Digging Into Vanguard Dividend Growth

The fund stands out for its focus on companies with a strong competitive advantage that can sustain and grow their dividends over time.

With $51.3 billion in assets, Vanguard Dividend Growth VDIGX ranks as one of Vanguard’s most successful actively managed funds. Manager Donald Kilbride has been at the helm since early 2006. Peter Fisher and Ashley Carew help manage the portfolio as part of Wellington Management’s three-person dividend growth team, which also draws on research from Wellington’s other portfolio managers and analysts. Kilbride and his compatriots target companies that they believe can achieve dividend-growth rates of at least 3% above inflation.

In this article, I’ll use Morningstar’s Global Risk Model to analyze the underlying characteristics of Vanguard Dividend Growth’s equity holdings. The portfolio stands out for its focus on companies with a strong competitive advantage that can sustain and grow their dividends over time.

Looking Under Vanguard Dividend Growth’s Hood

The fund maintains a relatively compact portfolio of about 40 stocks in large, established companies. Kilbride keeps portfolio turnover low and often holds on to or gradually adds to positions over many years; for example, he first purchased McDonald’s MCD and Procter and Gamble PG in 2002, and Coca-Cola KO in 2004. Despite the portfolio’s relatively short list of names, no holding made up more than 4% of assets as of March 2021. Kilbride’s pursuit of dividend growth isn’t limited to the United States; the fund currently holds about 10% in international stocks, primarily in Europe, the United Kingdom, and Canada.

Judged against its benchmark index, the Nasdaq U.S. Dividend Achievers Select Index, the fund's active share (a measure of portfolio overlap) stands at about 61.9%, indicating that less than 40% of the portfolio replicates the index. That shows clear evidence of active management as opposed to closet indexing.

