How to Temper a Momentum Strategy

The approach can struggle when the market changes direction or market volatility spikes.

A version of this article previously appeared in the August 2020 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

The coronavirus pandemic rocked global markets in the first quarter of 2020. But momentum exchange-traded funds navigated that period fairly well. IShares Edge MSCI USA Momentum Factor ETF MTUM, which has a Morningstar Analyst Rating of Silver, kept pace with the Russell 1000 Growth Index. Its international sibling, Silver-rated iShares Edge MSCI International Momentum Factor ETF IMTM, beat the MSCI All County World Index ex USA Growth by 2.8 percentage points during that period.

Such an occurrence is unusual but not improbable. Momentum strategies typically struggle when the market abruptly changes direction because the historical stock performance they use to predict future performance is no longer relevant to current market conditions.

The circumstances surrounding the coronavirus sell-off were an exception. MTUM and IMTM entered 2020 with heavy allocations to defensive sectors, including utilities, consumer staples, and healthcare, which provided some ballast as the market declined.

As it turns out, their emphasis on defensive sectors heading into 2020 was not an act of clairvoyance. Both funds made that transition in the wake of the 2018 market correction, when defensive names had strong past performance, and they stuck to those allocations through the 2019 rally. Their defensive stance heading into the new year was more coincidental than intentional. Understanding this context is important. Momentum strategies won't always find themselves so well-positioned to bear the brunt of a bear market.

Key Risks Momentum strategies perform well when markets persistently trend in one direction, allowing past performance to forecast near-term future performance. The most widely accepted reason for this anomaly rests with investor behavior. Market participants likely digest new information more slowly than they should, causing a trend to develop as they incorporate that information into market prices. And that trend can persist after a stock's price reaches its intrinsic value.

Along that line of reasoning, momentum strategies perform poorly when past information no longer serves as an accurate predictor of near-term future performance, which typically occurs when the market changes direction or market volatility spikes. This doesn't happen often, but the effect can be profound when it does.

High Volatility Periods of heightened volatility can disrupt the trends that momentum strategies thrive on. In these periods, markets are deluged with new information and investors can't agree on what that information means for future stock performance. Persistent trends all but disappear as the market tries to forge a new direction.

Turbulent periods, like 2008's global financial crisis, help illustrate this weakness. The latter half of 2008 saw financial markets wrestling with rising bankruptcies, a dramatically slowing economy, increasing unemployment, and the potential failure of major financial institutions. The future was all but certain. The MSCI USA Momentum Index, the benchmark tracked by MTUM, underperformed the Russell 1000 Growth Index by 10 percentage points when volatility spiked between July 2008 and February 2009.

Changes in Market Direction Abrupt changes in market direction are also problematic for momentum strategies, despite the exception of the first quarter of 2020. During those inflection points, leadership among stocks or market segments shifts and the past is no longer prologue. Momentum strategies tend to overweight risky stocks during market rallies. That improves their performance when the market is appreciating, but risky holdings can eat away at performance when the market eventually goes south. When the market emerges from a drawdown, momentum strategies tend to overweight defensive stocks, which often lag in the subsequent recovery.

The latter situation unfolded after volatility subsided in 2009. Between March and July of that year, the MSCI USA Momentum Index held a heavy dose of defensive stocks, which helped explain why it underperformed the Russell 1000 Growth Index by 7.6 percentage points during that time.

