What Are Fund Flows and Why Do They Matter?

Here’s what you need to know to start thinking about flows.

What Are Fund Flows? Fund flows, also referred to as asset flows or just "flows," measure the net movement of cash into and out of investment vehicles like mutual funds and exchange-traded funds. Fund flows do not reflect the performance of the investment, only how investors move their money.

Outflows reflect share redemptions, or when investors take their money out of a fund, while inflows reflect share purchases.

We can look at flows by share class, fund, Morningstar Category, asset class, and more to see how investors are moving their money. Fund companies report flows at the share-class level. These share-class level flows can then be aggregated to get the cumulative flows of larger segments of the market.

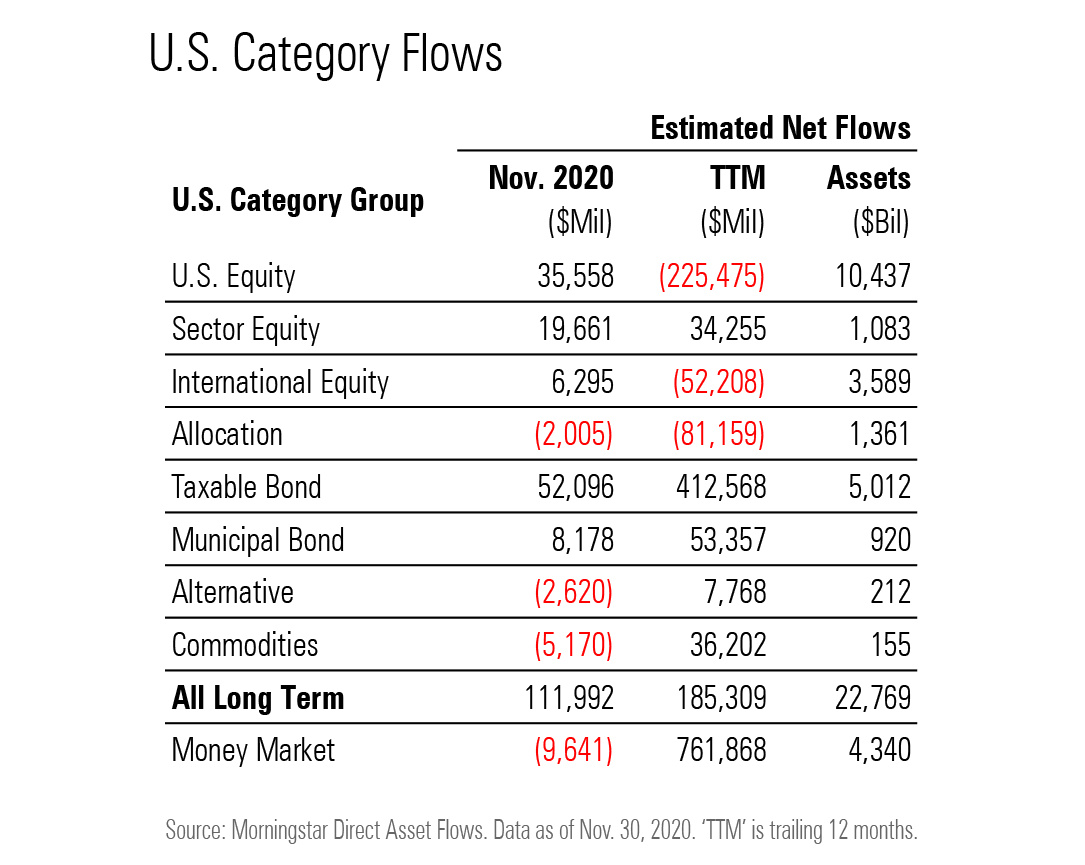

Below is an example from Morningstar's November 2020 monthly flows report of how we can look at aggregated fund flows. The figures in the "Nov. 2020" column are the sum of the flows into and out of the mutual funds and ETFs that belong to each category during the month, and the figures in the "TTM" column represent the flows into and out of the category over the course of the 12 months ending in November. The "Assets" column on the right is the sum of the total net assets of the underlying funds in each category as of Nov. 30, 2020.

Flows can be reported in dollar amounts like the table above or by organic growth rate, which expresses flows as a percentage of overall assets. Organic growth rate, or OGR, is calculated by taking the cumulative flow for a period and dividing by the beginning total net assets.