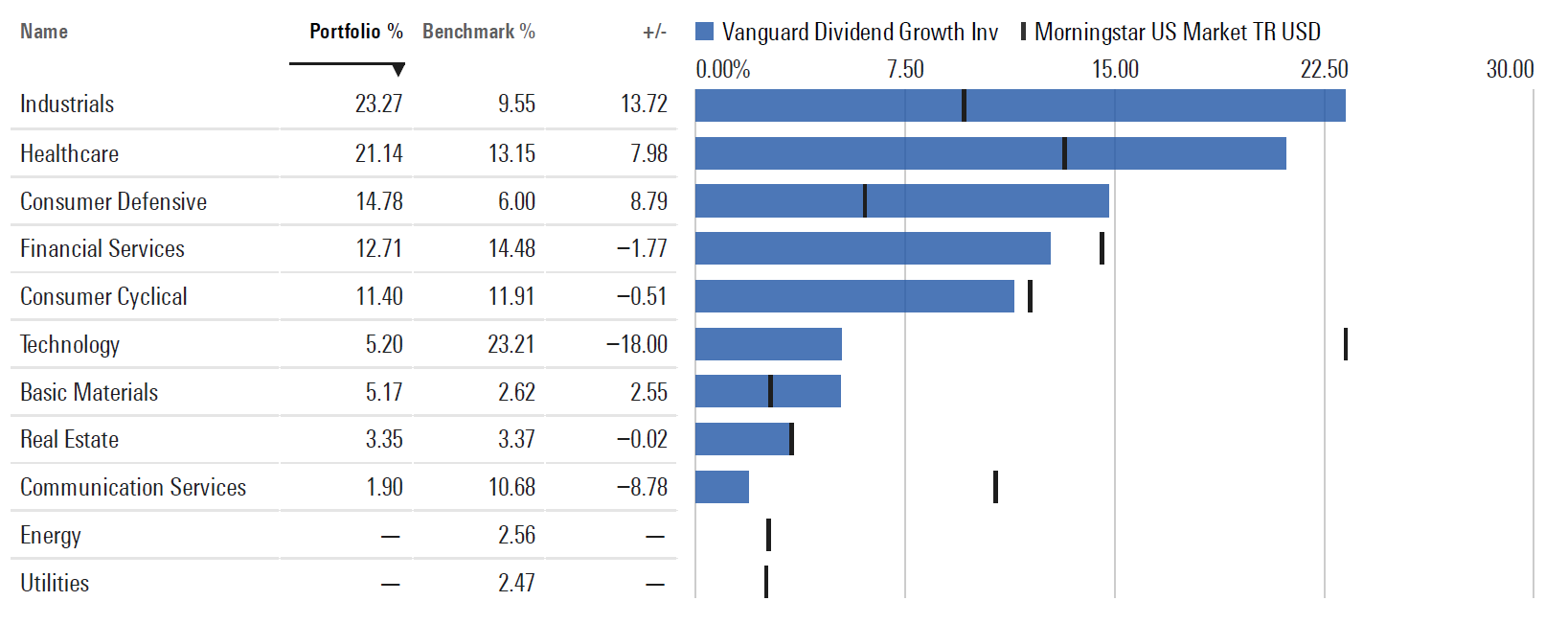

Vanguard Dividend Growth’s largest overweighting is in industrial stocks such as Union Pacific UNP, Northrop Grumman NOC, and Honeywell International HON, which make up about 23% of the portfolio. The fund also has large weightings in healthcare stocks such as UnitedHealth Group UNH, Johnson & Johnson JNJ, and Medtronic MDT, as well as consumer defensive holdings such as Colgate-Palmolive CL and PepsiCo PEP. It’s significantly underweight in technology stocks, which is one of the main reasons performance lagged in both 2020 and so far in 2021. It’s also light on communication services names such as Facebook FB, Alphabet GOOGL, and Netflix NFLX, which is another reason behind its weaker relative showing lately.

Exhibit 1: Sector Exposure

- source: Morningstar Direct, as of March 31, 2021.

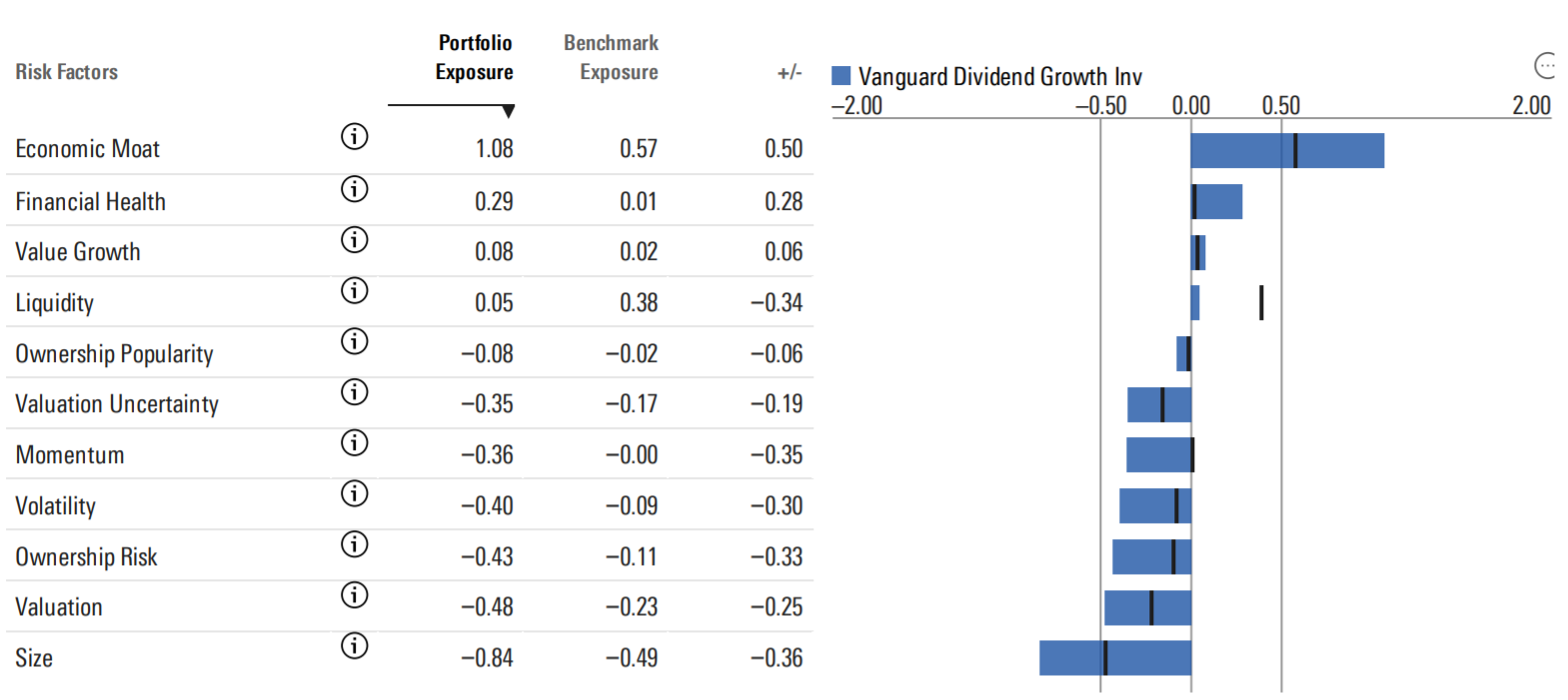

Next, let’s take a deep dive into Vanguard Dividend Growth’s holdings using the 11 style-based factors in our Global Risk Model.

