Stakeholder Votes Divided on Social Justice

Proxy voting reveals disagreement between the influential majority and smaller shareholders on diversity, equity and inclusion issues.

Corporations and investment firms have pledged publicly to advance racial equality in recent months by addressing workplace and operational biases.

In 2019, before people across the United States were compelled to examine their own roles in systemic racism, resolutions for the 2020 proxy-voting season had been filed and served as signs of what was to come. The issues they address--from worker treatment to technologies of surveillance--seemed to anticipate economic, social, and political fault lines, months before they surfaced.

But when votes were cast by stakeholders on these resolutions addressing inequality, Morningstar found a disparity between how majority and minority stakeholders viewed matters concerning diversity, equity, and inclusion.

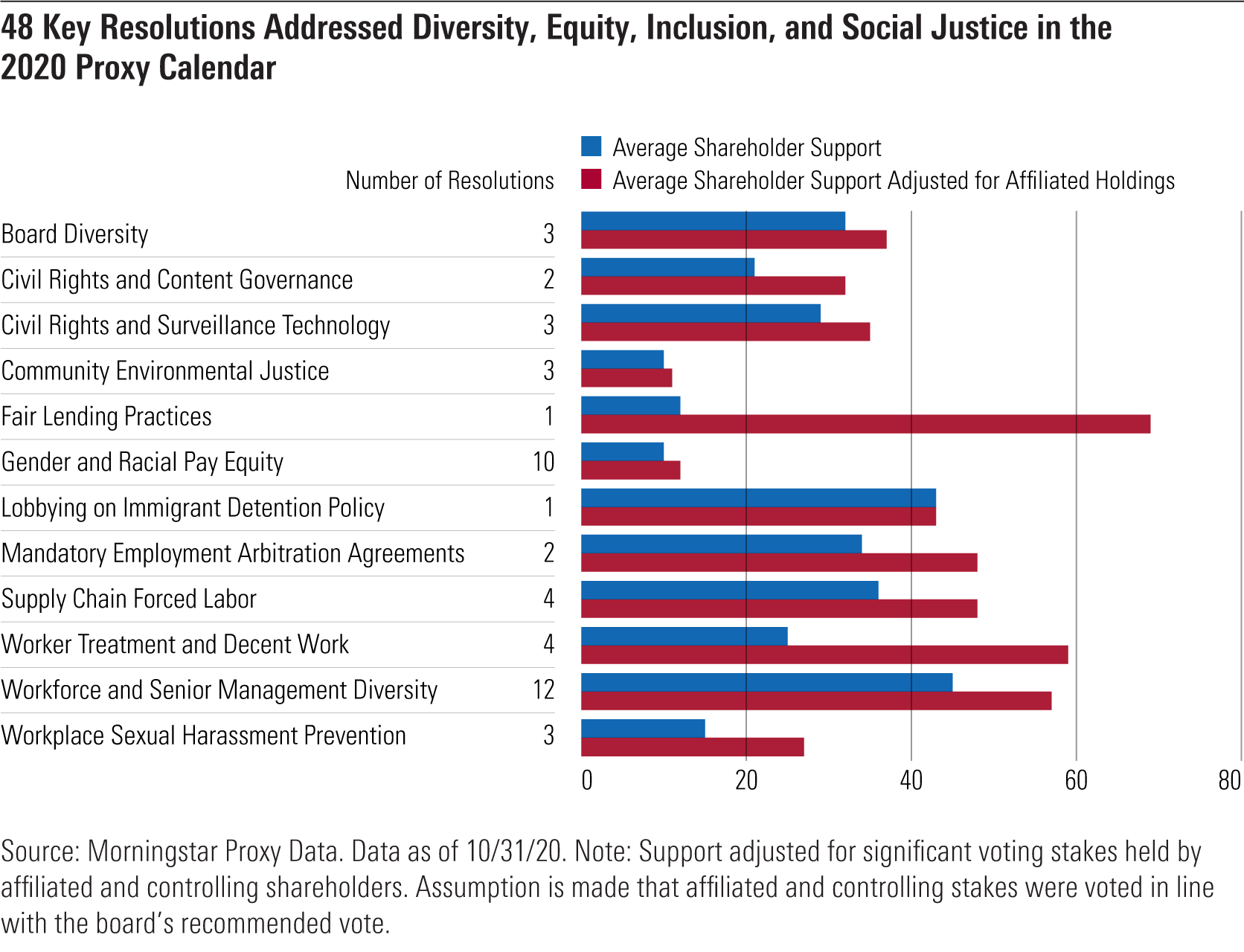

Morningstar identified 48 key resolutions on investor concerns related to racial equality that were brought to vote in 2020. Funds offered by the 20 largest fund companies, based on U.S. equity assets under management as of second-quarter 2020, voted on a variety of DEI and social justice matters on the ballot.

