What an Economic Rebound Could Mean for Corporate Bonds

Risks and rewards in the 2021 corporate-bond market.

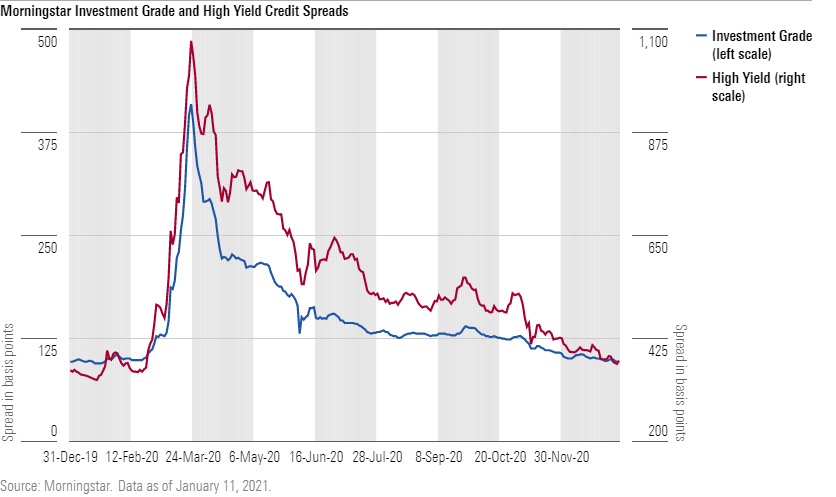

Corporate credit spreads have completely recuperated and are back to pre-pandemic levels--a notable move since it was only March 2020 when they reached their second-widest level in 20 years. As such, barring a sharp increase in underlying interest rates, we expect that the corporate-bond markets are setting up to provide a return that's equal to, or slightly lower than, their current yield. As of Jan. 11, 2021, the yield of the Morningstar US Corporate Bond Index (our proxy for investment-grade corporate bonds) was 1.88%, and the yield of the Morningstar US High-Yield Bond Index was 4.38%.

While the issuers that have suffered the most from the pandemic will continue to face headwinds in the first half of 2021, those headwinds will turn into tailwinds in the second half. Though there likely will be additional credit-rating downgrades over the next few months and the default rate will remain slightly elevated, we expect that broad vaccine distribution will pave the way for economic normalization, which will quickly help to bolster the credit metrics of those struggling companies.

The corporate credit spread is the extra compensation provided to investors to offset the credit risk of the corporate issuers. And even though corporate credit spreads are still near their lowest quintile of the past 20 years, the strong economic rebound we expect in 2021 and continued momentum in 2022 will provide support for credit metrics, and the default rate should drop to its historical average by the end of this year.

As of Jan. 11, 2021, the average corporate credit spread over U.S. Treasuries for investment-grade bonds was plus 97 basis points and plus 377 basis points for high-yield bonds. These corporate credit spreads over the past year are shown in the chart below.

Why We Expect a Strong Corporate-Bond Market in 2021 In addition to the strong economic growth and normalization we expect in 2021, there are a number of other factors that will help to support credit risk. For instance:

- In light of the outcome of the Senate race in Georgia, we expect that the combined Democratic executive and congressional branches will institute another round of fiscal stimulus on top of the most recent stimulus package. This would provide plenty of support for struggling businesses to survive in the near term as the economy rebounds over the course of the year.

- We expect that the Federal Reserve will maintain its highly accommodative monetary policy for as long as it can until inflation rears its ugly head. According to the Federal Open Market Committee's most recent Summary of Economic Projections, the Fed projects that the federal-funds rate will remain at 0% at least through end of 2023. Although long-term interest rates in the United States have ticked up to a little over 1.00% over the past few days, the yield on the 10-year is still below its pre-pandemic historical low of 1.50%. With interest rates in the U.S. near 1.00% and interest rates in other parts of the world at negative yields, investors are more than willing to stretch for additional yield and take on greater risk to capture that extra compensation.

- The Fed has not given any indication of when it intends to slow down its asset purchases. These open-market purchases mean additional demand for fixed-income securities, since every time the Fed buys bonds, those sellers need to then reinvest that cash, typically in more bonds. There was a record amount of new issuance in both the investment-grade and high-yield markets last year to satisfy this demand. To boost liquidity and survive the pandemic, corporations rushed to market to refinance near-term debt, prefund maturities for the next few years, and raise extra cash. However, we expect that corporate new-issue supply will decline in 2021, leaving less supply to satisfy investor demand.

- Rising oil prices will help to bolster bonds in the energy sector over the near term. Making up 13% of the high-yield index, energy is the largest individual sector, and it is the second-largest sector of the investment-grade index at 11%. The energy sector was hit hard during 2020 as shutdowns decimated gasoline demand, but with the glut of excess supply burning off, oil prices have been rising toward our price target of $55 per barrel for West Texas Intermediate. Corporate bonds in the energy sector had been some of the hardest-hit during the downturn but have recovered much of those losses and still have room to appreciate.

What Are the Risks for Corporate Bonds in 2021? Still, the greatest risk in 2021 for investors is rising interest rates. As yields have dwindled, the duration of corporate bonds has increased--and longer duration means greater price volatility.