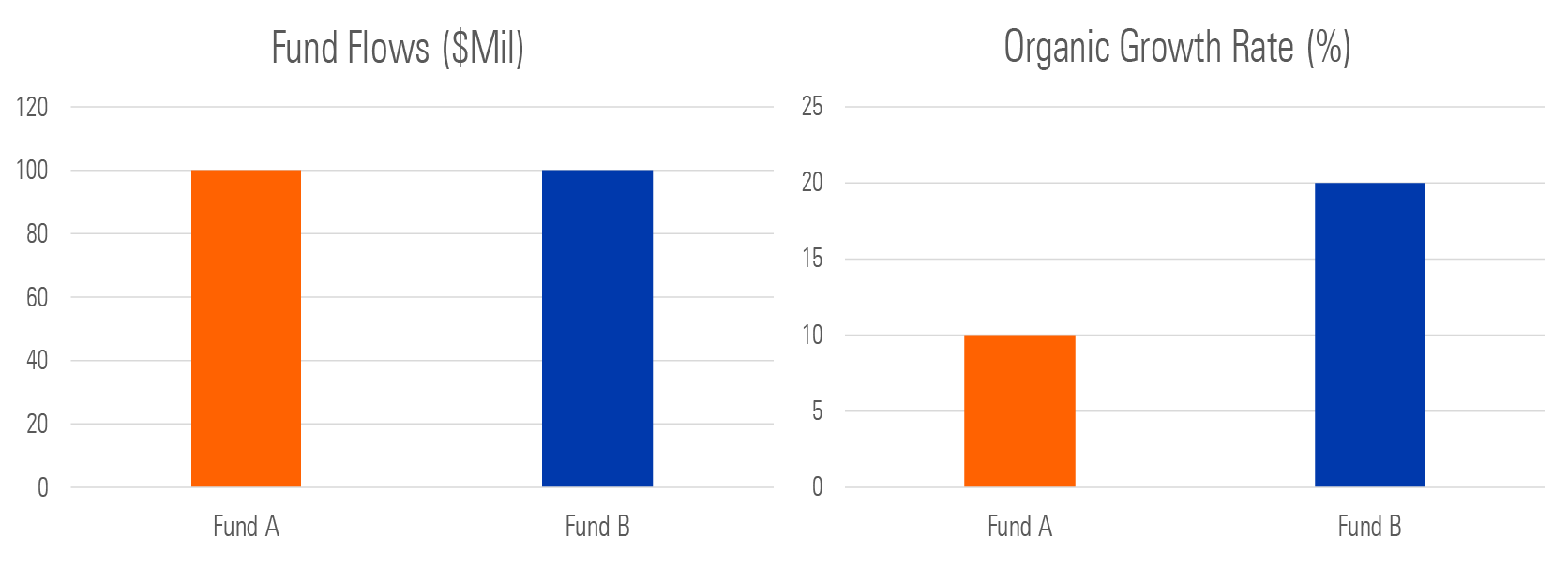

Representing the movement of cash as a percentage of total assets can help make comparison easier. For example, let’s say two funds, Fund A and Fund B, both experience $100 million of inflows. We know that they experienced the same amount of inflows, but does that dollar amount mean the same thing to both funds?

Now imagine that Fund A started with $1 billion in assets while Fund B started with $500 million. The $100 million of inflows is more significant to Fund B, which started with a smaller asset base. The organic growth rate makes this clear even without looking at the size of each fund: Fund B’s organic growth rate of 20% is double that of Fund A.

Looking at organic growth rates also helps put flows in context. The amount of assets in funds has grown significantly over the last two decades; in the United States, mutual funds and ETFs (excluding money market funds) collectively had less than $5 trillion in assets at the start of 2000. By the start of 2021, that number exceeded $23 trillion. Throughout 2020, we saw some big flows (in terms of dollar amounts) into different segments, but these flows aren’t necessarily large in terms of organic growth rate. It’s one thing to understand that equity funds lost tens of billions of dollars in a given month; it’s another thing to realize that might be less than 1% of the total assets in that group.

Why Do Fund Flows Matter? Broadly, fund flows are a window into investor behavior and are often considered an indicator of investor sentiment. Inflows may suggest that investors are optimistic about potential future returns while outflows suggest that investors are more wary.

Fund flows have long been viewed as a meaningful investment signal, especially in the equity space. The idea is that strong flows into equity funds drive up stock prices, attracting more return-chasing investors and bidding up prices further. Just as inflows beget more inflows, outflows beget more outflows, which in turn leads to falling stock prices.

If this holds true, security prices should move in the same direction as fund flows. Thus, investors may find opportunities by paying attention to flows; investors who target the least popular areas of the market stand to benefit when sentiment turns. Morningstar’s “Buy the Unloved” strategy based on this idea has seen success since its launch in 1994.

Are Fund Flows a Reliable Investment Indicator? As it turns out, interpreting fund flows and their relationship with performance isn't cut and dry, and trends have emerged that call the signaling power of flows into question. For example, persistent outflows have plagued U.S. equity funds even during periods of strong market performance. If fund flows were a reliable indicator, we would expect flows and performance to move in the same direction. Strong market performance would go hand in hand with strong inflows as investors chase returns.

Rebalancing may be at least partially to blame for this divergence. During periods of strong stock performance relative to other asset classes, the value of equity positions will increase relative to the rest of the portfolio. Investors may then choose to redeem equity fund shares and lean into other asset classes to maintain a certain asset allocation.

Morningstar's monthly asset flows commentary breaks down U.S. fund flows to identify trends and give context to the numbers. Morningstar's annual global fund flows report breaks down flows by category group, region, asset class, and more, analyzing what these trends reveal about investor preferences and behavior.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)