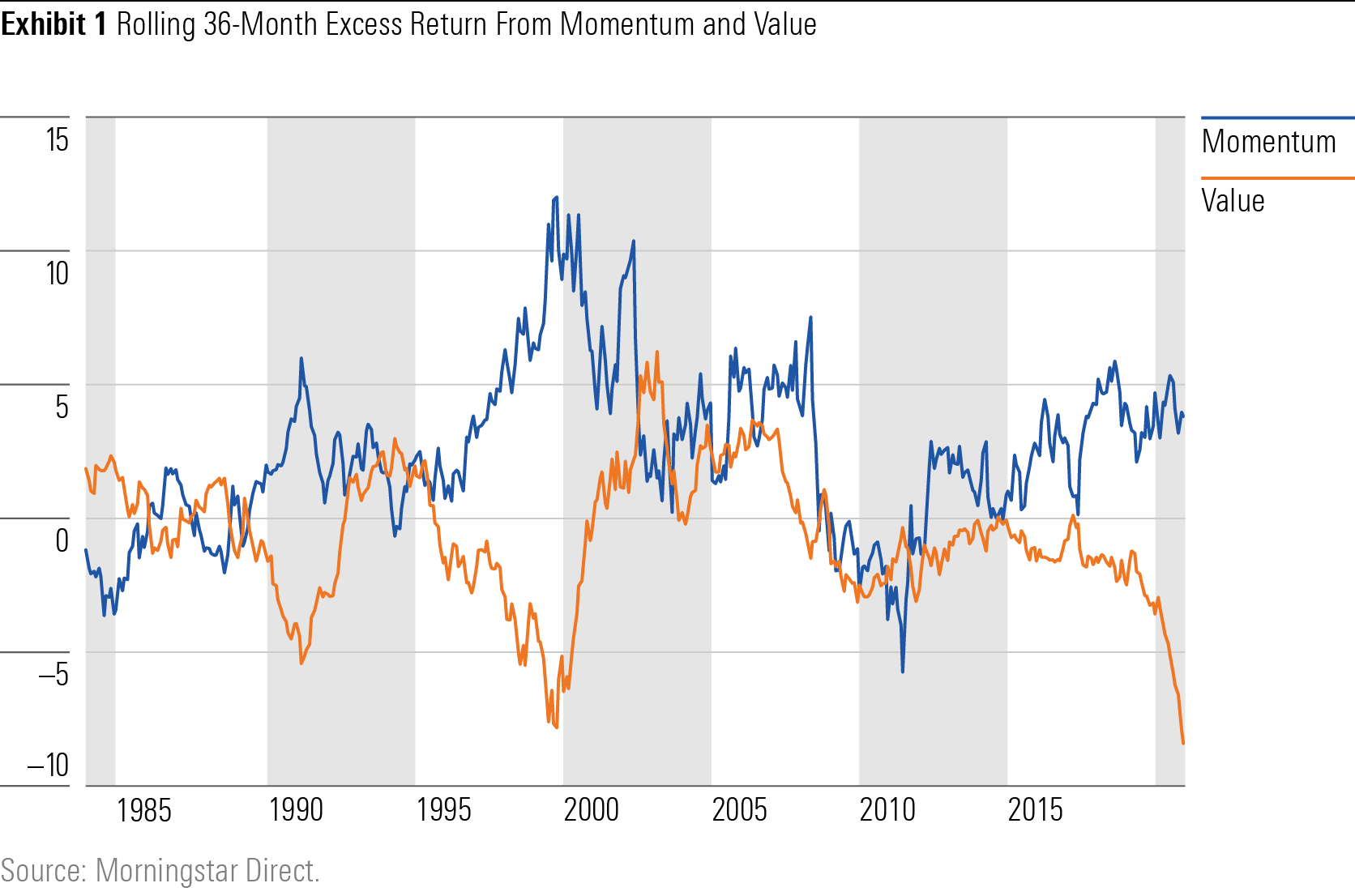

Value Is in Favor Momentum strategies also struggle when value investing works well. Historically, the active returns from these strategies have been negatively correlated, as Exhibit 1 illustrates. This is more than just a statistical relationship. Value strategies outperform because investors overreact to long-term trends, whereas momentum is driven by an underreaction to new information. These opposing behaviors illustrate why one style does poorly when the other does well.

Though no measure will completely eliminate these risks, there are some safeguards that can soften the edges and create a more palatable momentum strategy.

Taking the Edge Off Adjusting each stock's momentum for its historical risk can help take some of the edge off. This approach can steer momentum portfolios away from risky stocks during market rallies. It can also shift their focus to stocks with more consistent price momentum, which have a better chance of maintaining their positive performance in the future.

MTUM uses this type of adjustment, dividing each stock's price momentum by its trailing three-year volatility. It also has the freedom to perform a conditional rebalance when the market's volatility reaches extreme levels. That allows MTUM to rebuild its portfolio using recent information that is more relevant to current market conditions.

Momentum strategies often endure frequent rebalancing and high turnover to maintain their exposure to stocks with strong momentum. MTUM only rebalances its portfolio semiannually to keep turnover and trading costs manageable, which can lower its exposure to the momentum factor and contribute to lower risk.

