2021 Closes Out on an Optimistic Note Despite Multiple Bumps in the Road

Our quarterly markets review digs into inflation risks and the impact of the Great Resignation.

Investors breathed a big sigh of relief as vaccination rates improved and markets gained momentum in 2021. U.S. large-cap stocks posted impressive returns; U.S. small-cap stocks performed well, but underperformed their large-cap counterparts, which is a rather unusual phenomenon, historically.

Most developed-markets stocks outside the United States performed well, as vaccination programs allowed those economies to return to their regular levels of activity. Emerging-markets stocks, however, experienced losses, as those countries struggled to bring vaccination rates up and provide their industries a much-needed boost after the pandemic's crippling effects.

With interest rates starting to increase, investment-grade bonds delivered a weak performance. High-yield bonds, however, were able to thrive. Wide performance swings are not unusual for commodities given their high volatility, but even so, commodities were the surprise of the year. The asset class posted its highest annual return since 2000, as global supply chains regained their health and pent-up demand skyrocketed.

The not-so-good news for consumers was that inflationary pressure started building up globally in 2021. The U.S., Canada, parts of Europe, and Latin America experienced above-average levels of inflation. In response, the Federal Reserve announced its intention to tighten monetary policy going forward, raising interest rates and reducing bond purchases. A tight monetary policy is designed to keep a lid on inflation. On the flip side, such a policy also restricts growth. In more cheery news, however, markets anticipate less aggressive rate hikes.

Either way, investors are now bent on hedging inflation risk, as evidenced by the record inflows pouring into inflation-protected bond funds. Sustainable funds also received record high inflows, with investors adding environmental, social, and governance criteria to their investment selection process.

The "Great Resignation" continued in 2021, with more workers leaving unsatisfactory jobs for higher pay, more flexible hours, and work-from-home options. U.S. job growth was relatively strong for the year, yet many sectors still employed fewer workers than they did prior to the pandemic. Worker shortages have become common, suggesting that even though positions are open, the availability of candidates able and qualified to fill them remains scarce.

Like all its coronavirus-era predecessors, 2022 started with a high level of uncertainty (and yet another Greek-letter coronavirus variant), but a generous dose of optimism and confidence in the resilience of markets are providing investors some much-needed balance.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the market insights from our latest quarterly review.

