How to Find the Right ESG Fund

How to find a sustainable fund that addresses the issues you care about and works well in your portfolio.

A lot of people are interested in the concept of sustainable investing, but they’re not sure what they’re looking for or where to begin their search.

One of the obstacles is the seemingly similar terms--sustainability; ESG, or environmental, social, and governance; impact investing; socially responsible investing. What do these labels actually mean?

Sustainable investing is also very personal. In the same way that investors have unique goals and risk tolerances, they also have their own beliefs and issues they care about. How can you get under the hood in a way that lets you see whether the fund is investing in line with those beliefs?

In this article, we'll walk you through our framework for classifying and evaluating sustainable funds. We'll also show you how to find a fund that considers the issues that matter to you most and is a good fit for your portfolio.

What Are Sustainable Funds?

At Morningstar, we frame sustainable investing as the overarching investment approach that incorporates environmental, social, and corporate governance criteria throughout the investment process.

Sustainable funds come in many different investment styles. As Morningstar’s director of sustainability research Jon Hale points out in his Sustainable Funds U.S. Landscape Report, most are diversified funds that invest in the asset classes and subasset classes that are often used as the building blocks of investors’ portfolios, such as large-cap blend funds, intermediate-term bond funds, or allocation funds. Therefore, sustainable funds can be used in lieu of traditional strategies in investor portfolios.

Under the broad umbrella of sustainable funds, we further classify funds into three buckets:

Diversified ESG funds broadly integrate ESG concerns throughout their security-selection and portfolio-construction process. From there, the specifics vary. For example, some strategies may focus on avoiding the worst ESG performers, while others emphasize those with the best ESG scores.

Impact funds take a more thematic approach, seeking investments that will benefit from adopting more-sustainable business models and from the transition to a low-carbon economy. Some funds employ outright exclusions such as coal, fossil fuels, tobacco, or weapons. Increasingly, sustainable funds are applying an impact lens to their portfolios, evaluating the impact of the companies whose stocks they hold, the use of proceeds of the bonds they hold, and their own stewardship activities. It's important to note, Hale points out, that any given sustainable fund may employ several of these approaches.

Sustainable sector funds, by contrast, focus on "green economy" industries like renewable energy, energy efficiency, environmental services, water, infrastructure, and green real estate. Green economy companies can be found across a variety of conventionally defined sectors, and, according to one estimate, they constitute 5% of global market cap.

How to Use Sustainable Funds in a Portfolio

ESG funds take an integrative approach to building a portfolio and emphasize stocks that are ESG leaders in their particular industry. This tilts the portfolio toward companies that are better equipped to manage ESG issues and therefore less likely to face financial risks such as fines, lawsuits, and reputational damage. Importantly, too, the portfolio that results from an integrative approach often has a more marketlike profile, meaning that its returns are less likely to diverge meaningfully from the benchmark (or index).

Funds that fall under the impact and/or sustainable sector headings may not be as well diversified (or marketlike). These types of funds may focus on a single sector or area of impact, or they may use negative (or exclusionary) screening, in which problem stocks or industries are avoided completely (rather than taking a best-in-class approach to an industry).

It comes down to investor preference, of course. The important thing to keep in mind is the more different an ESG fund's portfolio looks from the broad market--whether through exclusions or a focus on impact--the more likely its returns are to deviate from those of broad market indexes, for better or for worse.

How to Find Sustainable Funds

Let's say you're interested in finding a low-cost, diversified stock fund that you can use as a core holding, such as an ESG-minded alternative to an S&P 500 index fund or a total stock market index fund.

Maybe you're in the market for a bond fund, and you'd like to look at some funds that focus on green bonds (which are also called impact bonds).

Or maybe there's a cause that is very important to you, such as universal access to clean water or advancing women's leadership, and you're looking for a fund that uses investor assets to a create a measurable impact or solution.

Once you've narrowed down what you're looking for, you can use our ESG Screener to find it.