How Vanguard Dividend Growth’s Holdings Stack Up on 11 Different Factors

The Morningstar Global Risk Model includes 11 style-based factors that help shed light on a portfolio’s underlying risk exposure. Six of the 11 style factors (Valuation, Valuation Uncertainty, Economic Moat, Financial Health, Ownership Risk, and Ownership Popularity) are based on Morningstar’s fundamental equity research and extensive ownership data. The other five factors (Liquidity, Size, Value-Growth, Momentum, and Volatility) are traditional risk factors that have been widely studied by academic research. We express each score in terms of the number of standard deviations from the average (also known as a z-score), with a score of zero indicating the average score for a universe of about 7,000 domestic stocks. We set the sign of each exposure so that positive numbers are generally associated with factors that have shown a positive effect on returns over time.

Exhibit 2: Risk Factor Summary

- source: Morningstar Direct, as of March 31, 2021.

Economic Moat: The Economic Moat factor is based on the Morningstar Quantitative Economic Moat Rating, which is designed to measure the strength of a firm's competitive advantage based on the sustainability of its profits. Higher scores suggest a firm will be able to keep competitors at bay for an extended period. Vanguard Dividend Growth's holdings score well above average on this factor, with a portfolio z-score of 1.08 versus 0.57 for the Morningstar U.S. Market Index. In fact, 31 of the fund's 41 holdings have wide Morningstar Economic Moats based on Morningstar's quantitative rating system, and it has more exposure to wide-moat companies than any other dividend-growth fund.

Financial Health: The Financial Health factor is based on strength of a firm's balance sheet. Higher scores imply stronger financial health and therefore a lower risk of bankruptcy. Stocks that score well based on this factor tend to hold up better during economic downturns, such as the global financial crisis in 2008. Vanguard Dividend Growth's holdings score above average on Financial Health, with an average z-score of 0.29 versus 0.01 for the Morningstar U.S. Market Index. Nearly all the fund's holdings have decent Financial Health scores, with only a few exceptions such as Deere & Co. DE and Raytheon Technologies RTX.

Value-Growth: This factor measures value and growth characteristics based on how the market is pricing a stock. If the stock's current price is high relative to a simple price estimate derived from earnings yield, dividend yield, and book value, that suggests the stock has higher growth expectations baked into its current price. On the flip side, a low current price indicates a value leaning. Kilbride looks for companies that are trading at reasonable prices, but the fund isn't a deep-value fund. As a result, its Value-Growth score is pretty close to the market average.

Liquidity: The Liquidity factor measures a stock's average trading volume over the past month relative to total shares outstanding. It's basically a measure of how quickly a stock's ownership base changes hands between different investors. Vanguard Dividend Growth's holdings score lower than the overall market for liquidity, but that probably reflects the fact that it doesn't own many ultra-popular names rather than any exposure to thinly traded stocks. Nearly all the fund's holdings are larger-cap names with ample trading volume, and liquidity doesn't seem likely to be a problem, especially in light of the fund's low-turnover style.

Ownership Popularity: The Ownership Popularity factor represents changes in popularity of a particular stock from the perspective of fund manager ownership. High Ownership Popularity scores indicate that more fund managers have been increasing their positions in the stock over the past several months. Vanguard Dividend Growth's holdings score about in line with the market based on this metric, with a portfolio z-score of negative 0.08 versus negative 0.02 for the Morningstar U.S. Market Index. Most of its holdings land toward the middle of the road on popularity, suggesting that it's neither chasing trends nor following a strong contrarian strategy.

