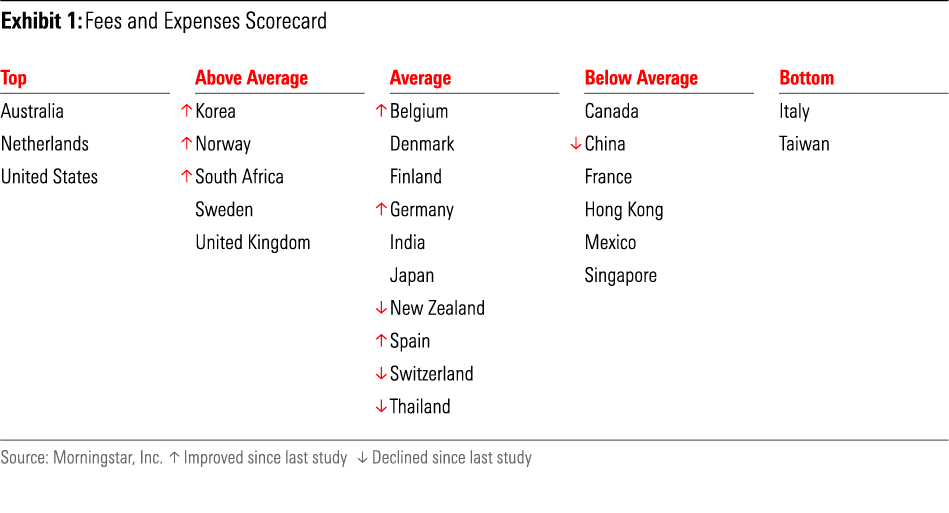

In the Fees and Expenses chapter of the latest Global Investor Experience study, we evaluate the environment for mutual fund investors in markets around the world, identifying the ones that are adopting best practices and the ones that need to improve.

As shown below, the highest overall grades went to Australia, the Netherlands, and the U.S., while Italy and Taiwan earned Bottom grades. This is the fourth study in a row that these three countries have nabbed the highest grade; it's the third in which Taiwan came in at the bottom and the second in succession for Italy.

In this report, we detail the market characteristics that drive increased transparency and lower global fund fees for retail investors. Here's what we're seeing.

United States: Vanguard Pushes Down Fees, Investors Move Toward Fee-Based Advice

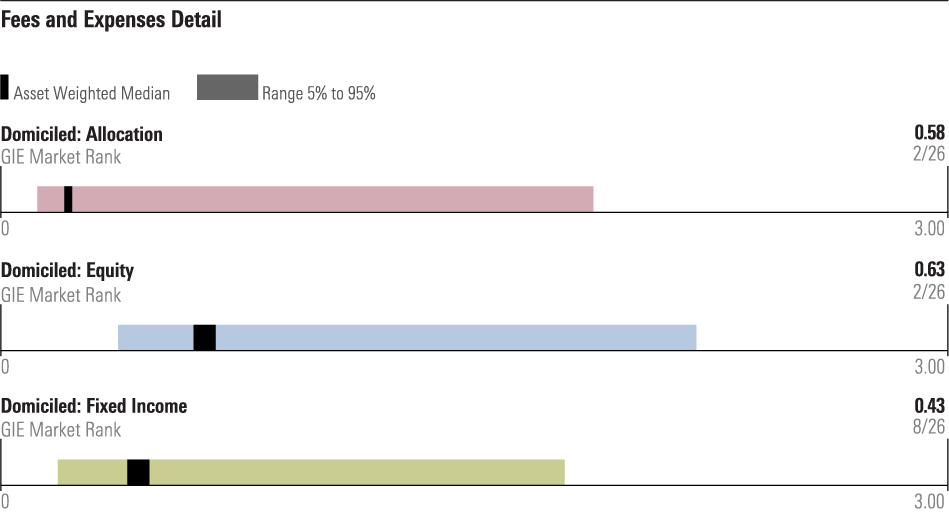

The U.S.' Top grade was driven largely by low asset-weighted median expenses across asset classes: 0.43% on fixed-income funds, 0.58% for allocation, and 0.63% for equity funds.

Source: Morningstar.

The U.S. investing environment is also benefiting from the growth of the fee-based advice market and the broad availability of no-load, no-trailer share classes for do-it-yourself investors.

Though front loads and trail commissions still exist, market forces are driving investments away from share classes that employ these traditional fee arrangements. As reported in our most recent fee study, these share classes have been in aggregate outflows for the past 10 years.

And investors' migration to fee-based advisors has led fee-based arrangements to constitute most of the retail fund assets in the U.S. In addition, it's increasingly common for investors to forgo advice entirely and invest directly in funds without loads or commissions.

This move toward fee-based, self-directed investment also means people are making good use of domestically listed exchange-traded funds. These funds lack the minimum investment requirements of open-end funds and feature prominently in digital advice solutions such as robo-advisors.

It's worth noting the influence that Vanguard has on the U.S. fee landscape. The firm offers numerous passive strategies and operates at enormous scale in a mutual ownership structure, which make it possible for them to offer investments to their clients at exceptionally low prices. The firm's size and influence have thus pushed down pricing more widely.

5 Takeaways From This Chapter of the 2022 Global Investor Experience Study

- The majority of the 26 markets studied saw the asset-weighted median expense ratios for domestic and available-for-sale funds fall since the 2019 study. For domestically domiciled funds, the trend was most notable in allocation and equity funds, with 17 markets in each category reporting reduced fees. Globally, lower asset-weighted median fees are driven by a combination of asset flows to cheaper funds as well as the repricing of existing investments. In markets where retail investors have access to multiple sales channels, people are increasingly aware of the importance of minimizing investment costs, which has led them to favor lower-cost fund share classes.

- Price wars in the ETF space have put downward pressure on fund fees across the globe. In the U.S., competition has driven fees to zero in the case of a handful of index funds and ETFs, and these competitive forces are spreading to other corners of the fund market.

- In global markets where banks dominate fund distribution, there is no sign that market forces alone will drive down asset-weighted median expense ratios for retail investors. This is particularly evident in markets like Italy, Taiwan, Hong Kong, and Singapore, where expensive offshore fund sales predominate over those of cheaper locally domiciled funds.

- Outside the United Kingdom, U.S., Australia, and the Netherlands, it is rare for investors to pay for financial advice directly. A lack of regulation toward limiting loads and trail commissions can cause many people to unavoidably pay for advice they do not seek or receive. Even in markets where share classes without trail commissions are for sale, such as Italy, they are not easily accessible for the average retail investor, given that fund distribution is dominated by intermediaries, notably banks.

- Australia, the Netherlands, and the U.S. earned Top grades because of their typically unbundled fund fees. As discussed above, this is the fourth study in a row that these three countries have received the highest grade in this area. The move toward fee-based financial advice in the U.S. and Australia has spurred demand for lower-cost funds like passives. Institutions and advisors have increasingly opted against costlier share classes that embed advice and distribution fees. The trend extends to markets such as India and Canada.

Fees and Expenses is the first of three chapters in this edition of the Global Investor Experience study. Up next is Disclosure, followed by Regulation and Taxation.

More details about the Global Investor Experience Study's methodology are available on the Signature Research and Methodology page.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)