The Best Municipal-Bond Funds

Here are the highest-rated mutual funds and ETFs across a series of Morningstar’s municipal bond fund categories.

Investors rely on bonds for many reasons: funding short-term goals, diversifying an equity-heavy portfolio, or generating income during retirement, to name a few. Before getting down to choosing a bond fund, however, step back and consider why you need one. What role is it playing for you?

Once you know what need a bond fund would fill, figure out whether a taxable-bond fund or municipal bond fund is a better choice for you. If you're investing via a tax-deferred account like an IRA or 401(k), a taxable-bond fund will be the better match. If you're investing in a taxable account, however, municipal bonds might be the better choice on an after-tax basis.

Why? Municipal bonds, which are issued by state and local governments, offer tax advantages to investors in higher tax brackets. So even though a muni-bond fund’s yield may look shrimpy when you compare it against the yield on a similar quality and similar term taxable-bond fund, that muni fund’s yield doesn’t reflect the tax advantages that may apply to you. How can you determine whether there’s a tax advantage if you take the muni-bond route? Walk through our five-step program to find out.

If there is in fact a tax advantage for you, you can begin the search for a muni-bond fund with the term and interest-rate sensitivity that meets your time horizon and appetite for risk. We suggest that you begin your search with Morningstar Medalist Funds--funds that we think are most likely to outperform over a full market cycle thanks to their competitive advantages, such as low costs and solid processes.

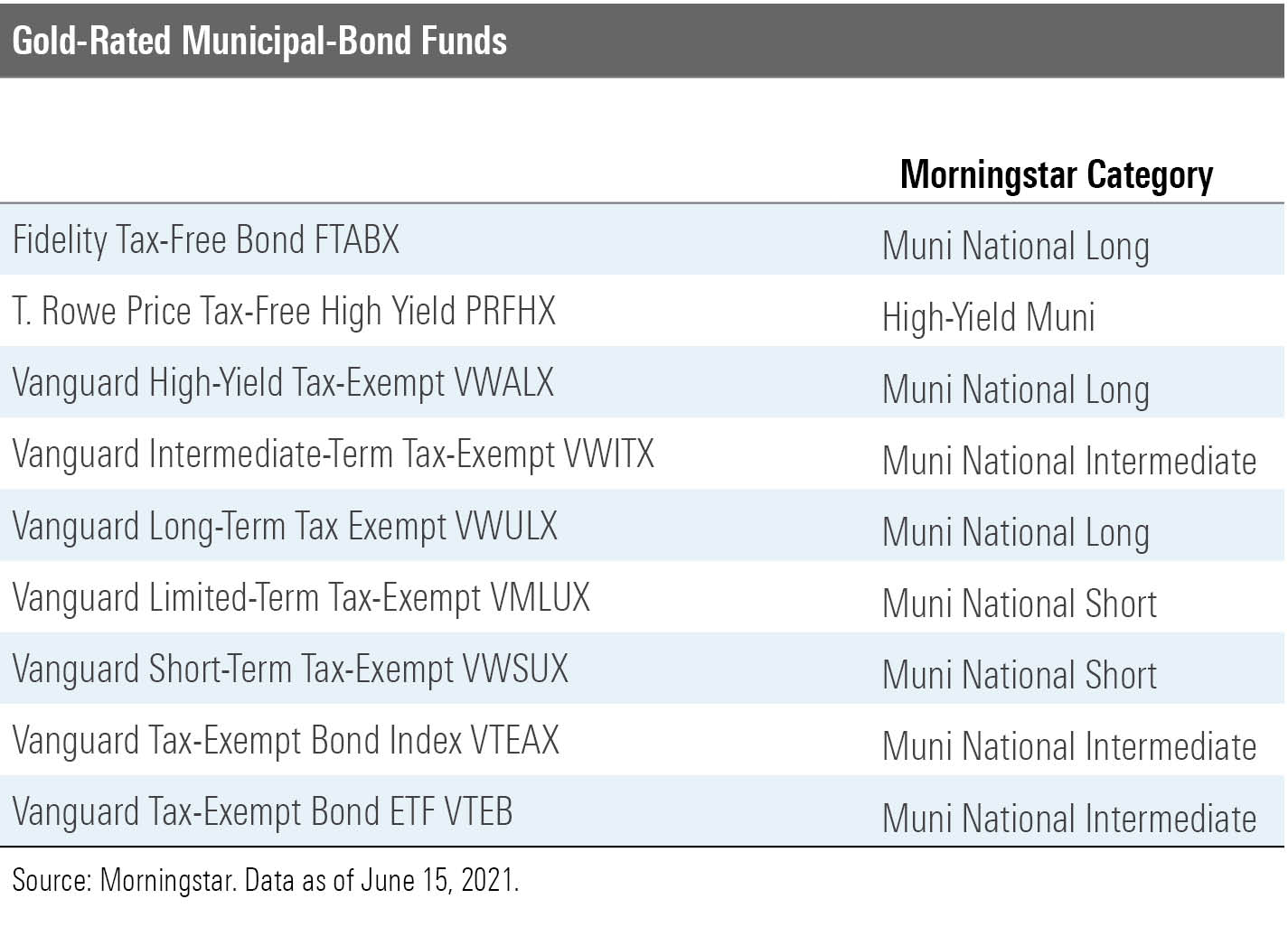

The muni-bond funds and exchange-traded funds listed below all earn our highest rating--a Morningstar Analyst Rating of Gold--as of this writing. They’re great starting points for your research.

Morningstar.com Premium Members have access to a complete list of all Medalist Funds and ETFs.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)