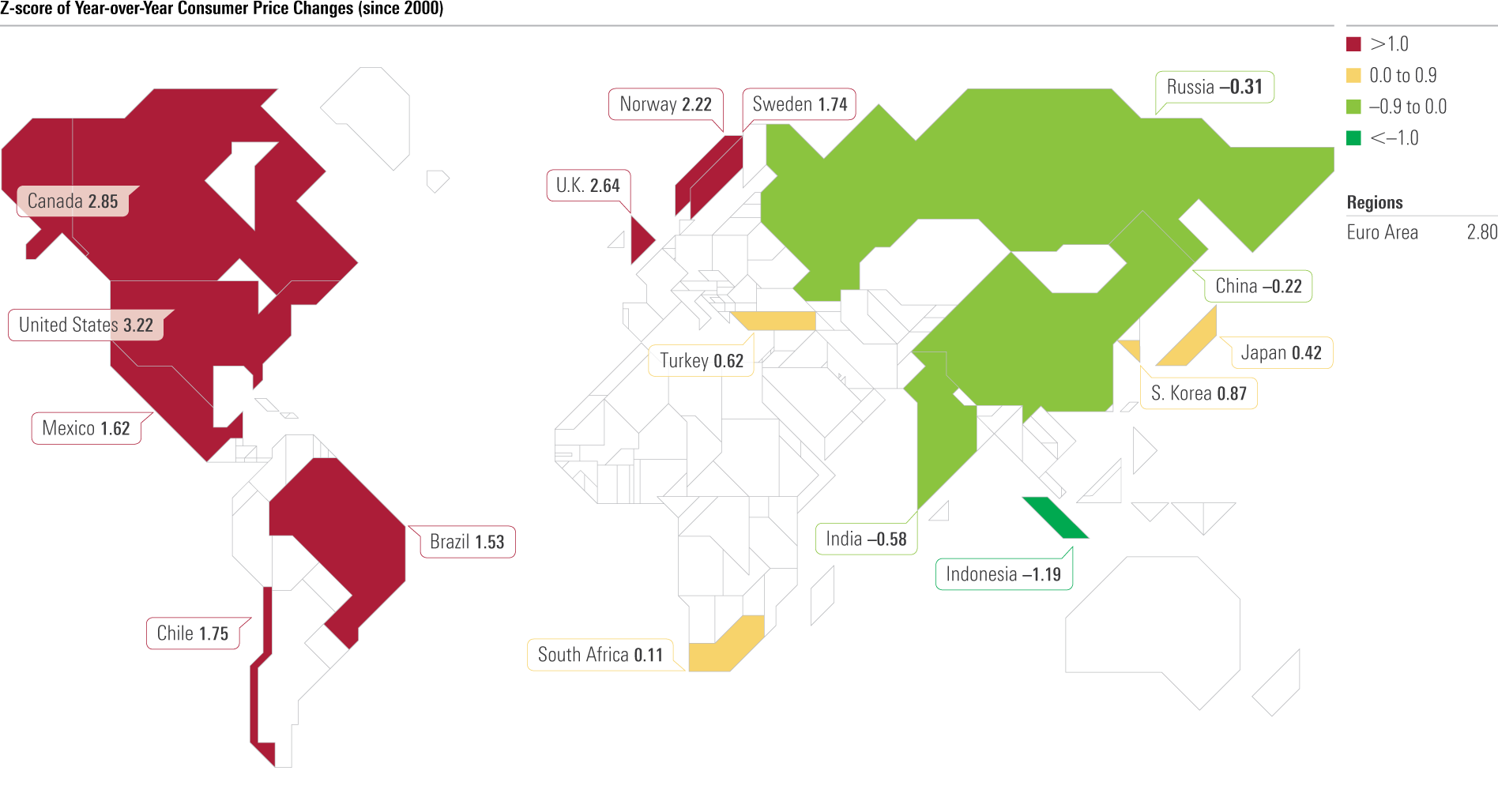

Inflation Pressure Is Building Up Globally, With the West Taking the Brunt So Far

Inflation in the U.S., Canada, and Europe is roughly three standard deviations above average since 2000; similarly, inflation is well above average in Latin America. However, inflation is not nearly as elevated in Asia when compared with the past 21 years, giving policymakers in the region more flexibility. Indeed, China recently eased monetary policy to support the economy. South Korea is the main outlier and has already begun raising rates.

Source: Organization for Economic Co-operation and Development. Data as of Dec. 31, 2021.