Valuation Uncertainty: The Valuation Uncertainty factor is based on Morningstar's Quantitative Uncertainty Rating and measures the level of uncertainty embedded in a company's Quantitative Fair Value Estimate. Companies with less consistent operating earnings and capital spending tend to have less-stable cash flows, making it more difficult to pin down an estimated fair value. Higher scores imply greater uncertainty with a wider range of potential valuation outcomes. By extension, portfolios with high scores for Valuation Uncertainty tend to have more volatility in returns. Vanguard Dividend Growth's holdings score below average for Valuation Uncertainty, with a portfolio z-score of negative 0.35, compared with negative 0.17 for the Morningstar U.S. Market Index.

Momentum: The Momentum factor measures how much a stock risen in price over the past year relative to other stocks. Academic research has found that stocks with strong recent performance often continue performing well, at least over shorter periods. Vanguard Dividend Growth's holdings score well below average on Momentum, with a portfolio z-score of negative 0.36, compared with zero for the Morningstar U.S. Market Index.

Volatility: Our Volatility factor is based on a stock's range of historical prices over the past year. Vanguard Dividend Growth's holdings score below average for Volatility, with a z-score of negative 0.40 versus negative 0.09 for the Morningstar U.S. Market Index. Most of the portfolio's holdings in consumer defensive stocks and healthcare tend to have relatively stable stock prices, and the fund owns only a few higher-volatility names, such as Deere & Co. and PNC Financial PNC.

Ownership Risk: The Ownership Risk factor defines a stock's risk level based on the company it keeps. We gauge Ownership Risk by looking at the risk profiles of the funds that own shares in the same security. If funds owning the stock tend to have high risk profiles, we assign a higher Ownership Risk score. Not surprisingly, Vanguard Dividend Growth's holdings don't show high levels of ownership risk; in fact, almost none of its holdings score above average on this metric.

Valuation: The Valuation factor measures how cheap or expensive a stock is relative to Morningstar's Quantitative Fair Value Estimate, a statistical estimate of fair value based on a company's projected future cash flows. Higher scores indicate the company is undervalued and more likely to generate positive future returns. The fund scores well below average on this metric, with a z-score of negative 0.48 versus negative 0.23 for the Morningstar U.S. Market Index. This reflects Kilbride's preference for companies with solid prospects for sustainable dividend growth as opposed to cheap stocks that are cheap for a reason.

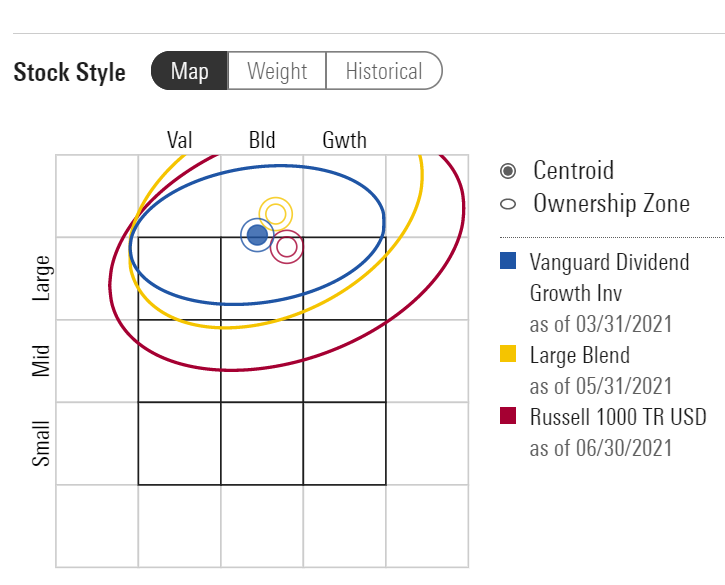

Size: The Size factor is based on the market capitalization of the stocks included in a portfolio, with higher scores indicating more exposure to smaller-cap stocks. Academic research has found that smaller-cap stocks tend to outperform over longer periods. Kilbride has a clear preference for large, established companies: The entire portfolio is in giant- and large-cap stocks, with no exposure to small- or mid-cap issues. Favoring the market's largest stocks was a tailwind during most of the past 10 years, but held back performance as small caps have pulled ahead since late 2020.

Exhibit 3: Morningstar Style Box

- source: Morningstar Direct, as of March 31, 2021.

Conclusion

As mentioned above, Vanguard Dividend Growth doesn't excel in every market, but its focus on quality growth stocks with wide economic moats has paid over time. It makes an excellent core holding for retirees and other risk-averse investors in tax-deferred accounts.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YGF5R6YDPJESJOU7XABKHHIP3Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)