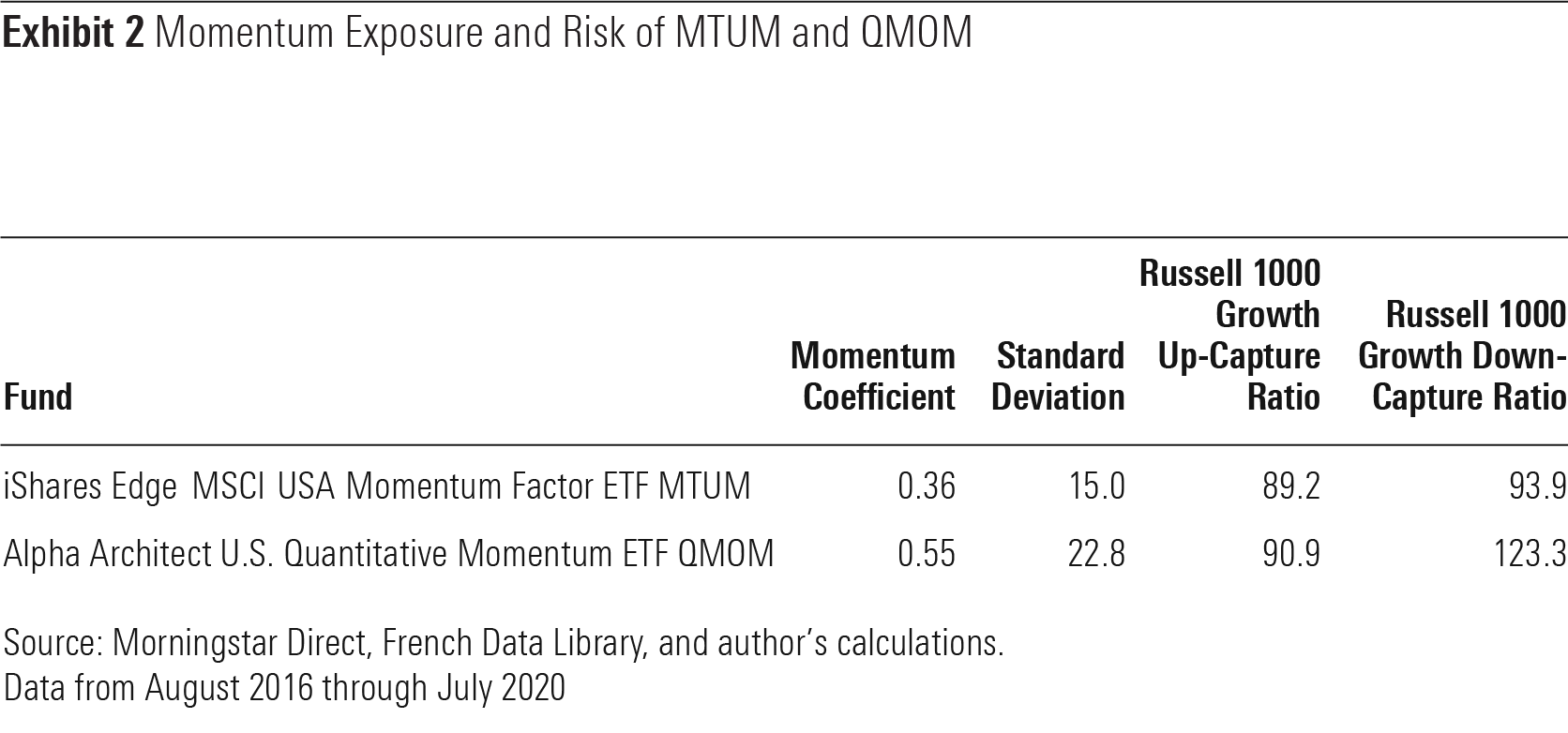

Comparing MTUM to Alpha Architect U.S. Quantitative Momentum ETF QMOM illustrates the trade-off between momentum exposure and risk. QMOM targets stocks with quality momentum that is likely to persist. But the technique employed doesn't control risk as well as the risk-adjustment in MTUM. QMOM also has a more compact portfolio, holding just 50 high momentum stocks, and reconstitutes its holdings quarterly. That translates into more potent exposure to the momentum factor than MTUM, as shown in Exhibit 2.