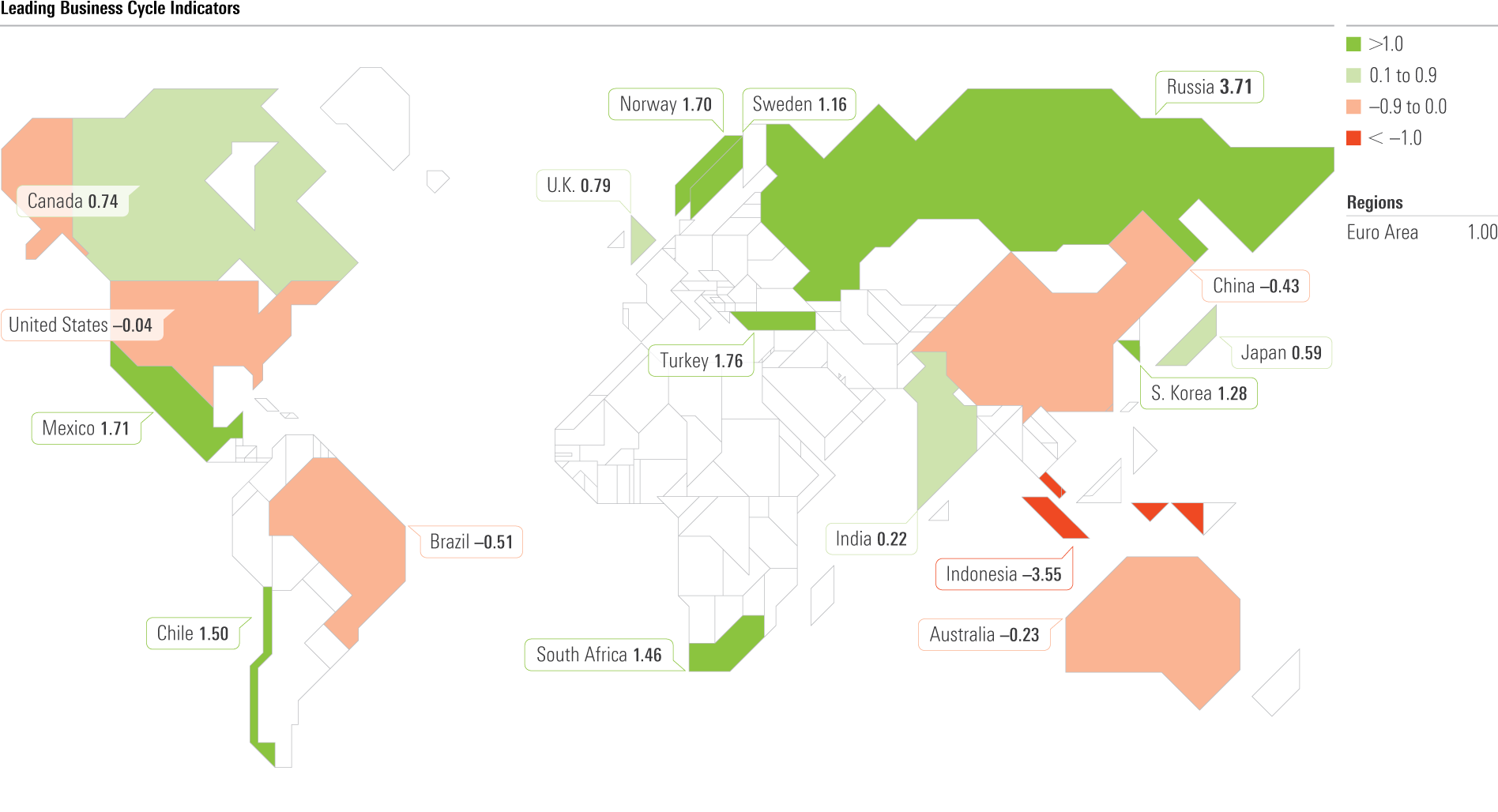

Forward-Looking Business Cycle Indicators Point to Diverging Global Growth in 2022

The Organization for Economic Co-operation and Development distills forward-looking data points into composite leading indicators meant to anticipate turning points in a country's economic cycle. The latest data for Europe, Japan, Canada, and several emerging markets remain positive, while China, Australia, Brazil, and Indonesia are expected to face more severe headwinds in 2022.

Indicators for the U.S. are roughly neutral but may tip negative as monetary conditions tighten.

Source: Organization for Economic Co-operation and Development. Data as of Dec. 31, 2021.