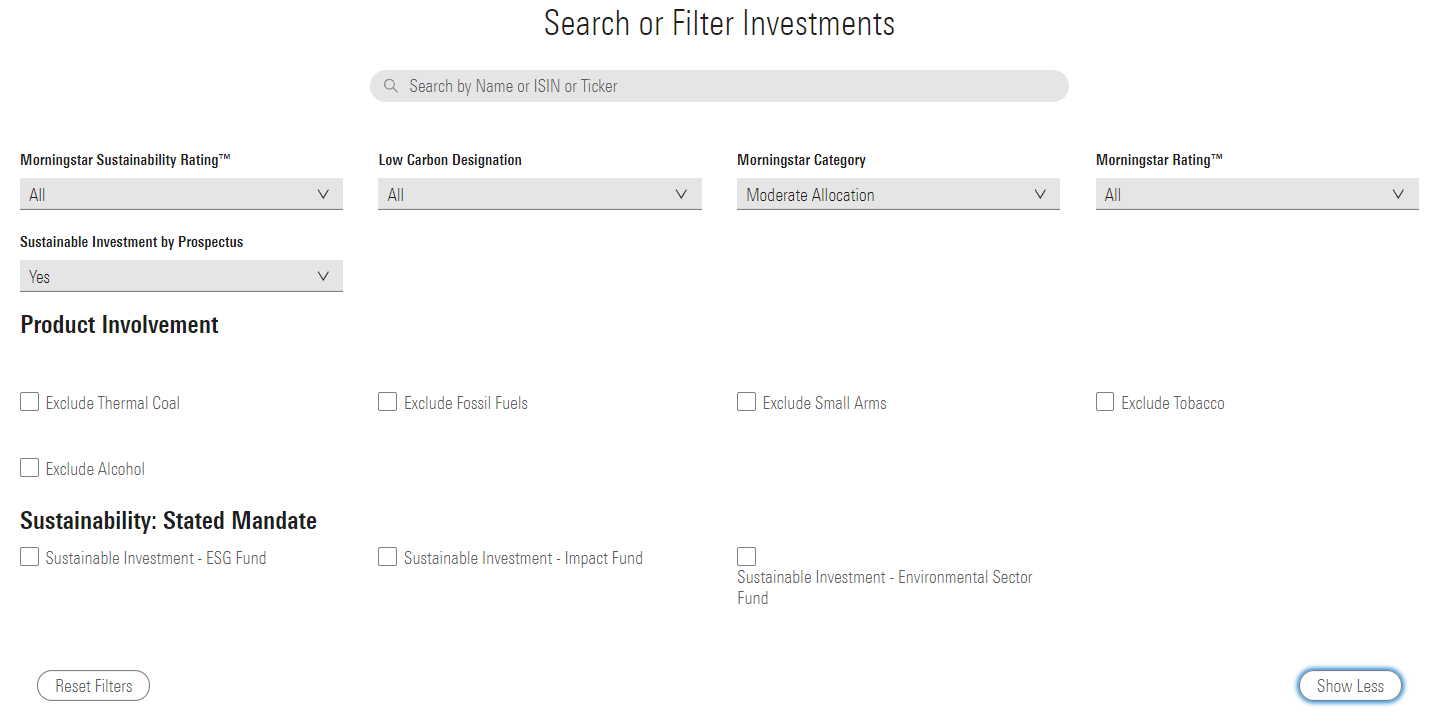

How to use the screener: In the screener interface (see screenshot below) find the dropdown menu that says "Sustainable Investment by Prospectus" and select "Yes." This step narrows the open-end fund universe to only those funds that state in their prospectus or other regulatory filings that they focus on sustainability, impact, or ESG factors.

From there, you can narrow your search to specific Morningstar Categories, such as large blend or fixed income.

To reveal some more granular prospectus criteria, extend the "Show More" screener menu. Using the "Product Involvement" criteria, you can narrow your search to funds that state in their prospectus that they avoid stocks of companies involved in the sale and manufacture of tobacco, alcohol, thermal coal, fossil fuels, and guns/small arms.

You can also search according to the three tiers of ESG funds in our framework, as discussed in more detail above. "ESG Funds" primarily incorporate ESG factors into the investment process or engagement activities. "Impact Funds," in addition to financial return, seek to deliver a measurable impact on specific issues or themes like gender diversity, low carbon, or community development. "Environmental Sector Funds" are strategies that invest in environmentally oriented industries like renewable energy or water.

Source: Morningstar.com.

How to Avoid the 'Greenwashers'

Unfortunately for investors, just because a fund says it considers ESG factors, doesn't mean it really integrates them into its investment decisions. It's murky. In fact, the SEC recently set up a Climate and ESG Task Force to examine transparency and completeness in ESG risk disclosure and sustainable investing strategies.

But one way investors can size up whether a fund actually integrates ESG considerations into its investment process is to see how much ESG risk is in the fund's portfolio. One would hope that a fund that claims to invests with a focus on ESG would expose investors to lower ESG risk than a traditional fund strategy in the same category.

The Morningstar Sustainability Rating (developed with Sustainalytics, Morningstar's ESG research partner) measures a fund portfolio's aggregate exposure to ESG risks. The rating measures the degree to which individual companies in the portfolio face financial risks from ESG issues, then it rolls those individual ESG Risk Ratings up into an overall portfolio-level score. The rating is easy to interpret: 5 globes means the overall portfolio has negligible ESG risk; 1 globe means it is exposed to significant ESG risk.

Looking to avoid fossil fuels? The Morningstar Low Carbon Designation, developed with Sustainalytics, helps investors easily identify funds that have very low carbon transition risks and low fossil fuel exposure.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)