This exhibit also shows that QMOM's volatility was considerably higher than MTUM's over the four years through July 2020, as was its downside-capture ratio. This higher risk is the cost of stronger momentum exposure.

Momentum Complements Value Risk adjustments can temper the volatility of a momentum strategy. But the most effective way to curb the risk of a momentum portfolio is to pair it with a complementary value fund, as they tend to work well at different times.

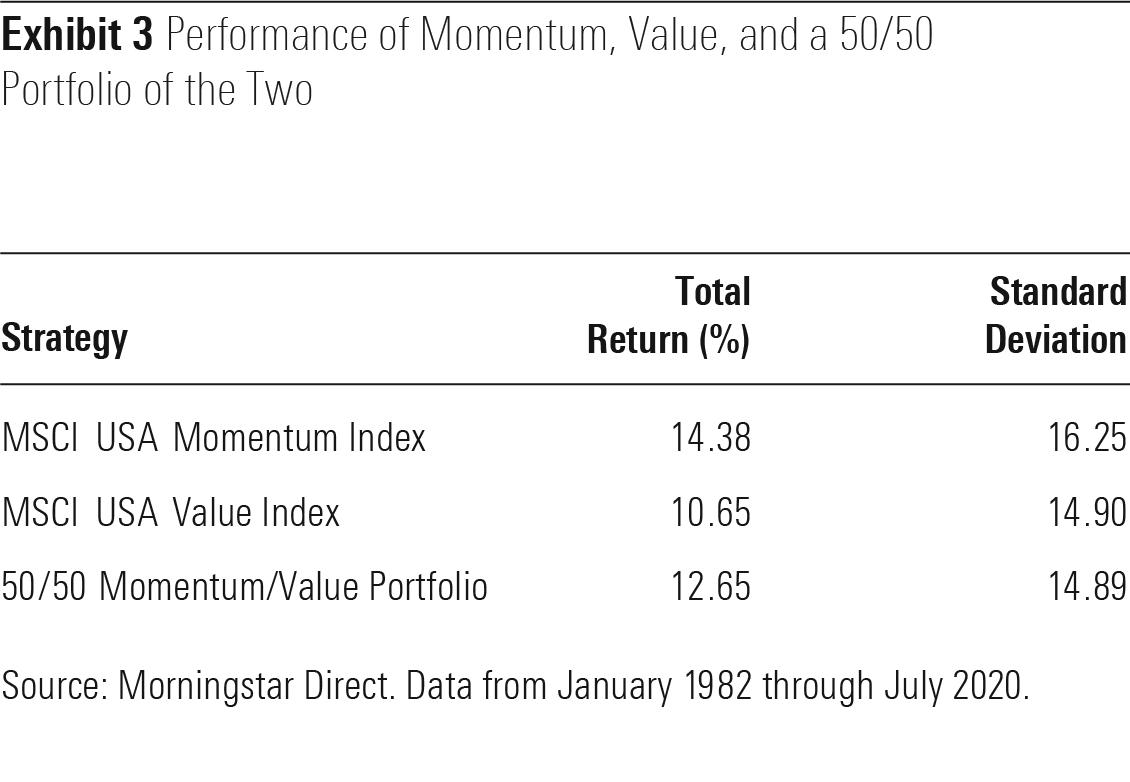

Exhibit 3 shows the results of a 50/50 momentum/value portfolio using the MSCI USA Momentum and MSCI USA Value indexes. The strategy was rebalanced annually back to a 50/50 allocation at the end of each year. The combination of value and momentum, with their negative correlations, resulted in a standard deviation nearly identical to that of the value index.

There is no way to fully eliminate momentum's risks. That isn't necessarily a bad thing. This risk prevents the effect from being completely arbitraged away. That's part of the reason momentum should continue working.

Investors interested in pursuing momentum might consider MTUM and IMTM. These are two of Morningstar's top-rated momentum strategies in the large-growth and foreign large-growth Morningstar Categories, respectively. Both funds build their portfolios using stocks with strong risk-adjusted momentum, can refresh their portfolios during volatile periods, charge a low fee, and provide solid exposure to the momentum factor. While these are fine as stand-alone strategies, they are more attractive when paired with low-cost value funds, like Gold-rated Vanguard Value ETF VTV.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)