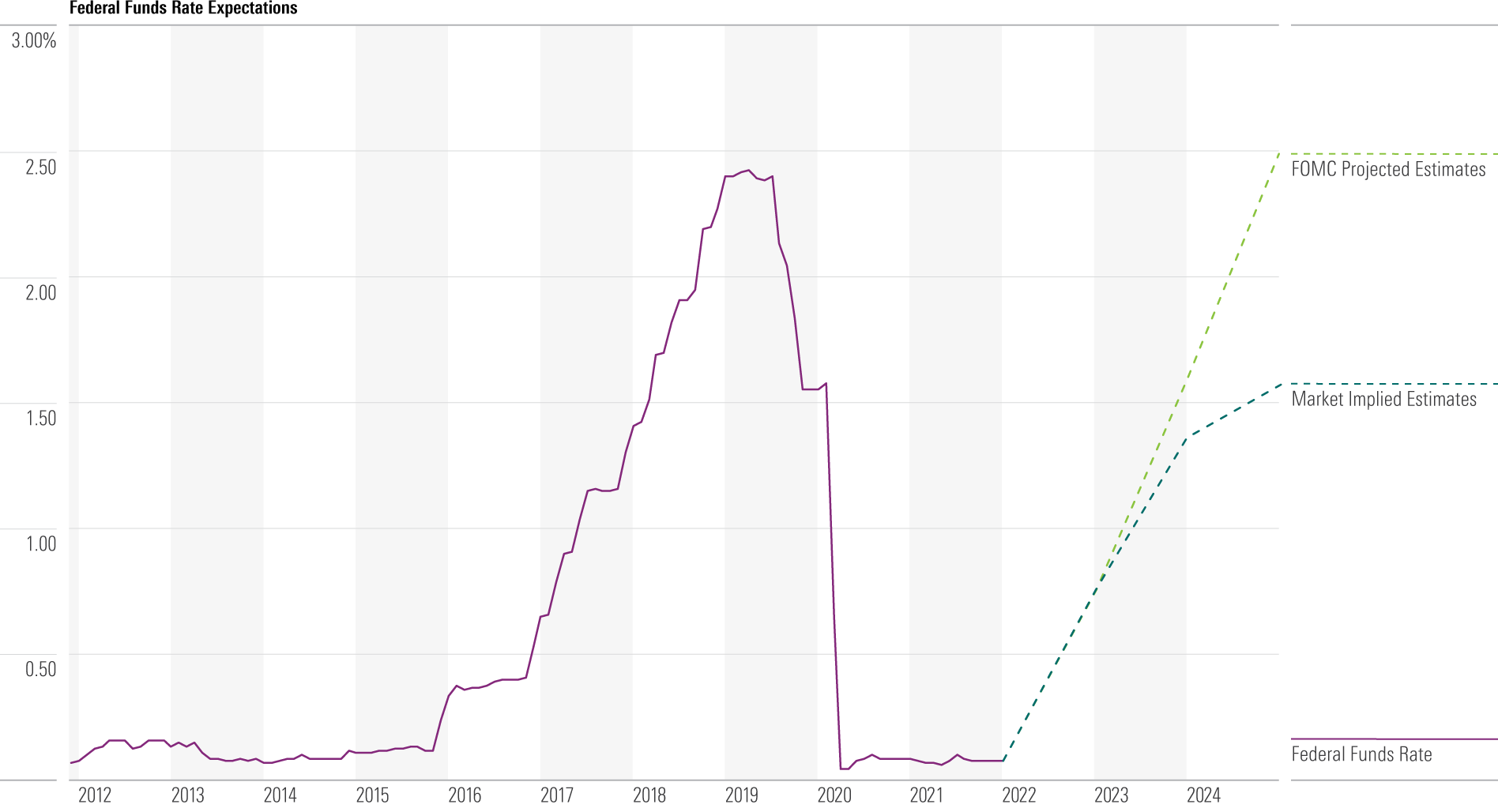

Market Anticipates Less Aggressive Rate Hikes Than Fed Guidance

The figure below compares the Federal Open Market Committee's estimate for the federal-funds rate against a market implied estimate derived from the futures market. Even though the market is pricing in a much more hawkish Fed, the market's expectation for rates remains lower relative to the Federal Open Market Committee's.

According to the Federal Open Market Committee, long-term rates are expected to rise to around 2.50% while the market is pricing in 1.60% by the end of 2024.

Source: St. Louis Federal Reserve, CME, Morningstar Marketplace API. Data as of Dec. 31, 2021.