Racial Inequality on the Ballot Shareholders typically cast their votes on important company decisions and resolutions via proxy, like mail or online; most don't appear in-person for the annual meeting where votes are cast. This provides a sense of democracy to how companies operate.

According to our research, 48 key resolutions devoted to DEI efforts were voted on at 39 shareholder meetings and were supported by an average of 27% of votes.

Eight of these key resolutions were supported by an outright majority of shareholders. An additional seven resolutions were supported by a majority of nonaffiliated shareholders after removing from the vote counts the impact of large stakes (more than 5% of voting shares) controlled by insiders, often founders, as well as stakes held by parent companies.

Twenty-three resolutions were supported by at least 40% of minority, nonaffiliated shareholders.

A high proportion of these resolutions came to vote at companies where affiliated or controlling shareholders exert a strong influence on vote outcomes relative to minority, nonaffiliated shareholders.

Often this influence is exerted via dual class capital structures with uneven voting rights. Directors and officers with founder or founding family links often hold a significant--greater than 5%--stake. In some cases, parent companies may hold a majority stake in the company, thereby controlling a majority of shares voted.

Where a resolution receives 15% or less support, it may get overlooked--appearing to have failed to convince a broad enough cross-section of shareholders to cast their votes "For."

However, when we stripped out the impact of significant affiliated and controlling stakes, we found a much higher level of support for resolutions addressing DEI and social justice on the ballot--many with initially low levels of support in fact were supported by a significant portion of the shareholder base, including many of the 20 large fund providers.

Our research takes into account the influence of controlling and affiliated voting stakes in assessing the influence of large fund providers’ votes on resolution vote outcomes and, by extension, on the broader influence of the resolution in addressing racial inequality.

Minority Investor Voices Are at Risk of Being Stifled The proxy process secures the ability of minority, or noncontrolling, shareholders to voice their concerns including those connected to DEI matters.

When the impact on vote outcomes of significant affiliated and controlling shareholders is removed, minority shareholder support is often higher than it appears in the reported vote.

Twenty-seven of the 48 resolutions were filed at companies where affiliated shareholders hold significant voting stakes or where majority voting power is held by a single interest.

Removing these votes, by assuming that affiliated and controlling shareholders cast their votes in line with the company board’s recommendation--in all 48 cases, "Against" the shareholder motion--reveals that average minority shareholder support was closer to 39% across all 48 resolutions and 43% across the 27 resolutions impacted by affiliated or controlling voting stakes.

In late September, a new federal rule was implemented by the SEC that will limit the influence of small investors, effectively handing greater power to affiliated holders of shares. It raises the required resubmission threshold levels of support. For consecutive submissions within any five-year period, starting in 2022, thresholds qualifying a resolution for resubmission will be raised from existing levels--3%, 6%, and 10%--to 5%, 15%, and 25%. This could affect how receptive boards are to minority investor concerns--particularly with respect to social issues like racial justice.

For instance, human rights concerns were brought to a vote at three meatpacking companies--Sanderson Farms SAFM, Tyson Foods TSN, and Pilgrim's Pride PPC--asking the boards of directors to conduct and share the results of due-diligence assessments of poultry-plant working conditions. The resolutions note that employees at poultry plants are disproportionately Black, Latino, and Asian.

In the case of Tyson Foods and Pilgrim's Pride with controlling shareholders, overall shareholder support was just 14.6% and 13%, respectively. But removing the controlling stakes held by the Tyson family and JBS USA Holdings, respectively, we estimate outside shareholder support to be closer to 59% and 73% support.

Much of this support came from large funds holding the stock. Of the 18 large U.S. equity fund providers that voted on the resolution at Tyson, 10 supported it and seven voted "Against" (Fidelity Investment’s funds opposed the motion, but Geode supported it). Of the 16 fund groups voting on the Pilgrim’s Pride resolution, 12 voted "For," three opposed it, and one abstained.

At Santander Consumer USA Holdings, a vehicle finance lender, the board was asked to investigate data showing that African American and Latino buyers paid an interest-rate premium compared with white buyers with the same creditworthiness. Removing the votes of its parent--Spanish financial services company Santander Bank SAN--raises support to 69% from 12%.

Of the 16 fund groups voting on this issue, only three opposed it and one abstained; at one fund company, the votes were mixed but predominantly "For." The remaining 11 fund groups voted "For" the motion.

These cases illustrate that fund companies’ proxy votes could become pivotal in securing a place on the ballot for key DEI and social justice issues in future proxy seasons.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)