Top Pick Emerges From Auto Microchip Shortage

Semiconductors face current challenges, but their future is strong.

Global demand for semiconductors has surged since the start of the pandemic. With social-distancing measures and remote work, many consumers bought computers, tablets, and other smart devices that rely on these chips.

Some tech firms anticipated demand for their chip-reliant products would persist during the pandemic, so they continued making orders. Other companies that rely on chips, however, didn’t anticipate this need as well.

One of the most prominent examples is the automaker industry. Many automakers stopped buying the chips used in vehicles because they didn't anticipate consumers would be buying cars and trucks during the pandemic. As a result, they halted auto production for nearly four months.

The quick economic recovery caught automakers off guard. To meet skyrocketing demand for vehicles, they submitted chip orders when semiconductor companies were busy filling existing orders from firms that anticipated the demand surge.

This meant automakers had to get in line for chips that hadn’t even been produced. And because chip suppliers didn’t have any inventory set aside for automakers, the shortage began.

In a recent report, Morningstar equity analysts Brian Colello, Victoria Radke, and Malik Ahmed Khan stated their belief that supply for auto chips won't recover until early 2022. (Morningstar Direct clients can read the full report here.)

Our analysts say current auto chip shortages present challenges, but strong demand down the road outweighs these concerns.

Vehicles require higher-quality chips to enable fancy tech features like blind-spot monitoring, 360° camera view, and adaptive cruise control. They also need a larger quantity of chips as vehicles become less mechanical and more electronic.

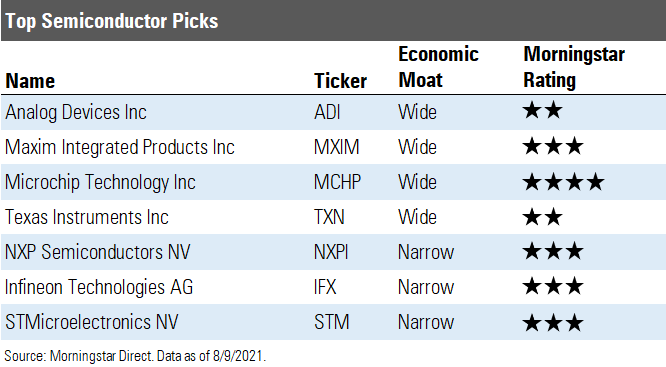

Our analysts view the semiconductor industry as fairly valued: “The chip shortages of 2021, and the robust demand, pricing, and factory utilization environment, appear to be priced into stocks in the near term,” but they recommend waiting for these stocks’ prices to drop before buying.

As of today, Microchip Technology MCHP is the most attractive. Here’s a closer look at this stock, according to Colello.

Microchip Technology MCHP "Microchip Technology is a leading supplier of microcontrollers, or MCUs, which are semiconductors that act as the brains within a wide variety of common electronic devices, from garage door openers to hands-free soap dispensers to electric razors and all types of products in between. We view Microchip as one of the best-run firms within the chip space and remain fond of the firm's ability to generate profitability and free cash flow under virtually any economic scenario.

"MCUs essentially recognize inputs, execute a program, and send an output. MCUs are often accompanied by analog chips that process real-world inputs such as temperature and pressure, so that, for example, a thermostat can recognize the current temperature and tell the MCU so that it can decide to turn the heating unit on or off.

"The businesses of MCUs and analog chips have many desirable features. Neither type of chip is overly dependent on leading-edge designs, so capital investments tend to be relatively low. These chips are selected based on performance rather than price, because they make up only a tiny portion of a product's overall cost. Customers tend to be loyal, and chips have long product lives because switching to a competing MCU could involve redesigning the entire end product. Thus, MCU and analog firms are able to maintain high margins and returns on invested capital.

"Microchip's historical strength has been the 8-bit MCU segment. These chips tend to be used in a wide range of simpler electronic products, and as a result, Microchip benefits by not being overly exposed to a single technology segment or customer. Microchip faces more competition in the more advanced 16- and 32-bit MCUs, but the firm has been gaining ground, and the firm’s analog chip business has grown at a nice pace both organically and as the firm makes bolt-on acquisitions.

"Overall, we foresee healthy demand for Microchip’s products going forward. As more and more electronic devices become ‘smarter’ and connected to the Internet, Microchip’s MCUs and analog chips stand to benefit. Microchip will likely continue to make acquisitions in order to further expand its product portfolio."--Brian Colello, equity analyst

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)