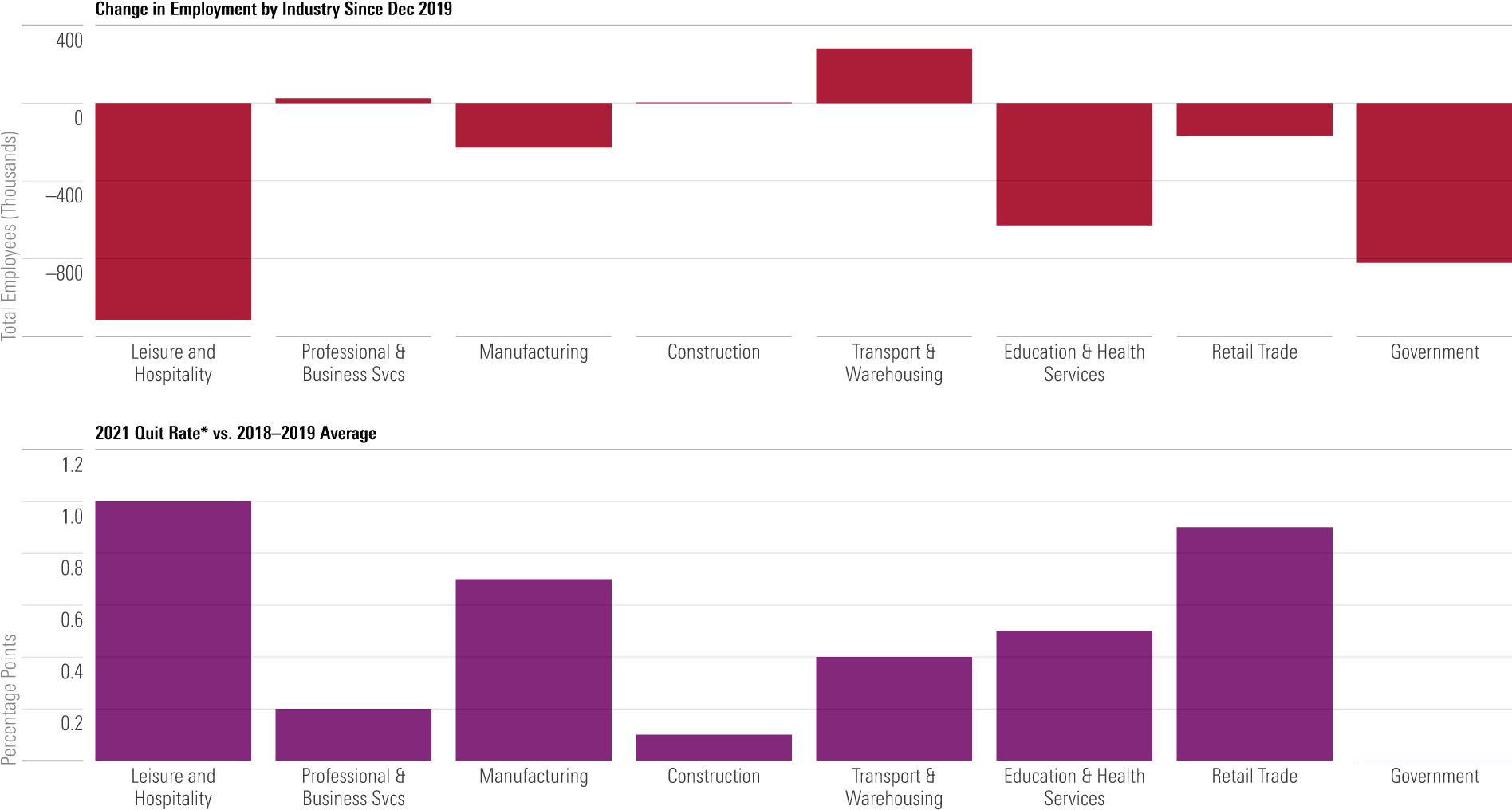

Elevated Quit Rates Affect U.S. Employment Levels Unevenly

U.S. job growth was relatively strong in 2021, yet many sectors still employed fewer workers than they did prior to the pandemic. On the demand side, COVID resurgences battered demand for leisure and hospitality services. At the same time, the quit rate in that sector was well above the prepandemic average, affirming the narrative that worker shortages were also a factor. Labor supply issues were also present in other sectors.

Source: Bureau of Labor Statistics. Data as of Dec. 31, 2021.