With their lower coupons, investment-grade bonds have longer durations and are more sensitive to changes in interest rates than high-yield bonds. The current duration of Morningstar's investment-grade index is 8.5 years, and the high-yield index's is 3.7 years. This roughly means that if the yield were to jump 1%, the value of the investment-grade bonds in the index would fall by approximately 8.0% and high-yield bonds would fall about 3.5%. Depending on how long it takes for interest rates to rise, some of the losses could be mitigated by the yield carry (interest payments) of the bonds in the index. For investors concerned that interest rates could spike this year, short- and medium-duration funds are much less sensitive to rising rates.

Rising interest rates are typically indicative of the economy improving, so this would mean that corporate credit risk should be declining. As credit risk declines, investors do not require as much compensation for the risk of a potential future default. As corporate credit spreads tighten, it helps to offset some of the increase in interest rates. Conversely, declining interest rates are typically indicative of a weakening economy and rising credit risk, which then is reflected in widening credit spreads.

Another potential risk to corporate bondholders this year is a resumption in debt-funded acquisitions, which typically result in heightened debt leverage and higher credit risk. However, after living through the free-fall and liquidity constraints of early 2020, management teams will be especially wary of leveraging up their balance sheets too much and will be unlikely to risk credit-rating downgrades. Corporations could be willing to issue debt to repurchase shares and leverage up their balance sheets at the expense of their credit ratings, but we expect those instances to be limited in 2021.

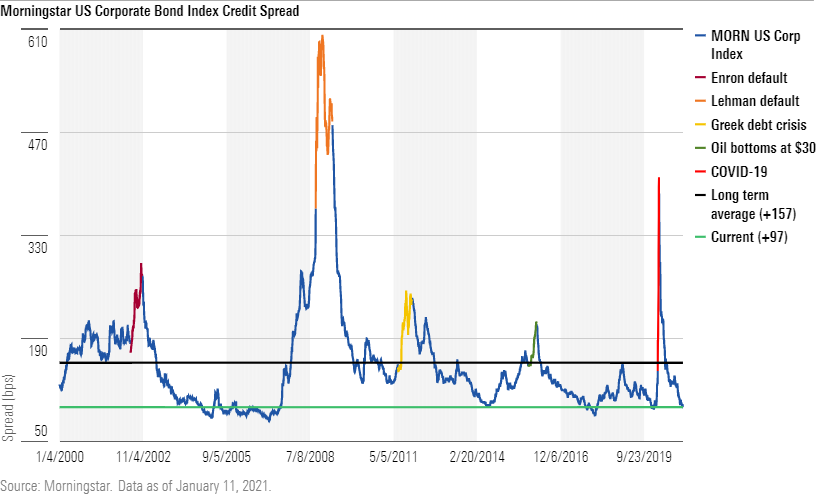

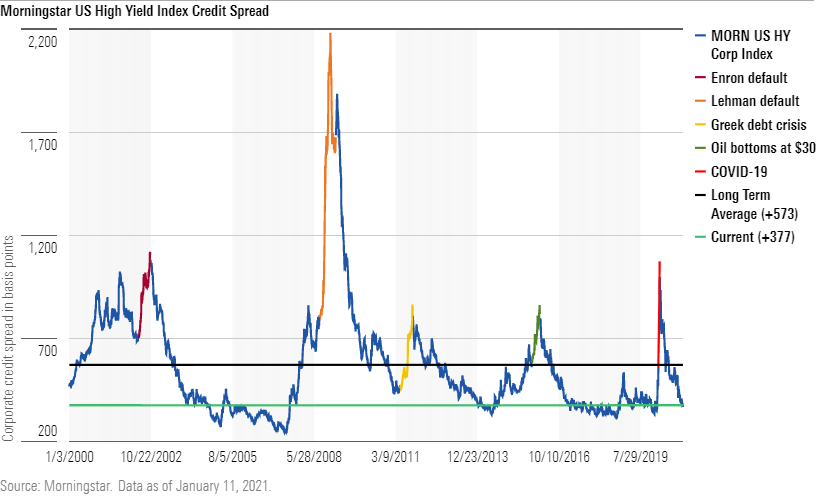

How Do Current Corporate Credit Spreads Compare With Historical Averages? In bond vernacular, corporate credit spreads are expensive as the low spreads provide only limited compensation for credit risk. Over the past 20 years, investment-grade spreads have been lower than they currently are only about 15% of the time. In the high-yield market, credit spreads have been lower only about 20% of the time. As such, we do not expect credit spreads to tighten much from here.

Currently, the average corporate credit spread of the investment-grade index is plus 97 basis points. As shown below, this is substantially tighter than the average we have seen over the past 20 years; however, we note that the average is skewed about 10 basis points higher from the worst of the global financial crisis. The tightest that this index ever traded was plus 80 basis points in February 2007.

The current corporate credit spread of the high-yield index is plus 377 basis points. As shown below, this is also substantially tighter than the average we have seen over the past 20 years; however, the average is skewed about 40 basis points higher from the worst of the global financial crisis. The tightest that this index ever traded was plus 241 basis points in June 2007.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)