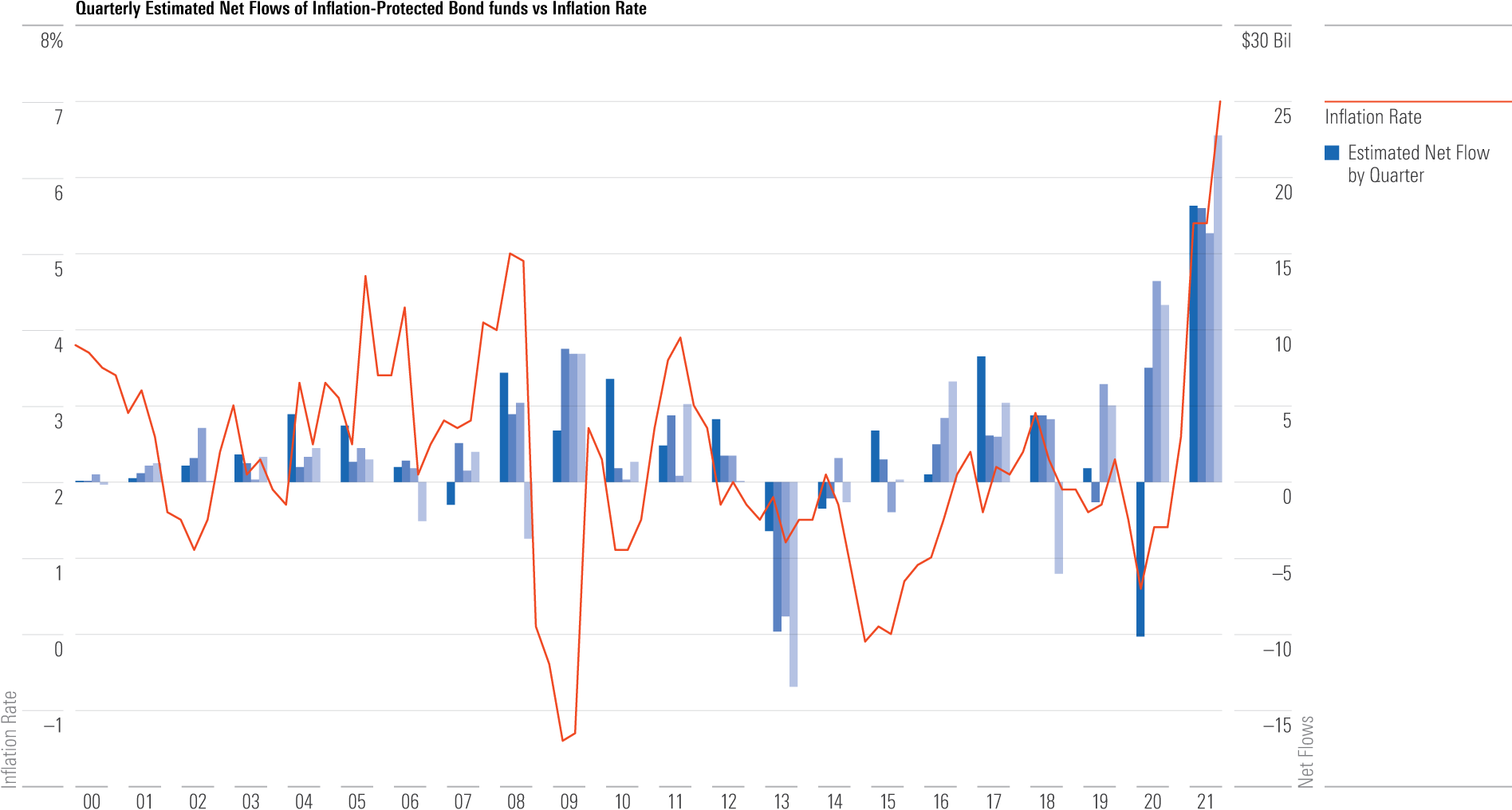

All-Time High Inflows in Inflation-Protected Bond Funds

Inflation-protected bond funds took in a record-breaking $75 billion of inflows in 2021, nearly 2.5 times the previous record of $29 billion in 2009. Inflation increased to 7.0% at the end of 2021 from 2.5% at the start of 2020.

This trend was consistent with previous episodes of rising inflation and inflows to inflation-shielding products, as investors look for ways to hedge inflation risk.

Source: Bureau of Labor Statistics, Morningstar Direct. Data as of Dec. 31, 2021.

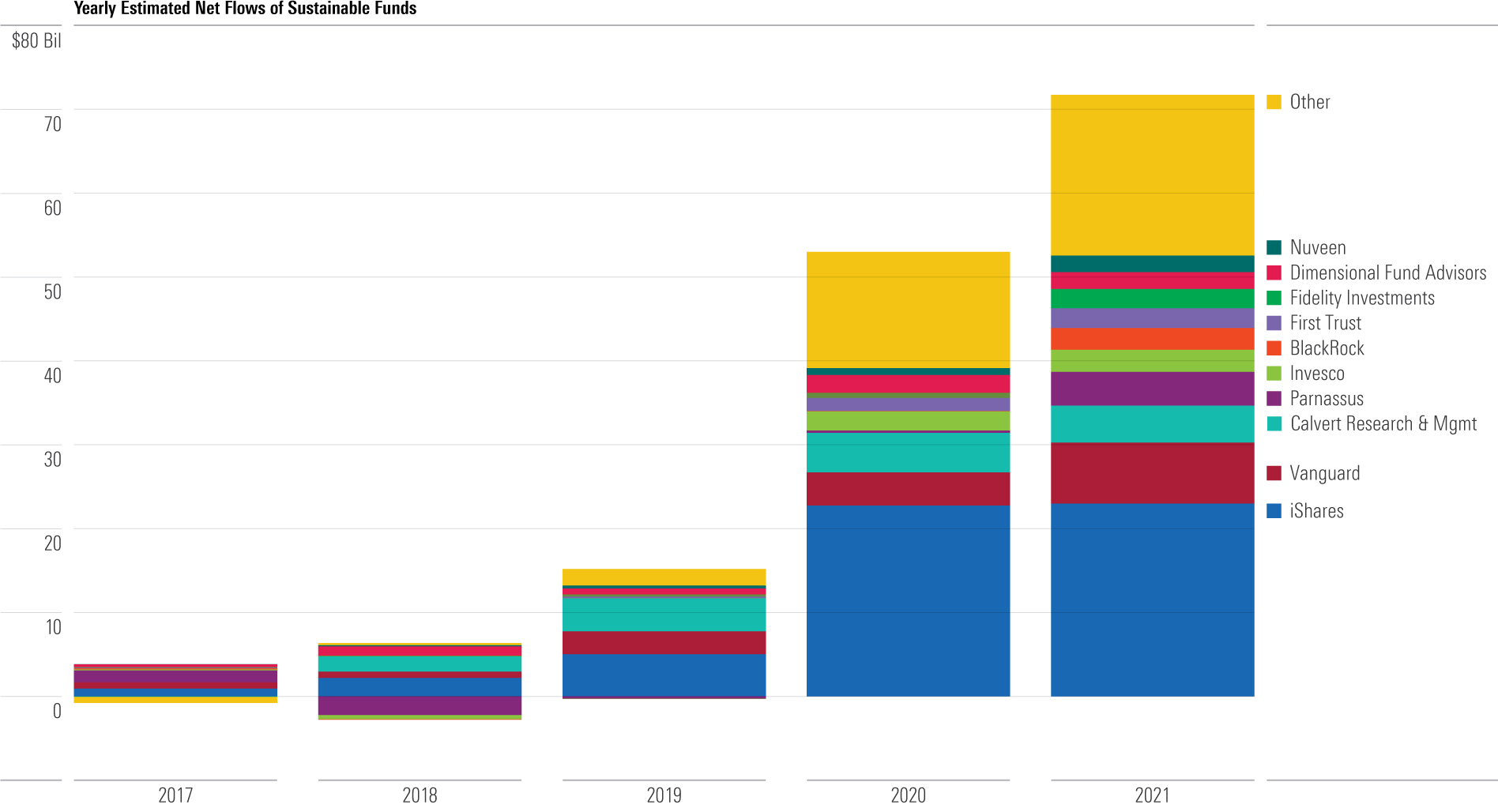

Sustainable Funds Also See Record High Inflows

Sustainable fund flows continued to hit record highs in 2021. The 10 largest fund companies accounted for nearly 75% of sustainable fund flows, down from 87% in 2019, as more fund companies continue to take greater market share in the sustainable funds space.

Source: Morningstar Direct. Data as of Dec. 31, 2021.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)